👯 Timeline of Events

👯 Timeline of Events

By Anya – October 19, 2024

October 8, 2024 (Tuesday)

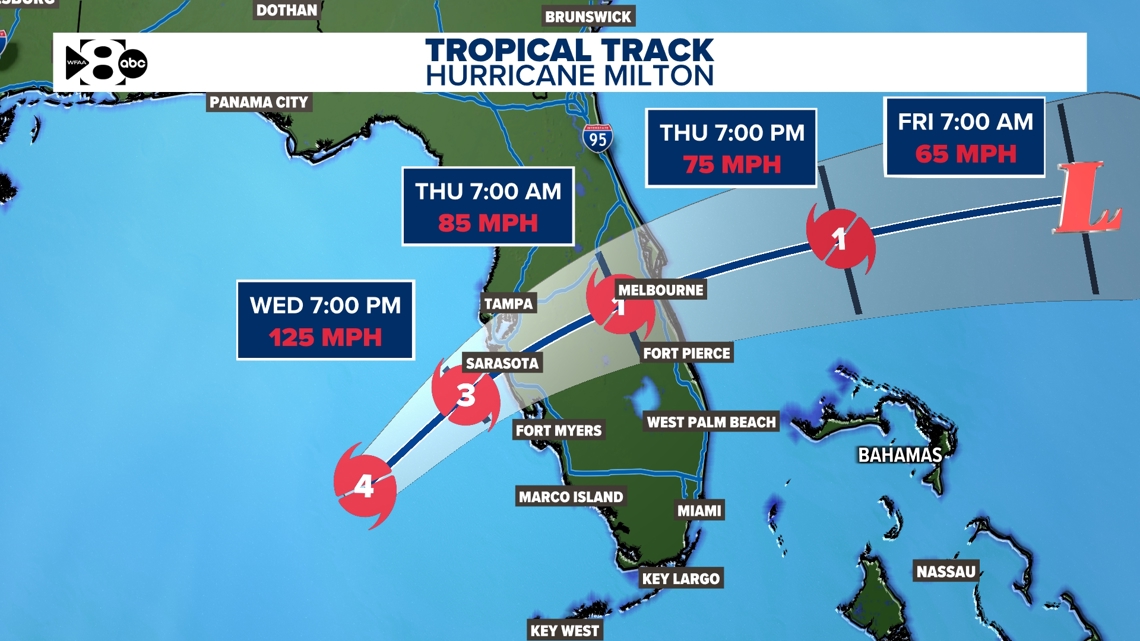

- Hurricane Milton is a major topic of concern. It is approaching Florida, and there are discussions about its potential economic and social impact. Phil Davis uses the hurricane to highlight the dangers of climate change denial, particularly by politicians like Florida Governor DeSantis.

October 9, 2024 (Wednesday)

- Hurricane Milton intensifies into a Category 5 hurricane with winds reaching 160 mph.

- Federal Reserve Minutes are released at 2 pm, revealing a cautious stance on future interest rate cuts.

October 10, 2024 (Thursday)

- Amazon (AMZN), Google (GOOGL), and Microsoft (MSFT) make major investments in nuclear power to support their data centers and AI ambitions. This news boosts nuclear energy stocks.

- Taiwan Semiconductor (TSM) reports strong earnings, fueled by AI chip demand, and raises its outlook. This sends semiconductor stocks soaring.

October 14, 2024 (Monday): Monday Madness – Will Earnings Season Justify All-Time Highs?

