Magic Mushroom ‘Pump and Dump’

Here’s what can happen when ‘shroom heads take control of a penny stock

“Everyone thought I was crazy, I bit this guy’s ear off. … I did all this stuff, and once I got introduced to the ‘shrooms … my whole life changed.” – Mike Tyson

Two hucksters took control of an inactive penny-stock and talked up its price by a mind-blowing percentage – promising ‘shrooms and the moon.

They began with a January 2020 press release that touted “the world’s first publicly traded company in the business of developing, marketing and distributing psilocybin mushrooms, also known as magic mushrooms or psychedelic mushrooms.” (They aren’t really legal … yet.)

They bragged that their company, Minerco, was worth $1 billion. (It wasn’t).

They said Minerco would sponsor a livestream concert with ticket sales eclipsing one million. (It never happened.)

They signed reggae fusion singer Sean Kingston as an ambassador. (At least that much appears to be true).

Kingston hit the top of the charts in 2007 with “Beautiful Girls.” (You got me suicidal, suicidal.) In a February 2020 press release Kingston said he’d been building a relationship with the mushroom company for a while.

“I am 100% behind in their mission as a company. In Jamaica, we have been using cannabis and psilocybin for medicinal purposes for years now …”

Yeah, mon.

On Wednesday, the U.S. Securities and Exchange Commission sued Minerco as well as Bobby Shumake Japhia, 56, and Julius Makiri Jenge, 54, for running a pump-and-dump that bilked investors out of $8 million.

Jenge, who lives in Texas and Michigan, has been charged criminally, as well, and was arrested in August as he prepared to board a flight for Tanzania, according to the SEC’s civil complaint. (Too bad for him. The Serengeti sounds like a wild trip.)

Psychedelic pink

The Pink Sheets, named for the color of the paper once used for their quotations, are among the most dodgy stocks investors can buy,

Minerco traded on the OTC Pink market where companies that don’t want to bother with audited financial reports and other pesky listing requirement can cheat unwary investors out of their pennies. It trading under symbol MINE.

The fact that a couple of mushroom heads could take control of a publicly traded stock and pump up its price with trippy tripe says something dark about the regulation of our market-based economy.

“Pump-and-dumps often begin when cheap stock of dormant companies is suddenly touted by a promoter as the next big thing,” said Melissa Hodgman, associate director of the SEC’s Division of Enforcement in a press release. “The SEC will remain steadfast in its efforts to root out of the market stock offerings that are more about hype than substance.”

I’ll skip the details of this pump-and-dump, but for anyone interested, the SEC’s complaint offers enough of an outline to practically serve as a swindler’s handbook.

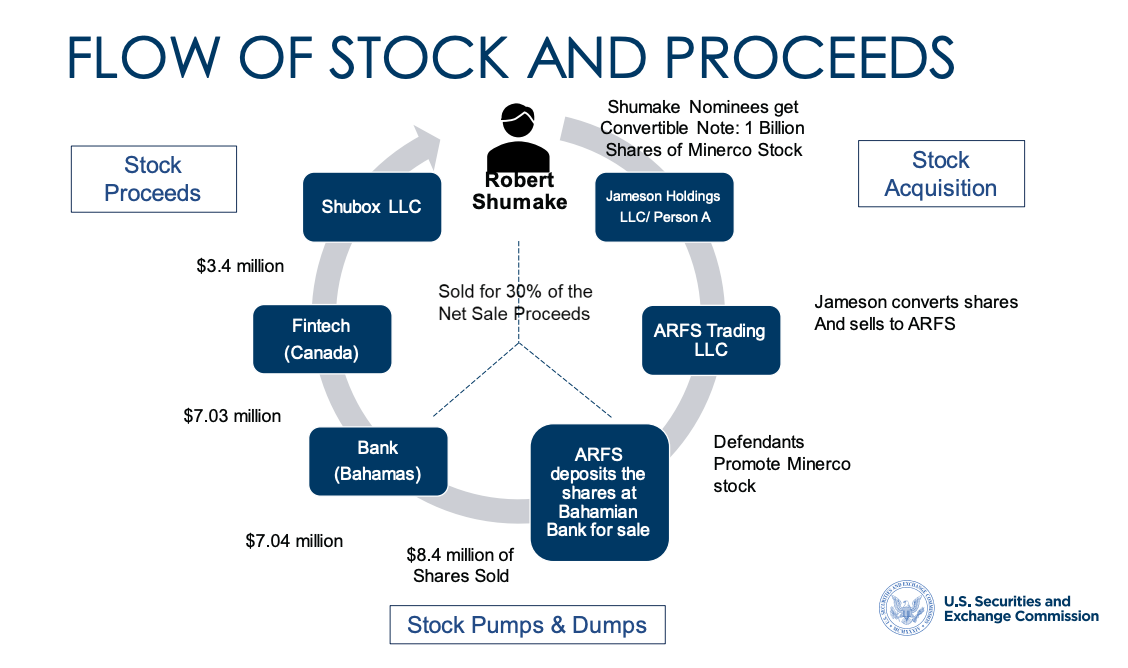

Here’s a chart showing a money trail between the entities involved. (Dude, the universe is a circle.)

SHRU for ‘shrooms

The SEC’s complaint doesn’t mention Minerco’s plans for a cryptocurrency that it dubbed SHRU, but it’s clear these guys had outsized ambitions.

“Well-known tokens like Etherium, Lite Coin, and Bitcoin all once had starting points to get to where they are, and this one is ours,” Jenge boasted in a February 2021 press release. “People will now have a centralized location to make all purchases related to Cannabis and Psilocybin because of SHRU, so as a result, we are definitely expecting its popularity to soar.”

