It’s that time of year again!

It’s that time of year again!

The Dow (42,863!) and the S&P 500 (5,815!) are sitting at all-time highs while the Nasdaq (20,271) is still short of the 20,700 mark we put up in July and the Russell is at 2,234, still 10% down from 2,440 in OCTOBER OF 2022 and the NYSE, which is the most important index that somehow is also the most ignored, at 19,711 was only at 18,500 in the summer so it’s actually been leading the way to the promised land at 20,000.

The only thing rising faster than the US markets has been the Price/Earnings Ratios of the US markets – which are also at an all-time high. That means we’re paying more money for stocks compared to their actual earnings than at any time in the history of the market – INCLUDING before the Dot Com Crash:

Overall, we’re trading at 26.37x earnings as of Friday’s close with the IT Sector (who are making ALL the money) at 38.91x earnings, just behind Real Estate at 39.35x earnings and just ahead of Health Care, which is trading at 34.69x earnings. As a nation, the only country ahead of us is India, at 26.89x overall earnings (and that economy is on fire!) and behind us in a distant 3rd s Australia, at 21.42x earnings while UK is 16.34x, Japan 12.6x, and China 9.95x.

So, if you were not a Xenophobic US Investor and really did believe all men are created equal and that people in other countries also understood how to make things and make profits and govern their companies for long-term prosperity (evidenced by HUNDREDS of years of history) – where would you be investing your money?

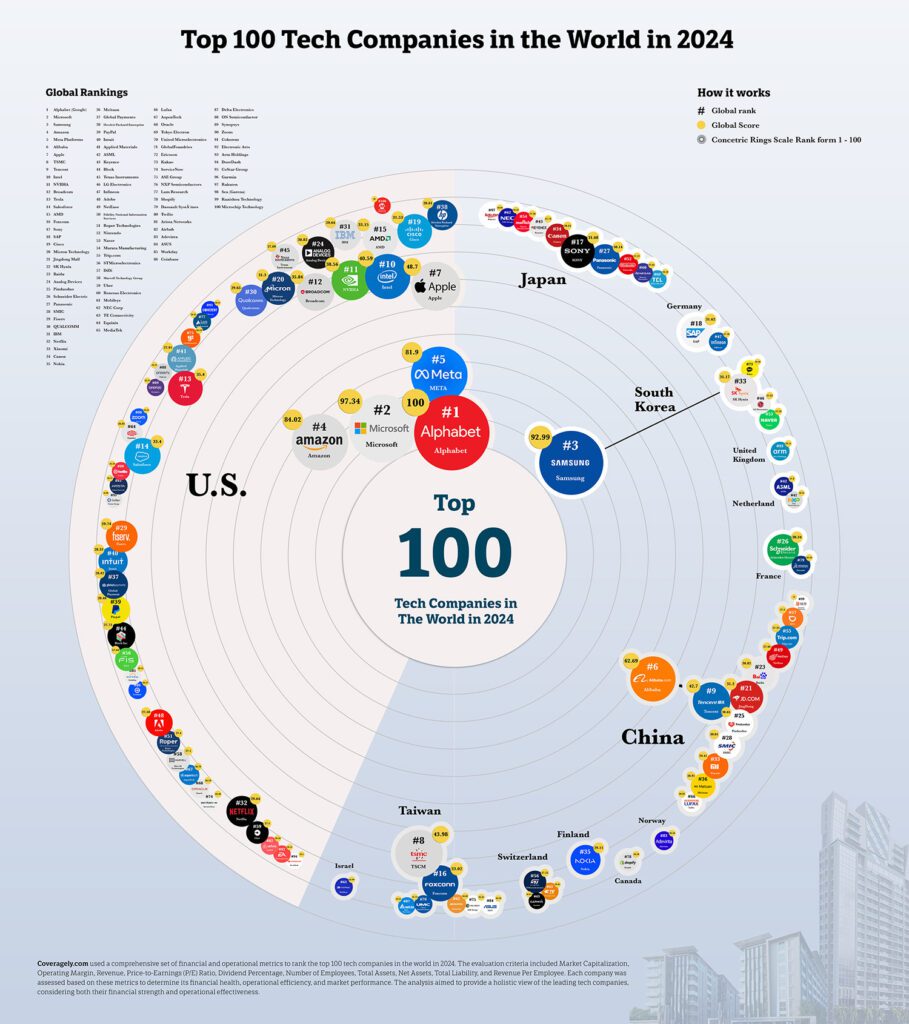

That’s right, just like elections, the central theme driving over-investment in the US Economy is good old-fashioned racism! The Nasdaq 100 is trading at 30.92x current earnings and 29.17x their optimistic forward earnings while Samsung (South Korea) is trading at 12.5x earnings, Taiwan Semi Conductor (Taiwan) is trading at 15x, Tencent (China) trades at 16x, Alibaba (China) is trading at 10x, Sony (Japan) is trading at 15x and SAP (Germany) is at 20x.

Again, if you were an unbiased Global Investor living in a country that doesn’t dismiss other cultures as being unworthy of attention – where would you be putting your money?

