$2,746,604!

$2,746,604!

Looks like we're going to need another Dr. Evil soon... Well today (updating) is Thursday and I just got done with the LTP and the market is rallying (read more below) on the 0.5% Fed Rate Cut and things could not be better for the LTP - so we have a HUGE total for our paired LTP/STP - up $160,000 (6.1%) from last month's combined $2,586,535. That is great money and, more importantly, we're on track for our next 100% gains over the next 12 months - enjoy the review!

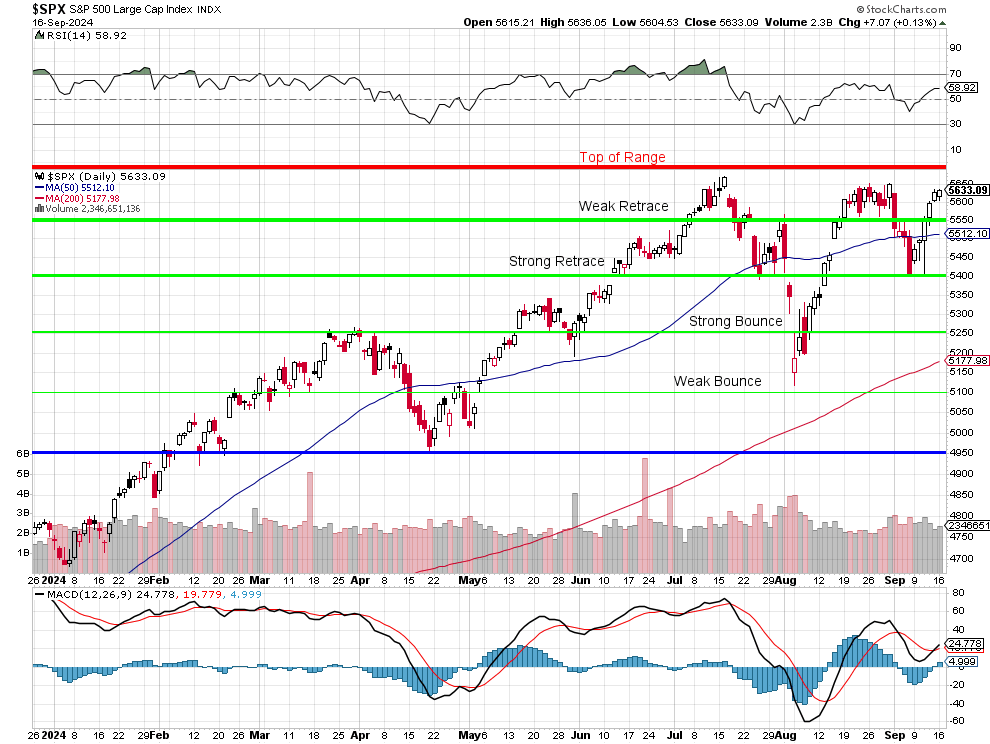

We are back where we started from in last month's review (13th) with the S&P 500 roller coaster at 5,543 then and 5,633 now and there's nothing we like more than a slowly rising market but it sure doesn't feel that way as we fell to 5,400 in-between. Our core strategy - other than, of course, picking great value stocks - is using those long positions as a platform through which we create an income stream SELLING OPTIONS (we don't buy them hence our slogan: "Be the House - NOT the Gambler") which enables us to do well if the market is up or flat - and even if it is down slightly.

That's because the only sure thing in the market is that ALL premium expires worthless so selling options premium gives us a tremendous advantage in most market conditions - anything but a sharp drop generally makes us money and, for a sharp drop - we HEDGE!

Hedging keeps us from losing a lot when the market has one of it's little pullbacks and, just as importantly, hedging lets us ride out these dips without panicking out of our perfectly good positions.

So, despite the wild swings (in fact, we adjust to take advantage of them), our strategy is practically perfect for this kind of market and that range on the charts - is exactly the 20% drop (hopefully not!)