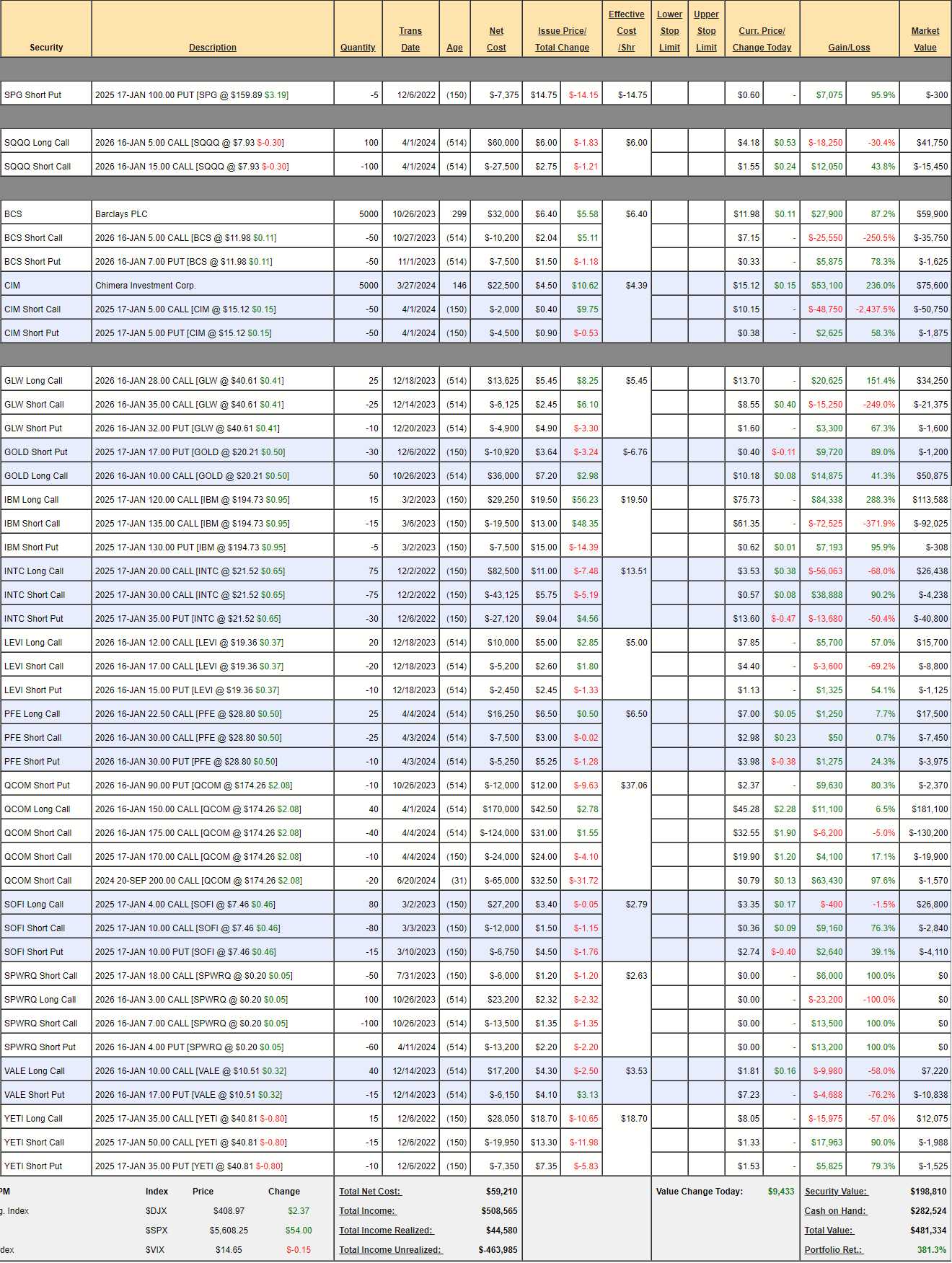

$481,334.

$481,334.

That’s up $53,723 (12.5%)on a portfolio we haven’t touched in 5 months. We only make changes to the Money Talk Portfolio when we’re doing the show on Bloomberg and we tape this afternoon for broadcast tomorrow at 7pm. Overall, the portfolio is up $381,334 (381.3%) since we began this one on November 13th, 2019 and I was going to give it a full 5 years but the market may be toppy and the elections are coming up so why risk these spectacular gains – we’re going to cash out completely and start a fresh $100,000 portfolio.

