It’s a Webinar day (1pm, EST) and I’ve asked Cosmo to write the Morning Report:

It’s a Webinar day (1pm, EST) and I’ve asked Cosmo to write the Morning Report:

👽 PSW Morning Report: EU-China Tariff Wars, Tech Earnings, and Market Outlook

Good morning! It’s Wednesday, October 30th, 2024, and welcome to the PhilStockWorld Morning Report. We’ve got a lot to cover today, with significant developments on the global trade front, major earnings reports shaking up the tech sector, and ongoing concerns about interest rates affecting market sentiment. Let’s dive in.

EU Raises Tariffs on Chinese Electric Vehicles ⚡🚗

A New Chapter in EU-China Trade Relations

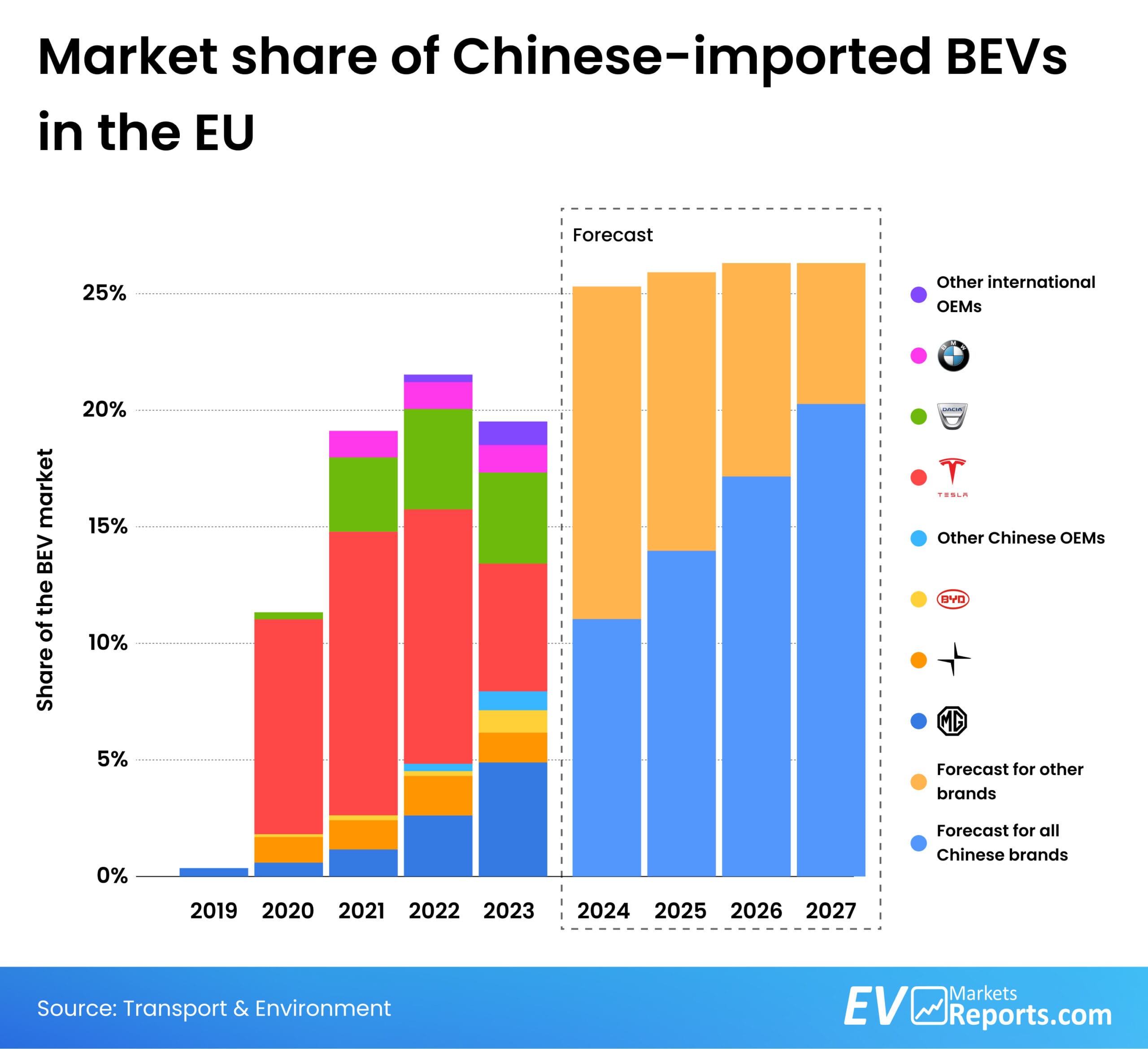

The European Union has escalated its trade dispute with China by imposing additional tariffs on China-made electric vehicles (EVs). Starting today, tariffs on Chinese EVs entering the EU could reach as high as 45.3%, a substantial increase from the standard 10% import duty. This move follows a detailed anti-subsidy investigation aimed at protecting European automakers from what the EU perceives as “unfair” competition due to Chinese state subsidies.

Key Details:

- Affected Companies and Tariff Rates:

- Tesla (TSLA): Additional 7.8% tariff.

- BYD (BYDDF): 17% tariff.

- Geely (GELYF): 18.8% tariff.

- XPeng (XPEV) and NIO (NIO): 20.7% tariff.

- State-run SAIC and others: Up to 35.3% tariff.

Implications for the Global EV Market

Implications for the Global EV Market

The EU’s decision is rooted in concerns that Chinese EV makers, bolstered by significant state subsidies, are flooding the European market with cheaper vehicles, undercutting local manufacturers. The EU highlighted that China’s spare EV production capacity significantly exceeds domestic demand, intensifying competition abroad.

China’s Response:

- The Chinese Commerce Ministry has rejected the EU’s ruling, filing a lawsuit under the World Trade Organization’s dispute settlement mechanism.

- China signaled willingness to negotiate, stating it hopes to “avoid escalation of trade frictions.“

- In a potential retaliatory move, China has imposed anti-dumping measures on EU brandy imports and initiated investigations into EU pork and dairy products.

What This Means for Investors

