The indexes are up this morning but, so what?

The indexes are up this morning but, so what?

As you can see on the bounce chart, all we have accomplished this entire week is turning the Strong Retrace box on our Bounce Chart from black to green as the Russell Futures are at 2,180 this morning – had they gone 10 points down instead of up and that box would still be black and we would have officially gone nowhere for the week.

Of course it FEELS like something happened because we drifted higher in to yesterday’s exciting open but then we went all the way back down (Helter Skelter) so, in short (don’t say short!) it’s been a week of drifting into the Fed Conference at Jackson Hole, that kicks of this morning with Powell speaking at 10 am (7am JH time).

That’s exactly the kind of noise our Bounce Chart is designed to ignore. The S&P topped out 70 points higher than yesterday’s close but it wasn’t enough to reach the July high and, if the boxes don’t change – we have no reason to adjust our stance. Movements within the boxes are range bounce and changing color status give us very quick references as to what we SHOULD be paying attention to as the market progresses.

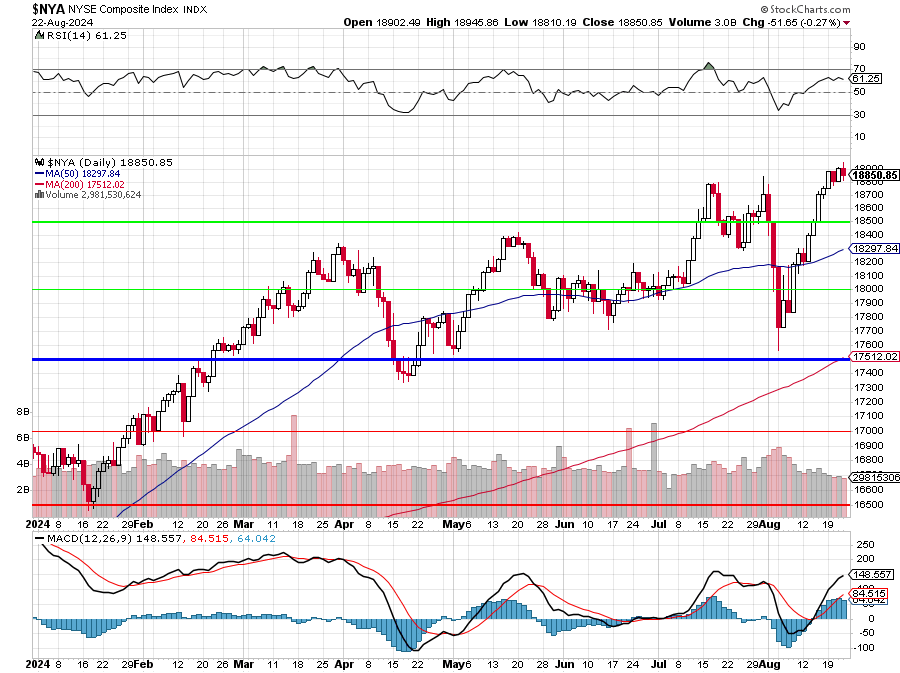

What is worth noting is that the NYSE has broken back out to a new high – after a MASSIVE 1,200-point (6.7%) run for the month as buyers rotated back into value stocks after the pullback (which was perfect for our portfolios!).

Unfortunately, we’re not seeing that sort of enthusiasm in the small-cap arena as the Russell has only recaptured about half it’s losses for the month vs 100%+ regained on the NYSE, which is 10x the size of the Russell.

Perhaps that’s because small-cap stocks are more sensitive to economic uncertainty while the larger-caps are more sentiment-driven and sentiment is strong heading into the Fed gathering so, to my mind, Powell can only disappoint this morning – anything but a virtual promise of a half-point cut at the next meeting is going to disappoint investors and, based on what the Fed said in their Minutes (see Wednesday’s Report) and the intervening data – I don’t think they are going to cut at all at the next meeting.

