More Fed madness!

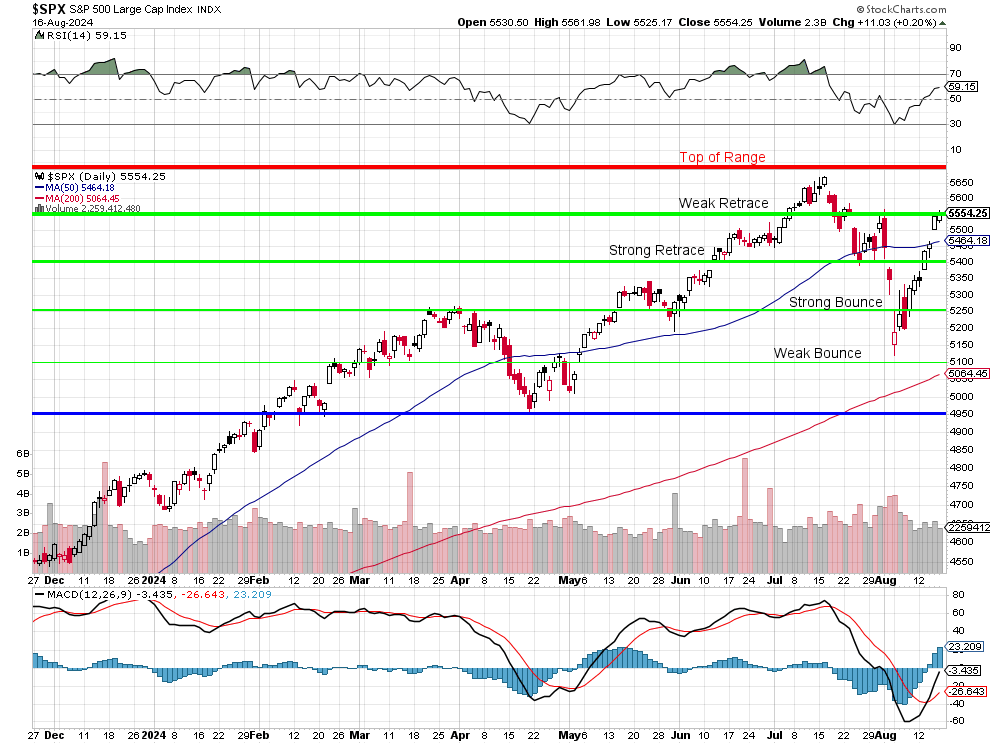

As we kick off the week, the markets are in a holding pattern, with futures showing little movement following last week’s strong performance. The focus is shifting to the Federal Reserve’s annual Jackson Hole symposium, a pivotal event that could provide crucial insights into the future of U.S. monetary policy though, as you can see from the Dollar chart, loose monetary policy expectations sink bear markets with the Dollar now down 4% in the last two months and the S&P 500 is up a grand total of 300 points (5.7%) since June 1st:

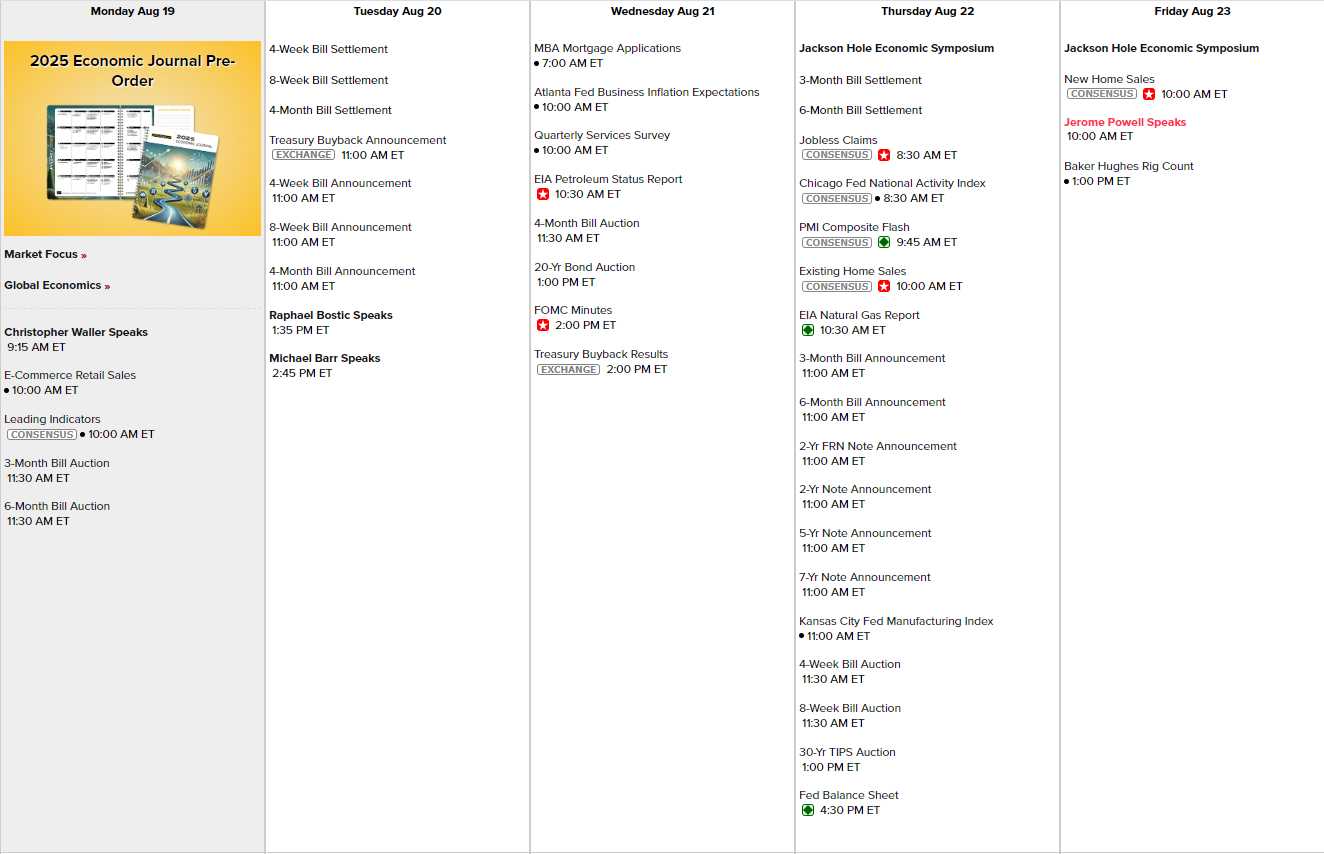

This week’s highlight will undoubtedly be Fed Chair Jerome Powell’s speech on Friday, where he is expected to discuss the economic outlook and potentially signal the Fed’s next moves on interest rates with a direct, non-vague statement that clearly let’s investors know what to expect — NOT! Markets really are eagerly awaiting confirmation of a rate cut in September, but the real drama surrounds what happens after. With inflation showing signs of improvement but unemployment on the rise, Powell’s vague words could significantly influence market sentiment and future rate expectations.

In addition to the Fed, several other central banks will be in the spotlight this week. The European Central Bank and the Bank of England will also release minutes from their latest meetings, which could provide further clues on their respective policy directions as well. Sweden’s Riksbank is expected to cut rates, while Turkey, South Korea, and other central banks are more likely to hold steady.

/storage.evrimagaci.org%2Ftpg%2Fd98a7362-2b33-42cd-a812-b1c345099cb3.jpeg)

This week’s U.S. economic data will be relatively light but still significant. Waller, Bostic and Barr speak before hopping on planes to Wyoming. We have Leading Economic Indicators this morning but nothing tomorrow. Wednesday is Business Expectations, Fed Minutes and the 20-Year Bond Auction – that should be an interesting day. The Economic Games officially begin on Thursday, kicked off by the opening buffet and the lighting of the chocolate fountain.

On Thursday, we also get the Chicago Fed Index, the Kansas City Fed, Existing Home Sales, a 30-Year Tips Auction and a peek at the Fed’s balance sheet and, on Friday, Powell will try to explain all the bad stuff away along with a sad New Home Sales Report – quite a week ahead!

After last week’s solid gains, with the S&P 500 up 3.9% and the Nasdaq Composite up 5.4%, the market is taking a much needed breather. Tech stocks, which led last week’s rally, are showing signs of softness this morning, with names like Micron (MU), Tesla (TSLA), and Nvidia (NVDA) down in pre-market trading. Meanwhile, the Yen’s renewed rise against the Dollar is adding a layer of complexity to global markets, particularly in Japan, where the Nikkei is down 1.6% from Friday’s open.

This week also marks the tail end of the Q2 earnings season, with key reports from Palo Alto Networks (PANW), Estee Lauder (EL), and Fabrinet (FN) today, and from major retailers and tech firms later in the week. As always, these reports will provide crucial insights into sector-specific trends and the broader economic landscape but, on the whole, earnings have been all over the place this season and very hard to predict – though we did manage to pick up plenty of bargains during the sell-off.

As we meander through the week ahead, the market’s attention is firmly fixed on Jackson Hole and the Fed’s next moves. With so much at stake, this week’s developments could set the tone for the markets heading into the fall (and hopefully not A fall!). Let’s keep a close eye on Powell’s speech on Friday, as well as any early indicators from the Fed minutes on Wednesday – when we’ll be covering the release in our Live Weekly Webinar (1pm, EST).