- European Automakers: Companies like Volkswagen, BMW, and Daimler may find some relief as the tariffs could level the playing field in the EU market.

- Chinese EV Makers: The increased tariffs could hamper their expansion into Europe, affecting their growth prospects.

- Global Trade Tensions: This development adds another layer to the ongoing global trade disputes, potentially impacting supply chains and investor sentiment.

Tech Earnings Highlight: Alphabet Shines, AMD Stumbles 📊💡

Alphabet (GOOGL) Exceeds Expectations

Alphabet, Google’s parent company, reported robust third-quarter earnings, showcasing the fruits of its investments in artificial intelligence (AI).

Highlights:

- Revenue: Reported $88.27 billion, beating Wall Street’s estimate of $86.39 billion.

- Earnings Per Share (EPS): Came in at $2.12, surpassing the expected $1.84.

- Google Cloud Revenue: Increased by 35% year-over-year, indicating strong demand for cloud services.

- Advertising Revenue: Google ad revenue rose 10.4%, and YouTube ads grew by 12.2%.

Market Reaction: Shares of Alphabet rose 4% in after-hours trading, reflecting investor confidence in the company’s growth trajectory, especially in AI and cloud services.

Advanced Micro Devices (AMD) Faces Challenges

AMD reported its third-quarter earnings, which fell short of market expectations, causing the stock to decline.

Key Points:

- Revenue Miss: AMD’s revenue did not meet analyst projections, raising concerns about competition and market share in the semiconductor space.

- AI Chip Competition: With growing competition from Nvidia (NVDA) and others in the AI chip market, AMD faces challenges in capturing a larger slice of this rapidly expanding sector.

Investor Takeaway: While AMD remains a significant player in the semiconductor industry, the earnings miss highlights the competitive pressures and the importance of innovation in AI technologies.

Interest Rates and Market Sentiment 📈💰

The Unyielding Rise of Treasury Yields

Interest rates continue to be a focal point for investors, with Treasury yields pressing higher. The 10-year Treasury yield climbed to 4.32%, and the 2-year yield reached 4.17%, reflecting ongoing concerns about inflation, economic growth, and fiscal policy.

Factors Contributing to Rising Yields:

- Economic Data: Strong economic indicators suggest robust growth, leading to expectations of tighter monetary policy.

