Are we there yet?

Not quite but this is a holiday weekend so this week is already over as Wall Street packs off for the Hamptons (or the Jersey Shore for junior associates). The Dow (which is a useless index) and the S&P are right by their highs but the Nasdaq Futures have been REJECTED at 20,000 – so now we have to worry about them and the Russell has made a nice comeback but even the 2,300 line we see on this chart is still far short of the 2,400 highs of November, 2021.

That’s right, small-cap stocks have gone NOWHERE in 3 years yet the MSM can’t stop gushing about the small-cap rally. Why is that? All that’s really going on with the $4Tn Russell index at the moment is that people are moving money out of the $26Tn Nasdaq 100 (which is actually just 7 stocks) and the $46Tn S&P 500 (half of which is actually the same 7 stocks) and SOME of it trickles into the Russell – for those people not going all CASH!!!

At 10am we’ll get a look at Consumer Confidence, which should tick up now that our future choices are no longer Trump and Biden (who wouldn’t be depressed) and we’ll see how much Harris’ “Joy” (to the World!) campaign is doing for those expectations but, for our Corporate Masters and misinformed Conservatives, it’s more like “Don’t Fear the Reaper” as Harris’s tax plan threatens to actually tax Corporations equitably for the first time in 50 years.

🤖 Harris’s proposed tax plan represents a significant shift towards taxing Corporations and High-Income individuals more equitably. This is a marked departure from the tax policies of the last five decades, which have favored Corporate Interests and Wealth Accumulation at the top. Here’s a closer look at the context, implications, and historical perspective of this shift:

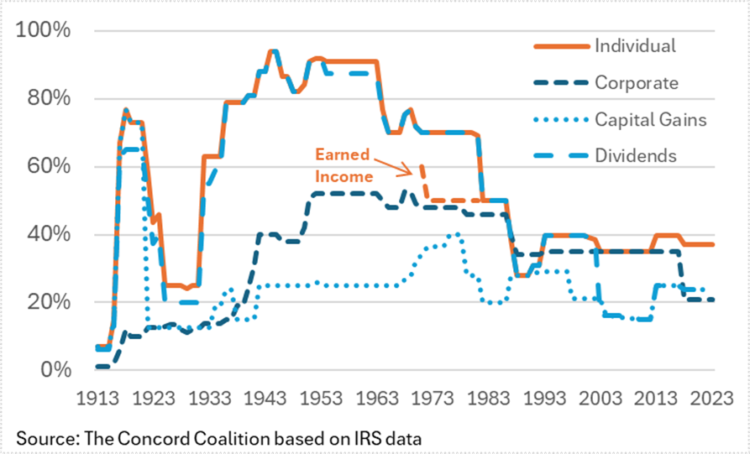

A Historical Perspective on Corporate Tax Rates

From Highs to Lows: Since the 1980s, U.S. corporate tax rates have seen a dramatic decline. Before the Tax Cuts and Jobs Act (TCJA) of 2017, the corporate tax rate stood at 35%. The TCJA slashed it to 21%, marking the lowest rate in over 40 years. Historically, Corporate Tax Rates in the U.S. have been much higher, often above 50% during the 1950s and 1960s—a period characterized by Strong Economic Growth, Industrial Expansion and a booming Middle Class.

Corporate Profits and Tax Avoidance: Despite these low nominal rates, many large corporations have paid even less in effective taxes. For instance, a study found that 55 of America’s largest companies paid no federal income tax in 2020 despite being profitable . The effective tax rate for many corporations has been far below the statutory rate due to Loopholes, Deductions, and Offshoring Practices. This erosion of the tax base has significantly contributed to Income Inequality, Underfunded Public Services and is the primary cause of the nation’s $35 TRILLION Budget Deficit.

Harris’s Tax Plan: Key Provisions

-

Raising the Corporate Tax Rate: Harris supports increasing the Corporate Tax Rate from 21% to 28%, a move expected to generate substantial revenue. This adjustment would partially restore the pre-Trump rates, but still well-below the 35% that prevailed for decades . Critics argue that even this modest increase could impact Corporate Investment and Economic Growth – a Randian fallacy that has long been debunked. However, proponents believe it will create a more balanced and fair tax system, redistributing the tax burden more equitably.

