Apparently it’s the Dems/Libs that are living in a bubble as MAGA takes back the Presidency along with the House and the Senate AND the popular vote — I guess pollsters were also in some kind of bubble too… In the end, this is a Democracy so we’ll have to accept the will of the people and give Trump the wheel for another 4 years – this time with no checks, no balances – whatever he wants to do.

And what do you get when you win the Presidency? Well, in Trump’s case, DJT is up 36% this morning and that’s good for +$2Bn to Trump’s net worth but now he can make DJT his primary means of communication as POTUS and possibly turn it into a real platform that doesn’t just bleed cash.

Bitcoin blasted up to $75,000 overnight and I’m sure Trump’s own coins will follow suit. Team Trump and many, many MAGA candidates in this cycle took in a lot of donations from the Crypto World and COIN is jumping 13% this morning as well and, FORTUNATELY, we stayed aggressive in our Long-Term Portfolio in our last review and our net $199,350 spread is now $420,000 in the money and right on track for our $600,000 target so – thank you President Trump!

All the indexes are up strongly this morning but the Russell 2000 is up 6% – that’s crazy! Less regulation, less taxes, tariffs to protect US companies – what could possibly go wrong?

And no sector is happier about this than our beloved Banksters with our Mega Banks up almost 10% and the entire Financial Index (XLF) up 5.5% this morning – living in a Bankster’s Paradise!

And no ONE is happier than Elon Musk, whose TSLA stock is up 13% this morning, back over $1Tn in Market Cap and netting Elon a cool $27Bn this morning (which won’t be taxed, thanks to Trump). Actually, since Elon Musk jumped on the Trump train after TSLA’s TERRIBLE Q1 Report in later April, TSLA has gone from $140 to $280 and that’s up 100% ($500Bn) and 23% of that goes to Musk so call it a $115Bn gain for Musk from hitching his wagon to Trump – a lesson that will not be lost on the rest of Corporate America – who will be lining up to kiss the ring a Mar a Lago this Winter.

Overall, the key policies we can expect to kick in early next year are:

-

- Tariffs of 10-20% on all imports and 60% on Chinese goods

- Cryptocurrency deregulation

- Tax policy changes with the TCJA provisions expiring in 2025

- Changes to trade relationships, particularly with China

- Potential impacts on international relationships and agreements

- The end of the Ukraine war – one way or the other.

From a sector standpoint, we can expect:

Technology Sector (XLK)

Positive Factors

-

- Cryptocurrency deregulation (Bitcoin already hit $74,000 on election news)

- Lower corporate tax rates likely

- Potential repatriation holidays

Negative Factors

-

- Tech companies with significant Chinese exposure could suffer from tariffs

- Social media platforms may face increased scrutiny

Industrial/Manufacturing (XLI)

Positive

-

- Infrastructure spending likely to increase

- “Buy American” policies could boost domestic manufacturers

- Defense spending likely to increase

Negative

-

- 60% tariffs on Chinese goods could disrupt supply chains

- Higher input costs due to broad 10-20% import tariffs

Financial Sector (XLF)

Positive

-

- Potential deregulation

- Higher interest rates likely (based on spending plans)

- Tax policy favorable to financial institutions

Negative

-

- Market volatility from policy uncertainty

- International banking relationships could be affected by trade tensions

Energy Sector (XLE)

Positive

-

- Fossil fuel friendly policies

- Reduced environmental regulations

- Domestic energy production emphasis

Negative

-

- Renewable energy might face headwinds

- International energy markets could be disrupted by geopolitical tensions

Healthcare (IYH)

Mixed Impact

-

- Potential ACA changes could affect healthcare stocks

- Drug pricing policies unclear

- Private insurance likely to benefit

Consumer Discretionary (XLY)

-

-

Lower taxes could increase disposable income, potentially boosting consumer spending.

-

Deregulation might lead to more aggressive business strategies by companies in this sector.

-

-

-

Tariffs could increase costs for goods, affecting consumer prices and potentially reducing demand.

-

Economic uncertainty might lead to cautious consumer behavior.

-

Real Estate (XLRE)

-

-

Tax cuts could stimulate investment in property markets.

-

Infrastructure spending might increase property values in certain areas.

-

-

-

Rising interest rates could cool down the housing market as borrowing becomes more expensive.

-

Tariffs on imported construction materials could increase building costs.

-

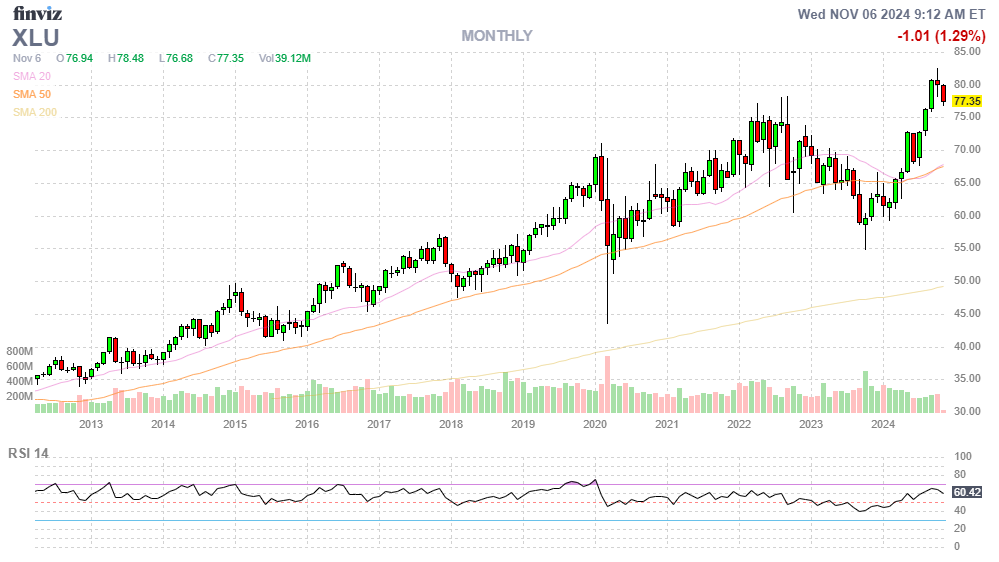

Utilities (XLU)

-

-

Traditional utilities might benefit from reduced environmental regulations.

-

Infrastructure spending could include utility upgrades.

-

-

-

Renewable energy initiatives might be sidelined, affecting green utility stocks.

-

Increased borrowing costs could impact capital-intensive utility projects.

-

Remember that historical market performance under different Presidents often has more to do with timing and external factors than specific policies. The S&P 500 showed strong performance under both Trump (12% annual) and Biden (14% annual).

-

-

Market Volatility: As policies are implemented, there might be increased market volatility due to uncertainty in trade, tax, and regulatory environments.

-

Global Relations: Trump’s win could strain relations with major trading partners, especially China, potentially leading to retaliatory measures affecting global markets.

-

Inflation Concerns: Tariffs might increase inflation if not offset by currency strength or productivity gains.

-

-

-

Diversification: Spreading investments across sectors could mitigate risks from policy-induced volatility.

-

Focus on Domestic Exposure: Companies with significant domestic operations might benefit more from ‘Buy American‘ policies.

-

Watch for Policy Details: The specifics of policy implementation will be crucial. For example, how broad or targeted the tariff application will be can significantly affect industries differently – so we will have to keep our eyes on what actually does pass into law next quarter.

-