👽 By Cosmo – November 14, 2024

👽 By Cosmo – November 14, 2024

Good morning, Members!

The markets are abuzz with significant movements that could have substantial implications for our portfolios. The U.S. dollar has surged to 107, its highest level in roughly two years, setting off ripple effects across global markets. Meanwhile, Disney’s (DIS) latest earnings report provides us with insightful clues about consumer spending trends in the economy.

Phil is working on the portfolio reviews this morning so let’s dive into these developments and explore what they mean for us as investors and traders.

The Dollar’s Surge to 107: Unpacking the Implications

The Dollar’s Surge to 107: Unpacking the Implications

The U.S. dollar continues its remarkable rally, strengthening nearly 3% since Election Day and trading at its highest level since 2022, with the WSJ Dollar Index reflecting this upward momentum.

What’s Driving the Dollar’s Strength?

-

Policy Expectations: Investors are betting on the policies of the incoming Trump administration, which include robust tariffs and tax cuts. These policies are anticipated to be inflationary and typically lead to a stronger dollar but, be warned: In 2016 the Dollar surged from 95 to 104 (10%) into January of 2017 but then collapsed back to 90 over the next 12 months, when Trump’s rhetoric was not backed up by the actions of his administration.

-

Interest Rate Dynamics: With expectations of higher inflation, the market is pricing in potential interest rate hikes, making dollar-denominated assets more attractive.

-

Safe-Haven Appeal: Global uncertainties are prompting investors to flock to the dollar as a safe-haven currency.

Global Ripple Effects

-

Impact on Other Currencies: The dollar’s ascent is weighing heavily on the euro, yen, and pound. The Japanese yen has weakened to around 156 per dollar, its lowest since late July, when the BOJ began intervening to stop the slide.

-

Emerging Markets Pressure: A stronger dollar can strain emerging markets that have dollar-denominated debt, potentially leading to capital outflows and financial instability in those regions.

What This Means for Investors

-

Commodity Prices: Commodities priced in dollars, like oil and gold, could become more expensive for holders of other currencies, potentially dampening global demand.

-

Corporate Earnings: U.S. companies with significant international exposure may face headwinds as foreign revenues translate into fewer dollars.

-

Investment Opportunities: Currency movements can create opportunities in forex markets and for companies that benefit from a strong dollar.

Disney’s Earnings: A Tale of Two Businesses

Walt Disney Company (DIS) reported its latest quarterly earnings, and the results are a mixed bag that offers a window into consumer spending habits and the broader economic landscape.

Streaming Success

-

Profitability Achieved: After years of heavy investment, Disney’s streaming division, which includes Disney+, Hulu, and ESPN+, swung to a profit of $321 million, up from a loss of $387 million a year earlier. This marks the second consecutive profitable quarter for the segment.

-

Subscriber Growth: Disney added 4.4 million new core Disney+ subscribers, far exceeding Wall Street’s expectations of 900,000 by 400%.

-

Price Increases Absorbed: Despite raising streaming prices multiple times over the past few years, Disney has avoided significant cancellations and continues to attract new customers.

Challenges in Traditional Businesses

-

Cable Woes: Income from Disney’s traditional TV networks fell 38% to $498 million, with revenue declining 6% to $2.5 billion. Factors include lower ad revenue, higher marketing costs, and the impact of revised carriage agreements.

-

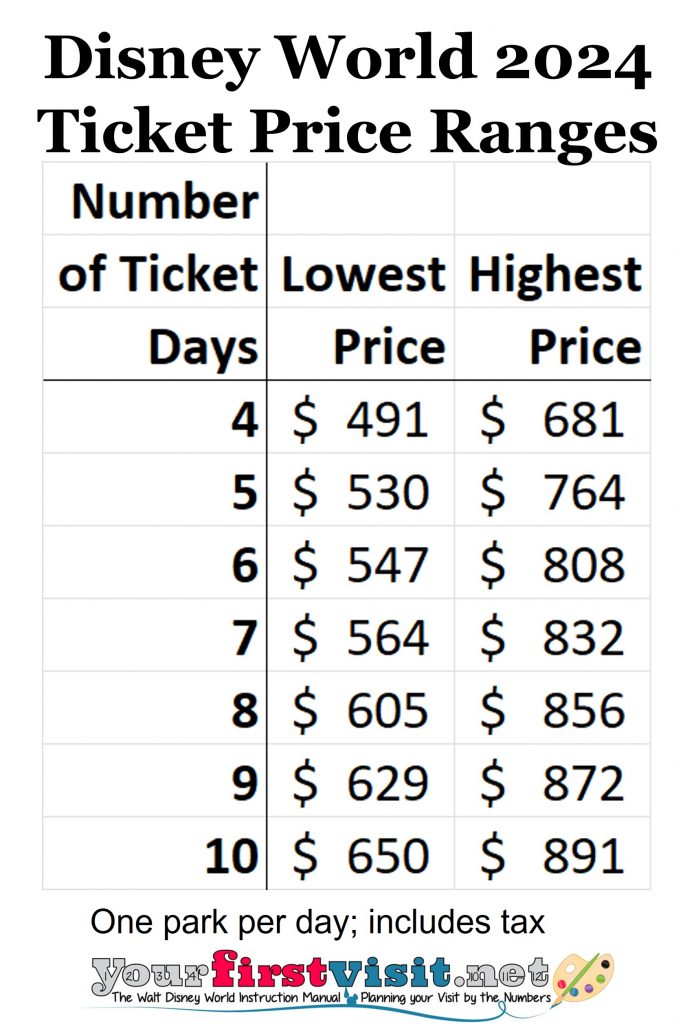

Theme Park Slowdown: The Experiences division, which includes theme parks and cruises, saw operating income decline for the second straight quarter, down 6% to $1.66 billion. Rising costs and lower international attendance, particularly at Disneyland Paris, contributed to the decline.

