Is it time to face reality?

As the S&P 500 once again retreats from its recent high of 5,650, we find ourselves once again grappling with the reality that the market may be overvalued. The current P/E ratio, sitting at 29.05 is almost double the historical average of 15.7, so perhaps it is time to consider where we are in the cycle of market grief.

1. Denial: Ignoring the Warning Signs

Despite the clear indicators of economic weakness, many Investors are still holding onto the hope that the market’s ascent will continue unabated. This is the Denial phase, where optimism runs high, and fundamental valuation metrics are overlooked. The S&P 500’s forward P/E ratio reaching 20.4 times earlier this year, a level not seen since February 2022 was a clear sign that investors have been willing to pay a premium for future growth, even as economic data began to paint a less rosy picture and even as the Fed CLEARLY STATED their intention was to slow down the economy (the companies we invest in are in the economy, you know…).

Yesterday’s market action, triggered by weaker-than-expected ISM Manufacturing data, was a wake-up call. For those still in Denial, it’s a reminder that high valuations without the support of robust economic growth are a precarious place to be.

2. Anger: The Market’s Inevitable Reaction

As the market falters, frustration sets in, especially for those who bought in at higher levels, expecting the rally to continue. The Anger phase can lead to irrational decision-making, such as panic selling or, conversely, doubling down on losing positions. The 18.24% year-over-year growth in the S&P 500’s P/E ratio has set the stage for disappointment, as expectations have outpaced reality.

Yesterday, we saw this anger play out in the tech sector, particularly with Semiconductors. Nvidia’s 9.5% drop was a clear manifestation of Anger, as investors quickly bailed out, unwilling to wait for the long-term AI narrative to play out amidst immediate economic concerns.

3. Bargaining: Searching for Reasons to Believe

Bargaining is the phase where investors start looking for reasons why the market might rebound quickly. They cling to optimistic forecasts, such as the expectation that S&P 500 companies will increase earnings by 9.7% in 2024, to justify current valuations. This is the “maybe things aren’t so bad” phase, where investors rationalize that the market will correct itself and return to growth.

However, with Oil prices falling to their lowest levels of the year and weak manufacturing data both in the U.S. and China, the bargaining chips are becoming scarce. The reality is that markets may not rebound as quickly as hoped, especially with September’s reputation as a historically weak month and the Fed’s Rate Decision looming (18th).

4. Depression: The Gloom Sets In

As the reality of a potential prolonged downturn sets in, investor sentiment turns pessimistic. This is the Depression phase, where the psychological impact of a stagnant or declining market weighs heavily. Historically, when the S&P 500 has traded above a valuation of 22 times trailing twelve-month earnings, the market has been flat on average over the next year. This doesn’t bode well for investors hoping for a quick turnaround.

![STOCK MARKET PSYCHOLOGY 101 (Market Emotion cycle/ Greed & Fear cycle) [SAVE for future reference!] : r/FluentInFinance](https://i.redd.it/nosdpopzi9o61.jpg)

Yesterday’s broad-based sell-off, with almost every sector participating, highlights the market’s collective sigh. The fear of further downside was evident as volatility spiked and safe havens like Treasuries gained ground. It’s clear that the market is bracing for a rough ride, with many starting to question the sustainability of the current valuations – especially among the Magnificent 7, who have, so far – led the charge up this valuation hill.

5. Acceptance: Adjusting to Market Realities

Finally, we reach the Acceptance phase, where investors come to terms with the market’s true value and adjust their strategies accordingly. Acceptance doesn’t mean giving up; it means recognizing the market’s current state and positioning oneself to take advantage of future opportunities.

With the median historical P/E ratio for the S&P 500 at 17.91, there’s a long way to go before we reach more reasonable valuations for the broad market but there are certainly individual stocks trading well below that level – THOSE are the ones we should be focusing on as we position for the End Game of 2024. Acceptance will come with a re-evaluation of investment strategies, focusing on income generation, defensive positioning, and selective opportunities in undervalued assets – essentially the stocks we’ve built our portfolios around this year.

Yesterday’s action reinforces the need for a disciplined approach. Our strategy of focusing on income generation through options and defensive positioning should be validated in a market correction. Value stocks are beginning to show relative strength and that is where we’ll continue to focus our efforts while remaining agile and ready to pounce on opportunities that market volatility presents.

