Welcome to another exciting week of earnings season!

The markets are flying high, but some turbulence is inevitable. We’ve got a packed week ahead with big names like TSLA, BA, GE, VZ, PM LMT, TXN, T, KO, IBM, KKR and UPS reporting, so let’s dive into what’s moving markets this morning and how to position ourselves for the week ahead.

Boeing (BA) is once again in focus. NOT for its engineering prowess, but for its ongoing crisis management efforts. After a brutal 40.5% drop in its stock price this year, Boeing has managed to reach a tentative deal with striking workers, offering a 35% pay hike. While this COULD end the strike that’s been hurting production, Boeing still faces a mountain of challenges, from missed revenue estimates to cash flow issues.

They’ll report Q3 earnings on Wednesday, and we’ll get more clarity on just how bad things are, but for now, Boeing remains in crisis mode. We have a bullish trade on them in our Long-Term Portfolio and I said to our Members last week:

- “BA – Here we have a $175,000 spread that’s $70,000 in the money at net $30,175 so PLENTY of upside potential and we’re hoping for a bounce so we can sell short-term calls.”

After Netflix’s (NFLX) blowout earnings last week, all eyes are on the tech sector as Texas Instruments (TXN) kicks off chip earnings this week. Investors are looking for signs of resilience in the Semiconductor space after Taiwan Semiconductor’s (TSM) rocky week, we’ll see whether Tech can continue driving the market rally. Tech has been leading the charge all year, but valuation concerns are finally creeping in (as I warned last week) as we’re back at new highs and back at 30x earnings and back at RSI 70 – all warning signs that we’re getting toppy.

After Netflix’s (NFLX) blowout earnings last week, all eyes are on the tech sector as Texas Instruments (TXN) kicks off chip earnings this week. Investors are looking for signs of resilience in the Semiconductor space after Taiwan Semiconductor’s (TSM) rocky week, we’ll see whether Tech can continue driving the market rally. Tech has been leading the charge all year, but valuation concerns are finally creeping in (as I warned last week) as we’re back at new highs and back at 30x earnings and back at RSI 70 – all warning signs that we’re getting toppy.

Be VERY cautious about overexposure to the Magnificent 7 stocks—corrections could be sharp if results disappoint.

