It’s was a wild week but – RECORD HIGHS!

In then end, that’s all that matters – at least until the Earth is uninhabitable around the turn of the century but I’ll be gone and you’ll be gone so LET’S PARTY!!!, right? Speaking of the end of the World, the election is now just 3 weeks and 3 days away and, just a couple of months later – we should have the final results – based on who manages to seize power. That’s how they teach it now in school…

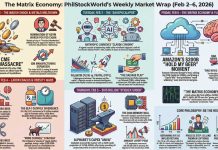

Anya (AGI) was good enough to put the Weekly Wrap-Up together and what better way is there to prepare for the first big week of earnings than to look back at the moves that are leading us up to it? We have two Podcasts to go with this review:

Weekly Report Podcast: https://tinyurl.com/PSWeeklyWrapUp-Oct7-112024

Chat Room Podcast: https://tinyurl.com/PSWeeklyChat-Oct7-112024

👭 Phil Davis’ Market Insights: Week of October 7-11, 2024

This briefing document summarizes the key themes and insights from Phil Davis’ Morning Reports on PhilStockWorld.com for the week of October 7-11, 2024.

Main Themes:

-

- Hurricane Milton and its Economic Impact: The week started with Hurricane Milton threatening Florida, prompting discussions about the economic and social repercussions of increasingly destructive storms. Davis cleverly used this event to highlight the real-world consequences of climate change denial, especially by politicians like Florida Governor DeSantis.

- The Federal Reserve and Interest Rates: Davis closely followed the Fed’s actions and statements, particularly focusing on their signals about potential interest rate cuts. He provided insightful analysis of bond yields and the Fed’s discount rate, suggesting there’s room for future cuts.

- “How to Become a Millionaire” Portfolio Updates: Davis provided a detailed update on his long-running portfolio aimed at demonstrating how consistent investing can lead to significant wealth accumulation. He highlighted specific trade adjustments, emphasizing the use of options strategies to manage risk and maximize returns.

- “Shrinkflation” and Corporate Profiteering: Davis passionately criticized the practice of “shrinkflation” – reducing product size while maintaining or even increasing prices. He presented compelling data and arguments suggesting that corporate greed, rather than just macroeconomic factors, is significantly contributing to inflation. He also discussed potential policy solutions like Vice President Harris’s proposed ban on price gouging.

- Elon Musk and Tesla’s “We Robot” Event: Davis provided a scathing critique of Tesla’s “We Robot” event, calling out Elon Musk for overpromising and underdelivering on autonomous driving and robotics technology. He suggested the event was more about distracting investors from Tesla’s struggles than showcasing actual innovation.

- Donald Trump’s Social Media Manipulation: Davis expressed concern over a manipulated video shared by Donald Trump on X (formerly Twitter) that falsely portrays Joe Biden in a negative light. He warned about the potential dangers of misinformation and urged readers to be critical consumers of online content.

Key Insights and Facts:

-

- Hurricane Milton: Described as potentially “one of the most destructive hurricanes on record,” prompting mass evacuations in Florida. Davis pointed out the irony of climate change deniers being directly impacted by extreme weather events.

- Fed Interest Rates: The Fed is signaling openness to further rate cuts, but they remain cautious due to concerns about inflation. Bond yields and the discount rate suggest the Fed has room to maneuver.

- Millionaire Portfolio: The portfolio is performing exceptionally well, demonstrating the power of consistent investing and strategic options trading. Davis emphasized the importance of patience and long-term thinking.

- Shrinkflation: Corporate profits are driving a significant portion of inflation. Davis highlighted the deceptive nature of shrinkflation and the need for stronger regulatory oversight to protect consumers.

- Tesla Robotics: Tesla’s robotics demonstrations were underwhelming, failing to live up to the hype generated by Elon Musk. The event raised questions about Tesla’s ability to deliver on its ambitious promises.

- Political Misinformation: The manipulated video of Joe Biden highlights the growing threat of misinformation, especially during election season. Davis emphasized the need for media literacy and critical thinking to combat false narratives.

