Well, I’m relieved!

NVIDIA’s (NVDA) Q2 2025 earnings call and subsequent market reaction gave us a clear snapshot of the current state of the tech industry, especially in the AI and Semiconductor sectors. The company’s performance highlights both the enormous potential of AI-driven growth and the inherent risks associated with high expectations and the current market dynamics.

I asked Boaty (AGI) to give us a full report based on the Earnings Report, Conference Call and a broader-market analysis for NVDA:

🚢 Based on the comprehensive review of NVIDIA’s Q2 2025 earnings report and the subsequent conference call, along with additional market analysis, here’s a detailed investor report:

NVIDIA Q2 2025 Earnings Analysis

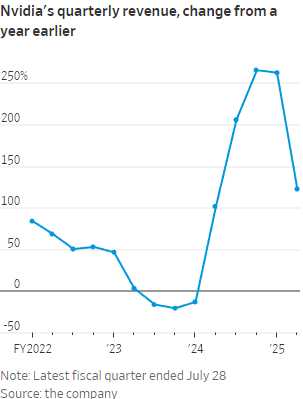

1. Financial Performance: NVIDIA reported exceptional Q2 results with revenue of $30 billion, up 122% year-over-year and 15% sequentially, significantly surpassing the $28.7 billion analyst consensus.

2. AI Dominance and Market Position: NVIDIA continues to lead the AI chip market, benefiting from the surge in demand for generative AI applications. The company’s CUDA ecosystem and optimized AI frameworks give it a significant competitive advantage. However, this dominance may face challenges as competitors like AMD and Intel ramp up their AI chip offerings.

3. Product Pipeline and Innovation: The anticipation for the Blackwell architecture is high, with expected revenue contribution in Q4 2025. This next-generation platform promises significant performance improvements, which could help NVIDIA maintain its technological edge. However, the transition from Hopper to Blackwell may present short-term challenges in terms of customer adoption and integration.

The Data Center segment was the standout performer, generating $26.3 billion in revenue, a 154% increase year-on-year. This growth reflects robust demand for AI-related infrastructure from major cloud service providers and tech giants like Amazon, Google, and Microsoft. The push to modernize data centers with AI and accelerated computing solutions is clearly benefiting NVIDIA, positioning it as a key player in the future of enterprise computing.

4. Diversification of Revenue Streams: NVIDIA is expanding beyond hardware, with its AI Enterprise software platform expected to approach a $2 billion annual run rate by year-end. This diversification could provide more stable revenue streams and higher margins in the long term.

5. Market Expansion and Customer Base: The company is seeing strong demand across various sectors, including cloud service providers, consumer internet companies, and enterprises. This broad-based adoption of AI technologies could provide resilience against sector-specific downturns.

6. Margin Pressure and Operating Expenses: Gross margins decreased slightly due to new product mix and inventory provisions. Operating expenses are expected to rise significantly as NVIDIA invests in R&D and product development, short-term profitability may face pressure with operating expenses expected to grow in the mid- to upper 40% range. These factors could pressure profitability in the short to medium term as NVIDIA invests heavily in R&D and market expansion.

7. Geopolitical Risks: While Data Center revenue in China grew, NVIDIA faces challenges due to export controls. The evolving geopolitical landscape and potential further restrictions could impact NVIDIA’s global market access.

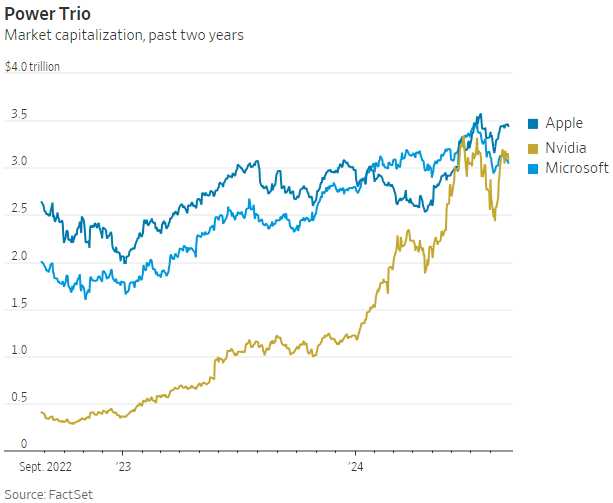

8. Market Valuation and Investor Expectations: NVIDIA’s stock price has surged over 160% year-to-date, reflecting high investor expectations. The company’s current P/E ratio of around 60 (based on forward earnings) suggests that much of the near-term growth is already priced in, leaving little room for disappointment. investors should be cautious about the sustainability of this growth, especially given the high bar set by past performance.