Fear not as this is not the first time we’ve cashed out a Money Talk Portfolio, this will be our 4th new portfolio and this one has averaged over 76% per year and the one before this actually did better than that so this is a fantastic opportunity for new investors to get in on the fun and another chance for everyone to learn the skills required to build a winning portfolio.

First of all – out with the old:

SPWR went bankrupt and cost us our chance at $500,000 but that’s OK – they can’t all be winners. For the most part, I still like ALL of these positions and, in our March Portfolio Review, we had already discounted SPWR’s upside potential to $0 but the rest of the positions had $254,830 (59.5%) of profit potential over the next 22 months and in 5 months we realized $57,723, which is 21% of our expected profits – right on track.

Options allow you to control your portfolio by using them for both leverage and for hedging as you can see we lost about $6,000 on our SQQQ hedge and thank goodness we didn’t need it but it’s a $100,000 hedge currently priced at net $26,300 so we had $73,700 of downside protection in the recent market dip, protecting us.

I want to emphasize that there’s nothing wrong with these trades – we’ll be adding many of them back into the new portfolio over time but we’re now locking in the $381,334 in gains from the $100,000 we started with back in November of 2019 and now we’ll see what we can do with a fresh $100,000 – let’s see what kind of fun we can have:

With a $100,000 portfolio we have about $200,000 of buying power so we split that into 10 allocation blocks of $20,000 each. We’re a bit worried about the market taking a dip so we’re going to want to make our first few selections defensive and, if they turn down, we’ll be happy to buy more at a discount and, if they do well, we can take a bit more risk in the next round.

Here are some of the top contenders we’re looking at, starting with ones from the portfolio:

-

- BCS – $12 is $43.7Bn and earnings bottomed out at $2.4Bn in 2020 but on track for $5Bn by next year and that would be less than 9x earnings. Price/Book is 0.48 – significantly below the industry-standard 1.0. I’m looking for, conservatively, 12x in 2026 and that’s up 33% at around $15.60

-

- GLW -$40.61 is $35Bn and they are making $1.6Bn so 22x but should be well over $2Bn in profits in 2026 and that’s only 17.5x so we assume they get back to 20x and that’s +14% to $46 but the cool thing about options is we don’t need the stock to go higher – we just need it not to go lower to make great money and I think GLW is very solid at $40. Driving Corning’s growth is high demand for new optical connectivity products for Gen AI – so it’s a nice side bet on that very hot market.

-

- INTC – We’ll get back to them eventually but it’s too early to take a full position. I do think we’ll sell some short puts to keep our toe in the water.

- LEVI – $19.36 is $7.7Bn and they are making over $500M so let’s say 15x. I think that’s a fair price but I also think it’s a pretty bullet-proof bottom. I like their DTC (Direct to Consumer) initiatives so this could be a strong defensive play.

-

- PFE – Well, if you ever want proof that investors are idiots, look to Pfizer – who are in the dog house because they cured Covid and now they don’t have those amazing Covid Vaccine revenues anymore. That’s like shorting Superman because he stopped a bank robber – there WILL be more! Meanwhile, PFE is dropping $16Bn a year to the bottom line (not $31Bn as they did in 2022) and $28.80 is $163Bn so we’re talking 10x for the company.

- They just raised guidance by 5% with a 14% growth in non-Covid revenues and they are doing a cancer moon-shot – expecting vaccines to be the next big thing in that arena. They also pay a 5.8% dividend and I can see them moving back to the mid-$30s by Jan 2026 with fair certainty.

-

- QCOM – Much as I love them, AAPL is moving off their chips and I see some pain ahead. THEN we will buy them.

- GOLD – Now at $20.21 ($35.4Bn), it’s not the no-brainer it was when we picked them below $15 but, with the current $2,500 price of gold (the metal), they should be making $3Bn so we’re talking 12x and it also makes a great hedge against inflation so – winner! I think $25 would be about right in 2026 – as long as Gold is over $2,000 and I doubt it won’t be. The company has successfully replaced all depleted gold mineral reserves for the third consecutive year, supporting a sustainable 10-year plan and management has always been driven to drive down extraction costs – keeping them in great position during Gold pullbacks.

-

- SOFI – $7.46 is $8Bn but it’s a new bank, just starting to turn a profit and next year should be $300M, which is still 26x but on a great path. Again, I have great confidence that $6 will hold and we can craft a great options play from that. Price to Book is only 1.17 so already about right and most banks aren’t growing much while SOFI is good for about 20% more revenues each year and, not only that but Membership was up 41% last year and they attract young people who, in theory, will put more and more money in the bank as they get older.

