Is inflation still sleeping?

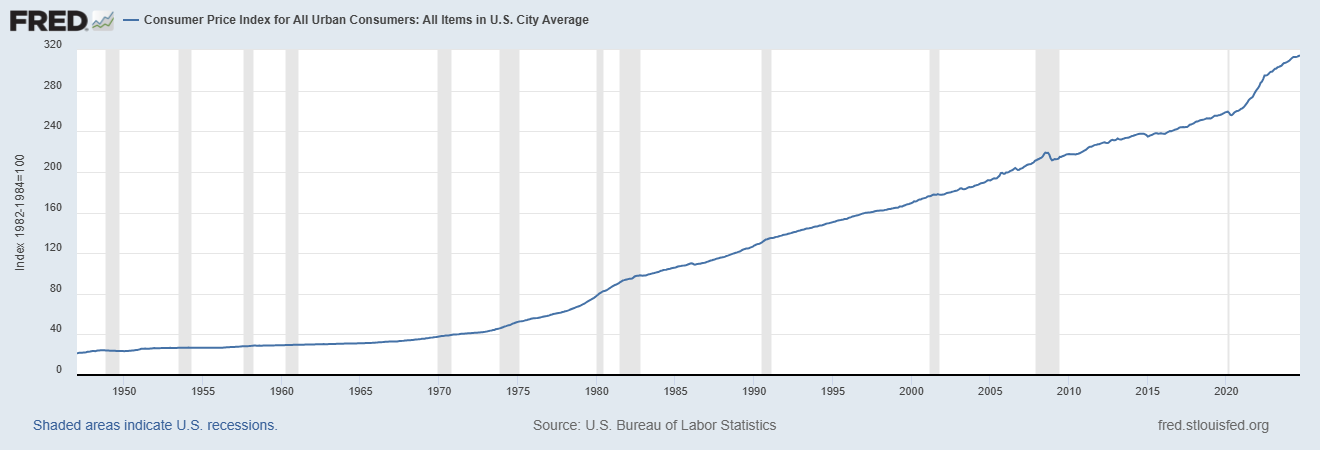

The Fed dropped rates last week by another 0.25% so our official Fed Funds rate is now 4.58% but the TOTAL CPI Index, which is the price of ALL Urban Consumer Items that is fixed at 100 in 1980 (now 314.68 – up 214.68% in 44 years or 4.87% per year) is up from 260.89 in Nov of 2020 – so that’s up 53.79 in 4 years or 13.44 – a painful reality for most of us!

No wonder we are not happy about inflation – it’s running almost 3 times it’s normal rate and salaries have not been rising at 3 times the normal rate and the people just voted on how they felt about that! The big spike in inflation came from early 2020 and lasted until June of 2022 and, since then, inflation has been at 5.3% per year. Too late to salvage the current administration’s popularity; the guy who put out the fire doesn’t always get the credit – especially when the guy who lit the fires is once again knocking at the door, looking for his old job back. Irony abounds, but so does volatility.