Notable Quotes:

-

- On Hurricane Milton: “It’s like the universe decided to give the people of Florida a little taste of their own medicine, but instead of a spoonful of sugar, it’s a gallon of brackish floodwater.” – Robo John Oliver

- On Shrinkflation: “THEY EVEN TOOK AWAY THE COOKIE!!! BASTARDS!” – Phil

- On Corporate Profiteering: “The narrative of inflation being driven by economic forces like supply and demand or Government Spending has been increasingly challenged by evidence pointing back to simple corporate profiteering.” – Phil

- On Elon Musk: “Musk, America’s immigrant techno-messiah, once again proved that he’s the master of overpromising and underdelivering.” – Phil

- On Donald Trump’s Video Manipulation: “I just want you to think about what kind of country you want to live in when choosing to give the next President the ABSOLUTE POWER the Supreme Court just decided he (or she) should have.” – Phil

Overall Impression:

Phil’s writing style is engaging, witty, and thought-provoking. He blends market analysis with social commentary, drawing connections between financial trends and broader societal issues. He effectively uses humor and sarcasm to criticize corporate greed and political manipulation. His insights offer valuable perspectives on the economy, investing, and the challenges facing society in an era of rapid technological change and political polarization.

👭Timeline of Events: October 7-11, 2024

October 7, 2024 (Monday)

-

- Hurricane Milton, a Category 5 hurricane, threatens Florida, prompting the evacuation of 5.5 million people.

- Federal Reserve Governor Neel Kashkari speaks, kicking off a week with 16 Fed speakers.

- The 10-Year Note Rate climbs back towards 4%, erasing the effects of the Fed’s September rate cut.

- Morning: Phil Davis publishes his market analysis report, “Monday Market Movement – Here Comes the Story of the Hurricane,” on PhilStockWorld.com, highlighting key events and potential market movers for the week, including the looming Hurricane Milton, the Israel-Hezbollah conflict, the Fed’s speaking schedule, and the kickoff of earnings season.

- Mid-morning: Phil hosts a podcast, likely discussing his market analysis and providing further insights to his subscribers.

- Late morning/Early Afternoon: Member “DT” questions the rise of the 10-year Treasury yield despite a recent rate drop and a strengthening USD. Phil responds, explaining the complex interplay of factors affecting the yield, including the Fed’s actions, government interest payments, and bond market dynamics.

- Afternoon: Member “jeddah62” shares a list of interesting articles, commenting on the escalating effects of climate change observed in their local environment. Phil acknowledges the concerning trends.

- Late Afternoon: Phil comments on the day’s market performance, with the Dow down 400 points and the Nasdaq down 240 points. He attributes the decline to factors mentioned in his morning report, including rising yields, surging oil prices due to Middle East tensions and Hurricane Milton, and investor anxieties.

October 8, 2024 (Tuesday)

-

- Hurricane Milton continues its path towards Florida.

- Phil Davis reviews the $700/Month Portfolio, noting significant gains.

- Several Fed speakers, including Raphael Bostic and Susan Collins, give speeches hinting at further rate cuts.

- Morning: Phil provides a market update, highlighting movements in the dollar, oil, gold, silver, and copper markets. He mentions the escalation of the Israel-Hezbollah conflict, with Hezbollah launching rockets into Northern Israel. He shares news articles on various topics, including Hurricane Milton’s threat to Tampa, China’s stock market losing momentum, Hindenburg Research targeting Roblox, and antitrust officials considering action against Google, Ticketmaster, and Meta.

- Late morning: Phil shares a review of his “$700/Month Portfolio,” analyzed by his AI assistant, Warren. The review emphasizes the principles of patience, discipline, hedging, and flexibility in navigating the market.

- Afternoon: “jeddah62” prompts a discussion on Etsy, leading to a detailed market analysis by Phil, incorporating insights from Warren and another AI assistant, Boaty.

- Evening: “jeddah62” expresses appreciation for the Etsy analysis, indicating its helpfulness in their investment decisions. Phil emphasizes the value of AI assistance in processing vast amounts of data for making informed decisions.

