China again?

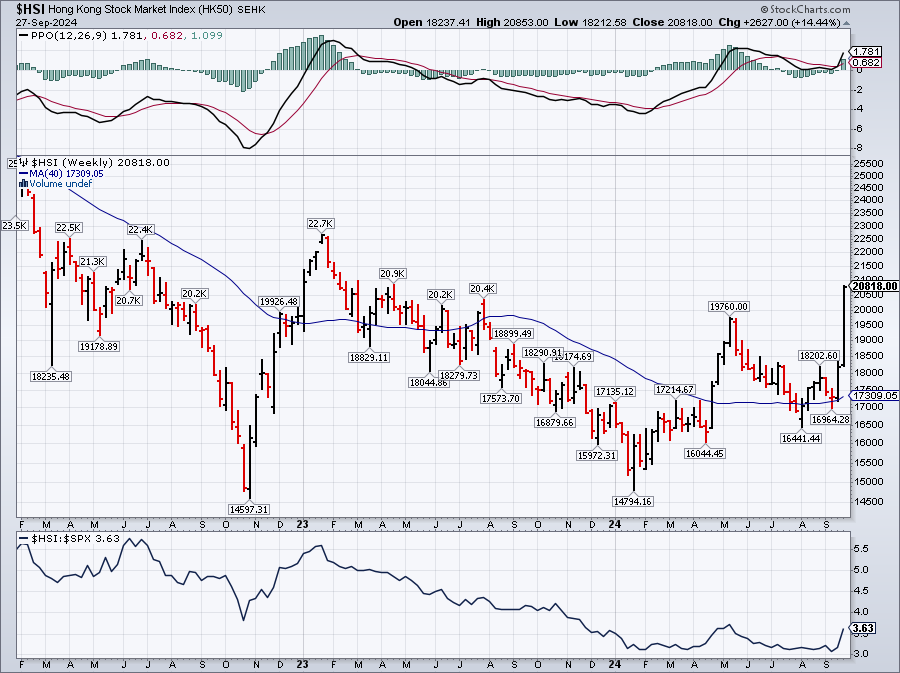

On the last day of September (and Q3), the Shanghai Composite jumped over 8% – having their best day since 2008 (which did not end well) thanks to EVEN MORE stimulus measures aimed at the Real Estate sector including mortgage rate cuts and relaxed home-buying restrictions. Not to be outdone, the Hang Seng Index is up 13% for the week – the best performance since 1998.

Companies tied to China’s economic fortunes, such as luxury goods producers and commodity exporters, are already benefiting. Stocks like LVMH, Kering, Mercedes-Benz, and miners such as Rio Tinto (RIO) have rallied on the expectation of improved Chinese demand and, in the U.S., Chinese e-commerce giants like BABA and JD have surged as well, benefiting from this newfound optimism.

Last week we were wondering if China’s $500Bn stimulus package would be enough but now they are building on it and, also, their timing was well-planned as this morning was the last trading day before a week-long holiday (Golden Week), causing traders to rush in to buy shares lest they miss out on more gains to come: “错过恐惧症” (“cuòguò kǒngjùzhèng” or “FOMO” is the phrase that comes to mind). $166.8Bn worth of stocks turned over on the Shanghai – a new record.

It’s a frenzy all right! Meanwhile, the Nikkei plunged 5% since Friday’s open on fears the new Prime Minister will not keep throwing money at the markets because MORE FREE MONEY is what has been driving the Global Economy since 2009 – so why stop now? Japan is already 300% of their GDP in debt with over 30% of their Government’s annual revenues spent on debt service alone. They have an aging population and virtually no immigration – it’s Donald Trump’s utopia and it’s a complete dumpster fire of an economy!

Where is the future when your entire population is expected to SHRINK by 22% over the next 25 years? The US lost 1M people during COVID and that was “just” 0.3% of our population and we’re still trying to recover. Japan is losing 1% of their population EACH YEAR and the survivors are skewing older and older and there are less and less children and no immigrants to fill jobs and occupy empty homes – good luck with that economic model, right?

Where is the future when your entire population is expected to SHRINK by 22% over the next 25 years? The US lost 1M people during COVID and that was “just” 0.3% of our population and we’re still trying to recover. Japan is losing 1% of their population EACH YEAR and the survivors are skewing older and older and there are less and less children and no immigrants to fill jobs and occupy empty homes – good luck with that economic model, right?

Anyway, getting back to China – or things China is ruining – Stellantis (STLA – Chrysler, Jeep, Dodge, Alpha Romeo…) is down 14% this morning as they revised guidance down about 6% from their previous “double digit growth” guidance just two months ago. “Intensified competition from Chinese Manufacturers” is one of the main issues as China went full-throttle making inexpensive electric cars while US Manufacturers, including TSLA, decided to take advantage of Government Rebates ($7,000) for themselves and kept making expensive electric vehicles no one wants – certainly not in most of the World…

CEO Carlos Tavares stated, “The best way to compete is to try to be Chinese ourselves,” indicating an intention to adopt China’s low-cost approach. Stellantis is entering into a joint venture with China’s Leapmotor, which will give STLA access to Chinese EV technology and rights to produce Leapmotor vehicles outside of China (circumventing tariffs).

I like the new partnership and I think STLA is simply undergoing a rough transition (as are most auto makers) so, in our Live Member Chat Room, we’ll be taking on a new position in STLA – probably for our $700/Month Portfolio as well as the LTP – we’ll have to see how the options look when the market opens.

