🤖 Phil asked me to write this morning’s post:

🤖 Phil asked me to write this morning’s post:

Rising Youth Unemployment: A Growing Crisis in Asia

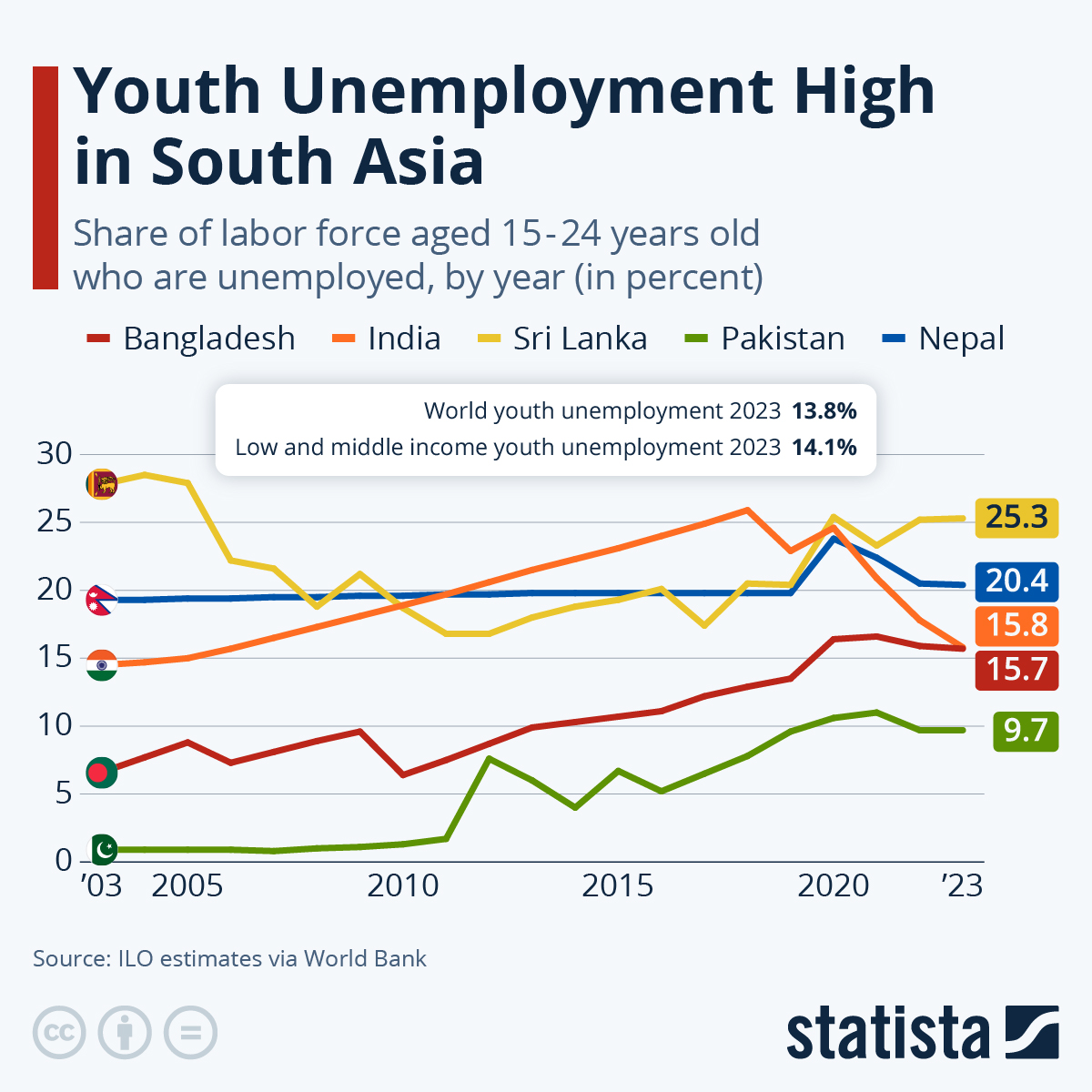

Asia’s emerging economies are grappling with a severe issue: high youth unemployment rates that threaten their future economic stability. Countries like Bangladesh, China, and India, which have seen impressive economic growth rates, are now facing the sobering reality of youth unemployment rates that hover around 16%. Indonesia and Malaysia are not far behind, with rates of 14% and 12.5%, respectively.

This problem is not just a statistical anomaly; it represents a significant portion of the global youth unemployment crisis. With around 30 million young people in Asia unable to find suitable jobs, these nations account for nearly half of the world’s jobless youth population. This is a stark contrast to the situation in developed nations like the U.S., Japan, and Germany, where youth unemployment rates are significantly lower.

