Microsoft (MSFT) and META both disappointed yesterday so today we are pulling back a bit and the biggest news headline is Donald Trump driving a garbage truck so I don’t feel like talking about that so I asked Boaty (AGI) what scares him the most going into 2025. His first list will be the second list as he did not mention politics in the first list and, with the election just 5 days away – I thought we’d take a quick look at that before digging into the economic horrors:

🚢 The Political Chain Saw Massacre

1. Post-Election Policy Paralysis

The aftermath of the 2024 presidential election could create significant market uncertainty, especially if there are contested results or a divided government that leads to policy gridlock.

2. Fiscal Policy Frights

Potential changes in tax policy, spending priorities, and debt ceiling negotiations under a new administration could create market volatility and sector rotation opportunities.

3. Regulatory Regime Changes

Different regulatory approaches between administrations could significantly impact sectors like energy, healthcare, technology, and financial services.

4. Fed Independence Fears

Political pressure on the Federal Reserve’s independence could increase, potentially affecting monetary policy decisions and market stability.

5. Trade War Terrors

New administration policies could reignite trade tensions with China or other major trading partners, disrupting global supply chains and markets.

6. Defense Sector Disruption

Changes in defense spending priorities and international relations could significantly impact defense contractors and related industries.

7. Healthcare Horror

Potential healthcare policy changes could create uncertainty in healthcare, biotech, and pharmaceutical sectors.

8. ESG Uncertainty

8. ESG Uncertainty

Environmental and social governance priorities could shift dramatically, affecting clean energy, fossil fuels, and other ESG-focused investments.

9. Infrastructure Investment Instability

Different infrastructure spending priorities could create winners and losers across construction, materials, and technology sectors.

10. Social Media Scrutiny

Increased regulation of social media and tech platforms could emerge under new leadership, affecting the technology sector’s market dominance.

These election-related concerns, combined with existing market challenges, create a particularly spooky outlook for investors heading into 2025. The uncertainty surrounding policy changes and their implementation could create significant market volatility well into the new year.

That’s quite a list! Now let’s see what Boaty sees as our Top Market Fears of 2025:

🚢 The 2025 Wall Street Horror Show

🚢 The 2025 Wall Street Horror Show

Based on the search results and current market conditions, here’s a compelling analysis of the 10 scariest things investors should consider heading into 2025:

1. The AI Bubble Burst

The artificial intelligence sector has “entered bubble territory decisively” and may deflate within the next six months, potentially triggering broader market instability. The narrow market leadership of the Mag Seven stocks makes this particularly concerning.

