Up nicely.

Up nicely.

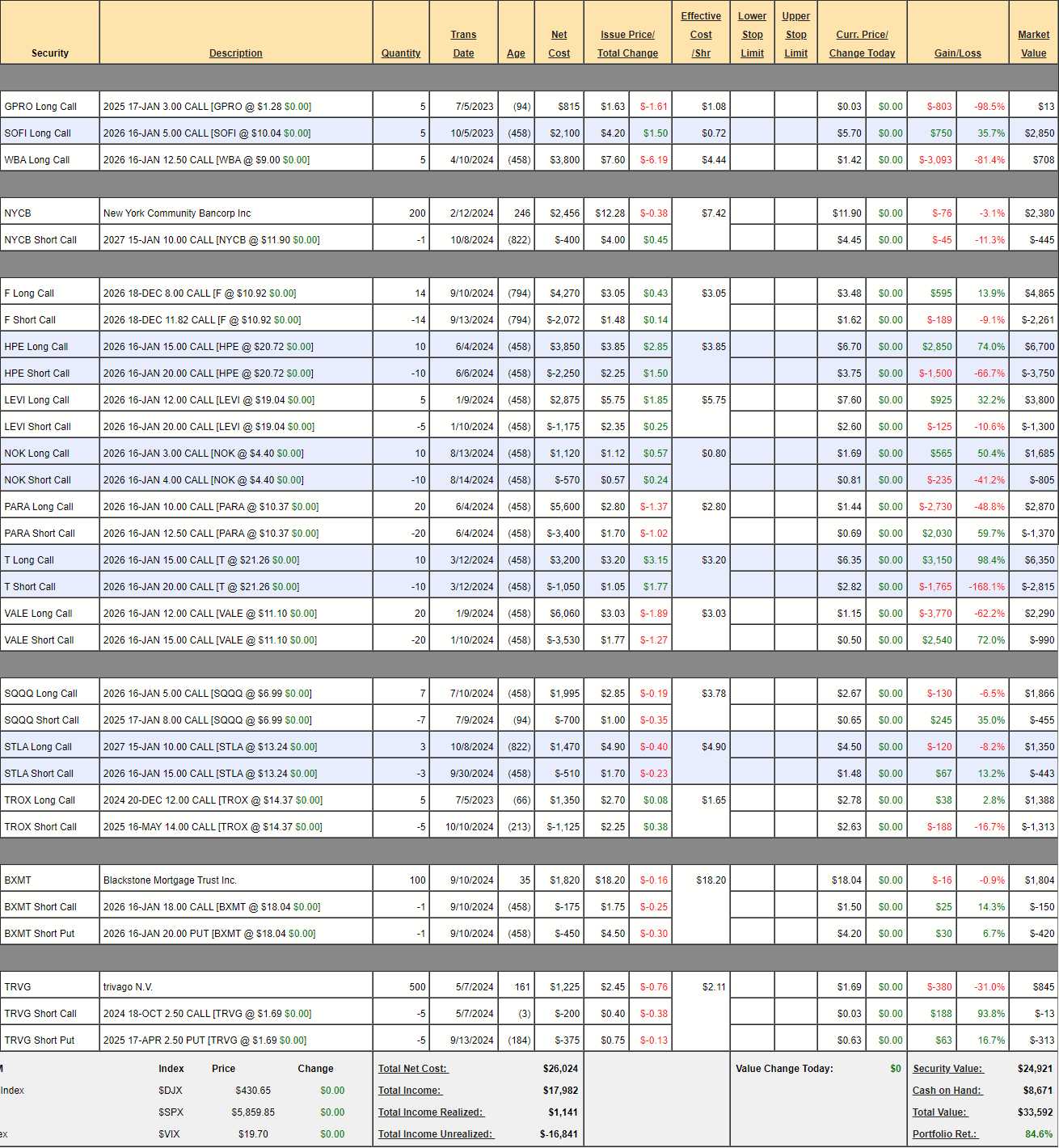

We won't get to the LTP until Thursday (hopefully!) but it's up just about 400% ($2.5M), which is very nice for 17 months and the STP is done and it's "only" up 120% in the same 17 months, so $441,710 at the moment (8am) and that's getting very close to 3M and that's too many Dr. Evils and the market is toppy so - should we shut down? We started with $200,000 in the STP and $700,000 in the LTP so we're up $2.1M (300%) overall in 17 months and you KNOW that's not sustainable - so why risk it?

It does depend on your risk tolerance but, if $3M is a lot of money to you - then PLEASE do not leave it all on the table. At least get 1/2 out and let the CASH!!! protect you in the event of a pullback. We may keep going up but you'll still end up with 75% of the potential gains - while avoiding 50% of the potential losses should the market pull back.

In fact, the first thing we're going to do here in the STP is spend money to help lock in the LTP gains. I'm NOT going to cash out the portfolios because I don't feel that strongly that we're going to pull back (yet!) but I do strongly feel that that is not an appropriate risk for people who have more than 50% of their assets in the market right now. For those people - I strongly suggest taking half off the table and ABSOLUTELY we will find more things to trade - during and after the current Earnings Season.

Meanwhile, in our September 17th Review, we left the S&P at 5,633 and the LTP/STP paired portfolios were at $2,746,604. Now we're at 5,859 and that's up 226 points (4%) for the month and, as you can see - we've punched over the projected top of our range at 5,600 and, as I noted yesterday, we're now at 26.3x forward earnings on the S&P and that's 63% higher than the "normal" 16x the S&P trades at.