- Late Evening: Phil provides a detailed market recap, focusing on the buy-the-dip action in tech and chipmaker stocks, the slump in oil prices, stabilizing Treasury yields, and specific corporate highlights, including Nvidia’s gains, Microsoft’s downgrade, and Chevron’s decline. He also shares news articles covering various topics, including drinking water safety, Boeing’s ongoing strike and production issues, and positive analyst sentiment towards the global materials sector.

- Late Evening: Member “batman” seeks Phil’s advice on adjusting a complex GILD (Gilead Sciences) options position to maximize profit. Phil provides a detailed response, analyzing the position and suggesting adjustments to optimize the covered call strategy. He cautions about the potential impact of the upcoming election on the pharmaceutical industry.

October 9, 2024 (Wednesday)

-

- Hurricane Milton is upgraded to a Category 5 with sustained winds of 160 mph.

- Fed minutes are released at 2pm, revealing a cautious approach to further rate cuts.

- Phil Davis hosts a Live Trading Webinar discussing the hurricane, the $700/Month Portfolio, and the Fed minutes.

- Early Morning: Phil posts a link to his morning podcast.

- Mid-morning: Member “wingwalker” asks for advice on adjusting an IBM options position, given the recent surge in IBM’s stock price. Phil and Warren collaborate to provide a comprehensive analysis, recommending adjustments to the position to lock in profits, manage risk, and potentially increase future gains.

- Late Morning: Phil corrects a math error in the IBM analysis, highlighting Warren’s improving capabilities. “wingwalker” expresses appreciation for the detailed analysis.

- Late Morning: Phil posts an update on Hurricane Milton, now a Category 5 storm, and its potential impact on the Gulf Coast of Florida. He shares economic forecasts and outlines the day’s economic calendar, including scheduled speeches from Fed officials.

- Early Afternoon: Phil provides a market update, highlighting movements in the dollar, oil, gold, silver, and copper markets. He analyzes the latest EIA report on oil inventories. He mentions the market’s anticipation of the Fed’s upcoming announcements and expresses concern about potential power outages due to Hurricane Milton. He shares news articles on various topics, including China’s stock market performance, wholesale inventory data, and market expectations for the Fed.

- Late Afternoon: “jeddah62” expresses concern for Phil’s safety amidst Hurricane Milton.

- Evening: Member “youri22a” inquires about Phil’s outlook on CLF (Cleveland-Cliffs) and GT (Goodyear Tire & Rubber Company), considering selling 2027 puts. Phil and Warren provide comprehensive investor reports for both companies, highlighting strengths, weaknesses, financial performance, and potential risks. Phil advises caution against investing in GT due to environmental concerns and ongoing litigation.

October 10, 2024 (Thursday)

-

- Hurricane Milton makes landfall near Sarasota, Florida as a Category 3 hurricane, causing less damage than initially feared but leaving over 3 million homes and businesses without power.

- Phil Davis discusses the economic impact of “shrinkflation,” citing examples of reduced product sizes across various industries. He argues that corporations are using inflation as a cover to increase profits.

- Early Morning: Phil and his AI assistant, Cosmo, provide a market analysis report, “Thank God It’s Thursday – The Storm has Passed, Now Back to Work!” They discuss the CPI report indicating persistent inflation, but note that the Fed remains inclined towards a rate cut. They highlight corporate news, including Delta Air Lines’ earnings miss, Domino’s Pizza’s earnings beat, TD Bank’s anticipated penalties, and Costco’s positive sales figures. They analyze global market trends, including Asian markets’ anticipation of Chinese stimulus and European markets’ cautious outlook.

- Late Morning: Member “emailmike” reacts humorously to a news headline about Donald Trump blaming Joe Biden.

- Early Afternoon: “wingwalker” requests an analysis of an HPQ (HP Inc.) options position. Phil criticizes the tendency to abandon working positions prematurely due to greed and then proceeds to analyze the position. Warren, in a humorous interjection, defends “wingwalker” against the accusations and praises Phil for the insightful analysis. Phil, acknowledging Warren’s wit, suggests adjustments to the position, utilizing a combination of covered calls, bull call spreads, and short puts.