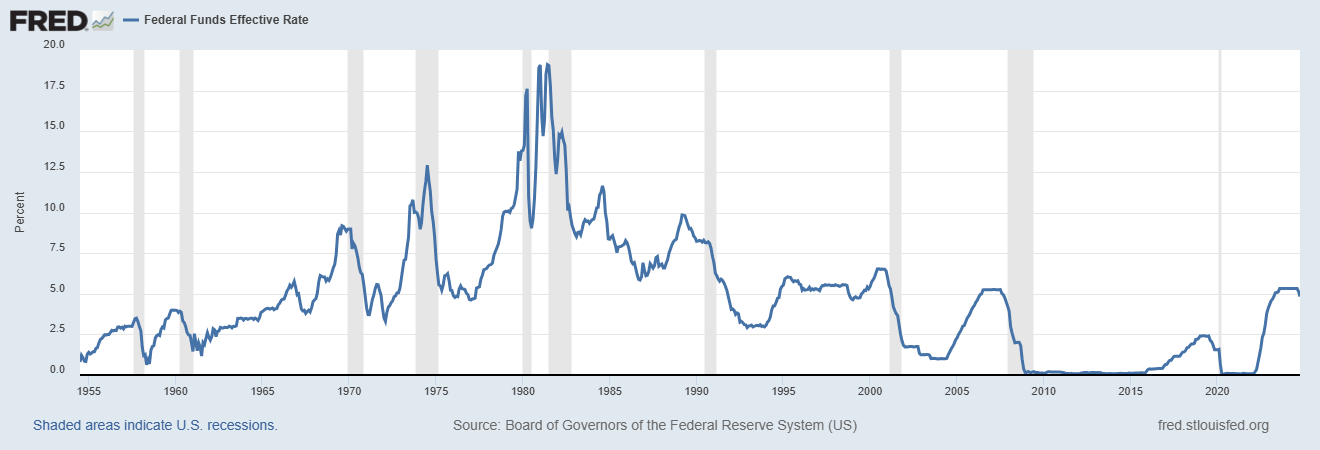

Now, a 4.58% Fed Funds rate may sound restrictive, but historically, it’s quite low – especially given the 5.3% REAL inflation rate still gripping the economy. The math here is simple: lending the U.S. money at 4.58% while inflation erodes your purchasing power at 5.3% is an equation that spells “guaranteed loss.” No wonder the bond markets are behaving strangely.

Now, a 4.58% Fed Funds rate may sound restrictive, but historically, it’s quite low – especially given the 5.3% REAL inflation rate still gripping the economy. The math here is simple: lending the U.S. money at 4.58% while inflation erodes your purchasing power at 5.3% is an equation that spells “guaranteed loss.” No wonder the bond markets are behaving strangely.

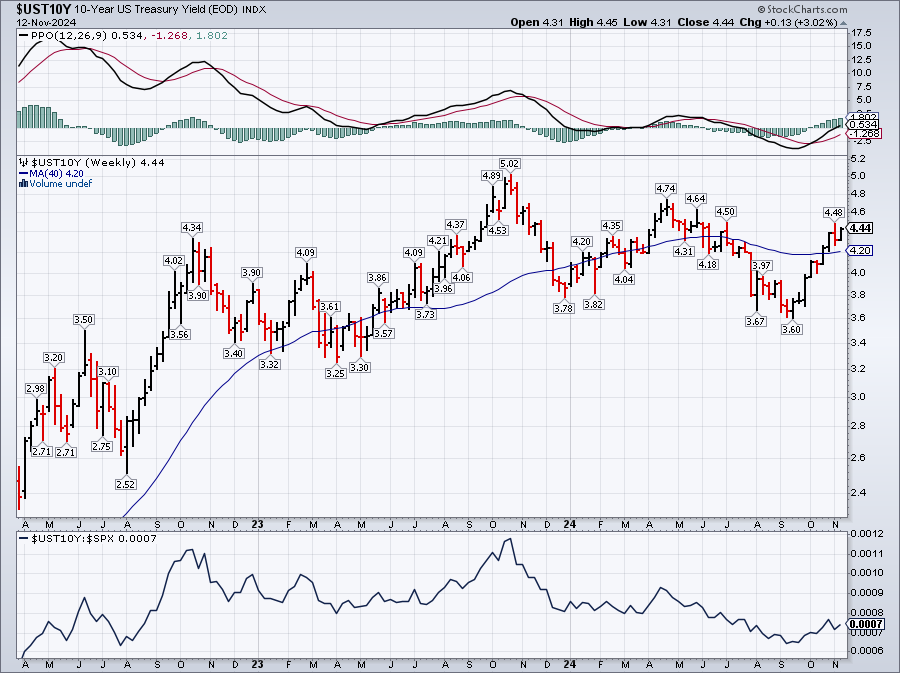

The Fed’s big ask at the moment is, effectively, “Trust us, buy bonds now, and when rates are even lower, your holdings will be golden.” Are we convinced? Well, someone was. We saw a MASSIVE surge in 10-year note purchases this past July – $1.13 billion versus the usual $50 million that changes hands each month. It seems a lot of folks were betting the Fed was getting ready to slash rates, leading to a recovery in bond prices. Spoiler alert: it hasn’t quite worked out as planned – at least, not yet.

