Strategies to manage risks

Lightly edited transcript:

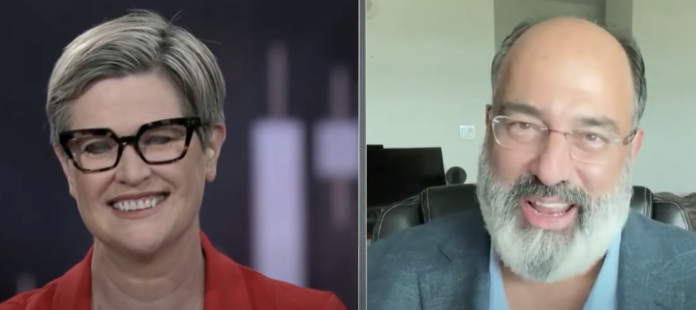

Kim Parlee: We touched a little bit on this, Phil, but I just wanted to finish. I think it’s important. This is a pretty diverse portfolio you’ve put together. We are, though, in volatile times. I would say Fall’s coming, September’s coming, we’ve got an election, all sorts of good stuff. So how do you risk manage all this?

Phil: I think the key is diversity. You have to think about the macro environment and find ways to push your risk around so that it’s not all concentrated in one place. In this case, we’ve got gold, which is an inflation hedge. If inflation goes up, we’ve got gold. We’ve got Barclays, which is going to make more money if inflation goes down. We have Invesco, which makes money from speculation. We have Nokia, which is a very basic nuts and bolts telecom infrastructure company. IMAX – now that the writers’ strike is over, there’s a bubble of films that will be coming out that’ll boost their earnings in the future.

The trick is to hedge by diversity. Also, you see how we do a lot of bull call spreads. We sell a put, and the put only forces us to buy the stock if it gets cheaper, so we’re going to buy the stock at a lower price than it currently is. Our worst-case scenario is getting a stock at a discount.

The next section is we buy a bull call spread. The bull call spread’s short calls hedge the long call so that if the market moves quickly down, the short call that we sell is going to lose money faster than the long call that we own. Then we can take the long call that we own and adjust it to a longer strike, a lower strike, or whatever by investing more money.

That’s why scaling in is very important. We start with a small amount, and if something happens, we’re happy to put a little bit more money to work, assuming we still like the position. If it just went down because the market got dragged down like everything did last month, then of course I want to put more money into things that are perfectly good stocks that went down.

Kim: It’s like if you’ve got your eyes on some good stuff, when these things go on sale, it’s a pretty compelling time to start to look at these. Phil, I wish I had another hour. I do not. I’m just going to ask you though, quickly, how do you manage when people have to watch the crazy volatility that happens? Because there’s a lot of volatility going to happen with these markets.

Phil: In our mature portfolios like the Money Talk Portfolio we just closed – and people should really take a look at it and see what we had before – we had an SQ22 spread, which was for the NASDAQ. It’s a three times inverse NASDAQ spread, and we will add those on when we need to. But right now, I got to tell you, the biggest hedge we made is taking that money off the table and putting one quarter of it back to work at a time when we don’t know for sure if the market has calmed down or not.

So what did we do? We took our profit – 100% of our profits off the table – and now we’re back to work with a new $100,000. That is a hedge. All that sideline money, should we need it, we can put it back.