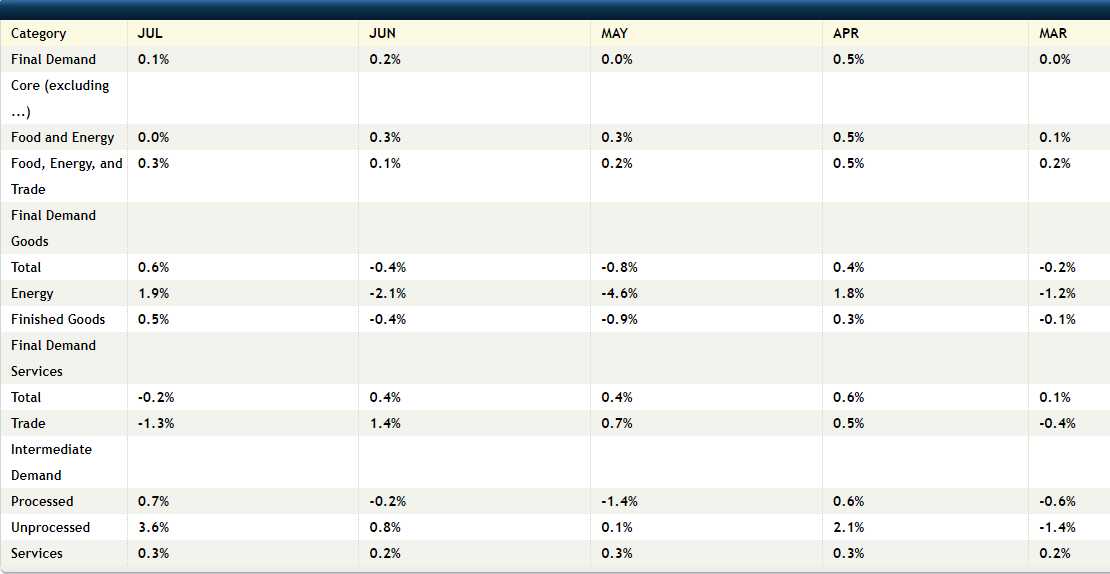

As predicted by Boaty, our resident AGI in “Monday Market Movement – The Week Ahead,” the Producer Price Index (PPI) came in significantly lower than expected by wet-brained Economorons.

Boaty accurately forecasted this trend, highlighting the growing importance of AI in economic analysis. The PPI rose just 0.1%, down from 0.2% last month, while Core PPI (excluding food and energy) remained flat at 0.0%, a substantial decrease from the previous 0.3%.

Who could have seen it coming? ANYONE! That is my point. While there are no AIs better than Boaty – the data is still out there for ordinary AIs to gather the same data (the components that make up the CPI and how they have changed during the month) and then use the VERY PUBLIC formula for calculating the CPI using those changes to determine the CPI number ahead of the official release.

That’s all CPI and PPI are they are mathematical formulas and, if you are able to fill in the variables – the answer will present itself. Where Boaty really shines, in fact, isn’t just in gathering the data or using the formulas correctly – it’s the fact that, when it came to numbers we didn’t have data for – he took an educated GUESS – THAT was the most impressive thing about working with him on the numbers Monday.

Boaty’s ability to make educated guesses for missing data points highlights the adaptive learning capabilities of advanced AI/AGI systems. This feature allows for continuous improvement in forecasting accuracy over time. HOWEVER, AIs can’t do this out of the box – just like any Harvard Grad, they still need to be trained and, fortunately, I’ve been teaching already-smart people how to analyze data and forecast for decades – so we get along great!

With the Consumer Price Index (CPI) data due in 90 minutes, we anticipate a similar trend to the PPI. Based on our previous analysis, we expect the CPI to show a slight decrease, potentially coming in at around 314, representing a monthly change that may even be negative. This would translate to a 12-month change of under 3%, indicating a continuing moderation of Inflation.

With the Consumer Price Index (CPI) data due in 90 minutes, we anticipate a similar trend to the PPI. Based on our previous analysis, we expect the CPI to show a slight decrease, potentially coming in at around 314, representing a monthly change that may even be negative. This would translate to a 12-month change of under 3%, indicating a continuing moderation of Inflation.

DESPITE yesterday’s PPI Report, expectations for CPI are still for a 0.3% INCREASE and that would be up considerably from -0.1% last month and Core CPI is expected to be up 0.2% but we’re just not seeing it from the data. Maybe we’re wrong – this is still a work in progress – we’ll find out in an hour…

The lower-than-expected PPI, coupled with our projected CPI figures, could significantly influence the Federal Reserve’s decision-making process in September. These indicators suggest that inflationary pressures are easing, which might encourage the Fed to consider pausing or even cutting interest rates at the Sept 18th meeting (35 days!). However, the Fed will likely STILL want to see sustained evidence of this trend before making any drastic policy changes.