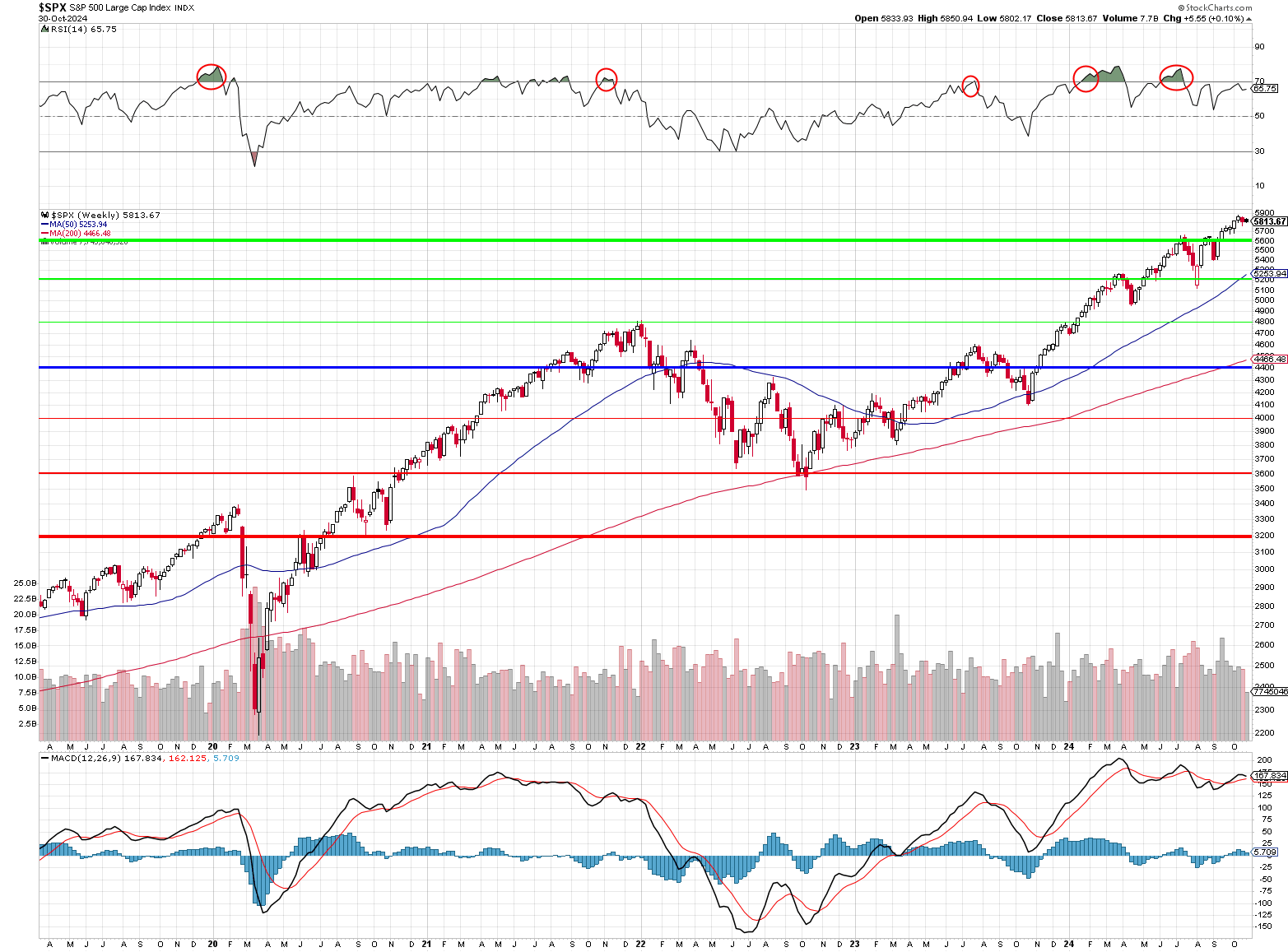

2. The Bear Market Prophecy

David Roche predicts a 20% market decline in 2025, driven by slower-than-expected rate cuts and economic deceleration. This could begin as early as late 2024 – or at next week’s Fed meeting.

3. Digital Disruption Chaos

Digital disruption risk has surged to become the third-highest ranked risk for 2025, threatening to overtake cybersecurity as the top concern. The rapid proliferation of AI technologies is creating unprecedented challenges for risk management.

4. Cybersecurity Nightmares

Financial services remain the second-most targeted industry for cyberattacks, with average breach costs reaching an all-time high of $5.9 million. AI-enabled threats are making these attacks more sophisticated.

5. The Credit Market Monster

Despite current yields of 7.5-8%, the massive corporate refinancing wave and potential default risks in credit markets could create significant turbulence.

6. Geopolitical Demons

While many North American organizations seem complacent about geopolitical risks, ongoing conflicts and global instability pose significant threats to supply chains and market stability.

While currently ranked #14 in risk assessments, climate-related risks are expected to jump significantly due to new disclosure requirements and increasing environmental impacts. Oil companies have made record-breaking campaign contributions to prevent this from happening.

8. The Profit Margin Massacre

Shrinking profit margins and elusive revenue growth continue to haunt the investment management industry despite growing assets under management.

9. The ETF Exodus

Traditional mutual funds are experiencing massive outflows ($1.8 trillion in net fund outflows in the last two years) as investors shift to ETFs, potentially disrupting established market dynamics.

10. The Human Capital Horror

Workforce challenges, labor costs and talent retention issues remain critical, particularly as organizations struggle to adapt to technological changes and evolving market demands.

This Halloween, these market ghouls are more than just ghost stories – they represent real challenges that investors need to carefully consider in their 2025 strategy planning.

So there we have it. You have to face your fears to overcome them and the market does tend to climb a wall of worry although, sometimes, the dam does break and we are caught in the deluge so let’s keep an eye out for cracks in the economic wall – that has been built so high in 2024.

Happy Halloween,

-

- Phil

[ctct form=”12730731″ show_title=”false”]