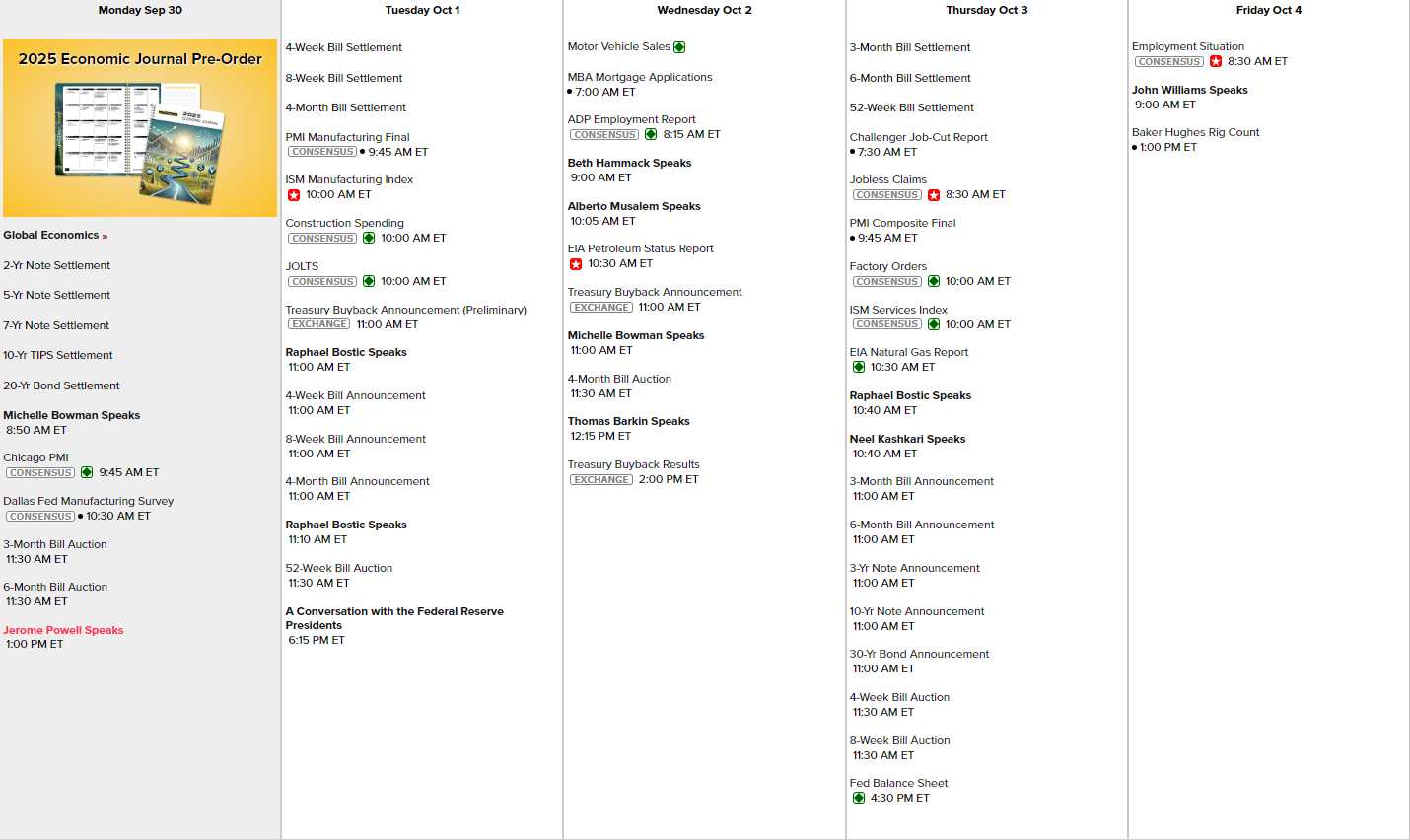

And, speaking of the broader markets, we have 12+ Fed speakers this week, including Powell at 1pm this afternoon – determined that the markets will end the month on a strong note. On the Data front – Chicago PMI and Dallas Fed this morning after the bell, tomorrow it’s PMI, Construction Spending, JOLTS and a Fed Conference in the evening to kick off October. Wednesday is Mortgage Applications and ADP, Thursday PMI, Factory Orders and ISM and Friday, it’s the Big Kahuna – Non-Farm Payrolls!

And, believe it or not, there are STILL earnings reports coming in and we can’t ignore NKE, LEVI and STZ, can we?

Boeing workers are still on strike with no end in site and East Coast Port Workers are about to walk out for another strike that will cripple the economy and reboot inflation (as will all these wages if they win). 45,000 dock workers from Maine to Texas are demanding a 77% pay raise as of midnight tonight or they won’t be there in the morning to unload the ships and load the trains.

JP Morgan equity analysts estimate a ports strike would cost the U.S. economy between $3.8 billion and $4.5 billion a day and the White House, so far, has declined to intervene – other than to help with the negotiations. Ocean carrier earning jumped $3Bn this year or $66,666 per striking worker, who are asking for about that much over the next 6 years ($11,111/year) – just a small share of the profits after working without a pay increase since 2017 while getting buried by inflation.

And how will the shipping companies respond to the strike? Some ocean shipping companies have warned of surcharges in the event of a strike of between $1,500 and $3,000 a container, according to JP Morgan analysts. They say container rates could rise by several thousand dollars a box in the case of a five-day strike – SMART!

Isn’t Capitalism FANTASTIC?

[ctct form=”12730731″ show_title=”false”]