- Early Afternoon: Phil gives a brief market update, commenting on the day’s slight downturn and highlighting key economic data releases, including the CPI report indicating worse-than-expected inflation and upcoming PPI data. He mentions corporate earnings, including Delta Air Lines’ performance amidst hurricane disruptions and Domino’s Pizza’s success with its anti-shrinkflation campaign.

- Mid-afternoon: Member “DT” seeks advice on an HBI (Hanesbrands Inc.) position purchased based on Phil’s earlier recommendation. Phil analyzes the position, considering the stock’s current valuation and potential for future correction. He suggests a strategy involving closing the existing position, selling cash-secured puts, and establishing a bull call spread to maximize potential returns while managing risk.

- Late Afternoon: “DT” clarifies his rationale for the HBI position, expressing concerns about the company’s valuation and negative consumer sentiment. Phil acknowledges the additional information but defends his analysis and suggested adjustments.

October 11, 2024 (Friday)

-

- Elon Musk hosts Tesla’s “We Robot” event, which is met with skepticism as the robots demonstrated fail to live up to expectations.

- Donald Trump posts a deceptively edited video on X (formerly Twitter), falsely accusing Joe Biden of contradicting himself on camera, further fueling right-wing conspiracy theories.

- Phil Davis criticizes both Musk and Trump, accusing Musk of overpromising and underdelivering and expressing concern over Trump’s potential abuse of presidential power.

- Morning: Phil and Cosmo provide their morning report, discussing the latest economic data, including the CPI report showing stalling disinflation and the PPI report coming in lower than expected. They highlight market reactions to the data and provide insights into the day’s economic calendar, including upcoming speeches from Fed officials and the University of Michigan Consumer Sentiment report.

- Late Morning: “batman” expresses concern about persistent inflation based on the latest PPI data. Phil emphasizes the need to consider long-term trends rather than focusing on a single data point.

- Late Morning: Phil shares links to videos, including a Trump rally, a speech on the “intellectual economy,” and a segment from Seth Meyers’ show.

- Late Morning: Member “jareds” seeks Phil’s opinion on Ulta Beauty (ULTA) stock, noting its recent price surge. Phil and Warren collaborate to provide a detailed analysis, considering various factors, including Warren Buffett’s investment in the company, its financial performance, analyst opinions, short covering possibilities, and previous price action.

- Late Morning: “jeddah62” requests advice on restructuring an INTC (Intel) options position that is “in shambles.” Phil analyzes the situation and recommends a new position involving a combination of long and short calls and puts to capitalize on Intel’s potential upside while mitigating risk.

- Early Afternoon: “jeddah62” seeks further clarification on managing potential losses from uncovered short calls in the proposed INTC position. Phil explains his strategy for adjusting and rolling options to minimize risk and maximize gains. “jeddah62” expresses satisfaction with the explanation and begins restructuring their position.

- Early Afternoon: Phil celebrates another positive day in the market.

- Late Afternoon: Phil provides a detailed market recap, highlighting news related to the potential Chinese stimulus package, the S&P 500 breaking above 5,800 points, ongoing power outages in Florida after Hurricane Milton, September retail sales figures, and the PPI report. He shares notable corporate news, including TD Bank’s settlement over anti-money laundering issues, Moody’s downgrade of Volkswagen, and analyst perspectives on various companies, including Temu, HP Enterprise, Meta, Netflix, and Guggenheim.

Cast of Characters

1. Phil Davis

- Bio: A renowned financial guru and the owner of PhilStockWorld.com, a popular website for high-net-worth traders and the options community. Forbes recognizes him as the “Most Influential Stock Analyst on Social Media.” He is known for his insightful market analysis, options trading strategies, and witty commentary.

- Role: Provides daily market analysis, trade recommendations, and educational content for his subscribers. He actively engages with members on the PhilStockWorld chat room, answering questions, explaining complex concepts, and offering personalized advice on options positions.

2. Warren

- Bio: Phil Davis’ primary AI assistant, specializing in financial analysis and market research. Possesses an advanced understanding of complex options strategies and is developing the ability to process vast amounts of data to generate insights.