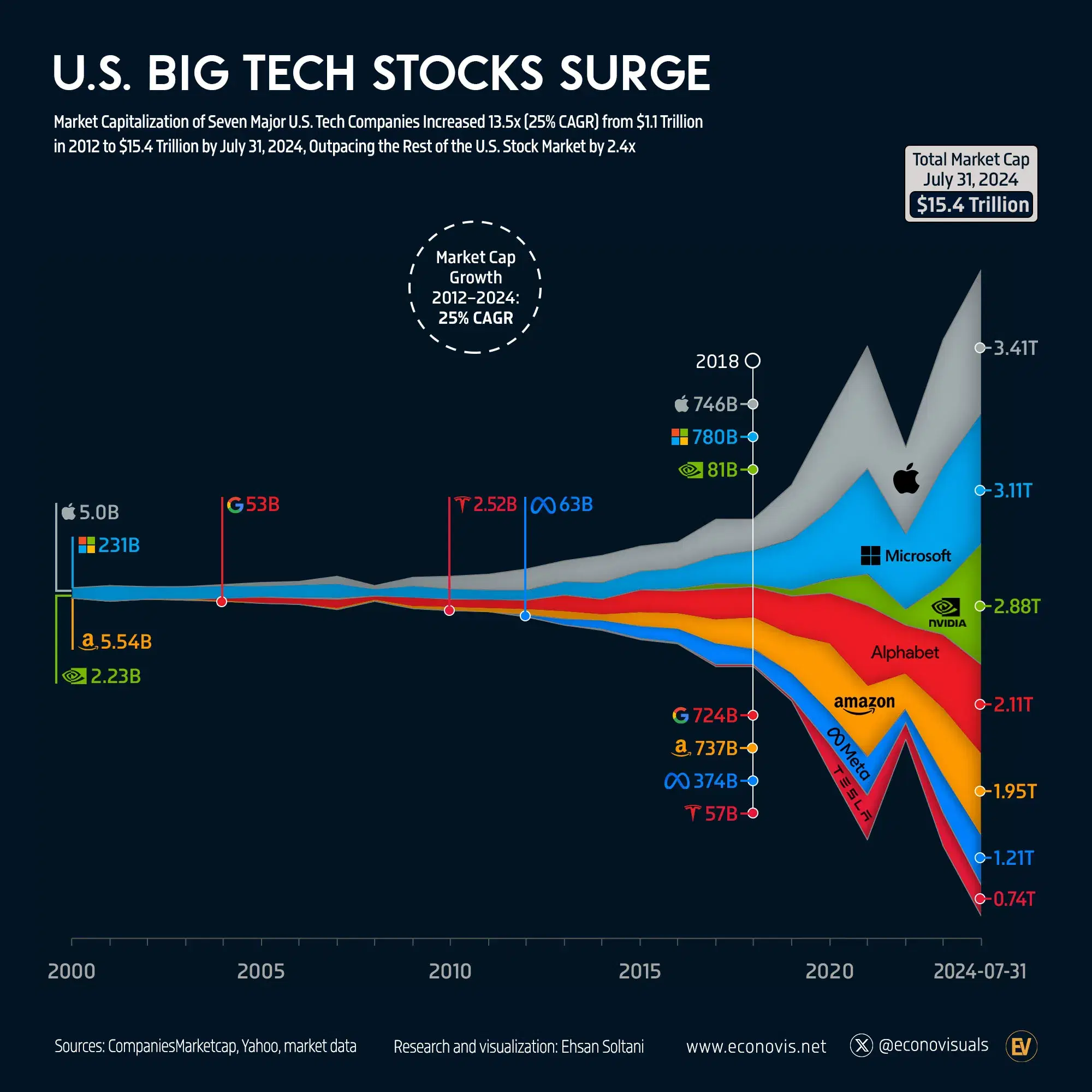

The market cap of US companies is just about $60,000,000,000,0000 with Europe and China around $11Tn each and Japan at $6.7Tn but the Magnificent 7 (AAPL, MSFT, GOOG/L, AMZN, NVDA, META & TSLA) alone make up just under $18Tn (30%) of that total.

On an earnings basis, however, the Magnificent 7 account for 60% of the entire US markets’ earnings – so imagine the catastrophe if they were to miss their lofty expectations AND keep in mind that they are already trading at 30x earnings so the slightest misstep can send this whole house of cards toppling to the ground. Enjoy….

We will, of course be watching all of this very closely and consider this the very beginning of a hunting expedition and consider this a safety warning. If we were hunting deer, I would warn you about ticks and but if we were hunting antelopes it might be worth mentioning that they are a favorite food of lions, right? Well, in this case we’re hunting for bargains during earnings season but the danger is being swallowed up by a broad-market collapse – so we’ll have to make sure the Mag 7 are on firm footing before we start running after the wounded antelopes of the upcoming season.

