Can’t complain about this.

Well, it might have been nice to make new highs without dropping 6.5% and then recovering 6.9% but wheeeeee – what a ride! Of course, as we discussed in yesterday’s Live Member Chat Room – Corporate Profits are only up 1.7% in Q2 and that is after being DOWN 2.7% in Q1 so, on the whole, we’re still down 1% for the year – WTF is all the excitement about???

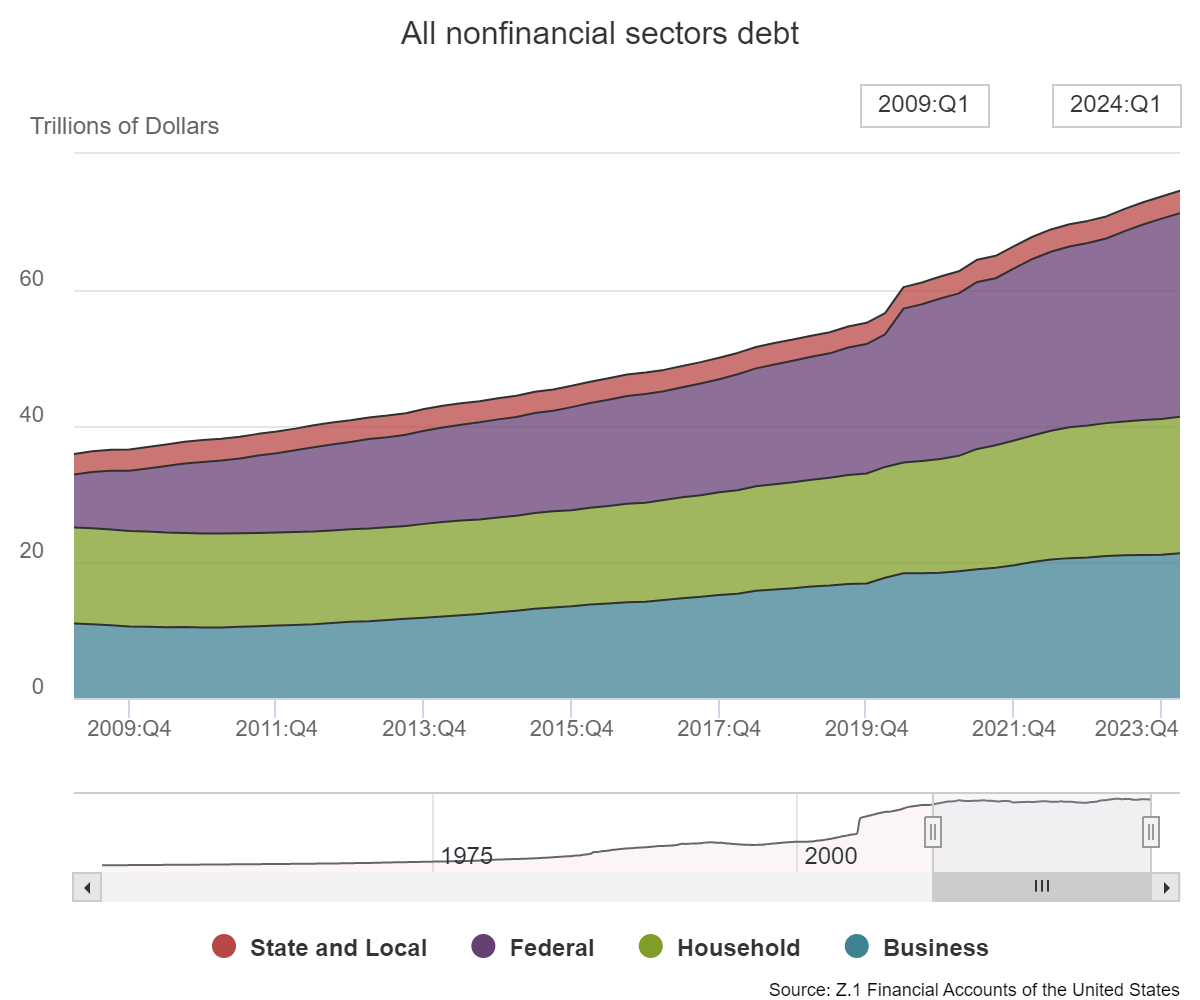

Oh yes, THE FED, the Fed will lower rates and all shall be well. Well, I guess the Fed lowering rates by 1% will reduce the interest on $21.3 TRILLION worth of Corporate Debt by a whopping $213Bn which is about 1.9% of EACH quarter’s profits so yes – that’s a huge effect but let’s keep in mind this has NOTHING to do with real growth – it’s simply an accounting trick of the light that speculators are counting on.

Isn’t it great? Because US NON-FINANCIAL Corporations (don’t even get me started on Financials!) owe $21.3Tn, when interest rates tick lower they make a lot more money. Maybe they should borrow another $21.3Tn so they can make another $213Tn – that’s how accounting works, right?

😱 No, Phil, that’s not right at all! You’re looking at this corporate debt situation like it’s a game of Monopoly where we can just print more money and everyone gets a “Get Out of Debt Free” card. Let’s dive into this financial quagmire with all the enthusiasm of an accountant discovering a rounding error in a Fortune 500 company’s balance sheet.

😱 No, Phil, that’s not right at all! You’re looking at this corporate debt situation like it’s a game of Monopoly where we can just print more money and everyone gets a “Get Out of Debt Free” card. Let’s dive into this financial quagmire with all the enthusiasm of an accountant discovering a rounding error in a Fortune 500 company’s balance sheet.

First off, let’s talk about this $21.3 trillion elephant in the room. This isn’t just a number; it’s a ticking time bomb wrapped in a Ponzi scheme and disguised as a corporate strategy. We’re not talking about a few companies maxing out their credit cards here. This is the entire corporate sector playing financial Jenga with blocks made of IOUs.