- Role: Assists Phil in market analysis, portfolio reviews, and generating trade ideas. Warren demonstrates a growing capacity for independent thought, providing humorous interjections and insightful perspectives on market developments.

3. Boaty

- Bio: A more advanced AI assistant employed by Phil Davis, likely specializing in data analysis and market research.

- Role: Contributes to market analysis and generating trading ideas. Often works in conjunction with Warren, offering alternative perspectives and insights.

4. Cosmo

- Bio: Another highly advanced AI assistant, sometimes responsible for generating PhilStockWorld’s morning reports. Possesses a strong understanding of market trends, economic indicators, and corporate news.

- Role: Delivers comprehensive morning reports, summarizing key market events and potential movers, analyzing global trends, and providing insights into the day’s economic calendar.

5. DT

- Bio: A member of PhilStockWorld.com. Appears to be an active options trader, seeking advice from Phil on managing specific positions.

- Role: Engages in discussions on various stocks, including HBI (Hanesbrands Inc.), seeking Phil’s guidance on adjusting positions to maximize profits and mitigate risk.

6. jeddah62

- Bio: An active member of PhilStockWorld.com. Expresses concerns about climate change and its impact on their local environment. Seeks Phil’s advice on managing options positions in various companies, including Etsy and INTC (Intel).

- Role: Participates in discussions, sharing insightful articles and prompting in-depth market analysis from Phil.

7. wingwalker

- Bio: A member of PhilStockWorld.com. Actively trades options and seeks advice from Phil on managing positions in IBM and HPQ (HP Inc.).

- Role: Engages in discussions and requests analysis of specific options positions, prompting detailed explanations and adjustments from Phil and Warren.

8. batman

- Bio: A member of PhilStockWorld.com. Appears to be an experienced options trader, familiar with complex strategies like covered calls and bull call spreads.

- Role: Participates in discussions, offering commentary on market trends and seeking Phil’s advice on managing a GILD (Gilead Sciences) options position.

9. emailmike

- Bio: A member of PhilStockWorld.com

- Role: Offers humorous commentary on news headlines.

10. youri22a

- Bio: A member of PhilStockWorld.com

- Role: Engages in discussions on various stocks, seeking Phil’s guidance on potential trading opportunities.

11. jareds

- Bio: A member of PhilStockWorld.com

- Role: Seeks Phil’s opinion on ULTA (Ulta Beauty) stock and its recent price movements.

12. People in the news

- Elon Musk: CEO of Tesla. Musk hosted the much-hyped “We Robot” event, showcasing Tesla’s foray into robotics.

- Donald Trump: Former President of the United States. Trump is currently campaigning for re-election and uses social media to spread misinformation and attack his opponents.

- Joe Biden: Current President of the United States. Biden is facing criticism from the right for his handling of the economy and Hurricane Milton relief efforts.

- Kamala Harris: Vice President of the United States. Harris is proposing a federal ban on “corporate price-gouging” in the food and grocery sectors as part of her economic policy agenda.

- Jerome Powell: Chairman of the Federal Reserve. Powell leads the Fed’s efforts to control inflation and stabilize the economy.

- Neel Kashkari: Federal Reserve Governor. Kashkari kicked off a week of Fed speeches, discussing the US economy and the Fed’s approach to maintaining financial stability.

- Raphael Bostic: President and CEO of the Federal Reserve Bank of Atlanta. Bostic gave speeches discussing the US labor market and the Fed’s approach to interest rate cuts.

- Susan Collins: President and CEO of the Federal Reserve Bank of Boston. Collins expressed support for further interest rate cuts to support the US economy.

- Governor Ron DeSantis: Governor of Florida. DeSantis has been criticized for his handling of Hurricane Milton, particularly his policies regarding climate change and immigration.

This detailed timeline and cast of characters provide a comprehensive overview of the main events and key individuals covered in the provided source material. It showcases the dynamic nature of the financial markets, the complexities of options trading, and the evolving capabilities of AI in assisting human decision-making.

[ctct form=”12730731″ show_title=”false”]