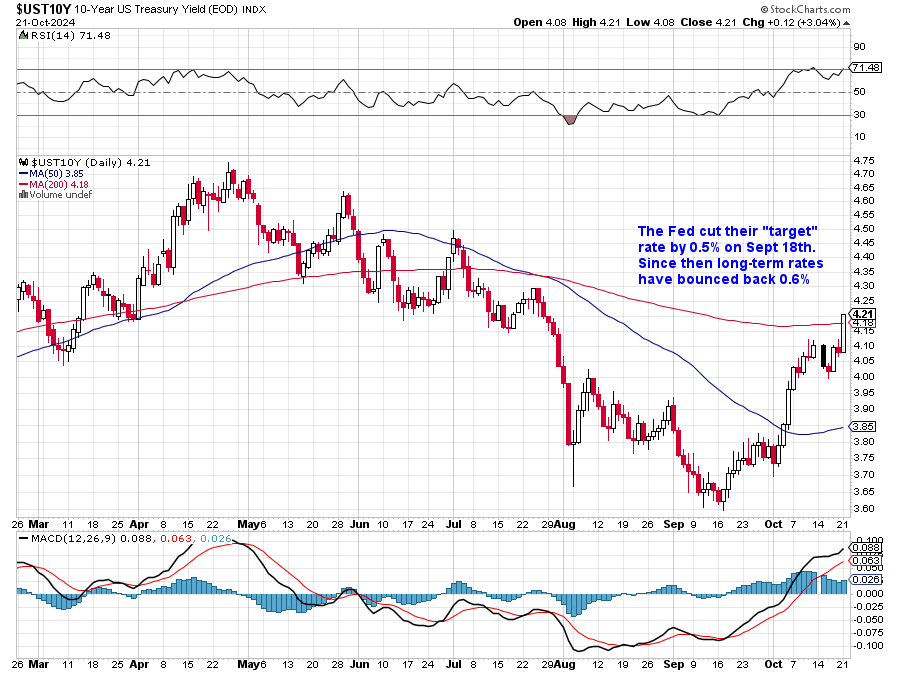

Oops:

It looks like the bond market has decided to throw a tantrum and the Federal Reserve is now scrambling to keep the kids in line. Just when we thought we had a handle on things, the 10-Year Treasury yield has jumped back above 4.2%, crossing its 200-day moving average like a sprinter breaking through the finish line. Remember when we were all celebrating the Fed’s huge 50 basis point rate cut last month? That feels like a long-lost memory now…

Way back then, the market was pricing in another 100 basis points of cuts by January. Fast forward 34 days and now we’re scratching our heads as those expectations have been whittled down to MAYBE 50 basis points over the next three meetings. The bond market is essentially saying, “Sorry, Jerry, we don’t believe you anymore.”

Treasury yields have been on a roller-coaster ride, with the 10-year yield fluctuating significantly as investors reassess their expectations for Federal Reserve rate cuts. Adding to the volatility is the looming U.S. presidential election, which historically has had profound impacts on market dynamics. This rise reflects a growing skepticism about the Fed’s willingness (or ability!) to continue cutting interest rates at the pace previously anticipated.

Federal Reserve officials have increasingly emphasized a cautious approach to monetary easing. Statements from policymakers suggest a preference for gradual rate adjustments rather than aggressive cuts. For instance, officials have indicated that further easing would require clear evidence of economic weakening, particularly in the labor market.

This cautious stance has led market participants to recalibrate their expectations. Futures markets, which once priced in multiple rate cuts over upcoming meetings, now reflect a more modest outlook. The diminishing likelihood of aggressive easing has exerted upward pressure on long-term bond yields, as investors demand higher compensation for the risks associated with longer maturities.

This cautious stance has led market participants to recalibrate their expectations. Futures markets, which once priced in multiple rate cuts over upcoming meetings, now reflect a more modest outlook. The diminishing likelihood of aggressive easing has exerted upward pressure on long-term bond yields, as investors demand higher compensation for the risks associated with longer maturities.

And that’s the canary in the coal mine I have been warning about. The Fed does not, ultimately, control rates – Bond Buyers do! The Fed can set a “target rate” but the REAL RATE is set when our Government auctions off debt and they are auctioning off $600 BILLION worth of it every month – THAT is a lot of reality checking against the Fed’s “Target Rate.”

As noted yesterday by Wolf Richter: “Today’s action may have been driven by hawkish commentary by Dallas Fed president Lorie Logan on the future of the Fed’s QT (article coming), by renewed fretting about inflation, and by concerns about the recklessly ballooning government debt that would pile up new supply, or by whatever.”