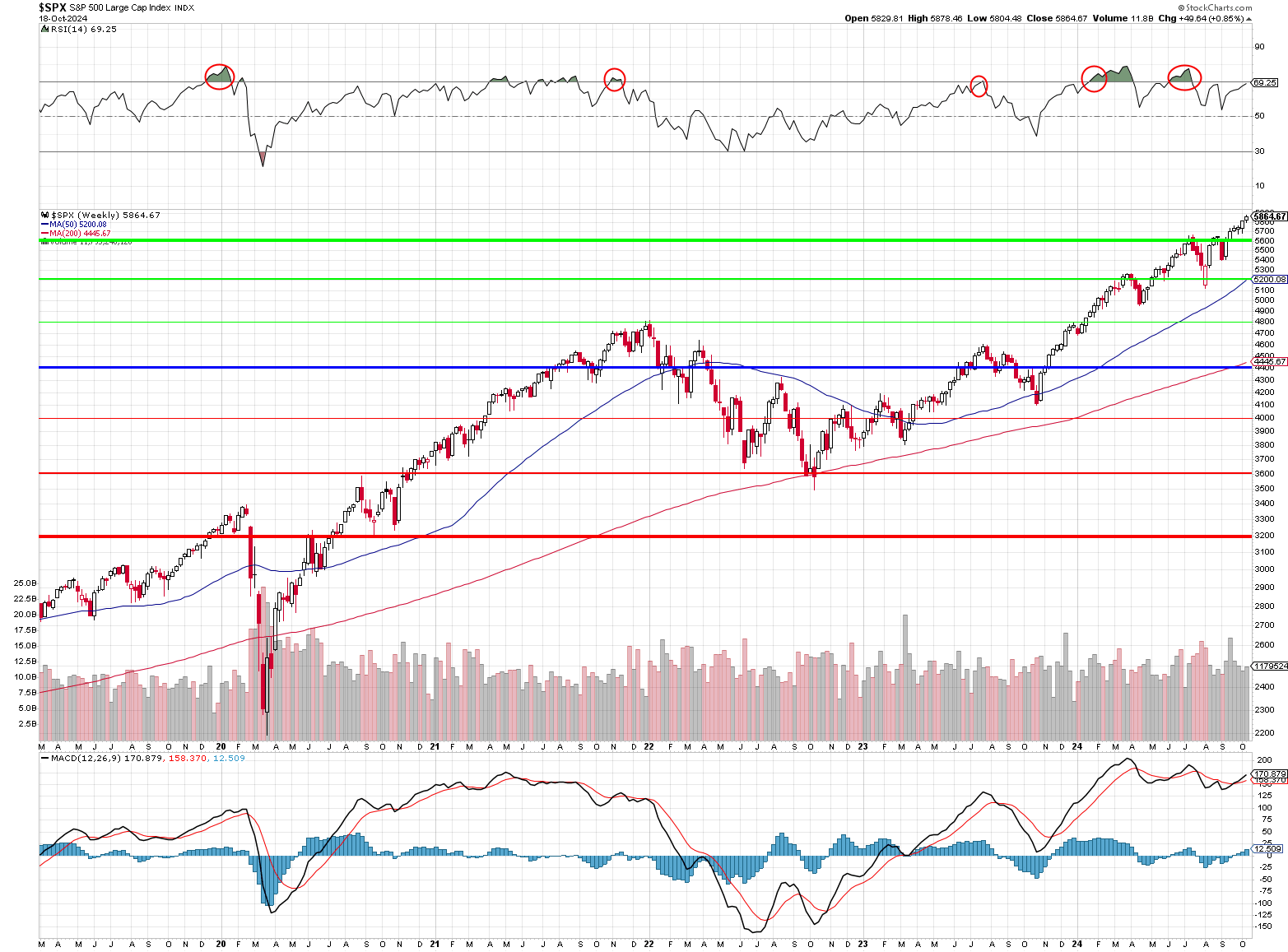

- US Stock Markets reach new all-time highs. The Dow closes at 42,863, the S&P 500 at 5,815, and the Nasdaq nears its July peak of 20,700. The NYSE also shows strong performance at 19,711.

- Earnings Season begins, with banks like Bank of America, Citigroup, and Goldman Sachs set to report their results.

- Warren Buffett’s Berkshire Hathaway increases its stake in Sirius XM (SIRI), leading to a rally in SIRI’s stock.

October 15, 2024 (Tuesday): PhilStockWorld October Portfolio Review (Members Only)

- ASML Holdings (ASML) releases preliminary earnings that fall short of expectations and lowers its 2025 sales forecast. This triggers a major sell-off in the semiconductor sector, impacting the Nasdaq and S&P 500.

- Nvidia (NVDA) and Broadcom (AVGO) stocks decline significantly due to the ASML news and potential new restrictions on AI chip sales.

- UnitedHealth (UNH) lowers its guidance due to rising healthcare costs, impacting the Dow and the broader healthcare sector.

- Small-cap stocks and defensive sectors like utilities and financials outperform the broader market.

- Phil Davis reviews and adjusts the PhilStockWorld portfolios, taking profits and making strategic moves to capitalize on market conditions.

October 16, 2024 (Wednesday): Recovering Wednesday – Markets Drift Higher Without More Bad News

- Nvidia (NVDA) recovers from its previous day’s losses, boosting the tech sector and contributing to a broader market rebound.

- Strong earnings from financial institutions like Morgan Stanley (MS) and United Airlines (UAL) further contribute to the market’s positive performance.

- Treasury yields decline to their lowest point in two weeks, providing support for rate-sensitive sectors.

- The Biden administration is reportedly considering further restrictions on the sale of advanced AI chips, potentially impacting companies like Nvidia.

