“Trouble (oh, we got trouble)

Here in Washington DC (Here in Washington DC)

With a capital “T” and that rhymes with “4.3%” and that stands for poor US Credit Ratings!” – Music Man (sort of)

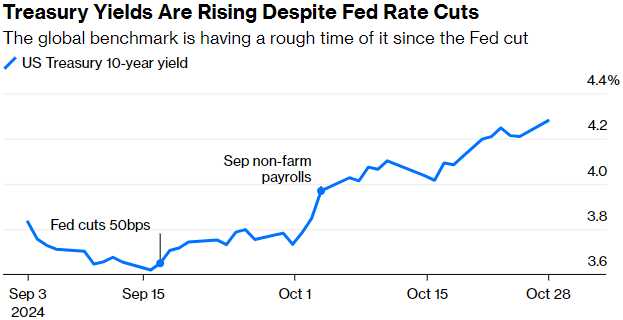

As the financial world braces for the upcoming Federal Reserve meeting next week, the bond market has been throwing curveballs, defying conventional wisdom and leaving investors perplexed. The unusual anomalies in the market, such as rising Treasury yields despite rate cuts and the strengthening US dollar, have set the stage for a soap opera that intertwines investor behavior, economic fundamentals, and policy uncertainties.

Our story began with the Federal Reserve’s recent interest rate cuts, which, in theory, should have led to lower Treasury Yields. However, in a surprising twist, yields on 10-year US Treasuries have risen by nearly 70 BASIS POINTS, leaving market participants scratching their heads. This unexpected development has sparked a flurry of speculation about the underlying factors driving this peculiar trend.

As the plot thickens, the US dollar takes center stage, appreciating by 4% over the past month. This development suggests that foreign investors are not shying away from US assets, but instead of flocking to them! They are channeling their funds into other areas, most notably US tech stocks, which continue to defy gravity into their earnings reports. The strengthening dollar adds another layer of complexity to the already intricate narrative.

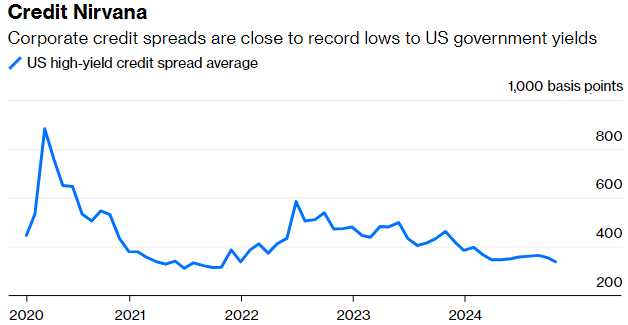

Meanwhile, Corporate Credit Spreads have been tightening, indicating a reduced perceived risk in corporate debt compared to government bonds. So much so that even Boeing (BA) was able to easily raise $21Bn yesterday. This little subplot raises questions about investor confidence in the face of economic uncertainty and highlights the resilience of certain asset classes and markets.

What this is really saying is that Investors would rather put their money into the accounts of our Corporate Masters than into the bonds and notes that are being issued by the Government which, in turn, is being taken over by our Corporate Masters – even as we speak…

The story takes an International turn as the stability in emerging market debt and the depreciation of the Japanese Yen come into play. Japan’s ruling coalition just lost its parliamentary majority, increasing the risk of Government intervention in Currency Markets.

Another sudden strengthening of the Yen (the BOJ intervened in July but, as we predicted, it was not enough to last) could force investors to unwind positions, impacting global liquidity and asset prices. These global factors add depth to the narrative, showcasing the interconnectedness of the world’s financial markets and the potential ripple effects of currency fluctuations.

As the Fed meeting looms on the horizon, the increased market hedging and volatility serve as ominous foreshadowing, hinting at potential challenges for Monetary Policy and global financial stability.

To unravel the mystery behind these unusual anomalies we must dig into the underlying factors contributing to the market’s peculiar behavior. Investor behavior and risk appetite, challenges to traditional valuation models, concerns over fiscal policy and government borrowing, and the uncertainties surrounding the upcoming US Presidential Election all play a role in shaping the narrative.

As the Fed meeting and the election approach us next week, the bond market’s unusual developments are set to reach a climax. The resolution of these uncertainties may lead to a realignment of asset valuations, forcing investors and policymakers to adapt their strategies in response to the evolving market dynamics.

As the Fed meeting and the election approach us next week, the bond market’s unusual developments are set to reach a climax. The resolution of these uncertainties may lead to a realignment of asset valuations, forcing investors and policymakers to adapt their strategies in response to the evolving market dynamics.

The current anomalies in the bond market reflect a confluence of factors reshaping the financial landscape. Rising Treasury yields amid rate cuts, a strengthening Dollar without a corresponding increase in Treasury demand, and tightening Corporate Credit Spreads challenge traditional market doctrines.

As the Federal Reserve’s meeting approaches, the stakes are high. The decisions and communications from policymakers will have significant ramifications for markets Globally. The bond market’s current state is not just a puzzle but a signal of deeper shifts in economic perceptions and Investor priorities. Whether these trends herald a new paradigm or a reversion to the mean after the election and Fed meeting remains to be seen. What is certain is that the financial world is watching closely, poised to respond to the next developments in this unfolding story.

And congratulations to all who followed us in yesterday’s Oil (/CL) Futures Trade. As it turned out, we had 3 $450 runs while we’ve been waiting to get to $70, which will be $2,500 per contract higher than our $67.50 entry – if we get there. If you have been cashing 1/2 out on the pullbacks and adding back at $67.50 – you should be doing quite well so far – you’re welcome!

As we expected last week’s demand to be impacted by the hurricanes, we expect this week’s API and EIA reports to have a “surprising” (to others) draw and we can play for that not just with Futures contracts but with options contracts like USO, which is at $70.65 this morning and was $79 last week but let’s say $67.50 would be silly – so we can play it like this:

As we expected last week’s demand to be impacted by the hurricanes, we expect this week’s API and EIA reports to have a “surprising” (to others) draw and we can play for that not just with Futures contracts but with options contracts like USO, which is at $70.65 this morning and was $79 last week but let’s say $67.50 would be silly – so we can play it like this:

-

- Sell 10 USO Nov $67.50 puts for $1.10 ($1,150)

- Buy 10 USO Nov $69 calls for $3.25 ($3,250)

- Sell 10 USO Nov $71 calls for $2.15 ($2,150)

That’s net $0 on the $2,000 spread so the upside potential is $2,000 if USO is over $71 on the 24th (17 days) and you can’t lose any money unless it’s below $67.50 and that would be about $65 Oil and that would be a very nice long-term long anyway.

Let’s see how that one works out!

[ctct form=”12730731″ show_title=”false”]