All the way

I’m on the highway to hell” – ACDC

I am very sorry to report that our currency (the thing everything is priced in and the thing people get paid with) is not in good shape.

Since the Fed began signaling it’s intention to lower rates (and the Government signaled no intention whatsoever to cut spending), the Dollar has been in a fairly constant slide from 106 to 100 so, if you are worried about silly things like confiscation of wealth – the LACK of realistic taxation on your current earnings to balance the budget (what’s that?) has led to a 6% tax (since June) on EVERYTHING you own, ALL of your cash, ALL of your savings, ALL of your stocks, ALL of your bonds – ALL have been devalued by 6% in two months!

During Wednesday’s Webinar, I had expressed hope that the Dollar would make a strong bounce, per our 5% Rule™, to 101.2 but we have FAILED to make that bounce AFTER half of the Fed gave speeches yesterday. That means that, Globally, we have been weighed, we have been measured, and we have been found wanting.

Look at that post death-cross 50 dma taking a power dive while we consolidate along the 100 line – that is so, so NOT GOOD from a technical standpoint. The 50 dma is under 102 and it fell 1.5 points in the last 30 days and it fell 1 point in the 30 days before that – so the decline of our currency is accelerating into the election and after the Fed has set policy – NOT GOOD!!!

Yesterday, we heard from half the Fed and here’s what they said:

🚢 Based on the information provided and the context of recent Fed actions, here’s a summary and analysis of the key Fed speeches on September 26, 2024:

1. Fed’s Collins Speech (09:10 AM):

Boston Fed President Susan Collins reiterated her recent stance that bringing inflation down to the 2% target will take longer than previously thought. She emphasized the need for patience and data-dependent decision-making.

-

-

- Stated that bringing inflation down to the 2% target will take longer than previously thought.

- Cited potential supply chain disruptions and slower economic growth as factors.

-

Analysis: Collins’ views suggest a cautious approach to future rate cuts, potentially supporting a more gradual easing cycle.

2. Fed’s Bowman Speech (09:15 AM):

Governor Michelle Bowman, the lone dissenter in the recent rate cut decision, explained her preference for a smaller rate cut. She emphasized concerns about prematurely declaring victory over inflation.

-

-

- She preferred a smaller 0.25 percentage point rate cut.

- Concerned that a 0.5 point cut could lead markets to expect similar cuts at future meetings.

- Worried about potential unwarranted decline in longer-term interest rates.

- Emphasized the need to pay close attention to price stability while being attentive to labor market risks.

-

Analysis: Bowman’s dissent and continued caution could indicate some internal disagreement within the Fed about the pace of future rate cuts.

3. Jerome Powell Speech (09:20 AM):

Fed Chair Powell’s speech at the U.S. Treasury Market Conference focused on the importance of the Treasury market and its role in monetary policy implementation. He avoided direct comments on current monetary policy.

-

-

- Emphasized the critical role of the Treasury market in implementing monetary policy.

- Recalled the “flash crash” 10 years ago and subsequent changes in market structure.

- Stressed the importance of the Treasury market functioning at a high level.

- Did not comment on current monetary policy or economic outlook.

-

Analysis: Powell’s focus on market structure rather than policy suggests he’s letting other Fed officials shape the narrative on recent decisions.

4. Fed’s Williams Speech (09:25 AM):

New York Fed President John Williams probably supported the recent rate cut decision and discussed the Fed’s outlook for the economy and inflation.

Analysis: Williams’ views are often closely aligned with Powell’s, so his comments reinforced the Fed’s current stance.

-

- Fed Vice Chair for Supervision Michael Barr Speech (10:30 AM):

Vice Chair Barr focused on the importance of the Treasury market and the Fed’s role in supporting its resilience. Key points include:

- Fed Vice Chair for Supervision Michael Barr Speech (10:30 AM):

-

-

- Discussed the importance of capital and liquidity regulations in supporting market resilience and financial stability.

- Highlighted the role of the discount window and standing repo facility (SRF) in supporting monetary policy implementation and financial stability.

- Announced exploration of new liquidity requirements for larger banks, including maintaining a minimum amount of readily available liquidity based on uninsured deposits.

- Considering partial limits on the use of held-to-maturity (HTM) assets in larger banks’ liquidity buffers.

- Reviewing the treatment of certain types of deposits in the current liquidity framework.

-

Analysis: Barr’s speech indicates a focus on enhancing liquidity regulations and improving the integration between monetary policy tools and supervisory practices. This suggests a more comprehensive approach to ensuring financial stability, particularly in light of lessons learned from recent banking stresses.

-

- Fed Governor Lisa Cook:

-

-

- Expressed strong support (“wholeheartedly backed”) for the recent 0.5% rate cut.

- Cited a slowing labor market and easing inflation as reasons for the cut.

- Focused on the potential impacts of AI on the U.S. workforce.

-

Analysis: Cook’s support for the larger rate cut suggests she sees a need for more aggressive easing to support the labor market and manage inflation.

-

- Minneapolis Fed President Neel Kashkari:

-

- Specific details of Kashkari’s speech are not provided in the search results.

- Previously, he has signaled support for maintaining current interest rates.

Analysis: Kashkari’s previous comments suggest a cautious approach to rate cuts, aligning with some other Fed officials.

Context and Meaning for Forward Fed Action:

-

- Consensus Building: Despite Bowman’s dissent, the majority of Fed officials seem to support the recent rate cut and the potential for further easing.

- Data Dependency: All officials emphasized the importance of upcoming economic data in shaping future decisions.

- Gradual Approach: The overall tone suggests a preference for measured steps in future rate cuts, unless economic data significantly deteriorates.

- Inflation Vigilance: Officials are balancing optimism about cooling inflation with caution about declaring victory too soon.