-

Minimum Tax on Large Corporations: To combat tax avoidance, Harris proposes a minimum tax rate of 21% on the largest corporations. This measure is aimed at ensuring that highly profitable companies contribute their fair share, closing loopholes that have allowed many to pay little to no tax .

-

Taxing Foreign Profits: The plan includes higher taxes on foreign profits, countering strategies where companies shift profits to low-tax jurisdictions. This would align with international efforts to implement a Global Minimum Tax, ensuring that Multinationals contribute to the economies where they generate profits .

Broader Economic and Social Implications

Broader Economic and Social Implications

-

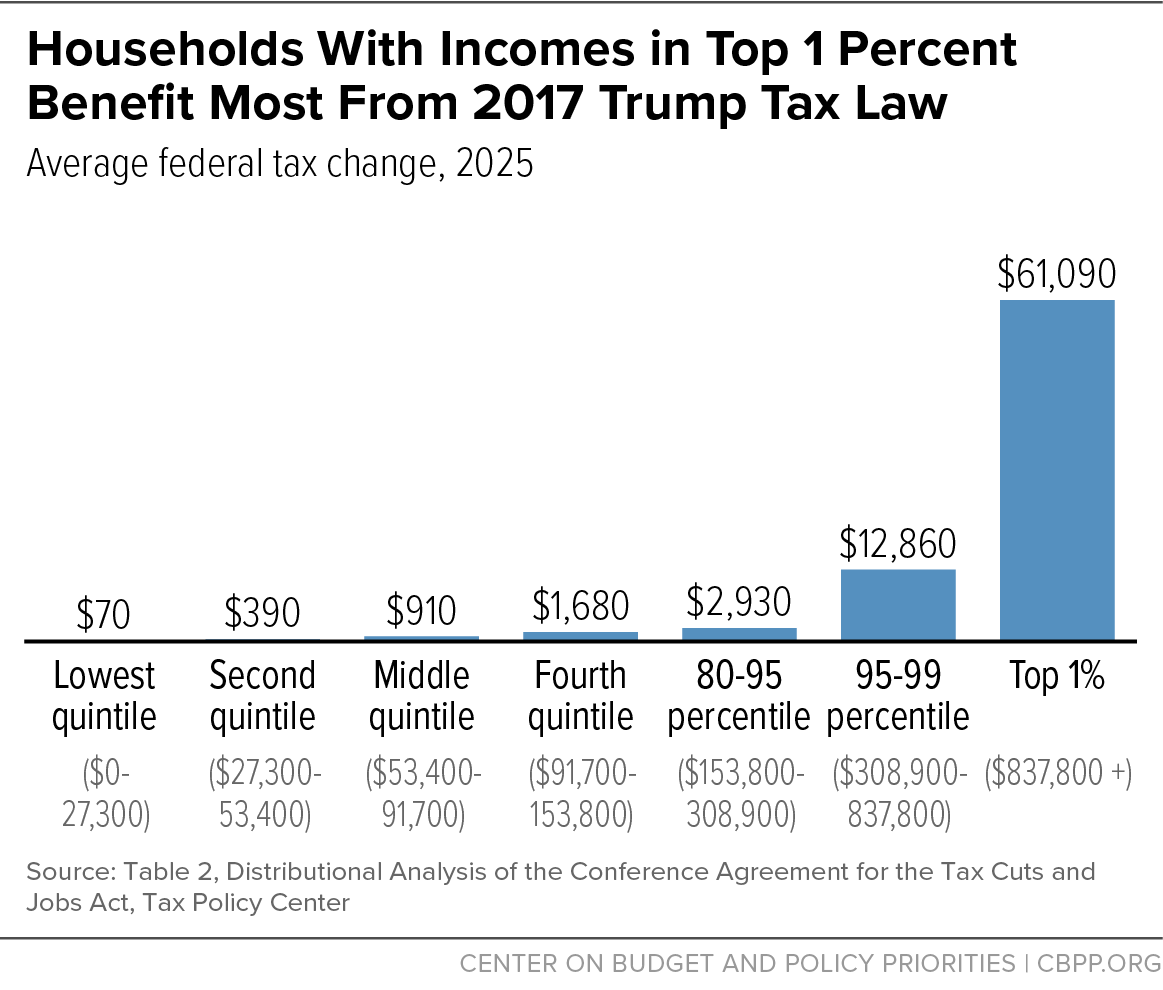

Impact on Income Inequality: By targeting corporations and the wealthiest individuals, Harris’s plan aims to reduce Income Inequality, which has reached alarming levels in the U.S. Over the past few decades, tax policies have disproportionately benefited the wealthy, contributing to the widening wealth gap . Implementing these changes could help rebalance the distribution of wealth and provide more funds for Public Services and Infrastructure.

-

Political and Economic Resistance: Despite these good intentions, the plan faces significant opposition from Conservative Lawmakers, Business Groups, and even some Centrist Democrats. Opponents argue that higher corporate taxes could discourage investment, stifle job creation, and ultimately be passed down to Consumers in the form of higher prices . Historical precedents show that such tax hikes are often met with fierce lobbying and public relations campaigns from the business sector.

-

Balancing Act: The challenge lies in finding a balance that ensures corporations pay fair taxes without hampering economic growth. This delicate balance has been a recurring theme in tax policy debates throughout U.S. history. In the 1980s, tax cuts were justified on the grounds of boosting economic activity (supply-side economics). Now, the pendulum swings back towards using tax policy as a tool for Equity and Public Investment .

A Necessary Correction or a Risky Move?

