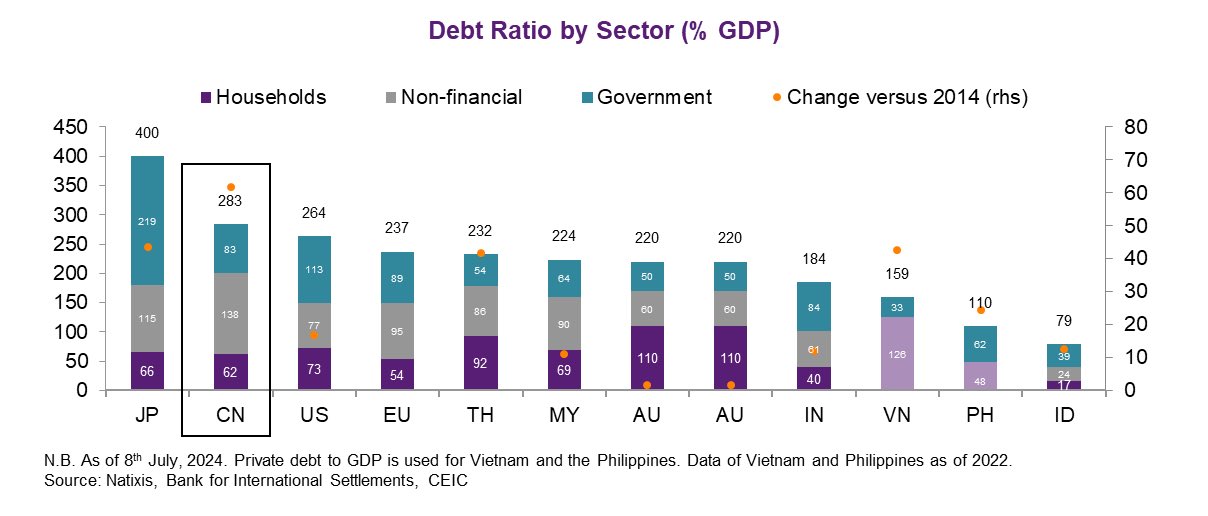

400%!

That’s where Japan hit on the Total Debt Ratio as of July 8th (it takes a while to count it) and, just as significantly, China’s TDR passed the US for the coveted #2 spot in Economic Irresponsibility and, as much as they like to play the scold, the EU is coming on strong at #4 – with 237% of their combined GDP as debt. Cue Bon Jovi.

Keep in mind, the only reason Japan is able to sustain it’s $16Tn in Total Debt (and notice, by the way, that FINANCIAL DEBT is not included – even in these totals) is because they are “only” rolling over about $3.4Tn of it per year, or about $283Bn per month – and that is an amount that is easily absorbed by the World’s $14.5 TRILLION annual Bond Market – rolling over about 13% of Global Debt every 12 months and HALF of that money is US Debt – yay US!!!

Keep in mind, the only reason Japan is able to sustain it’s $16Tn in Total Debt (and notice, by the way, that FINANCIAL DEBT is not included – even in these totals) is because they are “only” rolling over about $3.4Tn of it per year, or about $283Bn per month – and that is an amount that is easily absorbed by the World’s $14.5 TRILLION annual Bond Market – rolling over about 13% of Global Debt every 12 months and HALF of that money is US Debt – yay US!!!

Yes, you feel like there’s a disassociation because you see a chart that says the US “only” is $283% of it’s GDP in non-Financial Debt (let’s not even get started on that topic – another $70.4Tn!) but the US has a $28Tn GDP so our “Total” Debt is $72.24Tn while 4 x Japan’s $4Tn GDP is “only” $16Tn – so cute!

China’s GDP is $19Tn x 2.64 is $50.16Tn so you can combine China’s debt with Japan’s debt and our Total Debt is STILL 10% higher than that! USA, USA, USA – F Yeah!

Which brings us to Emerging Markets (not included in above figures) and imagine how out of control $105.4Tn of additional Debt is for countries with a combined GDP of about $15Tn – AMAZING!!! Don’t worry though, 40% of that is Financial Debt and when has our Financial Sector ever over-extended themselves?

