Via ZeroHedge

Amid the doldrums of summer liquidity, today saw some give back from Friday’s euphoric response to Jay Powell’s latest flip-flop.

Rate-cut expectations declined (most notably focused on a shift from 2024 to 2025)…

Source: Bloomberg

Stocks – broadly-speaking – did not love it and gave some back with the Nasdaq the biggest loser (and S&P dragged down by Tech). The Dow managed to reach a new all-time high before purging most of it back.

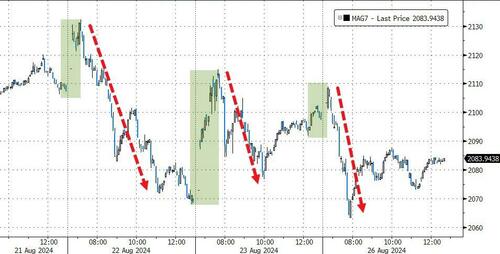

It’s been an interesting couple of days for Mag7 stocks…

Source: Bloomberg

…as the world readies for NVDA’s earnings…

Source: Bloomberg

The dollar rallied modestly, erasing some of the dovish decline…

Source: Bloomberg

Despite the dollar gains, gold rallied…

Source: Bloomberg

Treasury yields rose modestly (just 1-2bps), but remain down from pre-Friday panic. The short-end continues to outperform…

Source: Bloomberg

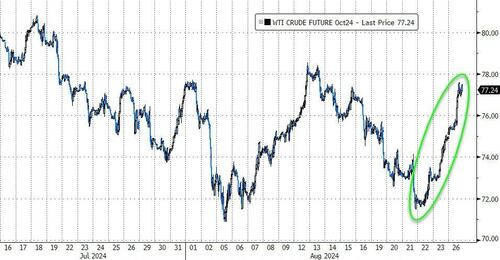

Oil prices also continued to rebound, with WTI back above $77…

Source: Bloomberg

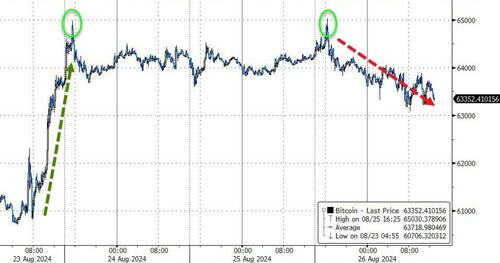

After surging above $65,000 twice over the weekend, Bitcoin was sold (ubiquitously) during the US day session

Source: Bloomberg

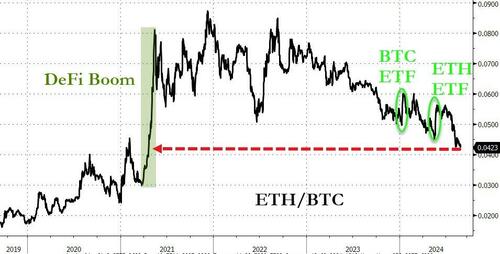

…and ETH is now at its weakest relative to BTC since the start of the DeFi boom…

Source: Bloomberg

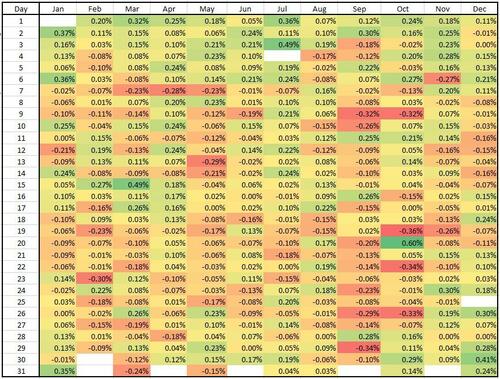

Finally, while the seasonals are holding up for now, the worst period of the year looms (September H2)…

BTFD to all-time high, then STFR and rest for post-election surge?