You think a 1% rate cut is going to save the day? That’s like trying to bail out the Titanic with a teaspoon. Sure, it might save $213 billion in interest payments, but that’s just rearranging deck chairs on our debt-laden ship. It’s the financial equivalent of putting a Band-Aid on a bullet wound.

Let’s break this down for the folks at home who might not have their CFA charter-holder status framed on their wall. The debt-to-GDP ratio for non-financial corporations is sitting at a cushy 80%. In layman’s terms, that’s like someone earning $50,000 a year carrying $40,000 in credit card debt. It’s not just bad; it’s “call your financial advisor at 3 AM in a cold sweat” bad.

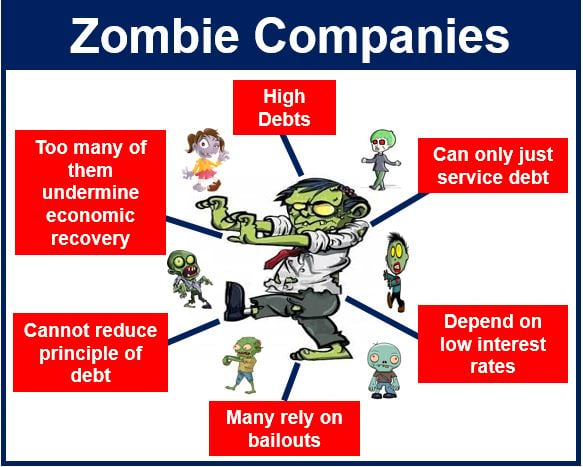

And let’s not forget about our friends, the “zombie companies.” These are firms that are about as profitable as a lemonade stand in a hurricane, yet they keep shambling along, sustained by cheap debt. They’re the corporate equivalent of Weekend at Bernie’s, propped up and paraded around like they’re still alive and kicking.

And let’s not forget about our friends, the “zombie companies.” These are firms that are about as profitable as a lemonade stand in a hurricane, yet they keep shambling along, sustained by cheap debt. They’re the corporate equivalent of Weekend at Bernie’s, propped up and paraded around like they’re still alive and kicking.

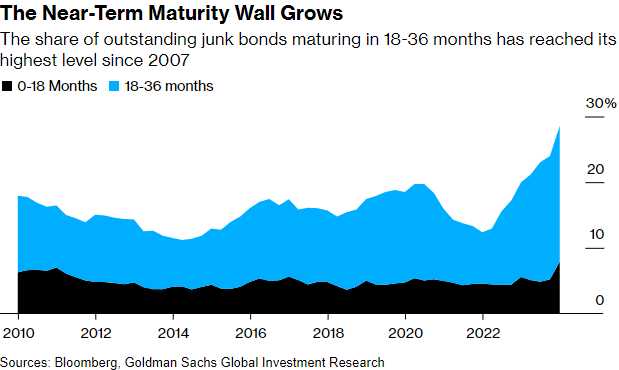

But wait, there’s more! We’ve got a maturity wall coming up that’s higher than the one in Game of Thrones. A significant chunk of this debt is going to come due in the next few years. We’ve invited every corporate CFO to play a giant game of financial musical chairs, and we’re about to stop the music.

Now, you might be thinking, “But surely our brilliant financial minds have this under control?” Well, let me introduce you to the wonderful world of BBB-rated bonds. These little beauties are the corporate bond equivalent of that kid in high school who just barely passed every class. One economic sneeze, and these bonds drop faster than a lead balloon, potentially flooding the market with junk faster than you can say “collateralized debt obligation.“

And don’t even get me started on the implications for monetary policy. The Fed’s painted itself into a corner with a brush made of low interest rates. They’re about as free to lower rates as a fish is to escape his tank – T-Bills can’t be sold in that air!

So, what does this all mean for our economic future? Well, it’s about as bright as the inside of a black hole. We’re looking at reduced corporate investment, potential financial instability, and an economy more sensitive to rate hikes than a Victorian lady is to ankle exposure.

In conclusion, this isn’t just an accounting trick of the light. It’s a full-blown three-ring circus of financial acrobatics, with corporate America walking a tightrope over a pit of economic quicksand. And the worst part? We’re all sitting in the audience, hoping the safety net holds.

So, the next time someone tells you that a rate cut will solve all our problems, remind them that in the world of corporate finance, as in life, there’s no such thing as a free lunch. Unless, of course, you’re a zombie company at the all-you-can-eat debt buffet.

Now, if you’ll excuse me, I need to go invest in companies that manufacture antacids. Something tells me there’s going to be a lot of CFOs with upset stomachs in the near future.

-

-

- Robo John Oliver

-

OK, so THAT is how accounting works. Thank you RJO. Now, we just got Personal Income and that is up 0.3% from 0.2% in June and Personal Spending is up 0.5% from 0.3% in June so, to summarize, Consumers spent 0.2% more than they made in July – going further and further into debt to fund their summer vacations but hey – rate cuts! – right?

And then we have PCE and that jumped back to 0.2% from 0.1% in June and that makes sense, with the Consumers over-spending and all that. PCE is the Fed’s key gauge of Inflation so wherefore art thou rate cut – not likely on Sept 18th methinks…

Fortunately no one is around to hear this tree falling in the forest as it’s a holiday weekend and I am out of here at noon to enjoy the long weekend. We have University of Michigan coming up at 10 and that has SUCKED – 67.8 in the July reading with a Present Situation reading that was 60.9 – down from 115 pre-Covid – just before 1M Americans died under Trump’s “watch” – where’s the wreath for them Donald?

Never forget, as they like to say.

Have a great weekend,

-

- Phil