Well, OK, a lot of times but then we can bail them out, right? All that happens then is we, the people, go even further into debt so they, the Banksters, can get right back on that train and start lending again making more and more record profits until the next bailout. The last one was 2009, right? Noooooooooooooo! It was 2022!!! See, there are so many bank bailouts you already forgot that one…

“Now you swear and kick and beg us that you’re not a gamblin’ man

Then you find you’re back in Vegas with a handle in your hand

Your black cards can make you money so you hide them when you’re able

In the land of milk and honey, you must put them on the table” – Steely Dan

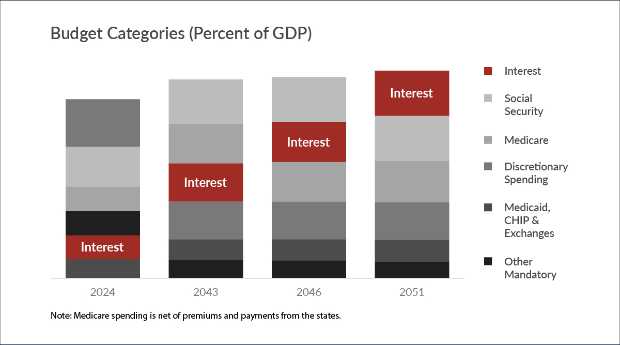

The numbers tell a story that would make Nostradamus want to cry. By 2051, we’ll be spending more on interest payments than Social Security – assuming there’s still a society left to collect either…