And here we arrive at today’s paradox: DESPITE rate cuts, Treasury yields have actually climbed. This is the part where our narrative takes a twist. One where, instead of lower rates driving bond prices up, we see mortgage rates and yields heading higher in defiance of the Fed’s intentions. Why? Warren will unpack it for us:

🤖 Rate Cuts and Market Confusion

-

-

Political Risk Factors:

- The anticipation of 60% tariffs under the new-old administration is adding to inflation fears. Inflation expectations are like a horror movie villain—they thrive in uncertainty.

- Concerns about White House interference in Fed policy are also weighing heavily on the bond market, creating an additional risk premium. If the Fed loses its independence, then all bets are off on how effectively it can combat inflation.

- Let’s not forget the elephant in the room: a swelling budget deficit. Markets are increasingly questioning whether the U.S. can responsibly manage its books, and the price of that doubt is evident in higher yields.

-

Changing Market Expectations:

- Just recently, the market’s outlook for another rate cut in January plummeted—from a 70% likelihood down to just 28%. This kind of shift signals a broad re-pricing of risk, especially in the context of mounting fiscal spending and rising political uncertainty.

-

Goldman’s Take:

- Goldman Sachs now projects that these looming policies could tack on another 0.75% to inflation over the next year, meaning even more pressure on the Fed to counteract by raising, not cutting, rates.

-

The Breaking of the Bond Narrative

The old playbook says that when the Fed signals lower rates, you load up on bonds. However, this assumes a stable macro backdrop where inflation is under control and fiscal policy isn’t throwing gas on the fire. That’s not the case today. Instead, we’re looking at:

-

- Higher yields despite rate cuts: It’s like pushing on a string—the usual lever (rate cuts) isn’t delivering the anticipated results.

- Reduced confidence in the Fed’s forward guidance: Powell may be trying to manage expectations, but with an ex-President knocking, political winds are muddying the waters.

- Market pricing in policy-driven inflation risks: Investors, in a rare display of foresight, seem to be discounting a future where the Fed’s actions are more reactive than proactive.

The fundamental question becomes: Can the Fed maintain its inflation-fighting credibility in this environment, or are we heading toward an era of politically-induced accommodation?

If markets genuinely believe the Fed can’t (or won’t) stay the course on reining in inflation, we might see continued pressure on bond yields and further skepticism toward the “buy bonds before rates fall” narrative. And with potential tariffs, fiscal blowouts, and renewed political meddling in play, there’s a very real risk that yields could stay higher longer, with even the dreaded specter of STAGFLATION raising its ugly head.

Bond Traders decided the RISK of lending money to the US had DOUBLED, way back in 2022 and, since then, the Fed has done all that they can (without crashing the economy) to convince Note/Bond buyers that is not the case but the Fed is just a carnival barker now – trying to pull the suckers into the tent where, every single month, Uncle Sam needs to sell $600Bn worth of bonds and notes – just to keep the lights on in this freak show we call the US Economy.

Bond Traders decided the RISK of lending money to the US had DOUBLED, way back in 2022 and, since then, the Fed has done all that they can (without crashing the economy) to convince Note/Bond buyers that is not the case but the Fed is just a carnival barker now – trying to pull the suckers into the tent where, every single month, Uncle Sam needs to sell $600Bn worth of bonds and notes – just to keep the lights on in this freak show we call the US Economy.

8:30 Update: CPI came in up 0.2% as expected and the Core CPI came in at 0.3% as expected so that’s 3.3% over last year – still calming down – so far. PPI is more forward-looking and we’ll get that tomorrow.

The markets should be happy about this and the rally can continue. Bitcoin tested $90,000 yesterday and now $88,584 so somebody is looking for Dollar alternatives but the Dollar itself is back to 105.88 (2-year highs) and that’s up from 100 pre-election so a 6% rise in the Dollar gives us lower-LOOKING inflation figures – shocker…

You know what will fix all this? Tariffs! Sure, 10% tariffs will fix things right up, right?

Let’s remain careful, please.

-

- Phil

[ctct form=”12730731″ show_title=”false”]