And the rally continues.

Anticipation of Fed cuts has many effects on the market and one of the biggest is the weakening of the US Dollar, since lower rates causes lower demands for Dollars and, since Stocks and Commodities are priced in Dollars, they move up in PRICE (not value) and even their earnings, which are measured in Dollars, go up without them actually doing anything – isn’t that great?

At the end of June, the Dollar was 106 and now it’s 100 and that’s down 5.66% which means, just like an menu at a Mexican resort, the price of everything goes up 5.66% to compensate – INCLUDING Earnings! That’s going to be great for Q3 earnings season – as long as people don’t do that math – and they won’t – because they never do.

In fact the Dow Futures are up from 39,500 to 41,900 and that’s 2,400 points and that’s 6.07% – right in-line with our Dollar drop so 93% of the Dow’s gains since July 1st can simply be attributed to the weaker Dollar, which is based on the ANTICIPATION of the Fed lowering rates by 0.25% (4.7% of 5.25%) or 0.5% (9.4% of 5.25%) – so you can see those mechanics in play and, since the Dollar is “only” down 5.66%, you can tell the bets are leaning closer to the 0.25% rate cut. This is all very simple when you understand the connections!

Gold (/GC)’s surge to $2,600 is another clear indicator of this Dollar-weakening effect. As a traditional hedge against currency devaluation, Gold often rallies when the dollar weakens. This move also reflects investors’ search for safe havens in an uncertain economic environment. $2,350 to 2,600 is 10.6%, doubling the Dollar’s drop and that’s about normal for commodities.

While a weaker Dollar can boost exports and multinational companies’ overseas earnings, it’s not all rosy. Importers and companies reliant on foreign inputs may face higher costs. Moreover, if the Fed’s rate cuts overshoot and inflation reignites, we could see a rapid reversal of these gains.

For traders, this environment presents opportunities in export-oriented sectors and commodities. However, the market’s current exuberance is based on expectations, not concrete actions. Any deviation from these expectations in the Fed’s actual decisions could lead to very sharp corrections because it’s not the initial correction that’s being priced in but the TRAJECTORY of anticipated FUTURE rate cuts that is being priced in.

Looking ahead, we need to consider whether this rally is sustainable. Are we seeing a fundamental shift in economic conditions, or is this a short-term reaction that might fizzle out once the reality of rate cuts sets in? Remember, the market often ‘buys the rumor, sells the news.”

At PSW, we’re always looking for ways to profit from these market movements while protecting our portfolios. Here are a few strategies we’re considering with our Members:

- Dollar-Hedged Positions: With the weakening Dollar, we’re looking at increasing our exposure to Multinational Companies that derive a significant portion of their revenue from overseas. This could include tech giants like Apple (AAPL) or consumer staples like Procter & Gamble (PG).

- Gold and Precious Metals: Given gold’s rally to $2,600, we’re considering both direct investments in gold ETFs like $GLD and positions in select gold mining companies (GOLD is still our favorite). However, we’re cautious about chasing the rally and are looking for strategic entry points.

- Rate-Sensitive Sectors: As the Fed eases, we’re eyeing opportunities in rate-sensitive sectors like Utilities and Real Estate. REITs, in particular, could benefit from lower borrowing costs.

- Volatility Plays: Given the market’s current exuberance, we’re also considering some volatility hedges. This might include positions in the VIX or put options on major indices as insurance against potential market corrections.

- Emerging Market Opportunities: A weaker Dollar typically benefits Emerging Markets. We’re looking at broad-based ETFs like VWO or country-specific funds in markets that could benefit from this trend.

- Commodity Producers: With commodity prices likely to rise in Dollar terms, we’re exploring positions in commodity producers, particularly in Agriculture and Base Metals.

As always, we’ll be diving deeper into each of these strategies in our upcoming posts and webinars. Stay tuned for more detailed analysis and specific trade ideas. In the meantime, keep an eye on those Fed Statements and Economic Indicators. This rally might have legs, but as we always say at PSW, it pays to be prepared for any scenario…