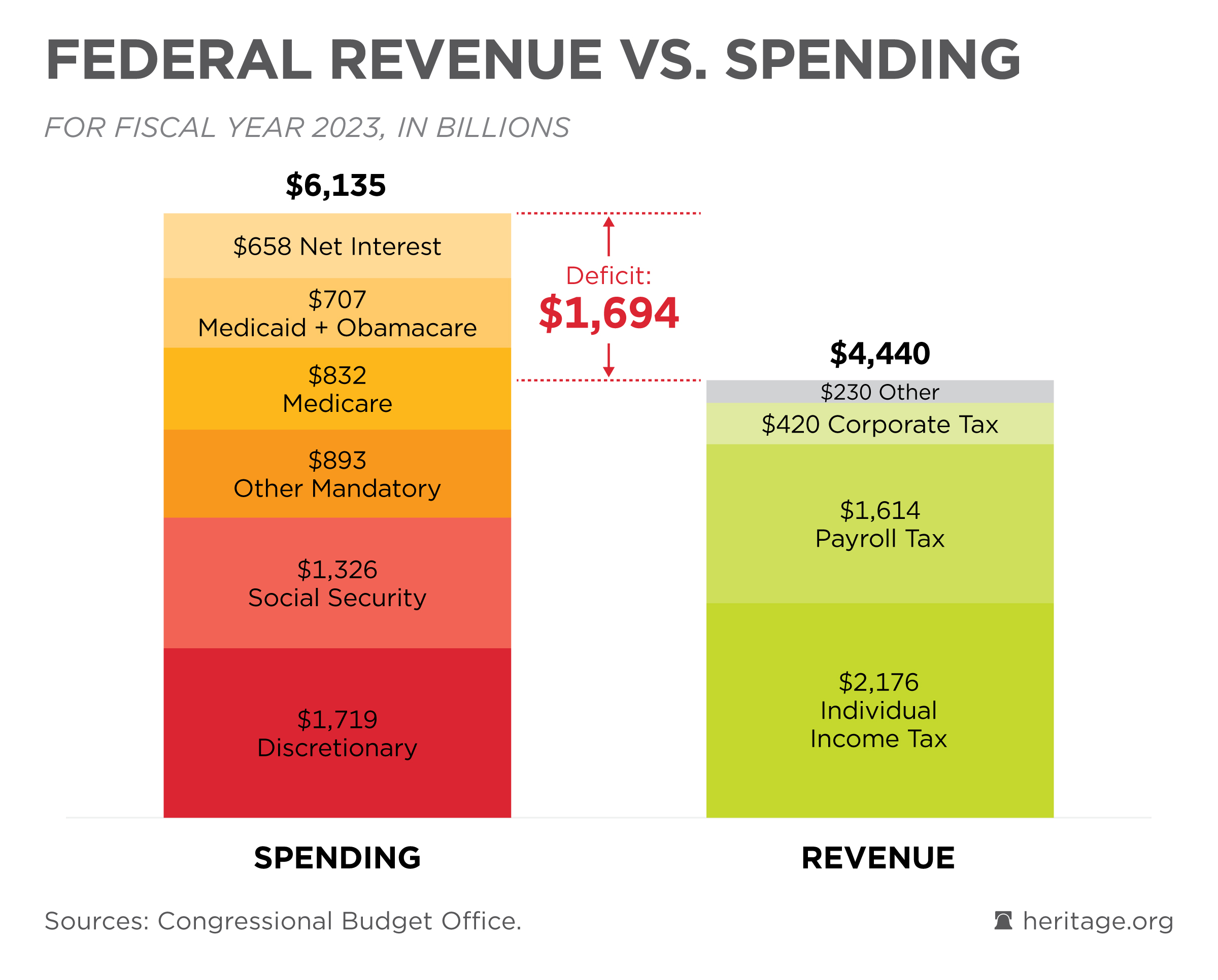

At $2.4Bn per day in interest payments (that’s about $27,777 per second for those keeping score at home), we’re essentially running a national credit card with the impulse control of Trump at a Teen USA pageant (such an adorable letch, right?).

At $2.4Bn per day in interest payments (that’s about $27,777 per second for those keeping score at home), we’re essentially running a national credit card with the impulse control of Trump at a Teen USA pageant (such an adorable letch, right?).

In two weeks, we might re-elect the same folks who treated our National Debt like it’s Monopoly money – the ones who think “fiscal responsibility” means even bigger tax cuts for the wealthy – because it’s worked so well for the past 50 years? At least Nero had the talent to play the fiddle while Rome burned…

Between Japan’s aging AND shrinking population (projected to decline from 135M to 96M by 2060, with the elderly reaching 79% of working-age population), America’s crumbling infrastructure (our bridges and dams are now old as old as the average Senator), and with Global Warming damage already costing us $1Tn annually due to INaction, we’re running out of mathematical gymnastics to make these numbers work.

Global Warming is the ultimate wild card in this game. The escalating costs of climate change mitigation and disaster relief are adding trillions to the debt burden. And if we fail to address this existential threat, the economic consequences alone WILL be catastrophic, making our current debt woes seem like a minor inconvenience. 4 more years of inaction could very possibly seal the fate of our planet.

What’s the solution?

What’s the solution?

Well, we could raise taxes by 50%, but that’s about as politically palatable as a kale smoothie. We could cut $2Tn in spending, but there’s not even $1Tn in non-military discretionary spending to cut. Unless we plan to run the government via Zoom from someone’s garage I guess we’re all just hoping that artificial intelligence will solve everything before the final bill comes due but, if you say “Hey, ChatGPT, any ideas on how to pay off $36 trillion in US Debt?” – I can guarantee it will lead to a very uncomfortable conversation with reality.

So, what’s left? Well, there’s always the “hope and pray” strategy. Maybe we’ll discover a hidden treasure chest filled with gold doubloons that are only MILDLY cursed or maybe a benevolent alien civilization will take pity on us and settle our debts with a few clicks of their intergalactic credit card (perhaps that explains why the Government has been stepping up the search for Aliens – we’re looking for someone we haven’t tapped out yet?).

Meanwhile, we’ll keep watching as ALL of our elected officials perfect the art of kicking the can further down what’s left of our deteriorating roads. At least we can take comfort in knowing that by the time this all comes crashing down, we’ll probably be too busy dealing with our new robot overlords to notice…

Remember folks, markets can remain irrational longer than Nations can remain solvent – and we seem determined to test that theory to its absolute limit!

[ctct form=”12730731″ show_title=”false”]