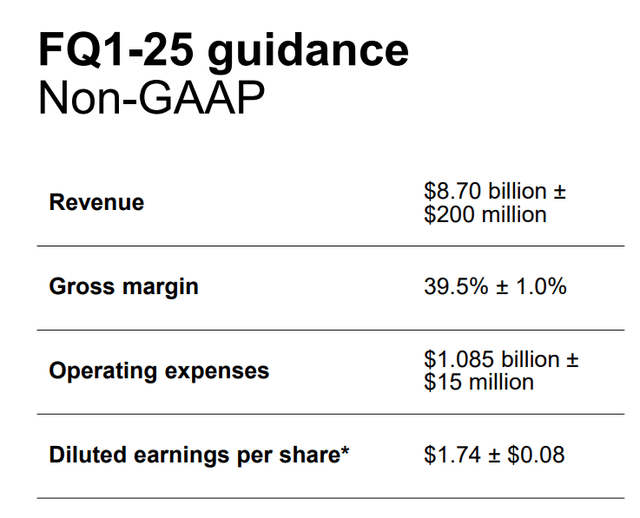

Micron’s guidance shines a spotlight on the broader “Magnificent 7” stocks (NVDA, MSFT, AAPL, TSLA, GOOGL, META, and AMZN) that have been leading the charge this year. The AI-driven demand surge is bolstering valuations across the semiconductor sector, but questions remain about how long these stocks can maintain their lofty valuations in the face of broader economic headwinds. While Micron has been oversold, it’s now proving that AI-related demand can buffer it against consumer slowdowns.

Today is essentially a Fed marathon, with speakers lined up from now (9am) until 6pm, each with their unique perspective on the current economic landscape. As usual, all eyes will be on Fed Chair Jerome Powell, who is expected to speak at 9:20 am, EST. Powell’s remarks will be critical, as the market tries to decipher the Fed’s future path on interest rates.

08:30 AM Durable Goods Orders

08:30 AM GDP Q2

08:30 AM Jobless Claims

08:30 AM Corporate Profits

09:10 AM Fed’s Collins Speech

09:15 AM Fed’s Bowman Speech

09:20 AM Jerome Powell Speech

09:25 AM Fed’s Williams Speech

10:00 AM Pending Home Sales Index

10:30 AM EIA Natural Gas Report

10:30 AM Fed’s Barr Speech

10:30 AM Fed’s Cook Speech

11:00 AM Kansas City Fed Mfg Index

01:00 PM Fed’s Kashkari Speech

01:00 PM Results of $44B, 7-Year Note Auction

04:30 PM Fed Balance Sheet

06:00 PM Fed’s Cook Speech

Fed Governor Michelle Bowman will speak right before Powell, and New York Fed President John Williams follows immediately after. Both are known for providing insights on inflation trends and economic growth projections. Traders will be listening closely for any signs that the Fed is reconsidering its current stance on rate cuts ahead of Friday’s Personal Consumption Expenditures (PCE) report, the Fed’s preferred inflation gauge.

Fed Governor Michelle Bowman will speak right before Powell, and New York Fed President John Williams follows immediately after. Both are known for providing insights on inflation trends and economic growth projections. Traders will be listening closely for any signs that the Fed is reconsidering its current stance on rate cuts ahead of Friday’s Personal Consumption Expenditures (PCE) report, the Fed’s preferred inflation gauge.

Also in the mix are Fed Vice Chair Michael Barr and Fed Governor Lisa Cook, both speaking around 10:30, along with Minneapolis Fed President Neel Kashkari at 1:00 pm. This steady stream of Fed commentary could shape the market’s view on whether inflation is truly tamed or if another rate hike might still be on the table.

With so many Fed heads speaking, the market will be looking for clues on two fronts:

- The Fed’s Rate Path: While the consensus has been leaning toward rate cuts by year-end, there remains a degree of uncertainty. Recent economic data, like this morning’s better-than-expected (0% but 0.5% ex-transport) Durable Goods Orders and steady GDP numbers (3%) suggest that the economy is still resilient, which could challenge the narrative of an imminent rate reduction.

- Inflation vs. Recession: Powell will likely address whether the Central Bank feels it has successfully curbed inflation, or if more action is required. If Powell signals caution, the markets could react negatively, particularly as investors fear the balance between taming Inflation and avoiding a Recession.

For now, Treasuries seem to be in a holding pattern, with the 10-year yield sitting at 3.77%, down one basis point. The bond market’s reaction to today’s remarks will be key in determining whether yields continue to rise or stabilize.

The tech sector remains the market’s leader following Micron’s AI-driven earnings, which set a positive tone for the semiconductor industry. Expect continued focus on Nvidia and AMD, which are riding the wave of AI optimism.

On the flip side, the Energy Sector has been under pressure as Crude Oil prices slip to $67.25 per barrel this morning DESPITE geopolitical tensions and that BS from OPEC that we discussed in yesterday’s Webinar. This sector is facing a tricky balancing act with oversupply concerns weighing heavily, while Hurricane Helene threatens energy infrastructure on the U.S. coast and in the Gulf – something else we’ll be watching closely in our Live Member Chat Room.

Globally, the markets are coming on strong with Asian markets up overnight. The Nikkei was up 2.8% and Hong Kong’s Hang Seng rising 4.2% as the additional stimulus gains a lot of fans, driven by tech optimism and hopes for even more Chinese stimulus. European markets are also in positive territory, supported by strong economic data and dovish comments from their own Central Bank.

We still have Pending Home Sales at 10:00, which could give us additional insight into the strength of the housing market.

Today will be all about the Fed and the market’s interpretation of its commentary. Expect volatility as each speech could shift sentiment, especially if Powell hints at a more cautious approach to rate cuts or discusses the Fed’s outlook on inflation. The Tech Sector should continue to outperform, but Energy and Cyclicals may remain under pressure from the rising Dollar (also predicted in the Webinar – now 100.9 – you’re welcome!) as we head into the final stretch of the 3rd Quarter.

Micron’s results solidify the ongoing narrative that AI is propelling a multi-year surge in demand for memory and semiconductor products, despite broader consumer weakness. The AI train isn’t slowing down – quite the contrary. Micron’s near-doubling of revenue year-over-year underscores just how significant the role of AI has become in reshaping the tech landscape.

Micron’s results solidify the ongoing narrative that AI is propelling a multi-year surge in demand for memory and semiconductor products, despite broader consumer weakness. The AI train isn’t slowing down – quite the contrary. Micron’s near-doubling of revenue year-over-year underscores just how significant the role of AI has become in reshaping the tech landscape. Micron’s guidance points to the potential for a sustained tech rally, even as broader economic concerns like weak consumer demand and high inflation persist. The bullish outlook for AI and data centers could continue to support elevated valuations in the sector, but the ride won’t be smooth. As we head into Q4, investors should remain cautious about overexuberance – especially with valuations stretched and broader economic indicators flashing mixed signals.

Micron’s guidance points to the potential for a sustained tech rally, even as broader economic concerns like weak consumer demand and high inflation persist. The bullish outlook for AI and data centers could continue to support elevated valuations in the sector, but the ride won’t be smooth. As we head into Q4, investors should remain cautious about overexuberance – especially with valuations stretched and broader economic indicators flashing mixed signals.