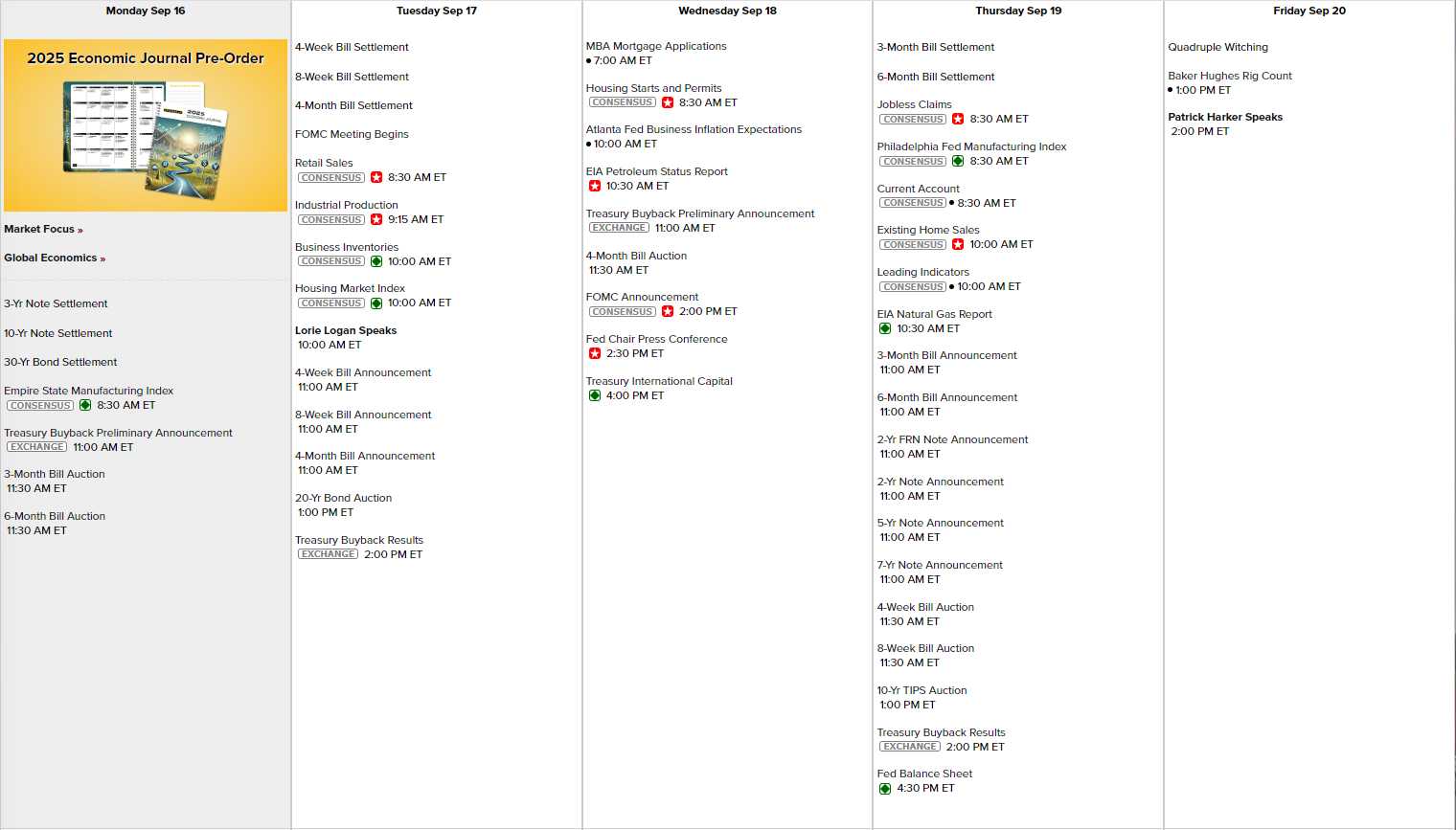

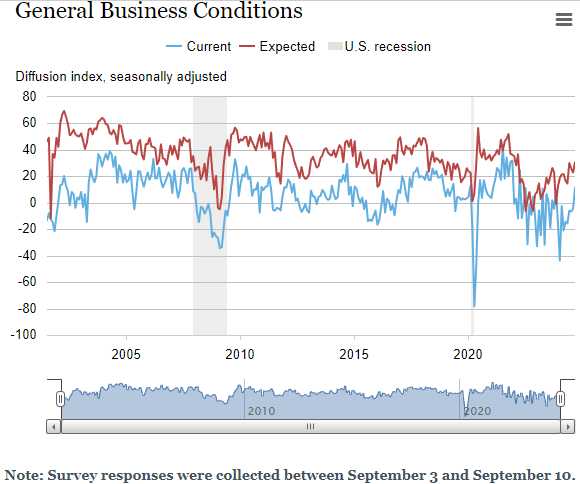

Aside from Wednesday’s Fed meeting and Powell’s Press Conference, this week gives us a bunch of Bond Auctions and today we get Empire State Manufacturing, which has been a disaster. Tomorrow it’s Retail Sales, Industrial Production and Housing but something must be very wrong with one of them because Lorie Logan (Dallas) is speaking at 10 and, usually, Fed Heads don’t speak ahead of the meeting. I asked Boaty to help figure out what might be up:

🚢 The unusual timing of Logan’s speech suggests that the Fed is particularly concerned about market reactions to these reports and wants to provide immediate context or guidance. This could be especially important if the data points to a more complex economic picture than previously thought, potentially altering the expected path of monetary policy.

