$2,586,535!

$2,586,535!

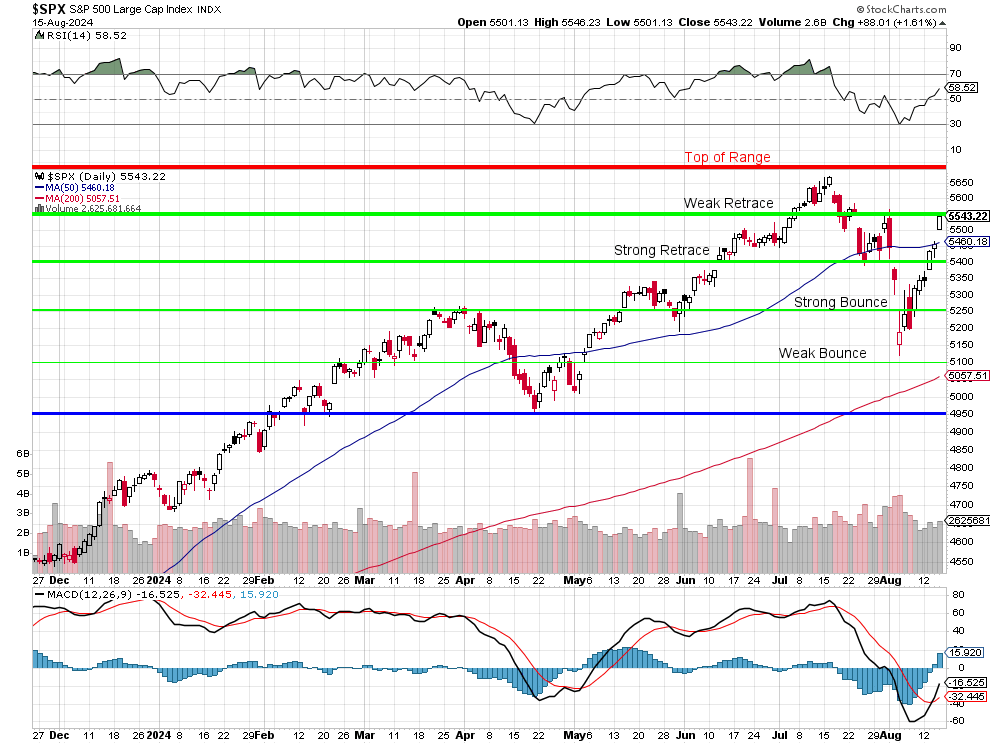

Nothing moves the needle on our strategy better than a pullback and a recovery - well, when we are smart enough to take advantage of them and - we usually are. We certainly were this time, cashing in our hedges on the day we hit the bottom and selling a ton of short puts in the STP and that was AFTER we bought back almost all the short puts in the LTP in last month's review. Timing is everything and timing is a lot easier when you have a chart that tells you what is likely to happen:

Well, it's not the chart that tells us, the 5% Rule™ tells us where resistance is likely to be and our Fundamental Analysis tells us if that resistance is likely to be a problem or not and, when we did our last Review on July 16th - we were pretty positive that the top of our projected range (based on VALUATION of the S&P 500) WAS going to be a problem - so we placed our bets accordingly.

Then, in early August, we were satisfied with the 10% pullback and we made bets that we thought 5,200 would hold (and 5,100 was likely to be bouncy at worst) and that has now worked out so we've bumped up our hedges AND we're doing a bit of shopping for stocks we like that are still on sale (see our Watch List).

Here's what the last month looked like in the markets (was all red two weeks ago):

Time to go shopping!

$700/Month Portfolio Review: Last week was so crazy that we forgot to do our separate review for this portfolio so we're doing it now. Amazingly, we came through the last month pretty well, now at $27,836 (up 65.7%) and that's up $1,836 but $700 of that is the money we added this month so the positions are up $1,136 (4.3%) since our July 9th Review.