- Labor Market Focus: Given recent weak jobs data, officials are probably closely watching labor market indicators to gauge the need for further easing.

- Market Expectations Management: The Fed seems to be trying to temper market expectations for aggressive rate cuts while keeping the door open for further easing if needed.

The speeches reveal a range of views within the Fed, from more aggressive easing (Cook) to a more cautious approach (Bowman, Collins). The consensus seems to be that while rate cuts have begun, the pace and extent of future cuts remain data-dependent. The Fed appears focused on balancing inflation concerns with supporting the labor market. The divergence in views suggests that future policy decisions will likely be the result of careful deliberation and may not follow a preset course. Market participants should expect continued emphasis on incoming economic data and a potentially gradual approach to further rate cuts.

All that yammering from the Fed and we got NO BOOST for the Dollar. You can’t blame the Fed entirely as they don’t control the Budget, which is now paying out $1,000,000,000,000 IN INTEREST PAYMENTS ALONE EACH YEAR on our $36Tn National Debt (128% of our now-inflated $28Tn GDP) and our GDP is projected to be $30.5Tn in 2026 but we’re running a $2Tn deficit so the Debt/GDP ration in 2 years will be 40/30 – 133% so, in simple terms – getting worse – hence the Dollar decline.

Of course stocks, like commodities, are assets and you will need more Dollars to buy the same stock in the same way you will need more Dollars to buy gas or food. So we will get swings towards equity but then we will see inflation and that will scare investors so strap in for a wild ride into the end of the year!

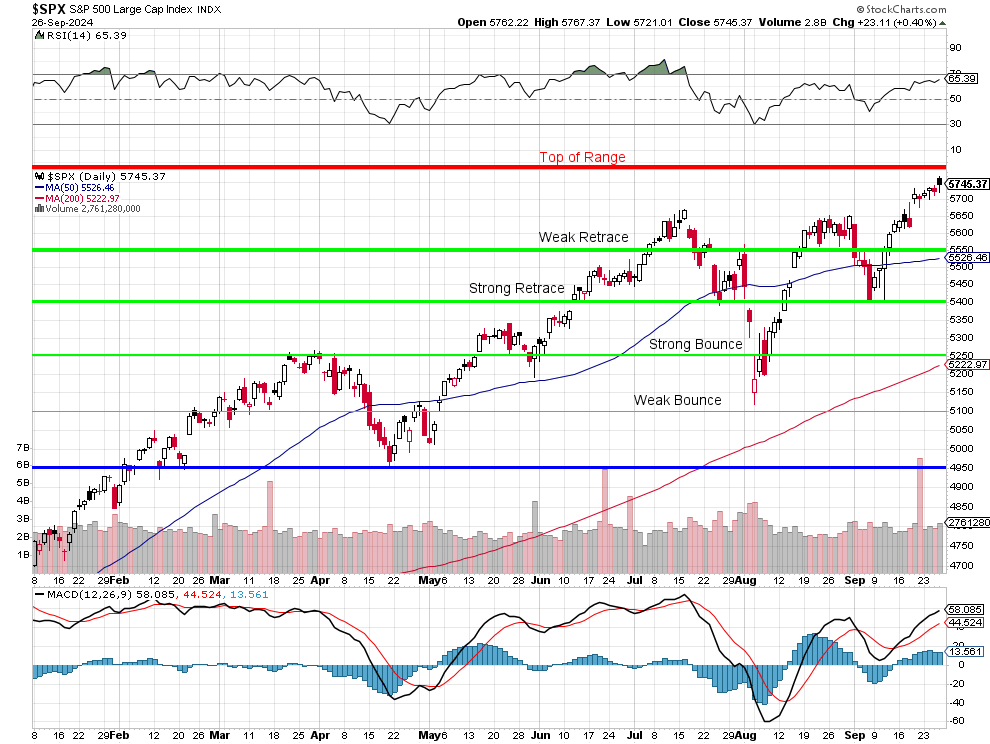

Since June, the Dollar has dropped 6% and the S&P 500 has gained 4.9% so it’s not really a rally when you are losing ground in constant Dollar terms. Gold (/GC) on the other hand has gone up more than 10% and BitCoin is up 3.6%, losing ground to growth but currently on a big run at $65,675 – which is up almost 20% for the month as the Fed rolled out their policy plans.

The lack of pessimism among retail investors presents an intriguing juxtaposition against the backdrop of the looming “Economic Timebomb.” This disconnect underscores a crucial market dynamic. Investor sentiment, while a potent market force, can often operate independently of Fundamental Economic Realities.

The lack of pessimism among retail investors presents an intriguing juxtaposition against the backdrop of the looming “Economic Timebomb.” This disconnect underscores a crucial market dynamic. Investor sentiment, while a potent market force, can often operate independently of Fundamental Economic Realities.

Market Psychology, driven by a confluence of factors including Fear, Greed, and Herd Mentality, can create a self-fulfilling prophecy. Retail investors, buoyed by positive narratives and recent market performance, might inadvertently fuel a market bubble, detached from the underlying economic vulnerabilities.

This divergence between optimism and economic realities presents a conundrum. While investor enthusiasm can propel markets higher in the short term, it also creates a fragile ecosystem prone to sharp corrections when reality inevitably reasserts itself. The potential “Economic Timebomb,” if it detonates, could trigger a cascade of panic selling, amplifying market losses. Hedging remains critical here – even if it feels like we’re buying insurance for no reason as the market scales new highs.

The current environment serves as a reminder that investing is not just about numbers and forecasts – it’s also about understanding Human Psychology and its profound impact on markets. Navigating this environment will require a balanced approach, combining optimism with a healthy dose of realism as we roll along with the crowd.

Have a great weekend,

– – Phil