Neel Kashkari just echoed those sentiments, wanting “real evidence” of a rapidly weakening labor market before deviating from a cautious path. Even San Francisco Fed President Mary Daly admitted that last month’s jumbo cut was a “close call” (and, don’t forget, Bowen flat-out dissented). In other words, the Fed is tapping the brakes, and the bond market is not amused.

As if the Fed’s mixed signals weren’t enough, we’ve got the looming U.S. presidential election throwing gasoline on the fire. Betting markets have shifted significantly towards a potential Trump victory, and investors are trying to price in what that could mean.

Historically, a Trump administration has been associated with expansionary fiscal policies (more debt) – think unbalanced tax cuts and increased tariffs – that will stoke Inflation and force the Fed to keep rates higher for longer. The bond market does NOT like uncertainty, and the prospect of a policy shift is causing jitters.

It’s important to note that markets can sometimes act as if the election outcome is a foregone conclusion, even when uncertainties remain. This premature pricing can lead to significant corrections if actual results diverge from expectations.

Stocks Shrug While Bonds Slump

Despite this week’s open, the stock market still seems to be wearing rose-colored glasses. The S&P 500 is holding up, buoyed by strong performances in the tech sector, especially semiconductor stocks. The equity markets and bond markets are living in two different realities for the moment and the upcoming election is a Quantum Event – Schrodinger will open his box on election day – or some time next year when all the legal arguments and insurrections are over – hopefully…

Despite this week’s open, the stock market still seems to be wearing rose-colored glasses. The S&P 500 is holding up, buoyed by strong performances in the tech sector, especially semiconductor stocks. The equity markets and bond markets are living in two different realities for the moment and the upcoming election is a Quantum Event – Schrodinger will open his box on election day – or some time next year when all the legal arguments and insurrections are over – hopefully…

But let’s not forget, the last time we saw a divergence like this was during the initial “Trump trade” post-2016 election. Stocks rallied while bonds sold off, only to culminate in the 2018 “Christmas Eve Massacre” when the stock market finally threw a fit over the Fed’s tightening.

The Markets are acting like the outcome is a done deal, but if we’ve learned anything from the 2016 election (or Brexit, for that matter) it’s that surprises can and do happen. Trading on presumed election results is no better than betting on a coin flip. This is why we bumped up our hedges and moved to more CASH!!! in last week’s Portfolio Reviews (you’re welcome!).

You are also welcome, by the way, as Oil (/CL) blasted back to $70.90 this morning – going long (again) at $68.60 was our call into the weekend with $70.80 giving us $2,000 per contract gains where, once again, it’s time to take half off the table with a stop on the rest at $70.30 to lock in $1,750 gains per contract – congratulation to all who played along!

Speaking of Energy: Coal stocks have, interestingly, outperformed clean energy stocks under the Biden administration, despite his push for green energy policies. Conversely, clean energy stocks rallied under Trump, who is no fan of windmills and has $1Bn worth of Big Oil bribes in his pocket. It just goes to show that market outcomes aren’t always aligned with policy intentions.

Keep in mind that Investors betting heavily on political outcomes can find themselves on the wrong side of the trade when unforeseen factors, like global supply issues or technological advancements come into play.

Meanwhile, the bond market sell-off isn’t confined to the U.S. European bonds are also feeling the heat, with German bund yields climbing and, in Asia, Australian 10-year yields surged as traders adjusted their expectations for rate cuts from their Reserve Bank. Emerging markets are also bracing for impact, as higher U.S. yields can lead to capital outflows and currency pressures. It’s a global game of dominoes, and the first piece has already fallen and the Dollar is once again hosting a “flight to safety” – especially with the war(s) heating up.

While it might be tempting to jump into long-duration bonds, keep in mind that, as yields rise, bond prices fall. Stick to higher-quality, shorter-duration bonds to mitigate interest rate risk. The stock market’s resilience might not last if bond yields continue to climb and the Fed remains cautious. We need to focus on sectors with strong fundamentals that can weather the volatility.

We are well-hedged, well diversified and well out of over-concentrated tech bets in our Member Portfolios but we still need to be ready for anything – so it’s a good week to check your hedges. We’re actually gaining on the pullback so far – because we made sure we sold PLENTY of upside premium last week (you’re welcome!).

Still, we certainly can’t afford to be complacent…

The Federal Reserve appears to be losing control of the narrative, and the markets are reacting accordingly. Between the Fed’s cautious stance, rising Treasury yields, and election uncertainties, we’re in for a bumpy ride.

[ctct form=”12730731″ show_title=”false”]