Imagine a world where everyone was stoned or tripping and paying with SHRU … and it’s still hard to believe a press release from this guy.

Not even a penny for your thoughts

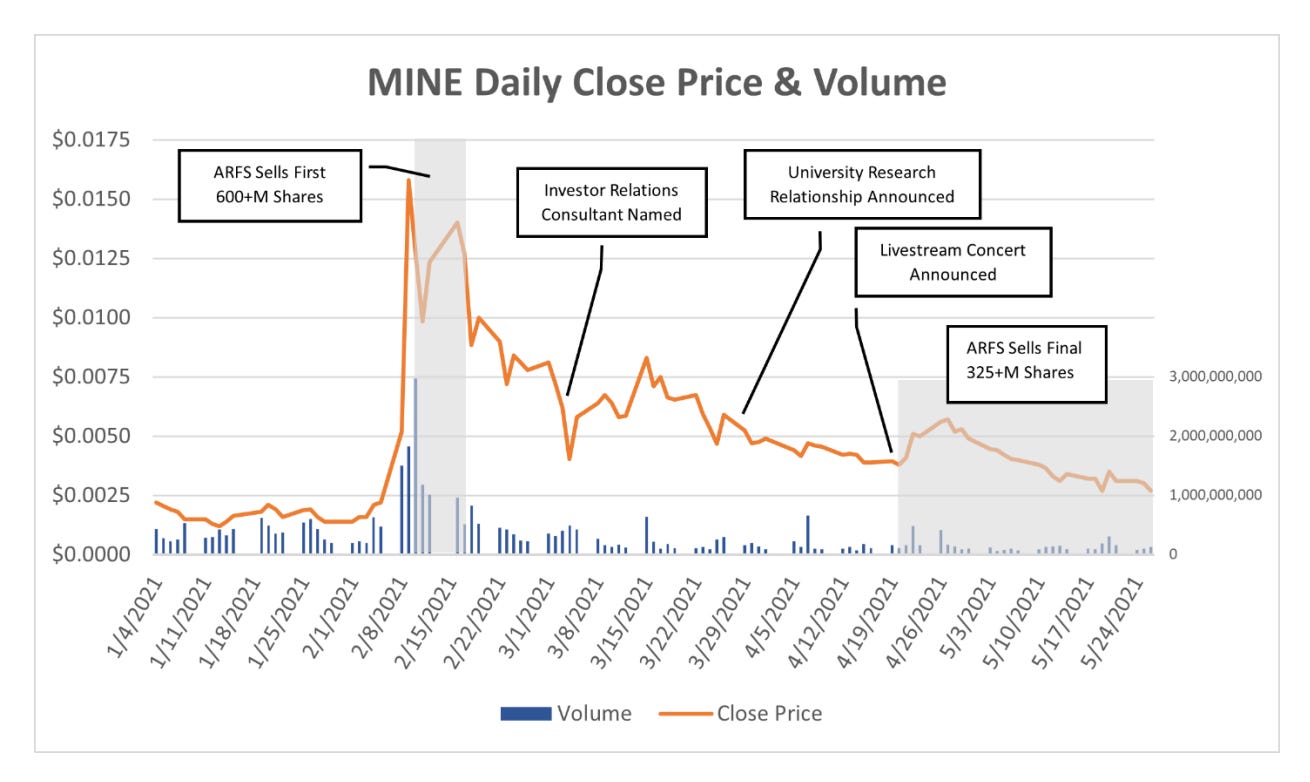

On Oct. 1, 2020, Minerco’s stock closed at $0.000001, or one ten thousandths of a penny.

A slew of dubious press releases later, its closing price hit $0.0127, or 127 hundredths of a penny. It happened on Feb. 10, 2021, just four months later.

Minute as the prices were, the shares soared 1,269,900% and netted the defendants about $8 million in ill-gotten gains, the SEC alleges.

If you can imagine wealth on such a tiny scale, it’s like, whoaaa!

Here’s a stock chart included in the SEC’s complaint:

Go ask Alice when she’s ten feet tall

In Feb. 2021, Minerco put out a press release claiming a billion-dollar valuation based on nothing more than technobabble.

The SEC complaint says that the PR guy who put out Minerco’s releases used an alias because he had a prior criminal conviction and SEC judgement against him.

“This valuation will give definitive confidence as to the financial strength and viability of the psilocybin industry,” Jenge said in the release. “In addition, it gives confirmation that we are in the right industry with the right business at the right time.”

It’s a long way to a billion when your stock trades in fractions of pennies. But for those who bought this stock, I will sympathetically point out that psychedelics can distort one’s perceptions of time, space and scale.

Like Alice famously admitted in Wonderland: “Why, sometimes I’ve believed as many as six impossible things before breakfast.”

P.S. Here’s the rest of what Kingston Said …

Kingston may have committed a Freudian slip in his press release quote about becoming Minerco’s ambassador:

“In Jamaica, we have been using cannabis and psilocybin for medicinal purposes for years now and have seen the adverse effects that it can have on people who suffer from physical and emotional challenges.”

Adverse effects? The PR guy Minerco hired should have corrected that. But maybe he was tripping, or too focused on concealing his criminal past.

Al Lewis has written for The Wall Street Journal, Dow Jones, CNBC, Houston Chronicle, Denver Post, Rocky Mountain News, and until recently, The Messenger – one of the biggest blunders in digital media history — you can read My Latest Blunder (The Messenger) here in case you missed it.

Subscribe to Al’s Business Blunders Newsletter to keep up with the most spectacular business blunders as they, inevitably, arise. >