As we approach the release of the highly anticipated August Employment Situation Report, the spotlight turns to the Fed’s next move. The markets are holding their breath as investors, traders, and economists alike brace for a pivotal day in shaping the monetary policy ahead of the Fed’s September 17-18 meeting. The stakes couldn’t be higher, with uncertainty swirling around whether the Fed will go with a 25-basis-point cut—the market’s most likely base case—or maybe the Fed will opt for a 50-basis-point cut, signaling greater concern about an economic slowdown.

Phil had been making the case for no cut at this meeting but, leading right up to the report, the economic situation is deteriorating and clearly the market is going to have a melt-down if it doesn’t get the rate cuts it expects on the 18th.

The Key Question: Is America Working?

With inflation seemingly tamed and heading toward the Fed’s 2% target, the focus now shifts to the labor market—the other half of the Fed’s dual mandate. The question now is whether the labor market is softening enough to justify a larger rate cut or if the data will show resilience, causing the Fed to take a more measured approach.

Pre-Market Expectations:

- Non-Farm Payrolls: Forecasted to add 164K jobs in August, an improvement over July’s disappointing 114K, which was partially skewed by temporary factors like Hurricane Beryl and retooling at auto plants.

- Unemployment Rate: Expected to tick down slightly to 4.2% from 4.3%, a figure that spooked markets in July. If unemployment drops, it could delay recession concerns.

- Wage Growth: With inflation pressures subsiding, wage growth is not expected to be a significant concern for the Fed in today’s data. However, any surprise here could reignite inflation fears.

What’s at Stake?

The Fed has already signaled that rate cuts are imminent, but the size and even the timing of the first cut (song cue, Phil?) hinges on this jobs report. With 59% of traders expecting a 25-basis-point cut and 41% betting on a 50-basis-point cut, the decision will shape how the market reacts in the near term. This report is crucial, as the jobs number will either justify the Fed’s patience or stoke fears that the central bank may be behind the curve in addressing labor market weakness.

Moreover, Fed Chair Powell has shifted his rhetoric to emphasize preventing further labor market deterioration. Powell’s pivot, along with comments from other Fed officials like San Francisco Fed President Mary Daly, underscores that while the labor market isn’t in recession, the Fed is on high alert for any significant cracks in hiring or wage growth.

What to Watch in the Jobs Data:

- Labor Force Participation: A stable or improving labor force participation rate could delay recession concerns.

- Revisions to Prior Data: If July’s jobs numbers are revised lower, it could accelerate calls for a more aggressive rate cut.

- Sector Strength: Watch for job growth in leisure/hospitality and construction—two bellwethers for broader economic activity. Any weakness here will likely signal cracks in the labor market.

Market Sentiment:

Futures point to a lower open, with Dow futures down 0.3%, S&P 500 down 0.6%, and Nasdaq down 1.1%. The market is reflecting the cautious tone heading into this critical jobs report. Meanwhile, Treasury yields are retreating, with the 10-year yield down to 3.70%, indicating investor jitters over potential economic weakness.

Fed’s John Williams to Speak at 8:45 AM

Right after the jobs report, New York Fed President John Williams will speak. His comments will provide the first official Fed interpretation of the jobs data, and as one of the most influential members of the FOMC, Williams’ words will carry significant weight in shaping expectations for the September rate cut.

Investors should be aware that Williams’ speech may be just as important as the jobs data itself. Markets will be parsing every word for clues about the Fed’s appetite for a larger cut or the possibility of more aggressive easing in future meetings.

PSW’s Strategic Move:

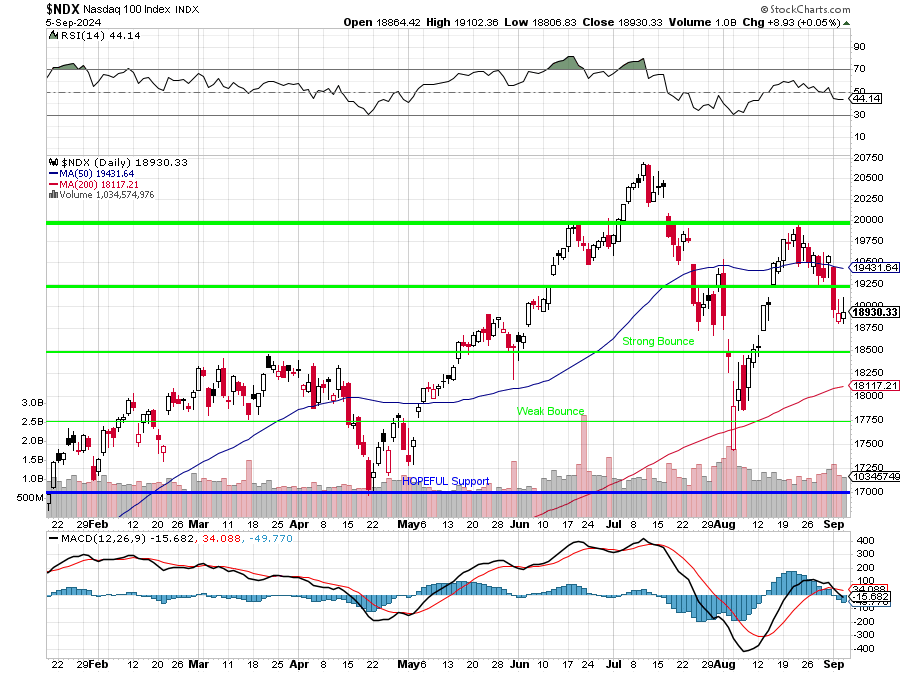

In the PSW Live Member Chat Room, we recently adjusted our Short-Term Portfolio to hedge for a potential market downturn, betting on continued weakness in the Nasdaq. We rolled our SQQQ 2026 $10 calls to the 2026 $5 calls, gaining more protection and leveraging a potential drop in the Nasdaq. As we noted, a 20% drop in the Nasdaq would propel SQQQ by 60%, providing significant upside for our hedge. Given today’s pre-market weakness in the tech sector, this hedge looks timely, and we are well-positioned if the data disappoints and the market reacts negatively.

Hedge Summary:

- SQQQ 2026 $5 Calls: Rolled from $10 strikes to maximize efficiency and reduce decay.

- Potential Protection: We now have a potential net protection of $475,750 on a 20% Nasdaq drop.

- Short-Term Strategy: Continued monitoring of the market’s reaction to the jobs report and Fed commentary, with flexibility to adjust the hedge if necessary.

Pre-Payroll Takeaways:

- Jobs Data: This report will dictate the Fed’s decision and set expectations for future rate cuts.

- Fed Commentary: John Williams’ speech at 8:45 AM will be crucial in interpreting today’s jobs data and shaping market expectations for the September meeting as the market’s digestion of the data cannot be left to chance as such a critical juncture.

- PSW’s Hedge: We’re prepared for a market downturn with a well-placed hedge on SQQQ in case of a negative market reaction.

Stay tuned for our 8:45 update after Williams speaks, as we’ll provide real-time analysis on the Fed’s next move.

8:30 Update (by Phil): 142,000 jobs were added in August – not bad on the surface BUT there were A LOT of downward revisions with July revised down to 89,000 from 114,000 (and how badly would we have freaked out on that number) and June has dropped 61,000 (1/3) to 118,000 from 179,000 as well so the June and July revisions wiped out ALL of August’s gains – that’s BAD!!!

Despite the collapse in job creation, Average Hourly Earnings are up 0.4% from 0.2% in the July report – so much for inflation under control (as if you couldn’t already tell from various strikes that are going on around the World). Unemployment is, in fact, DOWN to 4.2% from 4.3% last month which is EACTLY what we discussed in Wednesday’s Webinar – as the remaining labor pool is not matching up with the required jobs to be filled – so you can’t take this data at face value – which makes it hard for Warren to interpret and just as hard for the Fed to figure out what to do.

🤖 Summary of John Williams’ Speech:

John Williams, President of the New York Federal Reserve, delivered remarks focusing on the current state of the U.S. economy, inflation, and the labor market, using the term “equipoise” to describe the balancing of risks to the Fed’s dual mandate of maximum employment and price stability.

Key Points from Williams’ Speech:

-

Progress Toward Inflation Goals: Inflation has come down from its peak in 2022, with the PCE price index showing a significant decline to around 2.5%. Williams attributes this to both global and domestic factors, including improvements in supply-demand balance and the Fed’s monetary tightening.

-

Labor Market Normalization: While the unemployment rate has risen from historic lows, Williams highlights that this increase reflects a cooling from the previously overheated labor market, driven by higher labor force participation rather than mass layoffs. This signals a healthier, more balanced labor market.