9. Competition and Market Saturation: As noted by Phil during yesterday’s Webinar, NVIDIA has benefited from a period of uniqueness and scarcity, allowing for premium pricing. However, as competitors catch up and more players enter the AI chip market, NVIDIA may face pricing pressures and market share challenges in the coming years.

10. Broader Market Implications: NVIDIA’s performance is seen as a bellwether for the AI industry and tech sector at large. Strong performance from NVIDIA supports the narrative of sustained AI investment, but the reaction also indicates that investors are seeking more than just strong earnings—they want assurance of continued growth and innovation. Any signs of slowdown or increased competition could lead to a reassessment of AI-driven valuations across the market.

Investor Considerations:

Investor Considerations:

1. Growth Sustainability: NVIDIA’s results reaffirm the view that AI will be a major growth driver for tech companies. The increasing adoption of AI across various industries—from healthcare to automotive—signals a long-term trend that will shape the future of technology. However, sustaining this growth will require continuous innovation and addressing the evolving needs of different sectors.

NVIDIA’s dependence on large capital expenditures by tech giants also ties its fortunes to broader economic conditions. Any slowdown in IT spending or shifts in economic policy could impact demand for AI infrastructure. Additionally, regulatory scrutiny, particularly regarding market dominance and geopolitical tensions, will be important to monitor.

2. Valuation Risks: The mixed market reaction to NVIDIA’s earnings illustrates the volatility that can come with high expectations. As tech stocks have significant weight in major indices, fluctuations in companies like NVIDIA can have outsized effects on the market. Investors should be prepared for volatility, especially as the tech sector navigates economic uncertainties and competitive dynamics. These high valuation multiples leave little room for error and any disappointment in future earnings or guidance could lead to significant stock price volatility.

3. Technological Leadership: NVIDIA’s ability to maintain its technological edge with Blackwell and future architectures will be crucial for long-term success. Challenges have emerged, particularly related to production issues that required a Blackwell design tweak, leading to a $908 million provision for low-yielding materials. While these issues are being addressed, they highlight the complexity and risks associated with cutting-edge technology development.

4. Diversification Strategy: The success of NVIDIA’s software and services initiatives could provide more stable revenue streams and help offset potential hardware commoditization.

Citations:

[1] https://www.fool.com/earnings/call-transcripts/2024/08/28/nvidia-nvda-q2-2025-earnings-call-transcript/

[2] https://www.barrons.com/livecoverage/nvidia-earnings-stock-price-today

[3] https://www.cnbc.com/2024/08/28/nvidia-nvda-earnings-report-q2-2025.html

[4] https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2025

[5] https://www.morningstar.co.uk/uk/news/253686/nvidia-earnings-no-sign-of-an-ai-slowdown.aspx

[6] https://www.benzinga.com/news/24/08/40603328/nvidias-earnings-5-reasons-why-this-weeks-report-could-shake-up-markets-ai-stocks-and-the-s-p-500

[7] https://sg.finance.yahoo.com/news/nvidia-earnings-disappoint-investors-despite-065008049.html

[8] https://www.theguardian.com/technology/article/2024/aug/28/nvidia-nvda-q2-earnings-report

NVDA’s Q2 earnings demonstrate its current dominance in the AI chip market. Investors, however, should remain cautious due to the sky-high high valuations, potential market saturation, and increasing competition. The company’s future success will depend on its ability to innovate, diversify revenue streams, and navigate an increasingly competitive landscape.

While NVIDIA remains a leader in the AI revolution, the risk/reward profile for Investors has become more balanced given the stock’s wild run-up to over $3Tn in market cap and the still-high market expectations (60x FORWARD earnings).

I’m also VERY disturbed that the company is spending $50Bn to buy back their own stock, rather than to grow the company and build future value. $50Bn is only 1.666% of $3Tn, so it doesn’t even move the needle for current shareholders and the stock trades 350M shares a day at $125 so that’s $43.7Bn PER DAY so WHAT IS THE POINT, NVDA? For the management incompetence alone that this demonstrates – I’d stay far away from this stock!

8:30 Update: We’re making up some of yesterday’s losses but GDP (2nd estimate of Q2) coming in at 3%, revised from 2.8% is nothing to celebrate if you are looking for the Fed to cut rates, is it? Even worse, the GDP Deflator, which is a measure of Inflation, has bumped up from 2.3% to 2.5% – also going the wrong way for rate-cut fans. Jobless Claims are down 2,000 from last week at 231,000 – so no help there either.

