I told him you have to first come up with an investment strategy and work your way backward from there. This approach, which I like to call the “Goldilocks Entry,” is all about finding the perfect balance in your investment strategy.

Why Investment Strategy Comes Before Numbers

Before deciding how much money to invest in your portfolio, it’s crucial to have a clear strategy. The returns we’ve seen this year have been incredible, but that’s largely due to luck and circumstances – more so than skill. Assuming otherwise can lead to big trouble!

At PhilStockWorld.com, we emphasize having realistic expectations, especially with our Short-Term Portfolio (STP). This portfolio houses our hedges as well as our short-term “fun” trades – something to play with using a small percentage of a sensible portfolio. For larger investments, our long-term plays – buying LEAPS (Long-term Equity Anticipation Securities) and selling puts and calls against them – are the way to go as we follow our proven “Be the House – NOT the Gambler Strategy”

Diversification: The Key to Portfolio Success

Diversification is critical in managing risk and optimizing returns. We make many stock picks because and not all are right for everyone and it’s important to maintain a diversified mix of sectors in any portfolio. We also need diversity in direction: Regardless of how bullish or bearish the market is, no less than 25% of your portfolio should be in puts or short calls to help protect against downside risk. A valuable lesson from Jim Cramer’s old game “Am I Diversified?” is the importance of spreading investments – you should have no more than 20% of your portfolio concentrated in any single sector!

However, diversification isn’t just about the number of stocks or sectors; it’s about understanding how different factors interact. For example, holding a DOW call while also holding an oil put does not truly diversify your risk, as both bets are influenced by the price of oil. If you are managing a small portfolio of straight options, at least three of your ten trades should be either puts or calls, and no more than two trades should be in the same sector.

Managing Risk with Position Sizing and Cash Management

Position sizing and cash management are also crucial components of a successful investment strategy. At PPSW, we like to keep at least 1/3 of our portfolios in CASH!!! and, generally we like to make sure we have similar amounts of margin available for a rainy day. Available buying power is essential for maintaining the flexibility to adjust positions as needed. By adhering to this disciplined approach, even a complete wipeout in a single sector would only impact a small fraction of your overall portfolio.

For instance, if you have enough funds for just ten trades, ensure that no more than two (20%) in the same sector. Even in the worst-case scenario, where we are wiped out of a sector, my maximum loss (assuming a 50% stop-loss) would be no more than 10%. By using only a portion of cash and margin to double down, even a total wipeout would mean being down no more than 5% – a VERY manageable risk.

Now, let’s see how these principles play out with real-life examples from our recent trading activities.

Learning from Real-Life Trades: Practical Examples

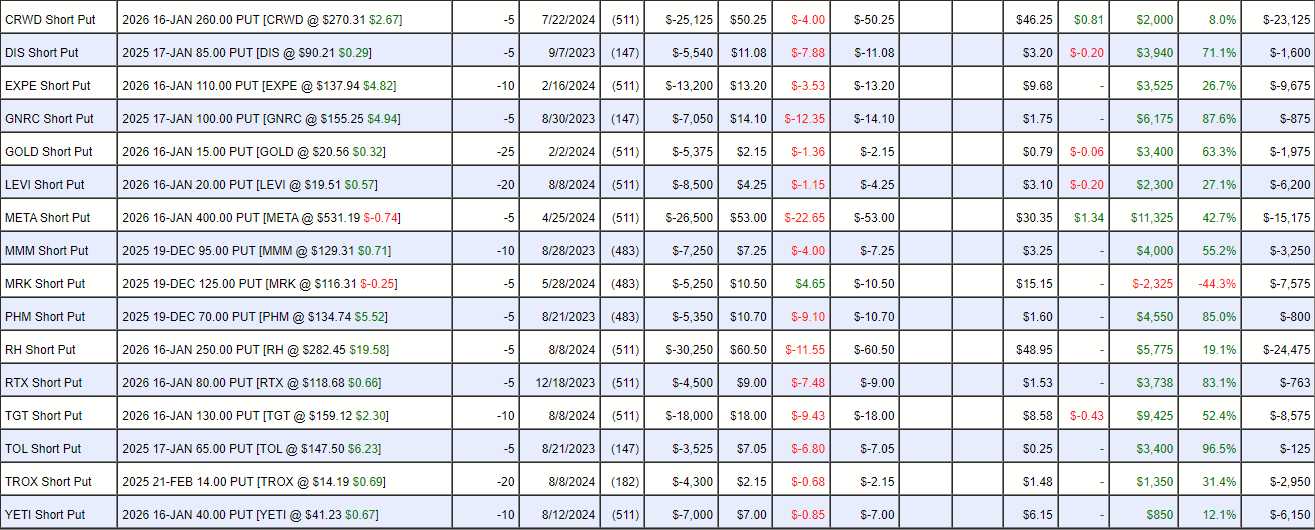

At PhilStockWorld.com, we believe in learning from real-life examples. As the market dipped in August, we ran to our Watch List and did a little shopping, selling short puts (getting paid for our willingness to buy) on CrowdStrike Holdings, Inc. (CRWD), Levi Strauss & Co. (LEVI), RH (RH), Target Corporation (TGT), Tronox Holdings plc (TROX) and YETI Holdings, Inc. (YETI). We added 4 Consumer Goods but we had none out of 12 – now 4 out of 16.

That’s what we do when we add new selections – we look to see where we can IMPROVE our balance – not exacerbate the imbalances…

Notice our 6 new additions are already up $25,438 in less than a month – so diversification can be fun AND profitable! You can follow our trade ideas every day in our Live Member Chat Room, which is available to our Trend Watcher, Basic and Premium Members.

Our only negative put, at the moment, is Merk (MRK) and those options are down 44.3% ($2,325) but we sold 5 Dec 2025 $125 puts for $10.50 ($5,250) – meaning we got paid $5,250 to promise to buy 500 shares of MRK for $125 between May 28th (our sale date) and Dec 19th of 2025. If we are assigned (forced to buy the stock), our net entry would be $114.50 and the stock is currently at $116.31 – so no worries, despite the fact the put is currently down 44.3% – THAT is how much cushion we gave ourselves with that entry!

Setting Realistic Expectations

Options trading is inherently risky, and setting realistic goals is essential. If your aim is to consistently outperform the S&P 500 or achieve returns on par with the top hedge funds, understand that higher returns come with higher risks. Patience is essential. Learn from experience, and don’t chase unrealistic gains.

For those new to PhilStockWorld.com, I highly recommend watching the short (and award-winning) film “The Man Who Planted Trees.” This film offers more insight into investing and planning for the future than many books, serving as both an investment and life strategy guide.

Good trading,

-

- Phil

To learn more about our investment strategies and join the conversation, explore our other articles on PhilStockWorld.com and consider becoming a member today!