War! What is it good for?

High oil prices, for one thing… We played Oil (/CL) long at $72 in our Live Trading Webinar on Wednesday (and in Member Chat right before) with a target of $75 this week and we already hit it on Friday ($3,000 per contract gain)so we took it off the table but now it’s $76.76 – so we have a little seller’s remorse as Israel switched opponents, making peace with Hamas and then launching a pre-emptive strike against Hezbollah in Lebanon.

Israel got word of Iran-backed Rent-A-Rebel activity in Lebanon and pre-emptively destroyed THOUSANDS of missile launchers on Sunday, after which Hezbollah replied by firing 20 missiles (all they had left) at Israel. Iran was very pleased with the outcome – which was an almost $5 recovery in oil prices – worth about $15M/day ($5.5Bn) to Iran alone as Rent-A-Rebel proves time and again to be OPEC’s greatest investment.

Libya also had a Labor Day gift for the markets – calling a halt to all oil production (1.2Mbd) and declaring “Force Majeure”, which means no one has to honor delivery contracts and that will have global repercussions as the effects domino throughout the complex oil trade.

The bottom line is oil is back to being 7% higher than it was last year and THAT causes a lot of Inflation – just when the Fed got done having a weekend party declaring it under control. Oops…

This slowdown is a direct challenge to Beijing’s ability to hit its 5% growth target for 2024. Even with expected rate cuts and other monetary easing, persistent problems like a Real Estate slump and sluggish Consumer Confidence are proving hard to overcome. The PBOC has even begun stress testing banks to prepare for possible market volatility, which hints at their concern over the fragility of the current economic situation.

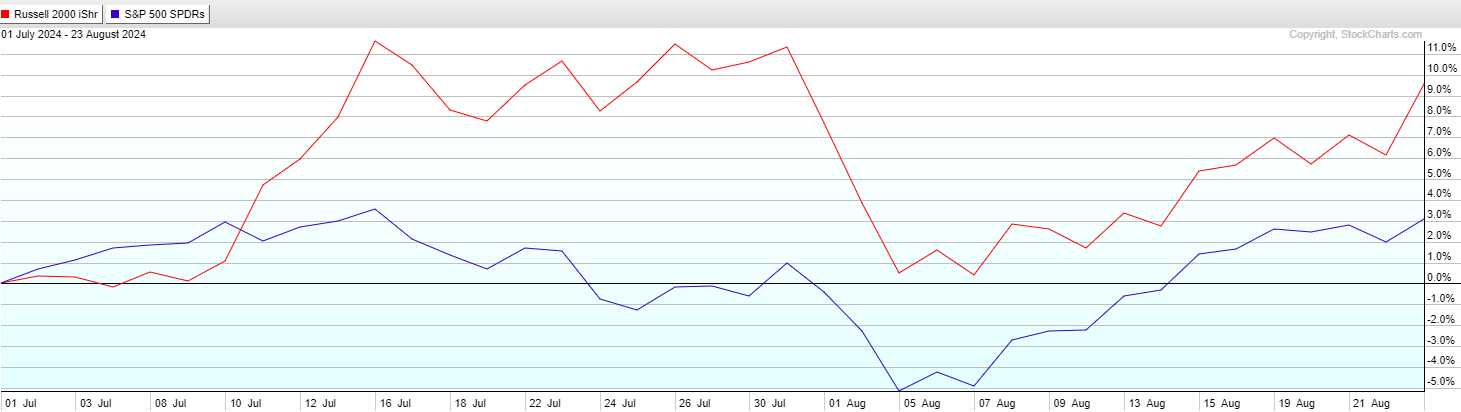

Hedge funds seem to be fading the recent rally in Global Equities, selling stocks at the fastest pace since March of 2022, according to Goldman’s Prime Brokerage. Despite a recent bounce in markets, there’s a distinct lack of risk appetite, with hedge funds reducing their exposure across regions, particularly in North America and Asia. Interestingly, while selling off large-cap stocks, hedge funds have shown a renewed interest in small caps – as witnessed in last week’s rally, suggesting a strategic shift in their portfolios as the Russell pulls 6% ahead of the S&P for the summer (again).

Fed Chair Jerome Powell made it clear at Jackson Hole that the Fed’s primary concern has shifted from Inflation to Unemployment. With Unemployment creeping up to 4.3%, the highest in nearly three years, the Fed is now focused on maintaining a strong Labor Market. Powell’s dovish tone seems to reinforce the likelihood of a rate cut in September, with the Fed signaling its readiness to act to prevent further weakening in Employment. This marks a significant shift in the Fed’s priorities, emphasizing support for the Labor Market over concerns about Inflation.

