S&P 6,000!

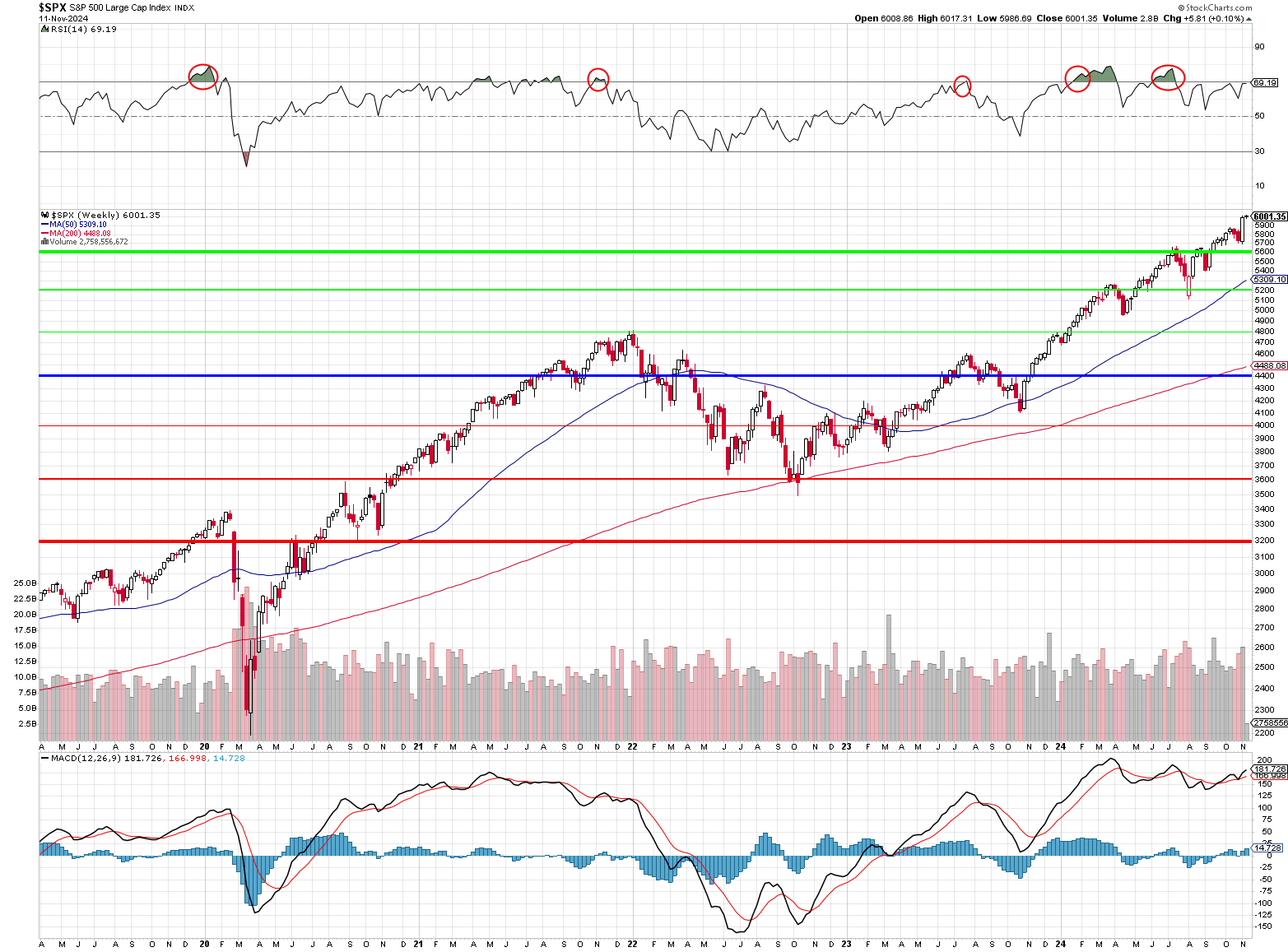

We just closed above that mark for the first time yesterday and, unfortunately, we're about to put a ring on it - one of those rings around RSI 70 that has, VERY RELIABLY, market the beginning of a sell-off 3 times in the past two years. Will this time be different? No - it will not...

The top of our expected range for the year was 5,600 but we didn't expect Trump to be re-elected and bring back his tax cuts and, as noted by Boaty yesterday, that can certainly get us another 15% next year - but not in a straight line... Overbought is overbought so we're more of a mind-set to lock in our gains at the moment than look for new ones.

HOWEVER - it is November and that means it's time to pick our 2025 Trade of the Year and we try to get it done around Thanksgiving (28th) - so that's our project for the next two weeks. What is considered a sure thing in Donald Trump's America?

Perhaps we can find a clue looking at the big winners of the last 7 days - since election day:

Well that's just silly, isn't it? Poor Healthcare - you would think they'd be happy. No more vaccines maybe? But no diagnostics too? Is Trump not even paying for lab tests anymore. I guess Kennedy's policy could be "Just cut out the things that don't work" - America will be as great as the Middle Ages again! I certainly don't get why sugary beverages are down with tobacco and candy - these are all things Trump likes. Packaged foods also down.

Banksters are huge winners, UNH is up 20% as we go back to infinite billing and finite coverage models. And, of course, it's good to be TSLA - up 38% ($400Bn) in a week!