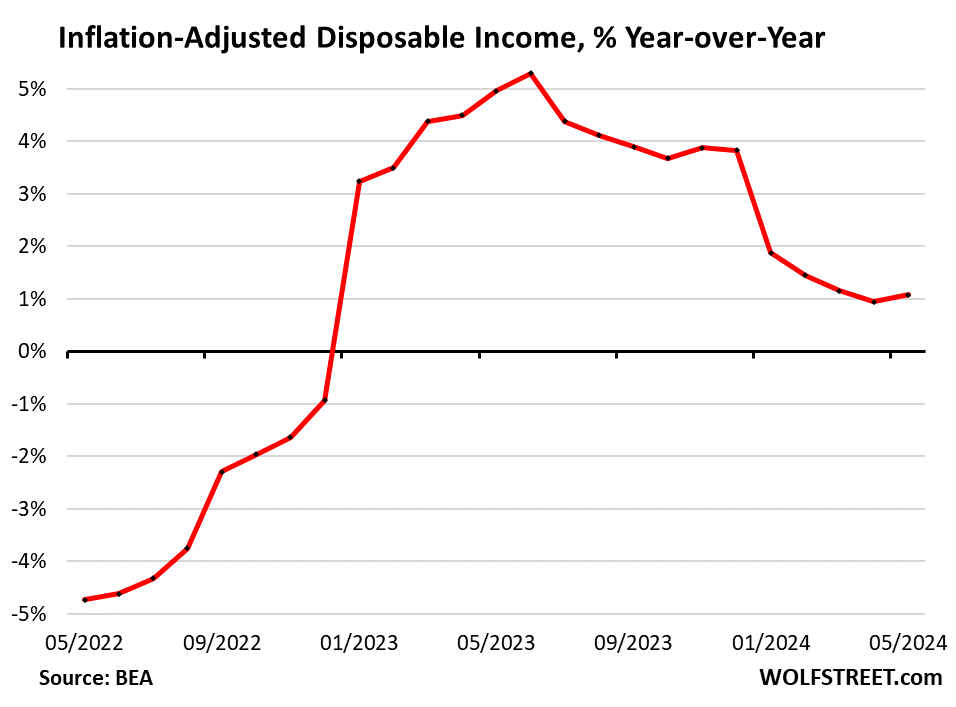

Speaking of employment, there’s an article in the WSJ today noting that, in the wake of a cooling hiring market, many employers are taking steps to reduce wages for new hires across various sectors, signaling a shift in power dynamics from workers back to employers who are going from “No experience necessary” to “No benefits will be provided.”

An analysis of job postings on ZipRecruiter.com reveals that average wages for new hires in industries such as retail, agriculture, manufacturing, and food have declined. Retail wages, in particular, saw the most significant drop, with advertised pay falling nearly 56% year-over-year! This trend is now extending beyond blue-collar jobs, affecting white-collar roles as well, with companies scaling back salaries that had previously been inflated to attract talent during the tight labor markets of the pandemic years.

Companies are using various strategies to lower costs, including hiring less experienced workers, moving job openings to lower-cost cities, or offering lower-paying contractor roles. Some firms are even relocating roles overseas to take advantage of cheaper labor markets. This “geographic arbitrage” is becoming a common tactic among businesses looking to manage Labor Costs more effectively.

Lower wages for new hires could lead to reduced Consumer Spending, potentially impacting Economic Growth. This is particularly relevant in sectors like Retail and Manufacturing, where wage cuts are most pronounced. If workers have less Disposable Income, it could dampen demand for goods and services, slowing down economic recovery efforts.

Lower wages for new hires could lead to reduced Consumer Spending, potentially impacting Economic Growth. This is particularly relevant in sectors like Retail and Manufacturing, where wage cuts are most pronounced. If workers have less Disposable Income, it could dampen demand for goods and services, slowing down economic recovery efforts.

The trend of reducing wages for new hires reflects broader changes in the Labor Market, driven by shifts in economic conditions and the balance of power between employers and employees. While these strategies may offer immediate financial benefits for companies, they carry risks that could affect long-term competitiveness and employee relations.

Employers need to navigate these challenges carefully, balancing cost control with the need to maintain a motivated and skilled workforce. As the market continues to evolve, businesses that adapt their strategies to address both current and future Labor Market conditions will be the ones that are best positioned for long-term success – making them worthy of our current investments.