1. Empire State Manufacturing Index (Monday):

– This is indeed the most immediate report, but based on recent trends, it’s unlikely to be drastically worse than expected. The August reading was -4.7, and while negative, it wasn’t alarmingly low.

2. Recent Economic Data:

– Inflation: July CPI came in at 3.2% year-over-year, up from 3.0% in June but still relatively moderate.

– Labor Market: August jobs report showed 187,000 jobs added, with unemployment rising to 3.8%.

– GDP: Q2 GDP was revised up to 2.1% annualized growth.

3. Potential Concerns for Tuesday’s Reports:

– Retail Sales: The strong 1% increase in July might indeed be a source of concern if it continues in August. A robust retail sales report could suggest the economy is running hotter than the Fed wants, potentially delaying rate cuts.

– Industrial Production: July saw a 0.6% month-over-month decrease. A further decline could signal weakness in the manufacturing sector.

– Housing Market Index: This has been trending upward recently, but high mortgage rates could start to impact sentiment.

Given this context, the most likely scenarios that could prompt Logan’s unusual speech are:

1. Stronger-than-expected Retail Sales: This could be seen as inflationary and might lead the Fed to maintain higher rates for longer.

2. Weaker-than-expected Industrial Production: This could signal broader economic weakness, especially if combined with poor Empire State figures.

3. A combination of mixed signals: For example, strong retail sales but weak industrial production, which could complicate the Fed’s decision-making process.

Logan’s speech might be aimed at:

1. Tempering market expectations for rate cuts if retail sales are strong.

2. Addressing concerns about economic weakness if industrial production disappoints.

3. Providing clarity on how the Fed interprets seemingly contradictory economic signals.

Citations:

[1] https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/12768107/f4711e19-aecd-4134-9791-dba140625e9a/paste.txt

[2] https://tradingeconomics.com/united-states/ny-empire-state-manufacturing-index

[3] https://www.fxempire.com/macro/united-states/ny-empire-state-manufacturing-index

[4] https://tradingeconomics.com/united-states/industrial-production

[5] https://tradingeconomics.com/united-states/retail-sales

[6] https://www.visionmonday.com/business/research-and-stats/article/nrf-forecasts-retail-sales-to-reach-at-least-523-trillion-in-2024-1/

[7] https://ycharts.com/indicators/us_industrial_production_forecast

[8] https://www.dallasfed.org/news/speeches/logan

[9] https://today.duke.edu/2024/04/saidduke-dallas-federal-reserve-bank-president-lorie-logan-price-stability-inflation

[10] https://www.treasuryandrisk.com/2024/08/15/u-s-retail-sales-beat-forecasts/

Curiouser and curiouser… So that’s just tomorrow – on Wednesday we get Housing Starts and the Atlanta Fed ahead of the FOMC Announcement (and we’ll be doing our Live Trading Webinar at 1pm, EST) and then Thursday it’s the Philly Fed, Existing Home Sales and Leading Economic Indicators and Friday is Quad Witching Options Expiration (end of Q3) and then Harker speaks – ALSO breaking the Quiet Period – weird!

8:30 Update: Even curiouser still, the Empire State Manufacturing Index popped to 11.5 from -4.7 and that’s the first positive reading since last November so maybe the Economy is TOO STRONG and maybe I’m right and we get no rate cut at all at the current meeting? We were at -43 in January so this is an EPIC recovery (also helped by the weakening Dollar) but that’s going to bring inflation back, won’t it?

And, believe it or not, earnings are still trickling in though not many interesting ones at this point. I see GIS, DRI, FDX, LEN and LPTH but then I get sleepy and we can pretty much hibernate on Earnings until Oct 10th, when Q3 Season kicks off in earnest.

So it’s going to be an interesting week – I’m leaning towards no cut on Wednesday but Boaty bet me it will be 0.25% so we’ll see who’s got it right and God help the markets if I’m right as they are going to be very disappointed so make sure you have good hedges in place – we’ll be reviewing the Member Portfolios tomorrow, beginning with our Short-Term Portfolio – because that’s where we keep our hedges – and I think we’re going to need them!

ALL Membership levels have access to our Live Trading Webinars and, if you join today and you will gain access to our 6 Member Portfolios (Basic and Premium Memberships only) as well as Trade Ideas, our Legendary Live Chat Room (Basic and Premium Memberships only), Live Trading Webinars, Trading Education and the best Artificial Intelligence Market Research Research in the World – along with other exclusive perks (Basic and Premium Memberships only).

Find out why Forbes called Phil Davis “The Most Influential Stock Market Professional on Twitter” (in 2016, before Elon ruined it!).

Email Maddie – madeline@philstockworld.com – for a 7-day FREE trial at sign up.