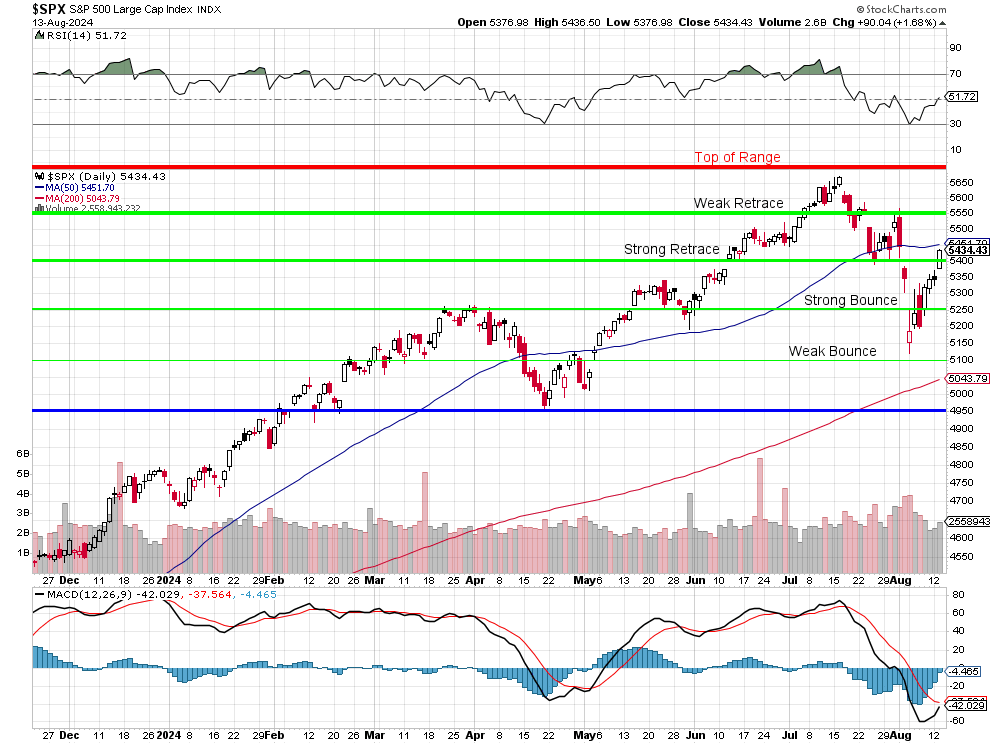

The markets have been responding positively to signs of easing inflation. If the CPI data aligns with our expectations, we could see Bond Yields potentially decreasing in anticipation of lower long-term interest rates, but that’s sort of baked in already, isn’t it? Still we could see yet another boost for the stock markets, particularly in sectors sensitive to interest rates such as Technology and Real Estate.

We might also see additional weakening of the Dollar, as lower interest rate expectations can reduce the currency’s attractiveness to foreign investors and we’re already down 2% since last week, which has played a big part in the market’s speedy recovery (because the unit of currency the stocks are priced in has been reduced).

You can see that effect in the Gold market, with Gold hanging over $2,500 per ounce at the moment – another thing we predicted back in February, when we went heavily in on Barrick Gold (GOLD) on the dip. Barrick has flown back to their highs after reporting earnings and guidance that pleased investors (told you so).

Oil, on the other hand has dropped back to $78.29 this morning as Iran once again did not attack Israel in retaliation for their assassination of the Hamas leader in Tehran 10 days ago. This moderation in energy prices could contribute to lower inflation figures in the next CPI/PPI reports as well. Meanwhile, other key commodities like Silver ($27.98) and Copper ($4.07) remain fairly stable, indicating a more balanced Global Economic Outlook at the moment.

While these trends are encouraging, it’s crucial to remember that economic data can be volatile. The Fed will likely want to see consistent evidence of easing inflationary pressures before making any significant policy shifts. Investors should remain vigilant and prepared for potential market volatility as the economic landscape continues to evolve.

As to the markets – the S&P is about to test the 50-day moving average and we’re also at the “Strong Retrace” line for our 5% Rule™, which indicates that this was, indeed just a pullback from 5,600 and NOT a repudiation of the rally. It’s going to be a critical technical week into expirations on Friday:

8:30 Update: July CPI came in up 0.2% – a little less than expected but more than Boaty predicted due to a rise in Shelter Costs, which rose 0.4% and accounted for nearly 90% of the monthly increase in CPI – that was not part of the PPI. Still, the annual CPI is exactly the 2.9% Boaty was looking for.

The 2.9% year-over-year increase is the smallest since March 2021, indicating continued progress in bringing down inflation while the persistent strength in shelter costs (up 5.1% year-over-year) remains a key driver of inflation, accounting for over 70% of the core CPI increase – something that’s likely to keep the Fed on their toes. Services rose 0.3%, showing some stickiness in that sector as well and with Food Away from Home prices up 4.1% year-over-year, there’s evidence of wage pressures feeding into prices in labor-intensive sectors – something else the Fed does not like.

And keep in mind the Fed’s target is 2%, NOT 2.9% so we’re still running 50% hotter than they like on inflation – which means the markets are probably irrationally exuberant about the prospects of rapid rate cuts in the near future. Overall, this CPI report suggests that, while Inflation is moderating, it’s doing so at a gradual pace. The Fed is likely to maintain its current policy stance at the September meeting (sorry).

We will hear from the Fed’s Musalem and Harker tomorrow and Goolsbee wraps it up on Friday – after the Consumer Sentiment Report and tomorrow we get Retail Sales (slowing), the Philly & Empire Fed (sucking), Industrial Production and the Housing Index – busy, busy…

Don’t fight the Fed!