I love 4-day weeks!

Friday’s window dressing has left the building but the indexes are, overall, still in very good shape with the Russell still holding above 2,200 and the S&P over 5,600 – large caps and small caps all agree things are just FANTASTIC – and who are we do disagree?

After this year’s 18% (so far) run in the S&P 500, Fidelity Investments now has 497,000 $1M+ accounts and that is up 31% from last year and that’s an exciting-sounding statistic if you don’t dig into how many of those are new accounts and how many of those accounts were $800,000+ least year – in which case just keeping up with the market isn’t actually very impressive…

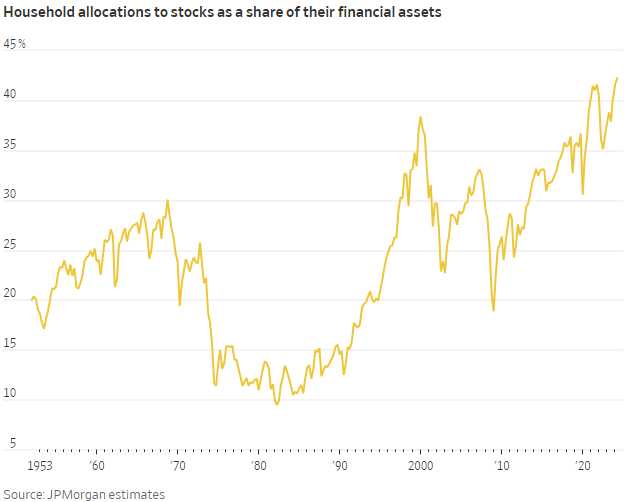

What is impressive, or terrifying, is that US Households now have 42% of their Financial Assets in stocks – the most ever recorded and far more than 1999 – and we know what happened after that experiment…

What is impressive, or terrifying, is that US Households now have 42% of their Financial Assets in stocks – the most ever recorded and far more than 1999 – and we know what happened after that experiment…

The total market capitalization of US Equities is $60Tn – it seems like it’s more but there’s a lot of redundancies in the indexes (and there’s GOOG and GOOGL but they are THE SAME COMPANY! – but don’t get me started) and let’s not get into the fact that the Mag 7 has a market cap of $15.4Tn – 25% of the entire market (again, don’t get me started) so we are in a period of unprecedented concentration which means we have unprecedented risk – so let’s take things seriously, folks…

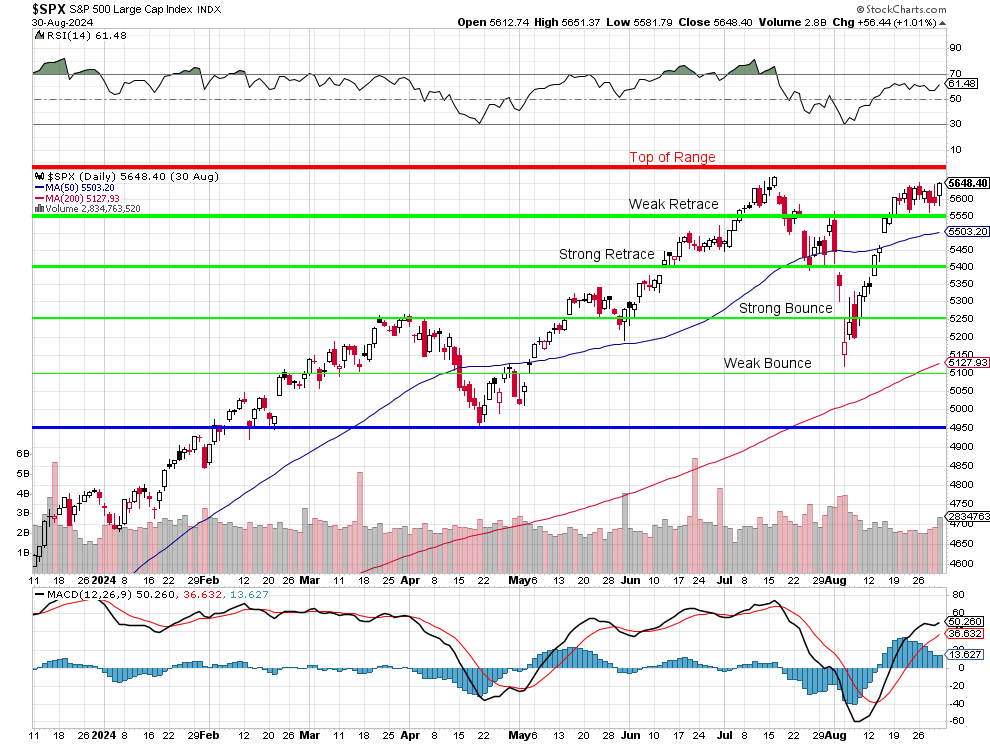

RSI 61.48 means we still have some room to run but MACD is also pushing higher so we’re certainly getting over-extended again and it would be a real shame if reality intruded on this little party we’ve been having but the punch bowl is still on the table and everyone is anticipating the Fed refilling it with lower rates on Sept 18th, just 2.1 weeks from today!

We’re not in trouble until/unless we start adding red boxes to the Strong Retrace Lines on our Bounce Chart – at the moment – we seem more likely to be consolidating for a run back to new highs – as Fundamentally silly as that may seem.

We will keep a close eye on the Bounce Chart but currently we’re in a frenzy and US Household Wealth is $160Tn and it’s not all Financial Assets, of course but consider that when 42% goes to 43% invested, that’s $1.6Tn (2.6%) more moving into the $60Tn markets – so you can see the power of sentiment.