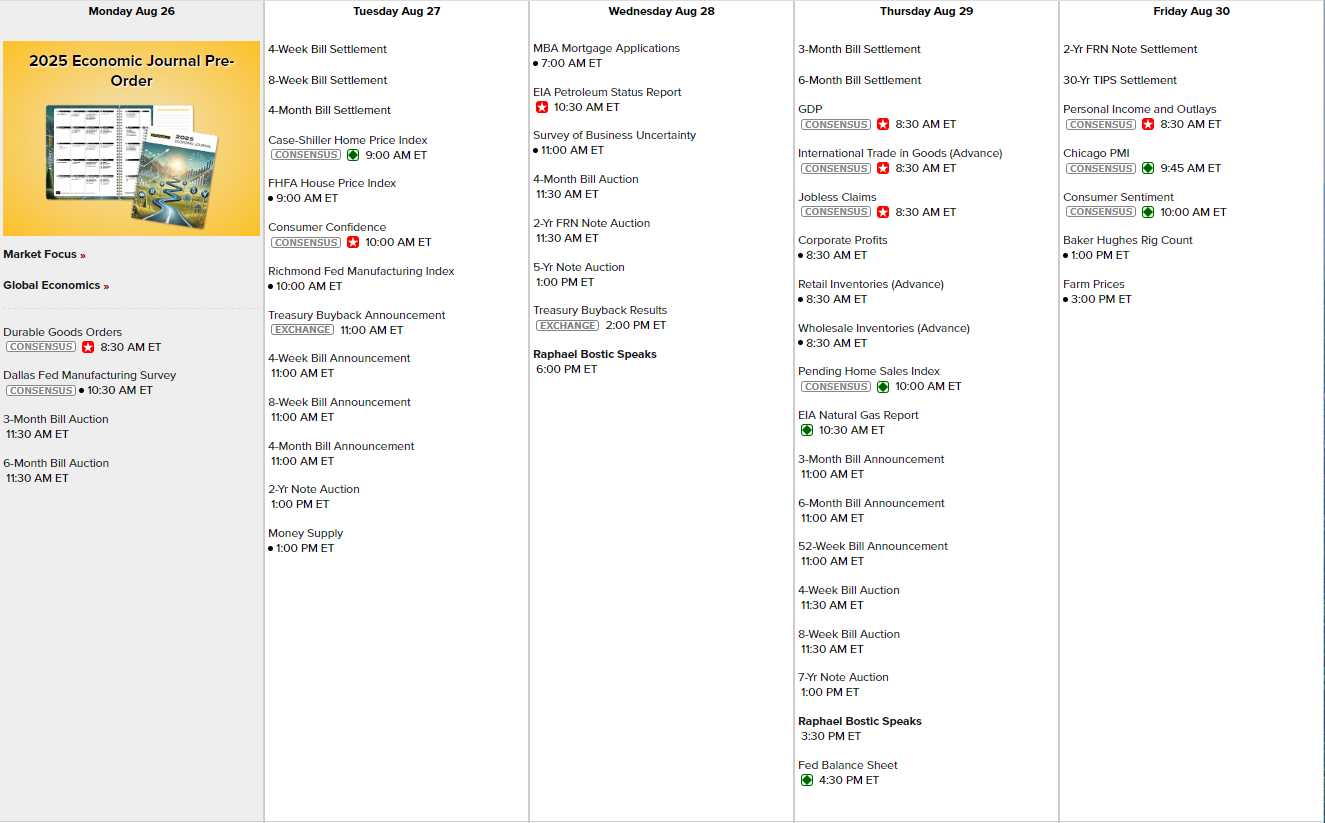

It’s not a slow Economic week – we have Note Auctions and we have Bostic speaking twice (and he’s been advocating cuts so GO MARKETS!) and today we get Durable Goods and the Dallas Fed, tomorrow we have the Richmond Fed and Housing Data and Wednesday is Business Uncertainty. On Thursday we’ll see GDP with Corporate Profits and a very important 7-year auction and Friday – even though no one will be around for it – we have Personal Income & Outlays, Chicago PMI, Consumer Sentiment and Farm Prices – that’s a lot of stuff not to pay attention to!

There is certainly no shortage of earnings reports but none of them matter more than Nvidia (NVDA) who report on Wednesday, after the close. Can they justify their $3.2 TRILLION market cap, which is 75 TIMES more than they make? Tune in and see…

This week might be a low-volume affair, leading into Labor Day, but it’s clear that the undercurrents in the market are anything but calm. From Geopolitical Tensions and Supply Disruptions impacting Oil prices, to China’s ongoing economic struggles, and shifting strategies among Hedge Funds, there are plenty of factors for traders to keep an eye on. The Fed’s focus on Employment over Inflation suggests a dovish stance that might support markets, but it also raises questions about the underlying health of the Economy.

I agree with this guy. When I used consult in Washington – it wasn’t surprising THAT politicians COULD be bought but how CHEAP it was to buy them! He’s also following my core diversification strategy – so good on him, right?!?