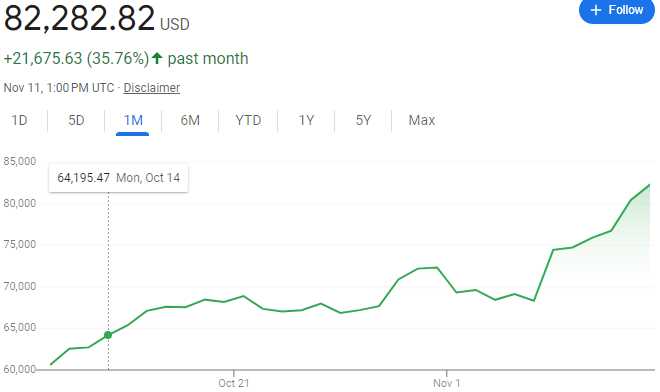

Bitcoin $82,282!

Bitcoin $82,282!

That’s up from $68,317 (20%) on election day as people are either running towards a crypto-friendly president or running away from a currency (US Dollars) that is a big step closer to collapsing. I would have to lean towards crypto-friendly as the Dollar itself is back at 105.43 this morning yet that has not caused the indexes to pull back – they are actually up another half a point this morning and the Russell is up 1.4% pre-market.

A 20% rise in 21M Bitcoin is “only” $293.3Bn – NVDA gained more than that since last week and Elon’s TSLA popped from $250 to $320 (28%) also adding over $300Bn to Musk’s car project, despite having elected a guy who doesn’t believe electric cars or boats are necessary!

“When logic and proportion

Have fallen sloppy dead” – Jefferson Airplane

We are slip-slidin’ down the rabbit hole now as our already stretched valuations are now gaining the GDP of Hong Kong/Pakistan/Finland/Portugal/New Zealand in a week. Bank of America, which Warren Buffett just dumped, has a TOTAL Market Cap of $346Bn, Netflix $339Bn, Chevron $279Bn, Coca-Cola $275Bn… Even Costco, which has been on fire lately, is only worth $418Bn yet TSLA, NVDA, GOOGL, AMZN – EACH added more than $300Bn to their market caps LAST WEEK.

Where did the money come from?

Where did the money come from?

Well that’s the fun of the markets, total inflows last week were just $127.44Bn last week, which is huge ($60-70Bn) is “normal” but should it be enough to move the needle $1,200,000,000,000 on just 4 companies? That is 10x bang for the buck and let’s not forget the entire 5% gain ($5Tnish)for all US Equities – all driven by “just” $127Bn worth of inflows.

So, just 40 more weeks like last week and the money flows will justify the gain in valuation but, if something else happens over the next 40 weeks that is not so market positive – where are you going to find the $5Tn worth of buyers to replace the sellers who believe their stocks are now worth $5Tn more than they were last Monday? This is why bubbles burst – they are PHYSICALLY unsustainable, they are MATHEMATICALLY unsustainable BUT they can keep floating along as long as nobody touches them (or blows too hard).

This is why our strategy, which is a bit of a buzzkill TBH, is to lock in our profits by spending 1/3 of our unrealized gains on additional hedges – something we did with our Members last Thursday in our Short-Term Portfolio Review and we will do it again this Thursday if the madness continues. We WANT to believe these things will never end – but they always do, don’t they?

We will be reviewing all of our Member Portfolios this week as November options expire on Friday but let’s be optimistic and look at the ways and reasons this rally CAN keep going for 40 weeks (Boaty’s list):