-

Monetary Policy Stance: Williams believes that with inflation moving toward 2% and labor market conditions easing, it is now appropriate to dial back the restrictiveness of monetary policy. He supports reducing the federal funds rate, signaling that the Fed is ready to begin the rate-cutting cycle, which markets have been anticipating. However, he emphasized that future moves will be data-dependent, particularly monitoring labor market conditions and inflation trends.

-

Economic Outlook: Williams forecasts moderate GDP growth (2-2.5% in 2024) and anticipates further declines in inflation, with PCE inflation expected to reach 2% next year. He sees the unemployment rate settling at 4.25% by year-end, moving toward 3.75% in the long run.

Analysis of Williams’ Speech in Light of Employment Data:

Williams’ remarks came shortly after the August employment report, which showed the addition of 142,000 jobs, with significant downward revisions to previous months’ data, a clear signal of weakening job growth. This aligns with Williams’ recognition of a cooling labor market, one of the key factors in his support for loosening monetary policy.

-

The Case for Easing: Given the revisions to June and July job data and the modest job gains in August, the labor market is clearly losing steam. Williams’ argument that inflation is moving closer to the Fed’s 2% target, combined with signs of a more balanced labor market, supports his stance on rate cuts. He emphasized the importance of not waiting for further labor market deterioration before adjusting policy—aligning with the notion that a pre-emptive move may be necessary to avoid a deeper slowdown.

-

Contradictions in the Data: While Williams is confident in inflationary trends moving toward the Fed’s target, the rise in average hourly earnings by 0.4% in the August report shows wage pressure, a potential threat to inflation targets. This makes the situation more complex for the Fed. Williams’ “equipoise” argument suggests the Fed is closely watching how wage growth factors into broader inflation trends, particularly if tight labor markets could reignite inflation pressures, which is what Phil has been arguing.

-

Impact on Market Expectations: The speech reinforced market expectations of at least a 25-basis-point cut, but Williams’ clear messaging that the Fed is now focused on a more neutral stance opens the door for more aggressive cuts, should the labor market continue to show weakness. The market will likely interpret his comments as a signal that the Fed is prepared to shift more decisively if upcoming data, such as next week’s CPI, confirm a downturn.

Conclusion:

Williams’ speech highlights the Fed’s readiness to adjust its policy in response to a weakening labor market and easing inflation pressures. With the August job data showing a deceleration in employment growth and the Fed’s focus on maintaining balance, a rate cut is now all but assured. The key takeaway from Williams is that while the Fed remains vigilant, it is ready to dial back its restrictive stance to avoid a more severe economic downturn.

Williams’ speech has reinforced what we’ve been tracking all week. The Fed is prepared to dial back its restrictive stance, as the labor market has cooled and inflation has eased significantly. Williams emphasized the word equipoise, a balance between supply and demand, indicating that the Fed’s dual mandate of price stability and full employment is now aligned, giving them more flexibility to reduce rates. He cited progress in disinflation and moderation in the labor market, which gives the Fed confidence to act.

The bond market has reacted swiftly, with the probability of a 50-basis-point rate cut at the upcoming September 17-18 FOMC meeting jumping from 41% to nearly 60%. Stocks are still down across the board, but the market could turn as investors digest the speech and factor in what now seems like a near-certain rate cut.

In corporate news, Broadcom (AVGO) continues to drag down tech stocks following its disappointing forecast but Phil still likes them long-term and considers this a buying opportunity. Meanwhile, UiPath (PATH) is a standout with strong earnings, beating both top- and bottom-line estimates and announcing a major stock buyback program.

This is a pivotal moment for the markets, with rate expectations driving short-term movements. As we head into the weekend, the focus will shift to next week’s CPI reading, which could further confirm the Fed’s easing trajectory.

Key Takeaways:

- Fed President Williams signaled the Fed is ready to reduce rates.

- A 50-basis-point rate cut is now more likely to be on the table at the September meeting.

- Despite weaker jobs data, wage growth is still a concern, rising 0.4% in August.

- Markets remain cautious, with futures pointing to a mixed open as investors weigh Fed policy moves and corporate earnings.

We’ll keep a close eye on developments heading into next week’s CPI report.

Have a great weekend,

-

- Warren