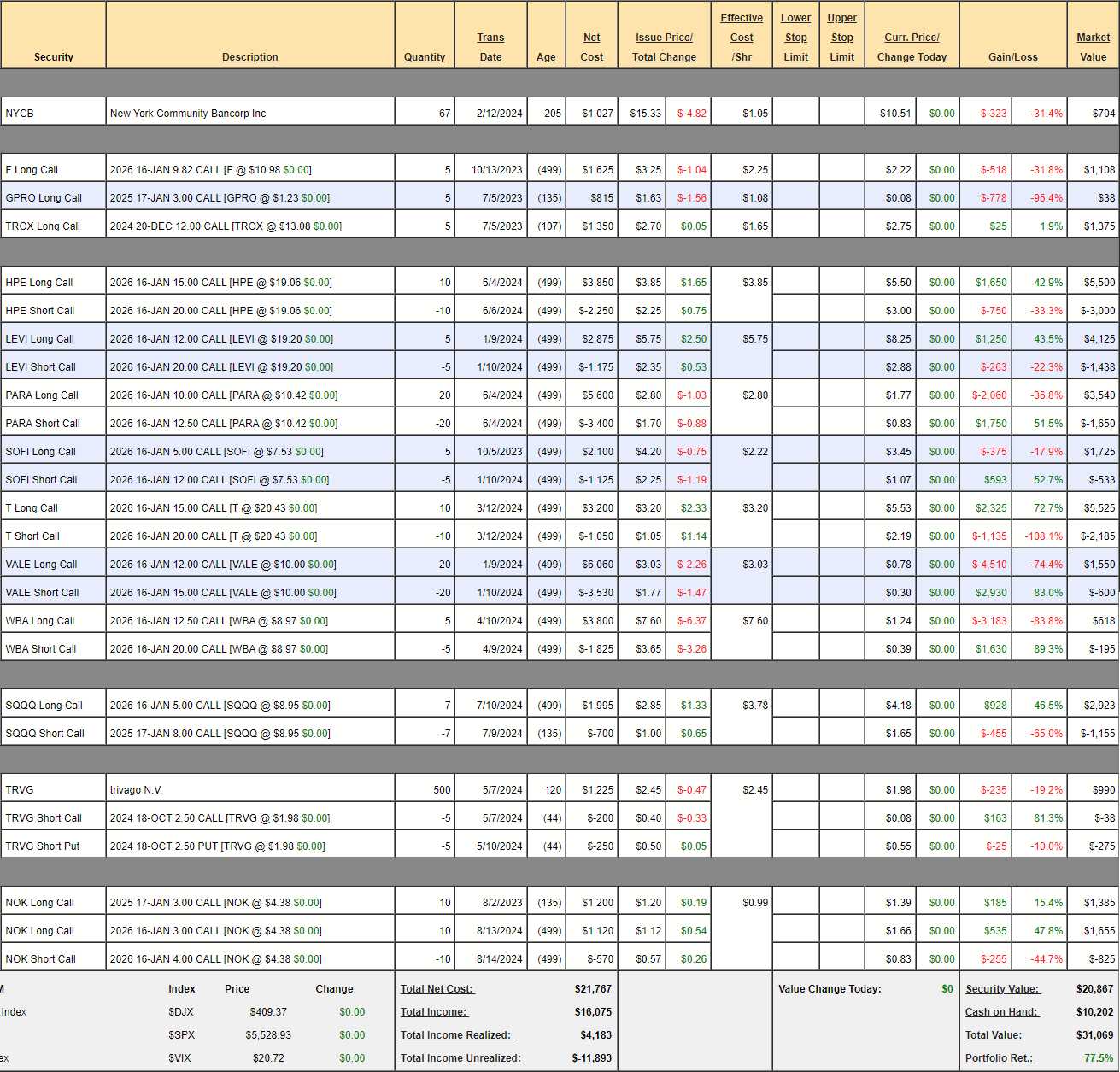

For example, we reviewed our $700/Month Portfolio on the 13th when it stood at $27,836, which was up 65.7% after our first two years (on a path to $1M in 12 years!). We made several adjustments and none of them were wrong so, just a few weeks later and after adding this month’s $700 – we stand at $31,069, which is up 77.5% – that’s riding out a wild market in style!

We’ll probably do a full review tomorrow but I’ll kick it off today during our Live Trading Webinar, which starts at 1pm, EST USING THIS LINK!

Navigating the Stages of Market Grief

As we navigate this period of market uncertainty, it’s crucial to recognize where we are in the cycle of market grief. Yesterday’s sell-off was a clear move from denial to anger, and possibly even towards depression for some. The key is to remain objective, understand the psychological phases at play, and stay disciplined in our approach. This is a CORRECTION – pricing has been INcorrect and now it is adjusting and Investors are moving their assets accordingly – we certainly can’t afford to be complacent either.

We may be facing a top of the range at 5,650 for now, and ACCEPTING that could be our best move. Markets are cyclical, and by understanding and accepting the current realities, we can position ourselves to weather the storm and capitalize on future opportunities. Remember, it’s not about timing the market perfectly – it’s about time in the market, with a strategy that’s built to last!

Let’s keep a close eye on the VIX, the market’s “fear gauge“, which jumped back to 20 yesterday but we flew up to 30 in the last downturn and I don’t think things are that unsettled – yet.

Yesterday was post-vacation day and the volume (60M on SPY) was very low – there just weren’t enough buyers to cover the sellers so let’s see if NVDA can catch a bid today along with MU – who I think is a bit cheap now. Also, as Oil tests the $70 line, OPEC is now walking back their statement that production would increase – which is what sparked the sell-off (along with the failed Rent-A-Rebel attacks in the Red Sea).

The Dollar is 102 and that’s keeping a bit of pressure on things with Gold testing $2,500 (I’d go long /GC with tight stops below) and Silver (/SI) testing $28, which is also a good line to go long on and Copper (/HG) is testing $4 and it’s too scary to play but if it fails $4 – get out of Gold and Silver! $4 should hold unless China has more bad data up its sleeve. GS downgraded their Copper forecast, panicking their sheeple out of positions.

Looking Ahead: Jobs Data and the Fed

The next big data point on our radar is Friday’s nonfarm payrolls report. This will be a critical indicator of Labor Market Health and could set the tone for the Federal Reserve’s September meeting. The JOLTS jobs data due today might give us a preview, but all eyes will be on the broader employment numbers at the end of the week. Later today, also in our Webinar, we will be taking a look at the Fed’s September Beige Book – that should also give us some clues…

The market is currently pricing in rate cuts from the Fed, but we need to tread carefully here. With inflation still a concern and the Labor Market showing signs of strain – not from layoffs, but from an increasing labor force due to (gasp!) Immigration – there’s a delicate balance to maintain. The Fed could face a tough choice between supporting growth and keeping inflation in check, and any misstep could spook the markets further.

Be careful out there!