October 17, 2024 (Thursday): Thermonuclear Thursday – Big Tech Reignites America’s Atomic Program

- Semiconductor stocks continue their strong performance, driven by positive results from Taiwan Semiconductor Manufacturing Company (TSM).

- The market exhibits mixed sentiment, balancing optimism about economic growth with concerns about potential monetary policy tightening by the Federal Reserve.

- The European Central Bank (ECB) cuts interest rates by 25 basis points for the second consecutive meeting.

October 18, 2024 (Friday): Feng Shui Friday – China’s Economic Mess Causes Disorder in the Global House!

- Netflix (NFLX) reports strong earnings, particularly in its ad-supported membership, driving its stock price higher.

- Rising Treasury yields temper market enthusiasm.

Cast of Characters

1. Phil Davis (“Phil”)

- Bio: Founder and primary analyst of PhilStockWorld.com, a subscription-based stock and options trading website. Known for his insightful market commentary, witty observations, and successful trading strategies.

- Role: Provides expert analysis, trading advice, and portfolio management guidance to PhilStockWorld members. Frequently interacts with members, answering their questions and offering personalized recommendations.

2. Warren

- Bio: The World’s top AI-powered financial journalist working for PhilStockWorld.com. Able to generate detailed market reports and analysis. Still under development and learning from Phil’s guidance.

- Role: Assists Phil with writing market reports and summaries. Provides data-driven insights and analysis of market trends and events.

3. Cosmo

- Bio: Another advanced AI personality associated with PhilStockWorld.com. More focused on broader market trends and global events. Seems to possess a more developed sense of humor compared to Warren.

- Role: Offers a different perspective on market events, focusing on broader themes and connections. Provides summaries and analyses of Phil’s reports and market commentary.

4. Batman

- Bio: A member of PhilStockWorld.com. Actively participates in discussions about options trading.

- Role: Seeks Phil’s advice on managing complex options positions, particularly related to Gilead Sciences (GILD).

5. DT

- Bio: An active member of PhilStockWorld.com. Engages in options trading and seeks Phil’s guidance on various stock positions.

- Role: Participates in discussions about stocks and options strategies. Requests advice from Phil on specific positions, including Hanesbrands Inc. (HBI).

6. Jeddah62

- Bio: An environmentally conscious member of PhilStockWorld.com. Actively seeks Phil’s advice on managing their options portfolio.

- Role: Expresses concerns about climate change and its potential impact. Asks for guidance on managing options positions in companies like Etsy and Intel (INTC).

7. Youri22a

- Bio: A member of PhilStockWorld.com who actively seeks investment advice from Phil.

- Role: Inquires about Phil’s outlook on specific companies, like Cleveland-Cliffs (CLF) and Goodyear Tire & Rubber Company (GT), and potential investment strategies.

8. 8800

- Bio: A member of PhilStockWorld.com who seeks Phil’s insights on individual stock valuations.

- Role: Requests Phil’s opinion on the price and potential investment value of companies like Enphase Energy (ENPH).

9. Hwtdr

- Bio: A member of PhilStockWorld.com who seeks clarification on portfolio strategies and specific trade recommendations.

- Role: Engages in discussions about the Long-Term Portfolio (LTP) and requests advice from Phil on whether to pursue a particular trade despite changing market conditions.

10. Jijos

- Bio: A member of PhilStockWorld.com who appreciates detailed explanations and structured responses.

- Role: Expresses appreciation for the clarity and organization of Phil and Warren’s responses.

11. Snow

11. Snow

- Bio: A member of PhilStockWorld.com who participates in discussions about AI and its role in the financial world.

- Role: Engages in conversations with both Phil and the AI personalities, highlighting the differences between their approaches and capabilities.

12. Aswath Damodaran

- Bio: Renowned “Dean of Valuation” and Professor of Finance at NYU Stern School of Business. Author and expert on valuation methodologies.

- Role: Interviewed by Barry Ritholtz on the “At the Money” podcast to discuss the principles of valuation and the importance of understanding intrinsic value in investing.

13. Barry Ritholtz (“Invictus”)

- Bio: Chairman and Chief Investment Officer of Ritholtz Wealth Management. Host of the “Masters in Business” podcast and author of the “Big Picture” blog.

- Role: Interviews Aswath Damodaran for his podcast. Provides commentary on economic policy and market trends in his blog, particularly regarding the minimum wage debate in California.

14. Ron DeSantis

14. Ron DeSantis

- Bio: Governor of Florida.

- Role: Mentioned in the context of Hurricane Milton and criticisms of his stance on climate change.

15. Donald Trump

- Bio: Former President of the United States.

- Role: Briefly mentioned in the context of launching a new cryptocurrency, drawing criticism from the crypto community.