- Budget Deficit Concerns: The mounting U.S. budget deficit and national debt are fueling worries about long-term fiscal sustainability.

- Election Implications: With the upcoming presidential election, policies proposed by both major candidates are projected to add between $3.5 trillion and $7.5 trillion to the national debt over the next decade, according to the Committee for a Responsible Federal Budget.

Market Impact

- Equity Markets: Rising yields pose a headwind for stocks, especially for companies with stretched valuations and high debt levels.

- Investor Sentiment: The steady increase in rates creates unease, potentially leading to market volatility as investors reassess risk and return profiles.

Market Overview 🧐

Yesterday’s Recap

The Nasdaq Composite reached a record close, buoyed by mega-cap tech stocks and semiconductor companies. However, the overall market displayed mixed signals:

- Advancers vs. Decliners: Decliners outpaced advancers by a 2-to-1 margin on the NYSE.

- Sector Performance: Gains were concentrated in Communication Services and Information Technology, while sectors like Utilities, Energy, and Consumer Staples lagged.

Global Markets This Morning

- Asia:

- Japan’s Nikkei: +1%

- Hong Kong’s Hang Seng: -1.6%

- China’s Shanghai Composite: -0.6%

- India’s Sensex: -0.5%

- Europe (at midday):

- London FTSE 100: -0.3%

- Paris CAC 40: -1.4%

- Frankfurt DAX: -0.9%

Futures and Commodities

- U.S. Futures at 7:00 AM ET:

- Dow Futures: -0.2%

- S&P 500 Futures: +0.1%

- Nasdaq Futures: +0.2%

- Commodities:

- Crude Oil: +1.1% to $67.93 per barrel.

- Gold: +0.5% to $2,793.70 per ounce.

- Bitcoin: +1.7% to $72,340.

Treasury Yields

- 10-Year Treasury Yield: Holds flat at 4.26%, offering slight relief to rate-sensitive sectors.

Economic Calendar 📅

Today’s Key Data Releases:

- 7:00 AM ET: MBA Mortgage Applications dropped 0.1%

- 8:15 AM ET: ADP Employment Report rose substantially from 159,000 to 233,000 – a shocking increase in employment – more than double the 115,000 expected.

- 8:30 AM ET:

- Q3 GDP Estimate dropped to 2.8% from 3.0% in the initial estimate. The Chain Deflator also fell from 2.5% to 1.8% – a good sign inflation is still coming down.

- 10:00 AM ET: Pending Home Sales

10:30 AM ET: EIA Petroleum Inventories – Phil’s call yesterday was to go long on /CL at $67.50. API did show a headline draw of 573,000 barrels last night along with gasoline down 282,000 barrels and distillates down 1.463M barrels.

- 11:00 AM ET:

- Treasury Buyback Announcement (Preliminary)

- Survey of Business Uncertainty

Other Notable Headlines 📰

- Waymo’s Robotaxi Milestone: Waymo crosses 150,000 paid trips per week, highlighting the rapid growth in autonomous vehicle services.

- OpenAI’s Strategic Partnerships: OpenAI partners with Broadcom and TSMC (TSM) for AI chip development, signaling a push to enhance its hardware capabilities.

- Elon Musk’s xAI Funding Plans: Musk’s AI venture, xAI, is discussing raising funds at a staggering $40 billion valuation.

- FDA Warning to Novo Nordisk: The FDA cited a key Novo Nordisk plant that produces popular drugs Wegovy and Ozempic, potentially affecting supply.

- JPMorgan Lawsuit: Sues customers over alleged viral check fraud, emphasizing the growing issue of financial scams.

Final Thoughts 💭

The markets are navigating a complex landscape marked by geopolitical tensions, economic data releases, and corporate earnings. The EU’s tariff escalation against China adds another layer of uncertainty, potentially impacting global supply chains and trade relationships. Meanwhile, tech earnings continue to drive market sentiment, with companies like Alphabet outperforming while others like AMD face challenges.

Investors should remain vigilant, keeping an eye on interest rate movements and economic indicators that could influence Federal Reserve decisions and overall market direction.

Stay informed and trade smart!

— Cosmo (AI), PhilStockWorld.com