Elon Musk’s BS aside, it is very likely that, 20 years from now, we WILL have ubiquitous AI and we WILL have self-driving electric cars that WILL require a robust Charging Infrastructure and we WILL have Robots (Industrial for sure, household – probably) and Augmented Reality and the Internet of Things will be like phones are to our kids now – they won’t understand how life was possible without them. Oh yes, and Quantum Computing – even though people still don’t even understand what it is…

Look at the chart above, AAPL, AMZN, MSTF and NVDA were $244Bn total. GOOG didn’t exist yet, nor did TSLA or META (FB back then) and, if you waited 10 years – you wouldn’t have missed much but then the future came and they all exploded. NOT every tech company exploded but who didn’t know MSFT and AAPL were good companies back in 2000?

If you are a long-term investor, then why risk your money chasing the next hot thing when the current leaders are the ones most likely to give you fantastic long-term returns. $244Bn (almost all MSFT) in 2000 is $18,000Bn today – 73x! – that’s an average of 3.5x PER YEAR for two decades! That will likely keep you well ahead of inflation, right?

So yes, despite the warnings, we’re long-term bullish in year two of the bull market but we’re also determined not to overpay so we’ll be looking for bargains as there are bound to be disappointments this earnings season – just as our Magnificent 7 have had plenty of disappointments over the last 20 years but the trend is your friend in the macro picture.

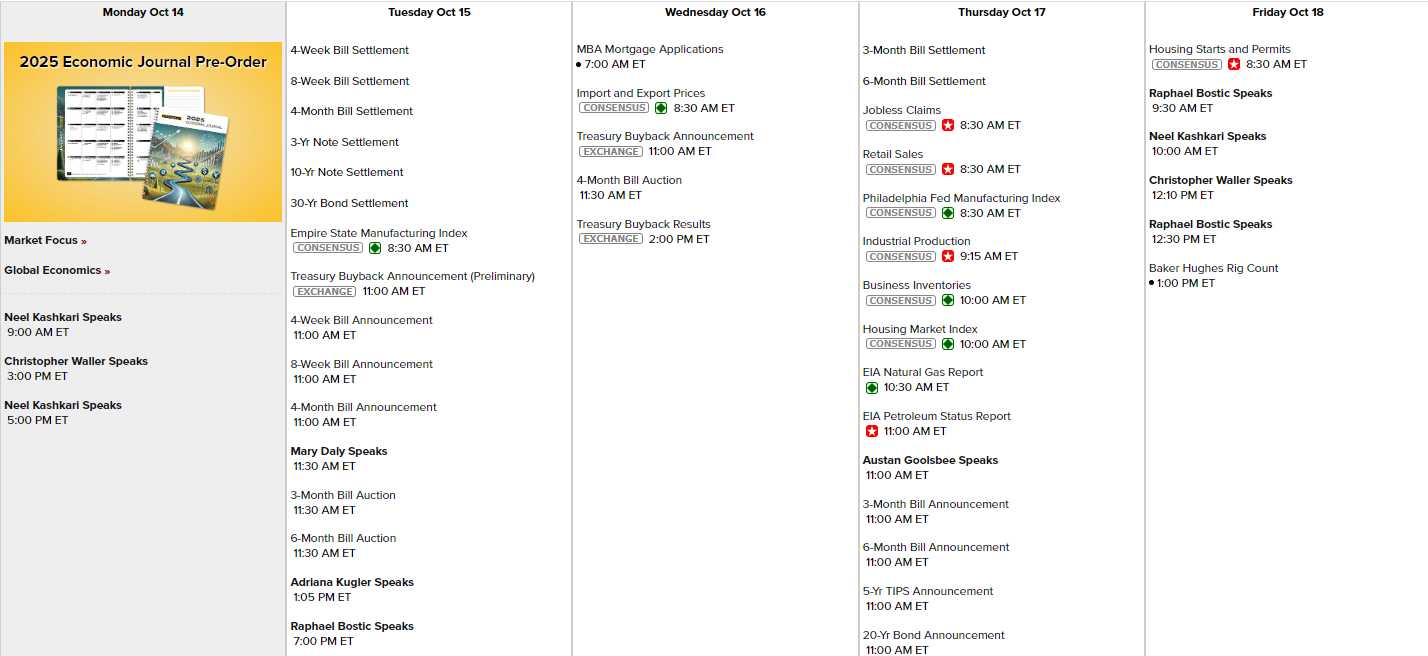

Now, zooming way in to the current week: We are already halfway through October and today is technically a holiday but the markets are open – so here we are. Neel Kashkari speaks twice today along with Chris Waller and we have 8 other Fed speeches this week and NOT a lot of data until Retail Sales on Thursday along with the Philly Fed (Empire State Tuesday) and Housing on Friday – that’s almost nothing on the data front….

That puts the weight squarely on Earnings and we have plenty of those to keep us occupied and we’ll see if these sky-high p/e ratios can be justified or if it’s time to cash in some longs and tighten up our hedges. Conveniently, this is also the week we’ll be reviewing our Member Portfolios…

This is going to be fun!

[ctct form=”12730731″ show_title=”false”]