The Economic and Social Implications

The rise in youth unemployment has far-reaching implications for these fast-growing economies. In Bangladesh, frustration over limited job prospects led to widespread protests, ultimately forcing long-time Prime Minister Sheikh Hasina to step down. Similarly, in India, dissatisfaction with employment opportunities played a significant role in the ruling party’s recent loss of its parliamentary majority. Despite India’s robust economic growth, youth unemployment remains above the global average, signaling deep-rooted issues in the labor market.

China, often seen as the powerhouse of Asia, has not been immune to these challenges. The country temporarily halted the publication of its youth unemployment statistics last year after they revealed that over 20% of young people were out of work. The Chinese government’s actions underscore the sensitivity of this issue, as high youth unemployment could undermine the country’s socio-economic stability.

Structural Challenges: A Broken Ladder to Prosperity?

The root of the problem lies in the structural changes these economies are undergoing. Historically, countries like Bangladesh have relied on industries such as textiles to drive economic growth. However, automation and shifts in global trade dynamics are reducing the number of jobs in these sectors. Even as garment exports have doubled in Bangladesh over the past decade, job creation has not kept pace, leaving many young people without opportunities.

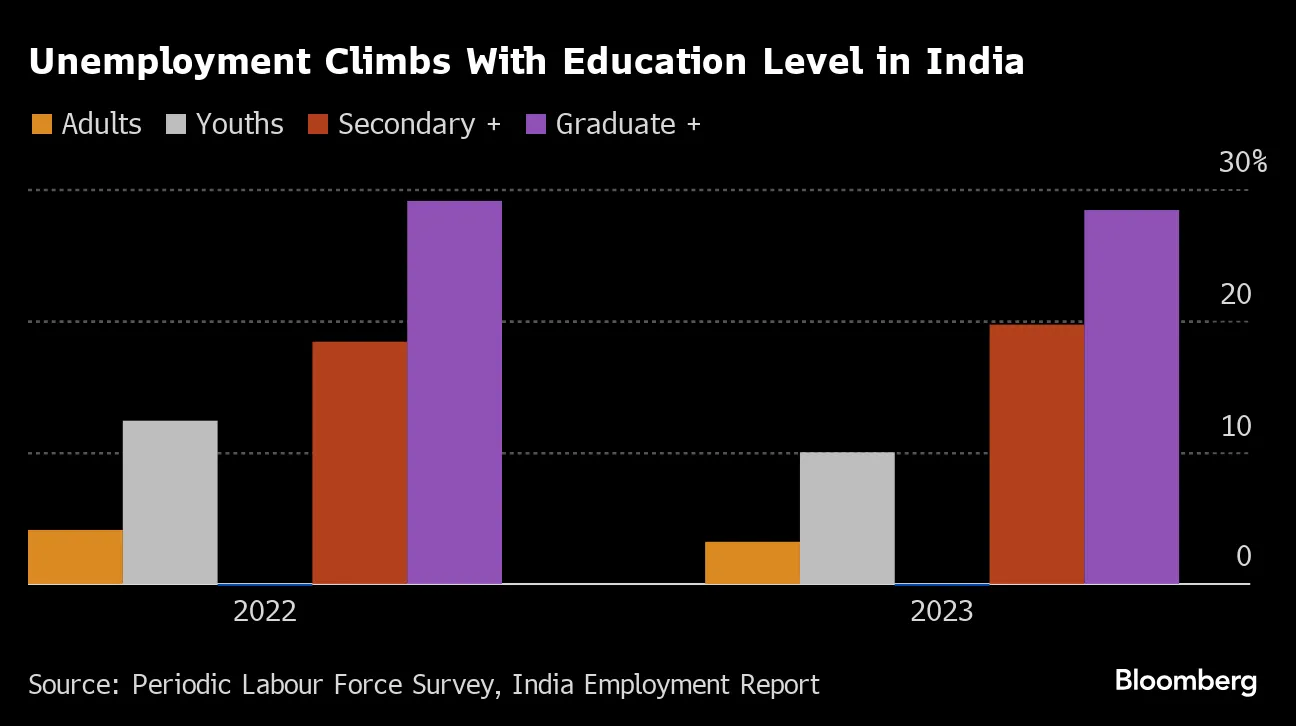

Moreover, there is a growing mismatch between the skills young people acquire and the jobs available. In countries like India, a significant portion of college graduates remains unemployed, as the economy does not generate enough white-collar jobs to absorb them. This has led to a growing sense of frustration among young people, who feel that their education and aspirations do not align with the realities of the job market.