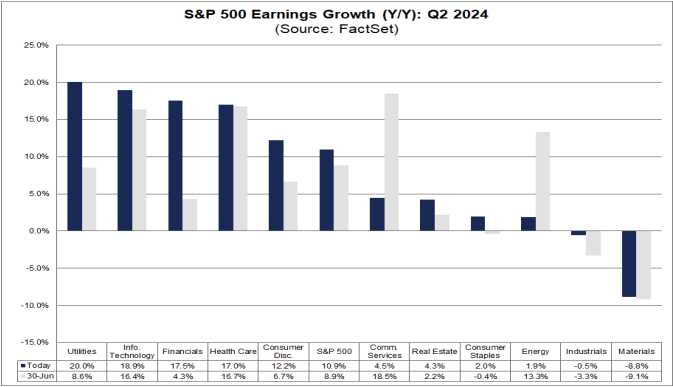

Small Cap companies are also more sensitive to interest rate changes but they are in more of a show me state than the Large Caps. The Russell is more weighted to Regional Banks, which have been struggling in 2024 while the NYSE has Big Tech – and it’s been a Big Tech sort of year with overall earnings up 10.9% thanks to Big Tech and Financials while Materials are down 8.9% and those kind of companies are leading the small caps lower…

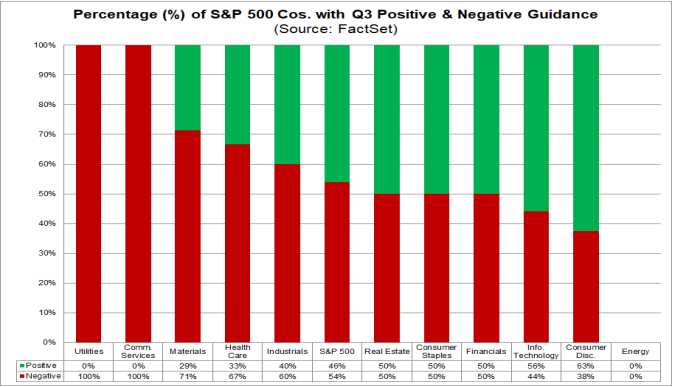

Personally, I’m a lot more concerned about the very scary percentage of companies that have been issuing negative guidance – though it’s all the more reason for the Fed to cut rates before these current fears turn into future realities:

As Powell speaks at Jackson Hole, the markets are likely to remain jittery, given that anything short of dovish signals could pressure small caps further. It’s a reminder that while the big players might be thriving, the underlying market breadth tells a different story, one of caution and selectivity.

This morning’s market optimism is buoyed by solid earnings reports from companies like Workday (WDAY) and Ross Stores (ROST), both of which delivered better-than-expected results. Workday’s partnership announcement with Equifax and Ross Stores’ upbeat guidance for the coming quarter have helped lift investor spirits.

However, this positive bias could be short-lived, depending on the signals from Powell’s speech – just 40 minutes away. With the S&P 500 within 1% of its all-time high, the stakes are high for the Fed to validate the market’s optimism.

On the global front, European markets are seeing a positive finish to the week, with major indices like Germany’s DAX and France’s CAC 40 posting gains. The European Central Bank’s recent comments suggest an openness to rate cuts, adding another layer to the global interest rate discussion. In Asia, Japan’s inflation data showed a slight cooling, which could ease some pressure on the Bank of Japan. Meanwhile, China’s potential tariffs on vehicles with large engines indicate ongoing economic adjustments.

As we await Powell’s speech, it’s crucial to keep an eye on how these narratives around interest rates, economic resilience, and corporate earnings evolve. 3 months ago, the market was pricing in at least one rate cut by year-end, but some Fed officials, like Atlanta’s Raphael Bostic, who just spoke on CNBC, are now suggesting multiple cuts may be necessary. This sentiment aligns with recent economist surveys predicting a peak in unemployment and calling for faster rate reductions.

While the market’s current buoyancy may feel encouraging, with Powell set to speak shortly, we need to brace for potential volatility. The balance between economic data and Fed signaling will be crucial in shaping market direction.

Let’s keep an eye on Powell’s speech and how the market digests any shifts in the Fed’s tone. The next few hours could set the tone for the weeks to come.

Have a great weekend,

-

- Phil