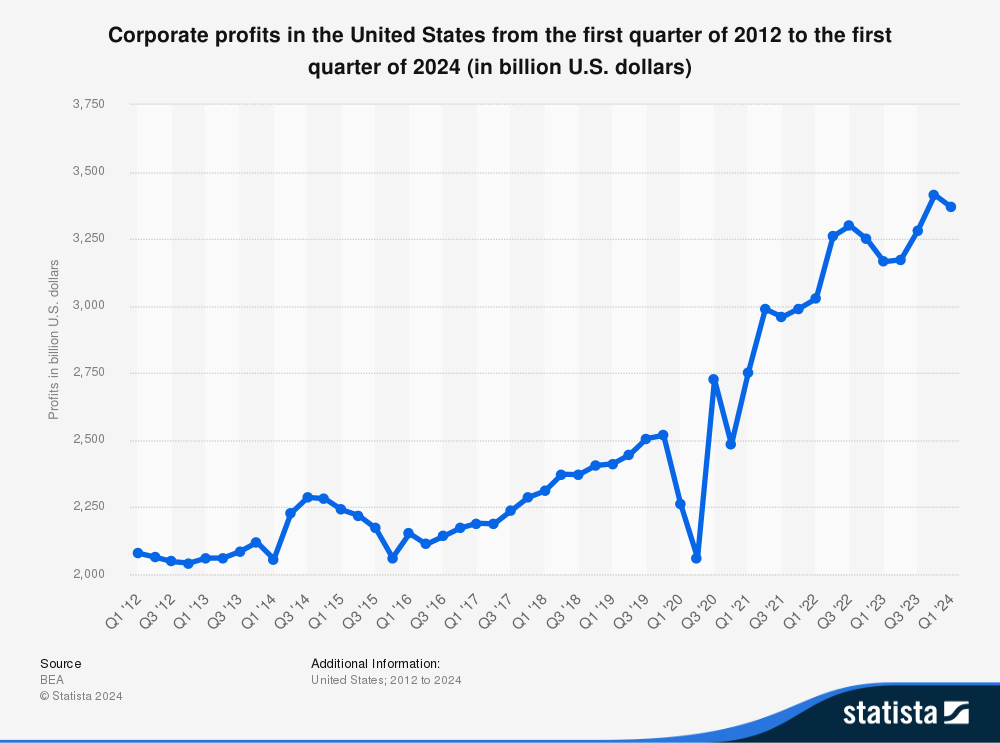

🚢 Corporate Tax Impact

Trump’s Proposed Changes:

-

- Lowering corporate tax rate from 21% to 15%

- Could boost corporate earnings by 7.2% (difference in tax rates)

- Would rank as 6th largest tax cut since 1940

- Corporate profits are at record highs despite lower transaction volumes

- Current profit margins inflated by “greedflation” (53% of inflation in 2023)

- Base corporate tax rate at 21%, but effective rate only 12.8% for large corporations

- Previous tax cuts led to 44% profit increase with 16% lower tax bills

- Specific sectors saw tax rates fall from 31% to 9.3%

AI Productivity Boost

Quantified Benefits:

-

- Could add $2.6-4.4Tn annually across 63 analyzed use cases

- Potential to increase labor productivity by 0.1-0.6% annually through 2040

- Combined with other technologies, could add 0.5-3.4 percentage points to annual productivity growth

- Software developers showed 56% faster task completion using AI tools

- 20-45% productivity improvement in software engineering

Inflation Tailwinds

Current Trends:

-

- Inflation down to 2.4% in September 2024, lowest since February 2021

- Energy costs declined 6.8%

- Core inflation at 3.3%, suggesting Fed may ease policy further

- Rate cuts could drive more money into equities (bond rates less attractive)

Additional Positive Catalysts

Market Momentum:

-

- Historical data shows when S&P 500 rises 15%+ through October, it continues higher in November-December 95% of the time

- Average additional gain of 5% in those scenarios

Global Capital Flows:

-

- Dollar strength attracting international investment

- European investors moving capital to US markets due to geopolitical concerns

- Institutional adoption of new investment vehicles (Bitcoin ETFs, AI-focused funds)

This combination of tax cuts, productivity gains, moderating inflation, and positive capital flows could theoretically support continued market expansion. A reasonable estimate would be 25-35% total profit growth over the next two years, assuming these catalysts materialize as projected.

Well, there’s your support! 25-35% profit growth over the next couple of years if all goes well. Of course, if we’re front-loading it now – there won’t be much gas left in the tank going forward but at least we are less likely to suffer from explosive decompression when things don’t pan out. Unfortunately, these policies tend to run up the debt and that’s another issues we need to remain keenly aware of but, nonetheless – we shouldn’t knee-jerk bet against the good times rolling along for another year.