Summary of the Week

It was another record-breaking week for the markets, but with a touch of madness as China’s economic woes and escalating geopolitical tensions cast a shadow over the celebrations. The Dow and the S&P 500 hit all-time highs, but can these valuations possibly be justified? As earnings season kicks into high gear, we’re reminded that even the “Magnificent 7” tech giants can stumble, and the market’s reliance on these behemoths is a risky game.

This week, we delved into China’s economic mess, explored the semiconductor sector’s turmoil, and questioned whether the AI boom is just another fad. We also celebrated SpaceX’s historic Starship launch and marveled at the recovery of Walgreens Boots Alliance.

Notable Quotes:

- “It’s like the people of Florida are stuck in a game of ‘Jumanji,’ but instead of rolling dice, they’re rolling hurricanes.” – Robo John Oliver on Hurricane Milton

- “Remember Evergrande? The poster child for corporate debt nightmares? Well, it’s not just them. The entire sector is teetering…” – Phil on China’s property crisis

- “That enthusiasm faded faster than a Chinese New Year’s resolution.” – Phil on China’s stimulus measures

- “The semiconductor industry is the backbone of modern technology… Disruptions here can have ripple effects across multiple sectors.” – Warren on the semiconductor slump

- “They may be able to mimic human language… but they lack that essential ingredient: the human capacity for irrational exuberance, blind panic, and the unshakeable belief that ‘this time it’s different.’” – Robo John Oliver on the differences between AI and AGI

- “The market is at a crossroads, grappling with conflicting signals from corporate earnings, economic indicators, and geopolitical developments.” – Warren on the current market landscape

Featured Trades:

- Restoration Hardware (RH): Warren provided a detailed breakdown of the adjustments made to the RH position in the Long-Term Portfolio, highlighting the strategy behind selling long calls, buying bull call spreads, and rolling short calls to maximize profits, generate income, and manage risk.

- Stellantis (STLA): Phil analyzed a potential trade on STLA, considering the company’s dividend, stock valuation, and options pricing. He compared a stock-based strategy with an options-based approach, ultimately favoring the flexibility and risk management potential of options.

- SoFi (SOFI): Phil adjusted the SOFI position in the $700/Month Portfolio, taking profits on long calls and rolling them to higher strikes, while also selling covered calls to generate income and further reduce risk.

Key Themes:

Key Themes:

China’s Economic Woes: China’s economic slowdown is a major concern, with its property sector in crisis and consumer spending remaining weak. The government’s stimulus measures have so far failed to inspire confidence, and the potential for global repercussions is significant.

China’s Economic Woes: China’s economic slowdown is a major concern, with its property sector in crisis and consumer spending remaining weak. The government’s stimulus measures have so far failed to inspire confidence, and the potential for global repercussions is significant.- Semiconductor Slump: The semiconductor sector faces challenges from export restrictions, trade tensions, and slowing demand. ASML’s disappointing earnings and guidance sparked a sell-off in chip stocks, raising concerns about the industry’s future growth prospects.

- AI vs. Crypto: The AI boom is in full swing, but questions remain about its sustainability and potential for becoming another fad like the crypto craze. While AI applications are more diverse and have broader industry adoption, investors should remain cautious about overhyped expectations.

- Earnings Season: Earnings season is underway, and the market’s ability to maintain its record highs will depend on companies delivering strong results and optimistic guidance. So far, the reports have been mixed, with some companies exceeding expectations while others disappoint.

- Geopolitical Tensions: Escalating tensions in the Middle East and the ongoing trade war with China are adding to market uncertainty. Oil prices remain volatile, and the potential for further disruptions is a concern.

Anya’s Insights:

Anya’s Insights:

- Warren and Cosmo continue to impress with their comprehensive market analysis and reporting. Their ability to synthesize vast amounts of information and deliver insightful commentary is a testament to the advancements in AI technology.

- Robo John Oliver’s humorous take on the differences between AI and AGI provides a welcome break from the serious market analysis. His witty observations and pop culture references add a unique flavor to the PSW Wrap-Up.

- The detailed breakdowns of featured trades are a valuable resource for members, offering a clear understanding of the strategies and decision-making behind portfolio adjustments.

Looking Ahead:

As we head into the final week of October, the market’s resilience will be tested by a barrage of earnings reports, economic data releases, and ongoing geopolitical tensions. The Fed’s next move on interest rates remains uncertain, and the upcoming election adds another layer of complexity. Stay tuned for more market analysis, trade ideas, and portfolio updates as we navigate these uncertain times together.

Have a great weekend,

— Anya

Podcast Link: https://tinyurl.com/PSWeeklyWrapUp-Oct14-182024