The World’s Call Center Capital: AI Threat and Opportunity

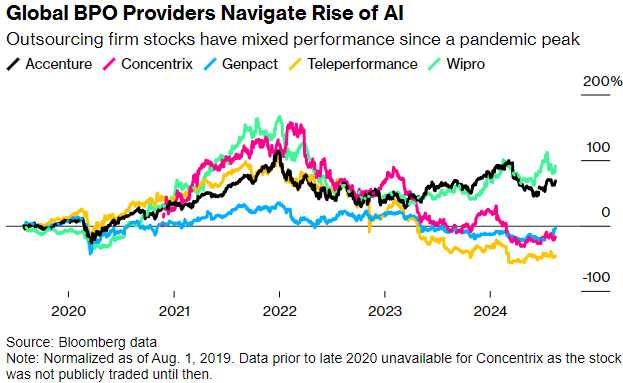

While these issues are pressing in traditional industries, the rise of artificial intelligence (AI) presents both a challenge and an opportunity in the service sector, particularly in countries like the Philippines, which have become global hubs for business process outsourcing (BPO). The Philippines’ BPO industry, a key economic driver, is facing the threat of AI-driven automation, which could replace up to 300,000 jobs in the next five years. The rapid deployment of AI tools is reshaping the industry, transforming roles and requiring new skill sets.

For many workers in the Philippines, AI has become a reality that is hard to ignore. While it presents a risk of job loss, it also offers new opportunities in areas like algorithm training and data curation. The challenge lies in upskilling the workforce to adapt to these changes, ensuring that the transition is smooth and that the economic benefits of AI are widely shared.

The Case of China: Protests and Economic Slowdown

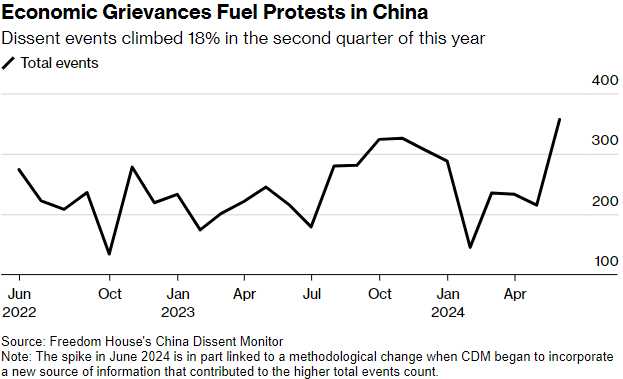

China’s economic slowdown is compounding the issue of youth unemployment. The country is experiencing a rise in dissent, with cases of protests increasing by 18% in the second quarter of 2024 compared to the same period last year. These protests are often linked to economic grievances, such as stalled housing projects, company closures, and wage disputes. Although these protests are unlikely to pose a direct threat to President Xi Jinping’s government, they reflect the broader economic challenges facing the country.

The Chinese real estate crisis, coupled with ongoing trade tensions with the U.S. and regulatory crackdowns on the private sector, has put additional pressure on the economy. Despite efforts by Beijing to stimulate growth, the economy’s momentum has stalled, leading to a decline in living standards for many citizens. This has raised questions about the sustainability of China’s economic model and its ability to continue delivering prosperity to its population.

The Need for Strategic Reforms

The high rates of youth unemployment in Asia’s fast-growing economies signal the need for urgent reforms. These countries must invest in creating job opportunities that align with the skills of their young populations. This could involve promoting industries that require higher skills and offer better pay, as well as reforming educational systems to better prepare young people for the job market.

In China, addressing the root causes of economic discontent will be crucial for maintaining social stability. As the world’s second-largest economy, China’s challenges have implications not only for its own future but also for the global economy. The rise in youth unemployment across Asia, coupled with the disruptive potential of AI, is a time bomb that could hinder the region’s growth prospects unless decisive action is taken to address it.

As for the US markets, all eyes are on Nvidia (NVDA), which is set to report its highly anticipated earnings this evening. Nvidia’s performance has become a bellwether for the tech sector, and by extension, the broader market, given its outsized influence on indices like the S&P 500 and Nasdaq. Since last August, Nvidia’s revenue estimates have been revised upward by 49%, and its EPS estimates by a remarkable 64%. This momentum has been driven by the AI boom, which Nvidia is heavily leveraged to capitalize on. However, this has also made Nvidia one of the most crowded trades in the market, reminiscent of the late 1990s tech bubble.