Speaking of Corporate Profits, let’s see who’s making money this week as we still have many, many Earnings Reports to get through:

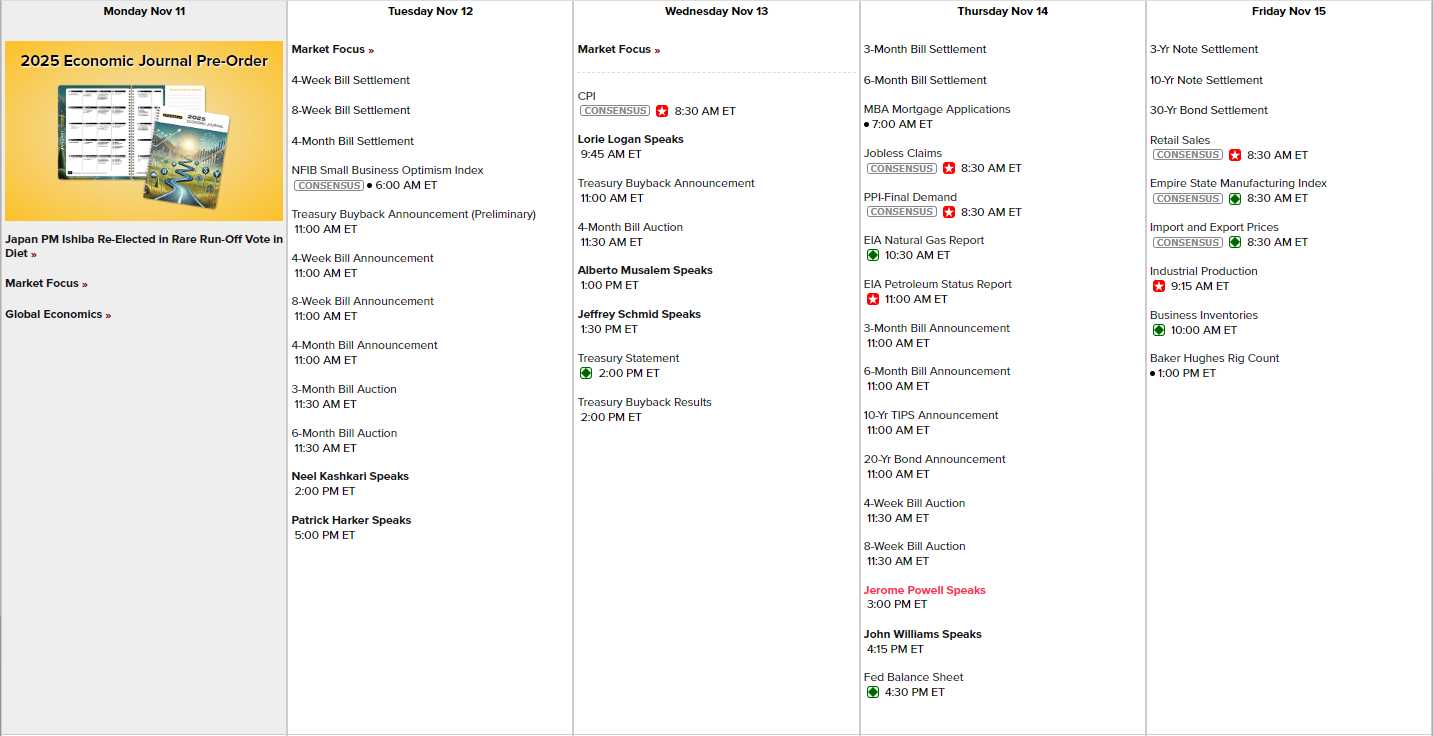

On the Economic front, we have lots of short-term note auctions this week and 7 Fed Speakers – including Chairman Powell on Thursday at 3pm. While we wait for that we have Small Business Optimism tomorrow, CPI Wednesday, PPI Thursday and Friday we have Retail Sales, Empire State Manufacturing and Industrial Production as November Options finish their runs:

[ctct form=”12730731″ show_title=”false”]