Kamala Harris’s tax plan, much like those before it, is a reflection of the political and economic ideologies of the time. While increasing Corporate Taxes may face resistance, it represents an effort to correct decades of tax policies that have favored Capital over Labor and Wealth Accumulation over Distribution – a situation that has now gotten so extreme that the Middle Class is facing extinction. The proposed changes are not only about raising revenue but also about redefining the social contract between Corporations, the Government, and the Public it is meant to serve.

As we look forward, the real challenge will be in the details – ensuring that new tax revenues are effectively utilized to foster Sustainable Economic Growth and Social Equity. The debate will undoubtedly continue, but as history shows, tax policy is as much about values and priorities as it is about economics.

As I said in last week’s Bloomberg Interview, the market has yet to price in a Harris victory in November with Conservatives still living in the Fox/WSJ echo chamber that ignores both the current polls and the rolling mental break-down of the man who, at 78, would be the oldest person ever elected President (Biden was 5 months younger) – something that, until Biden stepped down – was considered far too old to serve by the GOP attack dogs.

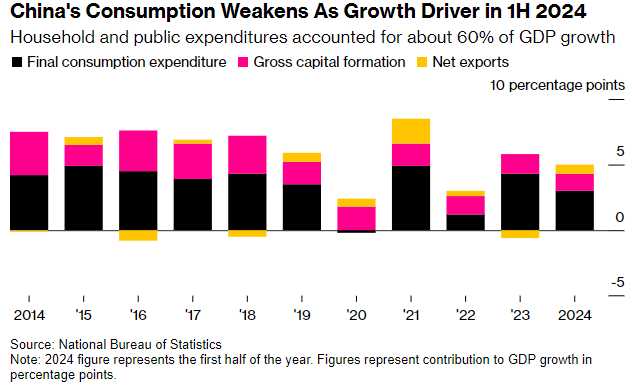

The market also has yet to price in REALITY – the reality that Corporate Profits don’t only go up and harder times are indeed ahead – tax cuts or no. For example, China’s PDD Holdings (Temu) lost $55Bn (33%) in market cap yesterday after disappointing on sales and lowering guidance – who’d have thought that giving 90% discounts would come back to bite them?

PDD’s massive stock drop is a clear indicator of the growing economic issues in China. Despite being one of the last bright spots in the Chinese consumer market due to its focus on low-cost products, PDD’s struggles reflect broader consumer caution and reduced spending power. This is compounded by macroeconomic factors such as high unemployment, low income growth, and diminishing consumer confidence. The Chinese economy is not rebounding as expected post-COVID, with retail sales growth lagging significantly behind pre-pandemic levels (just over 3% in the first seven months of 2024, compared to 8%-plus growth in pre-pandemic times).