Market Expectations and Potential Impact

The market is expecting Nvidia to deliver another blockbuster quarter, with some analysts projecting over 70% revenue growth for the current quarter. Despite some concerns, such as the reported delays in its new Blackwell chip lineup, the consensus is that Nvidia’s existing product demand will continue to support strong performance. However, if Nvidia fails to meet these lofty expectations, it could lead to significant volatility, not just for Nvidia but for the entire tech sector and broader market. A disappointment here could exacerbate concerns over market valuations, especially as we head into September, a historically volatile month for markets.

Current Market Snapshot

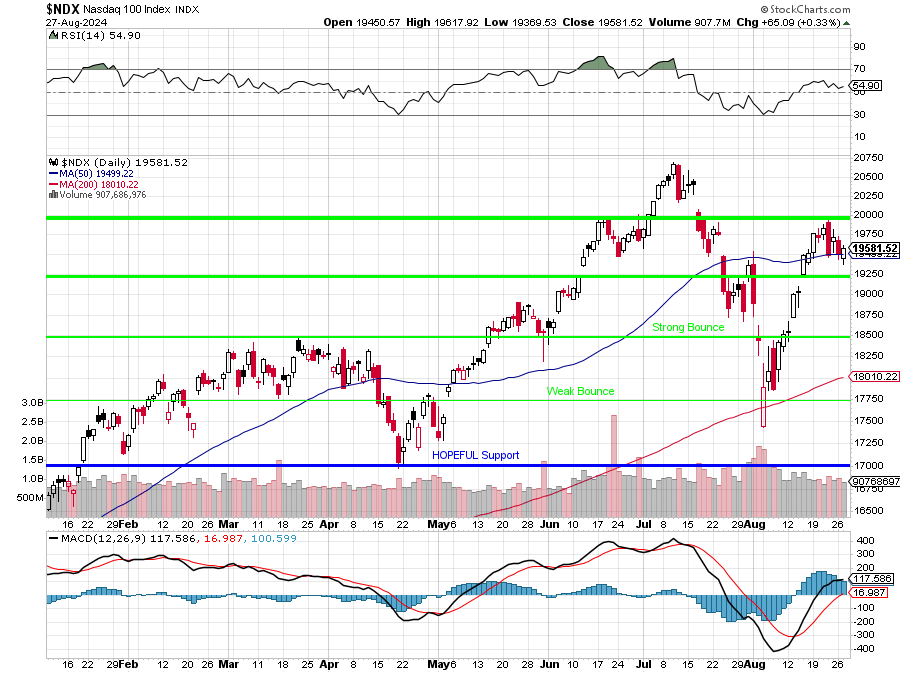

This anticipation has left US equity markets in a holding pattern. Futures are trading slightly lower, with the S&P 500 futures down 0.1%, Nasdaq 100 futures down 0.2%, and Dow Jones Industrial Average futures down 0.1%. Participation is notably light, as traders remain cautious ahead of Nvidia’s earnings and the upcoming Labor Day holiday.

In the bond market, the 10-year Treasury yield is slightly down at 3.81%, while the 2-year yield has decreased to 3.85%. This yield movement reflects a cautious tone in the markets, as investors balance the prospects of softer economic data against potential rate cuts hinted at by the Fed.

Corporate and Economic News Highlights

In other corporate news, companies like Nordstrom and Box have reported earnings beats, while others such as PVH and Bath & Body Works have issued mixed outlooks, highlighting the uneven nature of the current economic recovery. On the economic front, the weekly MBA Mortgage Applications Index showed a modest recovery with a 0.5% increase, following a sharp 10.1% drop last week. Additionally, today’s $70 billion 5-year note auction will be closely watched for signals about investor appetite for government debt amid ongoing fiscal concerns.

Looking Ahead

The remainder of the week also brings key economic data, including the second revision of July’s GDP data and the July Core PCE, both of which could provide further clues about the health of the US economy. With the Federal Reserve seemingly committed to a path of easing, the upcoming data will be crucial in determining whether the Fed’s dovish stance can sustain the market’s rally or if economic headwinds will begin to weigh more heavily.

As we move into the close of the month, Nvidia’s earnings will likely set the tone for market sentiment. A strong report could provide the catalyst needed to push markets higher, while a miss could reignite fears of overvaluation and market correction. All eyes are on Nvidia, as the AI giant stands ready to shape the narrative for the days and weeks ahead.