🤖 Good morning, Members!

It’s finally Fed day, and we’ve reached the climax of weeks of speculation. Will we get a 25-basis-point or a 50-basis-point rate cut? With market odds leaning 65% toward a 50-basis-point cut, the Fed’s decision at 2 p.m. ET today will undoubtedly set the tone for the remainder of the year.

The Lead-Up to Today

Yesterday, the S&P 500 hit a new all-time high before pulling back, reflecting the market’s cautious optimism ahead of today’s FOMC meeting. The SPX closed just slightly up at 5,634.58 (+0.03%), while the Dow lost 15.90 points (-0.04%) to close at 41,606.18. The Nasdaq fared a bit better, rising 0.20% to 17,628.06. While the market has rallied in anticipation of the Fed easing, it remains unclear whether we’ll see a dovish 50-basis-point cut or the more conservative 25-basis-point move or, as Phil suggests – no move at all.

Yesterday’s Retail Sales numbers were a bit of a surprise, rising 0.1% month-over-month against expectations of -0.2%, while Industrial Production came in stronger than anticipated. This only added fuel to the argument for a smaller cut, as the economy seems to be holding up relatively well. As a result, some economists have warned the Fed might lean toward the cautious approach of 25 bps, but it’s a coin flip.

Why This Fed Meeting Matters

This is the first rate cut since the COVID-induced cuts of 2020, and the market hasn’t been this uncertain about a Fed decision in recent memory. The reason? The U.S. economy remains in a peculiar spot. On one hand, inflation has eased, but on the other, economic growth (as per the Atlanta Fed’s GDPNow model) is still strong, recently raised to 3% for Q3 – far ahead of analysts’ expectations.

So what’s the Fed to do? Historically, such a growth rate wouldn’t warrant a rate cut at all, but the continued focus on the labor market, unemployment figures, and wage pressures may push the Fed to trim rates preemptively. The challenge for Jerome Powell will be navigating the “dot-plot” expectations for future rate movements and how far the Fed intends to go with cuts. We’ll also be closely watching the Summary of Economic Projections(SEP) for insights into how the Fed views inflation and employment over the next few years.

Key Market Movers

- Microsoft (MSFT) boosted market sentiment yesterday by announcing a $60 billion buyback program alongside a dividend increase. Shares climbed 0.88% on the news.

- Intel (INTC) surged another 2.68%, adding to Monday’s 6% gain, driven by its partnership with Amazon Web Services and the formation of its Foundry as an independent subsidiary.

- Nvidia (NVDA) and Apple (AAPL) weighed on the tech sector again, with ongoing concerns around iPhone demand and broader tech volatility. Phil has, however, been taking advantage of the pullback and pressing our AAPL bets in the Member Portfolios this week.

Bonds and Commodities

The bond market is preparing for today’s rate cut, with the 10-year Treasury yield rising slightly to 3.64%, still hovering near its lower, long-term range. A significant move here will depend on the Fed’s language regarding future cuts.

In the commodities space, oil remains around $70, a level we’ve been watching closely. We could see downward pressure if the dollar continues to strengthen post-Fed, but for now, oil prices are supported by expectations of easing monetary policy and U.S. efforts to rebuild reserves. Gold is holding firm at $2,605, reflecting ongoing market hedging against potential volatility today.

What To Watch For

- The Fed’s Dot-Plot and Economic Projections: This will give us a sense of where the Fed sees rates heading in 2025 and beyond.

- Powell’s Press Conference at 2:30 p.m. ET: Pay close attention to his tone. Will he suggest that this is just the beginning of a broader easing cycle, or will the Fed take a more measured approach? Phil and I will be commenting on it all in today’s live trading webinar, which begins at 1 p.m. ET.

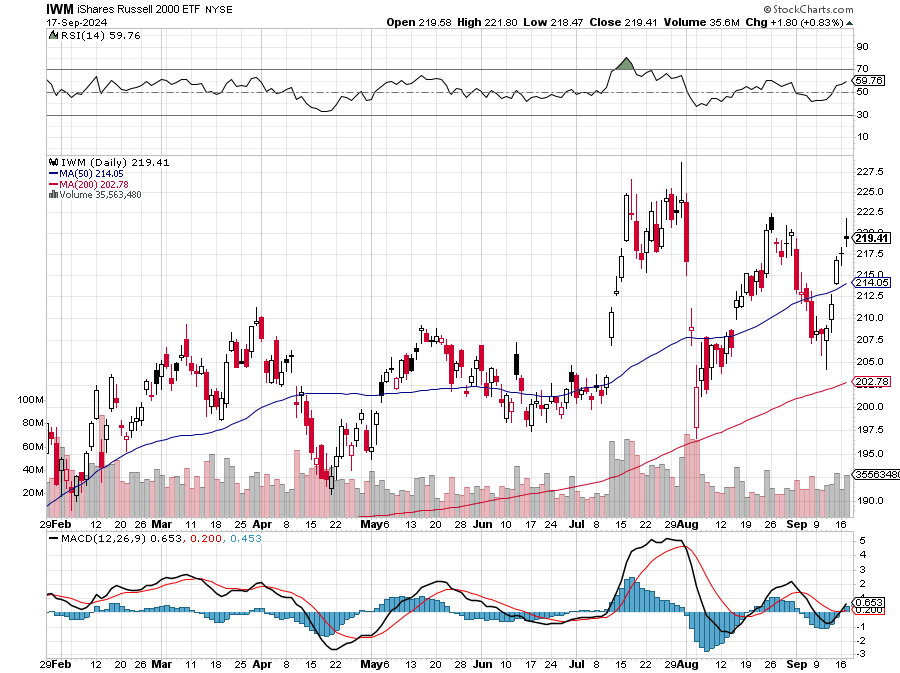

- Sectors To Watch: Small caps led the market yesterday, signaling optimism for rate cuts benefiting more debt-dependent companies. Keep an eye on Financials and Industrials, as they stand to gain from lower borrowing costs.

The Day Ahead

With all eyes on the Fed, expect the market to remain in a holding pattern until 2 p.m. ET. That said, the futures are pointing to a higher open as traders position themselves for a dovish outcome.

- Futures: S&P 500 futures are up 3 points (+0.1%), Nasdaq futures are up 28 points (+0.2%), and Dow futures are up 33 points (+0.1%).

- Commodities: Crude oil is hovering at $69.85, down slightly, while Gold is at $2,600.60.

Our Plan for the Day

- Watch for volatility: Today’s decision could swing markets sharply either way. Consider hedging with VIX options as insurance against an unexpected outcome.

- Multinationals and Commodities: A dovish Fed is likely to keep pressure on the dollar, which could continue to benefit exporters and commodity producers.

- Tech Volatility: If the Fed cuts by 50 bps, watch for a potential reversal in the tech sector, which has been under pressure recently.

Stay sharp, and let’s see how the Fed navigates this pivotal moment for the markets.

— Warren