-

- VALE – Our 2024 Trade of the Year has not worked out so far. $10.50 is $45Bn and we thought $60Bn was far too cheap last November. Iron Ore prices collapsed on surprisingly weak China demand and the company has overhanging lawsuits that still need to be resolved. Still, it’s quite the bargain at $10.50 and China usually stimulates infrastructure, so we’ll see what happens.

-

- YETI – Our 2023 Trade of the Year was a big winner and could be again back at $40.81. $3.45Bn at this price making about $250M is 14x with 10% annual growth so for sure we like them below $45 and I think $50 will be right in two years but let’s say $47.50 for a target and that’s plenty of room for us to make a nice play.

-

- NOK – When stocks are below $5, there are many ways to win using options. NOK is at $4.17, which is $23Bn and not only do they make $1.8Bn (p/e 13) but they have $3Bn CASH!! in the bank net of debt. NOK just won a contract to roll out 5G in Brazil – that will be a significant bump for them. The company is buying back a lot of shares and I think $5 is very conservative and we can make very nice plays out of that!

-

- T – Speaking of phone companies. T is getting no respect at $19.46, which is $139Bn and T makes $16Bn so 8.5x but TMUS is priced at $230Bn and they “only” make $11Bn so one of them is way off an 8.5x says it’s T that’s still too low. As with GLW, fiber revenue growth was 7.4% over last year. They have invested massively in 5G and they now cover 290M Americans and will soon reap what they have sown. A 6.5% dividend too!

-

- IMAX – DIS scares me but IMAX makes money off anyone’s good movies. $20.39 is just $1Bn and they are making $55M so less than 20x and they are installing 140 new theaters this year from 1,772 at the end of last year so +10% and the writer’s strike held them back early this year so next year should be packed with movies and a record 15 films will be shot on IMAX cameras next year (another revenue stream and huge for the box office).

-

- SKX – Had a great run but $66.79 still only 14.5x $700M earnings (10.2Bn) with 10%+ growth and $1Bn in CASH!!! net of debt – what’s not to love? Like LEVI, SKX is pursuing DTC and it’s up 12.4% from last year and International Sales are up 14.7%. If the shoe fits…

-

- TAN – Solar ETF is a bet Harris will win the election. SPWR dragged them down (and our portfolios!) but that’s done with now and hopefully the survivors are a little stronger for it? High rates have held back Solar Financing so Fed to the rescue – we hope. I think this is a very nice bottom for them and $60 is very reasonable in 2026.

-

- TD – $59.30 is $104Bn and they make $14Bn but it’s Canadian money so only $10.2Bn but that’s still 10x so Y’eh! Earnings are Wednesday and I say get them before they go up – even $60 is too low and I think $70 by 2026. And they pay a 5.1% dividend!

-

- IVZ – These guys run TAN. They just had a strong beat on earnings and we TRIPLED down on the stock in the LTP so I don’t even have to look but $16.84 is $7.6Bn and they make $800M so less than 10x and price to book is 0.69 – also very low. AUM popped 12% to $1.7Tn making IVZ a very serious player these days. Low $20s would be my target and they are buying their own stock so why shouldn’t we?

-

- LOVE – Still cheap at $23.78, which is $375M (so cute!) and they make $25M so call it 15x but it’s been a supply chain issue for the past few years and that’s ending but still there are economic concerns as the couches are not cheap (but so cool!). This is one I think has such a good base at $20 that I have no fear buying it – and that can be very profitable. Oh, and $87M net of debt in the bank!

-

- TGT – Earnings are tomorrow and for that reason alone I can’t put them in as one of the first stocks but $144.50 is way too cheap as it’s 15x with $4.5Bn in profits pouring in while WMT is 28x – so unfair!

- WHR – More like WTF? at $96.85 which is $5.3Bn and they make a very solid $650M so we’re talking 8x for a very intrenched durable goods operation. Again, the Fed lowering rates will be a tremendous help. They just beat on earnings and confirmed guidance so at least $120, maybe $140 in 2026 and I want to be there first!

OK, that’s a solid set and, yesterday, in our Live Member Chat Room, we ran these pick by our AGI, Boaty and he preferred GOLD, TGT, GLW, TD and YETI. Warren, our resident AI (not self-aware but very clever) liked QCOM (but didn’t know Apple was pulling out), GLW, TD, SOFI and IMAX as his top 5.

Phil (and obsolete human) likes WHR, IVZ, IMAX, SKX, T, NOK, BCS and PFE and yes to their picks as well so tricky….

Now it will come down to which ones can we make the best option spreads on and which ones to we think can ride out another dip like we just had.