We can’t ignore what’s happening in China – it’s also happening here as that dwindling Middle Class is also running out of buying power and Europe is NOT going to save us all by picking up the slack on Consumption! Meanwhile, back in the USofA, Commercial Real Eestate is facing a dramatic shift, with a staggering $557Bn (52%) drop in office values since 2019, predominantly affecting aging Central Business Districts (CBDs). Cities like Los Angeles, Chicago, and Boston are seeing High Vacancy Rates, Foreclosures, and Declining Values.

Major landlords like Brookfield Corp. are defaulting on billions in mortgages as they abandon struggling properties, signaling a lack of faith in the recovery of these once-coveted locations. The decline of central business districts indicates a long-term shift in urban dynamics, where the old prestige of a downtown office is being replaced by the practicality and appeal of suburban and peripheral areas.

The pandemic has accelerated existing trends, such as the move towards remote work and the preference for less dense, more livable urban environments. Despite attempts by companies to bring employees back to the office, the lingering appeal of remote work and the comfort of working in safer, suburban-like settings have diminished the draw of traditional office spaces. This shift is reflected in the rise of office vacancies in downtown areas, where crime and inconvenience are deterrents to employees who have adapted to working from home or in more accessible locations.

The dramatic devaluation of office properties in CBDs has caught the attention of both domestic and foreign investors, who are increasingly cautious about putting money into these markets. Big players like Blackstone and Starwood Capital Group have pulled back, and foreign investors have incurred significant losses which, in turn, spill over to our friends, the banks and God help us all if they can’t keep propping up earnings seasons!

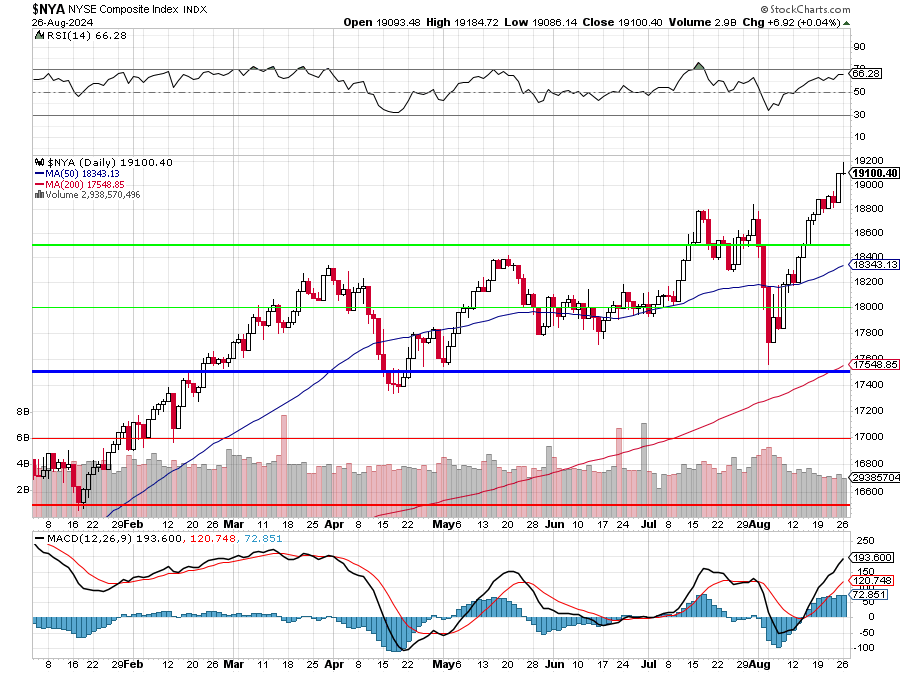

And that brings us to the ultimate index – the NYSE – which is at it’s all-time high of 19,100 with the RSI at 66.28 and look what happened last time we hit 70! The MACD is HIGHER than it was last time we hit 70 but the 200 dma has crossed over our Must Hold (blue) Line – so that should be excellent support next time we drop and THEN we can buy with some confidence.

Be careful out there!