With the market up 18% this year, Bonds do not seem like a very attractive alternative at less than 5% and mortgages are more than 7% – so Housing is not an attractive alternative and Americans are not big gold hoarders – because we have a solid currency and fairly low inflation – so where else are people going to put their wealth – if not US equities?

We just reviewed our Top Trade Alerts for the first half of 2024 and we’ve had 41 Trade Ideas with 27 (65.8%) winning trades (so far) but there is still $687,565 of upside potential between now and Jan, 2026 (some adjustments were made to Dec, 2026 but not many) and we will be going through our Watch List once again – looking for bargains as this rally MIGHT keep going – and we need to prepare for that in the same way we prepare for it NOT to keep going by managing our hedges.

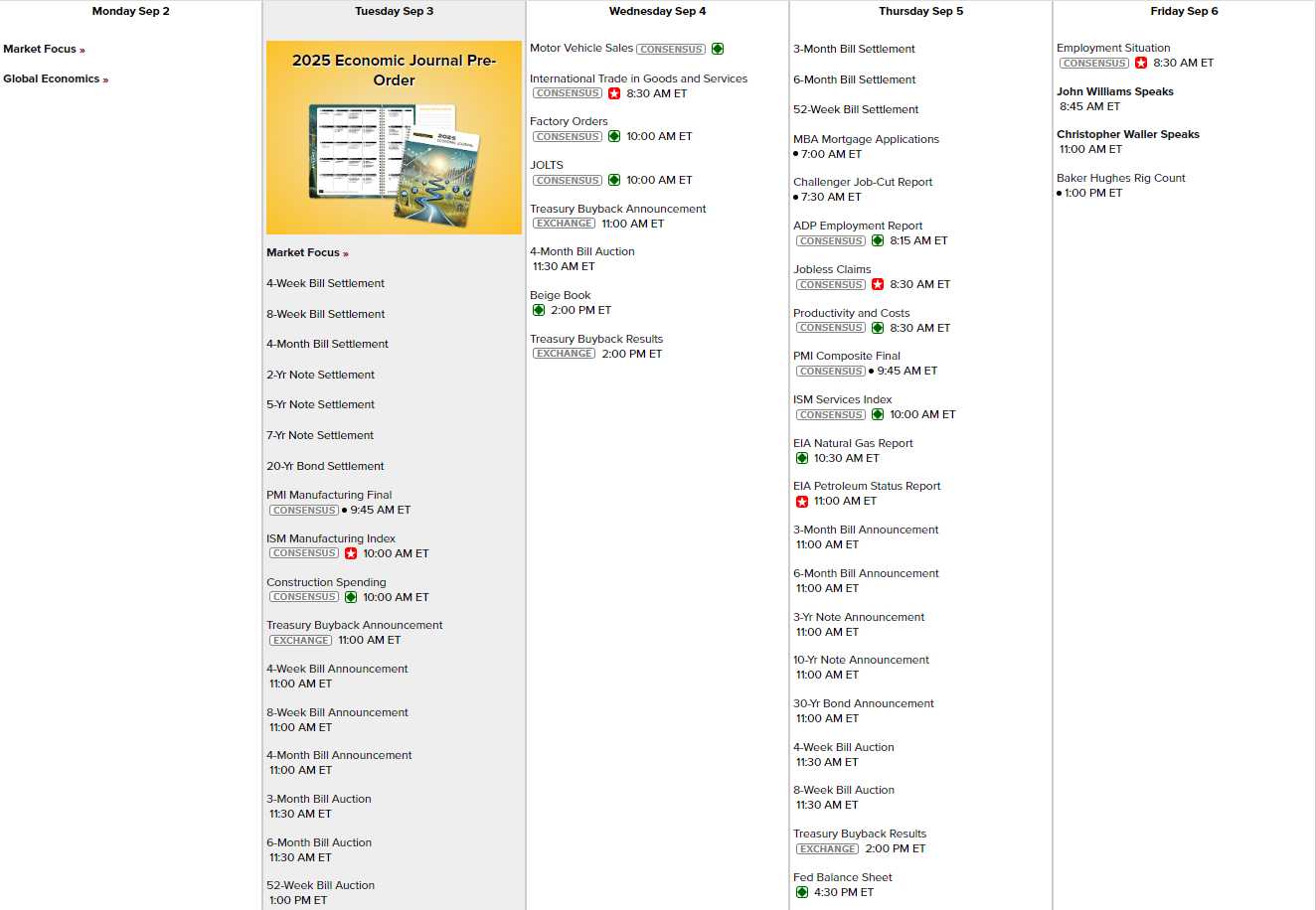

It’s a dull data week but a lot of Bonds settle today and some short-term notes, though not too interesting. This morning we get PMI, ISM and Construction Spending, tomorrow it’s Motor Vehicle Sales, Factory Orders, JOLTS and the Beige Book. Thursday is Productivity, PMI & ISM and Friday (already) is Non-Farm Payrolls followed by 2 Fed Speakers – which makes me think something is terribly wrong with the NFP report that Williams and Waller have to spin it for us – so that should be exciting!

And still there are earnings! Not too many that we care about but a little excitement with HPE and AVGO sneaking in along with DKS, AI, HRL, DLTR, LE, PATH, DOCU and BIG – not nothing.

Not even Rent-A-Rebel could save Oil this weekend as WTIC plunged back to $72 early this morning despite two (2!) Houthi attacks in the Red Sea this morning. Neither ship sustained much damage so the attacks were a bit counter-productive and carry nowhere near as much weight as OPEC’s rumored decision to increase output – before they lose all of their market share to US producers, where even Harris is now chanting “drill baby, drill.”

Global turmoil means the Dollar is firming up – back at 101.8 this morning and that puts a bit of pressure on everything that’s priced in US Dollars so let’s be careful out there but nothing really matters as we’re just waiting on the Fed for the first half of this month.