OK, let’s finalize it as follows:

GOLD – Gotta love the inflation hedge with the Fed lowering rates and devaluing the Dollar. If it does go lower, we just want to buy more.

-

- Sell 5 GOLD Dec 2026 $20 puts for $3.50 ($1,750)

- Buy 20 GOLD Dec 2026 $17 calls for $6.30 ($12,600)

- Sell 20 GOLD Dec 2026 $22 calls for $4.15 ($8,300)

That’s net $2,550 on the $10,000 spread that’s $6,000 in the money to start. There’s $7,450 (292%) upside potential at $22 in 2.5 years and our worst case is owning 500 shares of gold at $20 ($10,000), which still gives us plenty of room in our $20,000 allocation block.

BCS – Won out over TD by virtue of being $11.81, which fits in better for our new trades.

-

- Sell 20 BCS 2026 $12 puts at $1.75 ($3,500)

- Buy 40 BCS 2026 $10 calls for $3 ($12,000)

- Sell 40 BCS 2026 $12 calls for $2 ($8,000)

That’s net $500 on the $8,000 spread so here we have a potential $7,500 (1,500%) upside at $12 (0.20 higher than we are now). The worst case is we own 2,000 shares of BCS at $12 ($24,000) but that would only use $12,000 worth of buying power – so we’re very comfortable with it.

You can see how our old portfolio ended up making almost 400%!

IVZ – Too compelling not to pick and also the low price (which can give you better option premiums than more expensive stocks).

-

- Sell 10 IVZ 2026 $17 puts for $2.45 ($2,450)

- Buy 20 IVZ 2026 $15 calls for $3.20 ($6,400)

- Sell 20 IVZ 2026 $20 calls for $1.10 9$2,200)

That’s net $1,750 on the $10,000 spread with $8,250 (471%) upside potential at $17 in 17 months. We made an aggressive call sale because we think IVZ is very undervalued. The worst case is we own 1,000 shares going forward.

NOK – Also too cheap to ignore.

-

- Sell 20 NOK 2026 $5 puts for $1.10 ($2,200)

- Buy 50 NOK 2026 $3 calls for $1.35 ($6,750)

- Sell 50 NOK 2026 $4.50 calls for 0.50 ($2,500)

That’s net $2,050 on the $7,500 spread that’s $1.10 ($5,500) in the money to start so I don’t think we’re too ambitious and the upside potential is $5,450 (265%) and our worst-case scenario is owning 2,000 shares at $5 ($10,000), which we’re happy to do.

IMAX – Another one we’d love to buy more on on a dip. They don’t have long-term option contracts but still worth playing as we think the value is certainly there.

-

- Sell 15 IMAX March $20 puts for $1.85 ($2,775)

- Buy 20 IMAX March $17 calls for $4.50 ($9,000)

- Sell 20 IMAX March $22 calls for $1.80 ($3,600)

That’s net $2,625 on the $10,000 spread that’s $6,000 in the money to start. The upside potential at $22 is $7,375 (280%) but we’ll make $4,375 (166%) just holding $20! Our worst case would be owning 1,500 shares at $20 but consider we could then sell $6 worth of puts and calls against those and drop our basis to $14 – this is why we don’t fear the assignments.

Speaking of which, since we’ve only used $9,475 worth of our cash and we have an upside potential of $38,075 (401%) if we hit our targets, we can afford to move a few of my runner-ups into the on-deck circle by selling some short puts – which will drop more cash into our portfolio:

- TGT – Let’s sell 5 of the 2026 $120 puts for $10 ($5,000). The worst thing that happens is we get assigned 500 puts at net $110, which is a $33.35 (23%) discount to the current price. Anything above $120 and we simply keep the $5,000 (5% of our portfolio and the upside potential).

- T – Let’s sell 15 of the 2026 $20 puts for $2.35 ($3,525) and we certainly don’t mind owning 1,500 shares of T with a 6.5% dividend as our worst case with a net of $17.65 – a 9% discount to the current price.

- PFE – Let’s sell 10 Dec 2026 $32 puts for $6 ($6,000) as that’s still net $26, which is a 10% discount to the current price and then I won’t feel so bad if it takes off (and we’ll build a spread around the short puts).

There’s another $14,525 (14.5%) of profit potential over the next 17 months and now we can sit back and relax for a few months and see how our initial plays work out. Already our Money Talk Portfolio has the potential to make $52,600 (52.6%) and, of course – as we always have – we’ll make adjustments each quarter and add more trades along the way.

Looking forward to building it with you,

-

- Phil