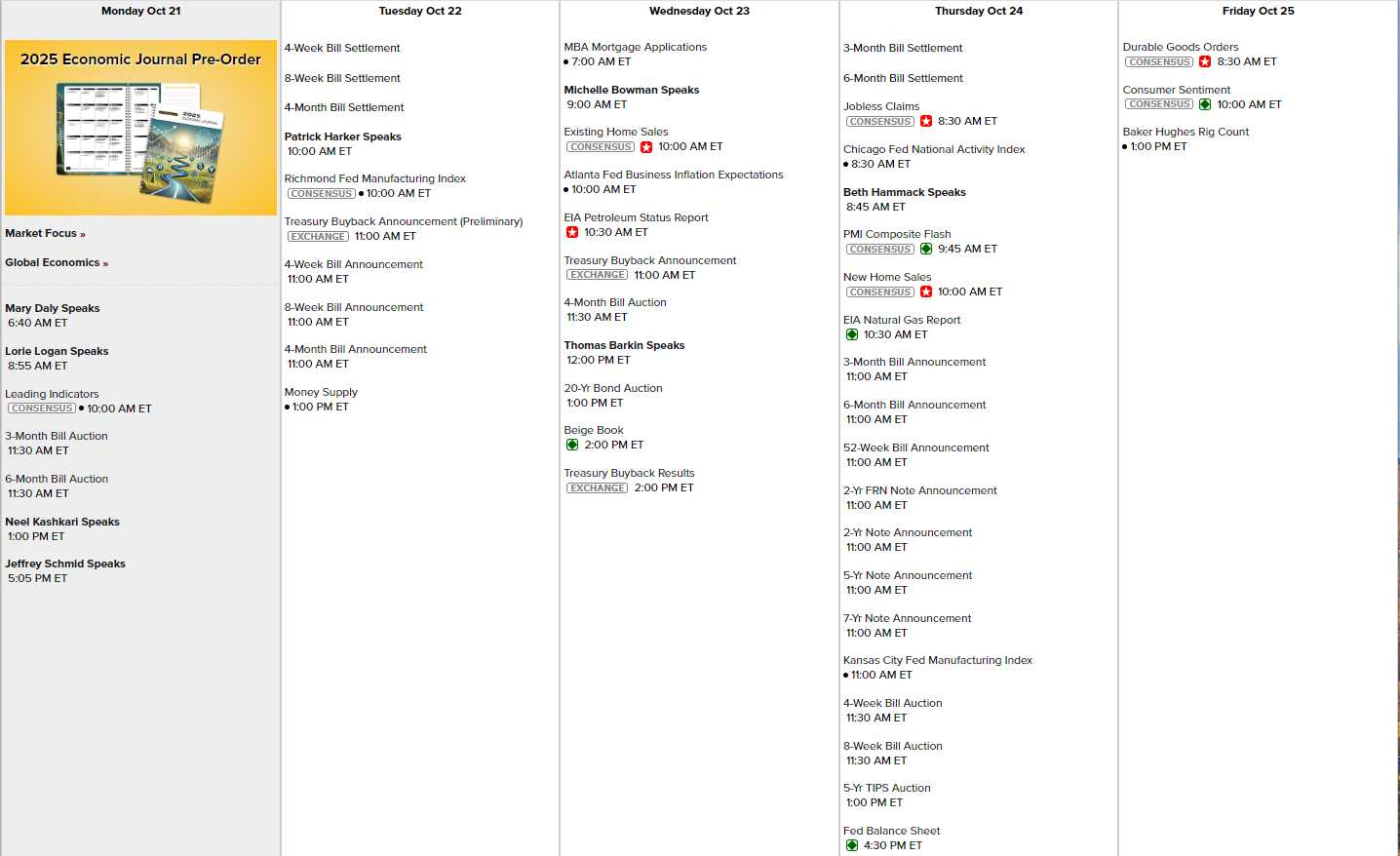

The economic calendar is light this week but we’ve got 4 Fed speakers lined up today and 4 more during the week and the Beige Book on Wednesday (2pm). Keep an eye on any hints regarding the pace of rate cuts, especially as Bond Yields continue to edge higher. The 10-Year Treasury yield is sitting at 4.13%, up 4 basis points this morning, signaling that the market is deeply concerned about whether or not we get a rate cut next month.

Leading indicators (10 am) are expected to come in at -0.3%, continuing the theme of an economic slowdown beneath the surface that matches the ones we’re seeing in Asia and Europe. America may currently have the World’s strongest economy but that’s like saying the Yankees are the best team in NY – not that impressive when none of the others make it to their finals, right? Oh wait, Buffalo is in NY – go Bills!

Leading indicators (10 am) are expected to come in at -0.3%, continuing the theme of an economic slowdown beneath the surface that matches the ones we’re seeing in Asia and Europe. America may currently have the World’s strongest economy but that’s like saying the Yankees are the best team in NY – not that impressive when none of the others make it to their finals, right? Oh wait, Buffalo is in NY – go Bills!

Europe is off to a weak start, with key indices like the DAX and FTSE in the red this morning and Asian markets were mixed, with China up 0.2%, while Hong Kong cancelled that out – falling 1.6%. As we discussed on Friday, China’s economic struggles remain a major concern, with growth stalling and deflationary pressures mounting.

The broader market is starting to look expensive – REALLY expensive. As Michael Kramer is now also pointing out, the S&P 500 is trading at some of the highest price-to-earnings (P/E) and price-to-sales ratios in history. We’re talking levels not seen since the dot-com bubble and the COVID-era surge. Yes, the Magnificent 7 stocks have been carrying this market, but that comes with risk. Valuations are stretched, and Goldman Sachs is calling for just a 3% annual return for the S&P over the next DECADE. Let that sink in…

If you’re in index funds, you’re paying a premium, and history tells us this doesn’t usually end well. Stock selection will be key going forward. This is no time to “set it and forget it” in our portfolios! We’ve seen growth slow, and if earnings growth doesn’t justify these lofty multiples, the markets could be in for a rude awakening.

That doesn’t mean you dump everything, but it does mean you need to be selective about where you put your money. We will keep looking for undervalued plays in sectors that haven’t run up as much and we will consider more defensive plays to carry us through this earnings season.

Let’s be careful out there!

[ctct form=”12730731″ show_title=”false”]