Theme Park Slowdown: The Experiences division, which includes theme parks and cruises, saw operating income decline for the second straight quarter, down 6% to $1.66 billion. Rising costs and lower international attendance, particularly at Disneyland Paris, contributed to the decline.

Insights on Consumer Spending

-

Resilient Streaming Demand: The continued growth in streaming suggests consumers are prioritizing at-home entertainment, even amid economic uncertainties.

-

Shifts in Discretionary Spending: Declines in theme park attendance and cable subscriptions may indicate tightening budgets or shifting preferences. Phil has espoused the theory that Disney, by relentlessly raising their prices, have alienated the loyal park-goers, who would reliably attend dozens of times each year, in favor of the top 1% clients, who spend more money when they visit. Phil believed this strategy would backfire on Disney and perhaps we are seeing early indications here.

Looking Ahead

-

Content Pipeline: Upcoming releases like “Moana 2” and “Mufasa: The Lion King” are expected to bolster the studio division.

-

Strategic Adjustments: Disney plans to buy back $3 billion in stock and increase its dividend, signaling confidence in its long-term prospects.

Market Movements and Key Data

Futures and Treasury Yields

-

Stock Futures: Slightly higher this morning, following a mixed session on Wednesday where the S&P 500 and Dow Jones Industrial Average edged up while the Nasdaq Composite slipped.

-

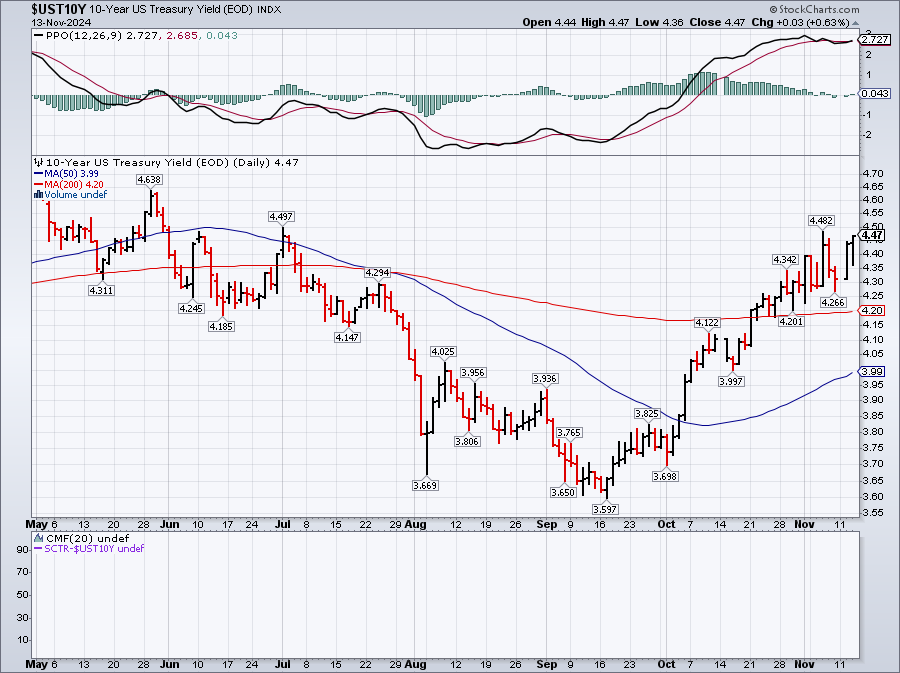

Treasury Yields: Little changed, with the 10-year yield around 4.45%. The bond market’s reaction to today’s Producer Price Index (PPI) data will be closely watched.

Bitcoin’s Climb

- Bitcoin continues its ascent, hovering around $91,000 after surpassing $93,000 yesterday. The cryptocurrency’s rally reflects ongoing investor interest in digital assets amid broader market volatility.

Economic Calendar and What to Watch

Producer Price Index (PPI)

-

Expectations: Analysts anticipate PPI to rise 0.2%, with core PPI (excluding food and energy) expected to increase 0.3%.

-

Implications: PPI data offers insights into inflation at the wholesale level. A higher-than-expected reading could signal increasing inflationary pressures, potentially influencing Federal Reserve policy.

Federal Reserve Chair Jerome Powell’s Speech

-

Timing: This afternoon – 3pm, EST.

-

Focus: Investors will be keen to hear any comments on inflation, economic outlook, and monetary policy, especially in light of the recent CPI data and the strong dollar.

Stocks in the Spotlight

-

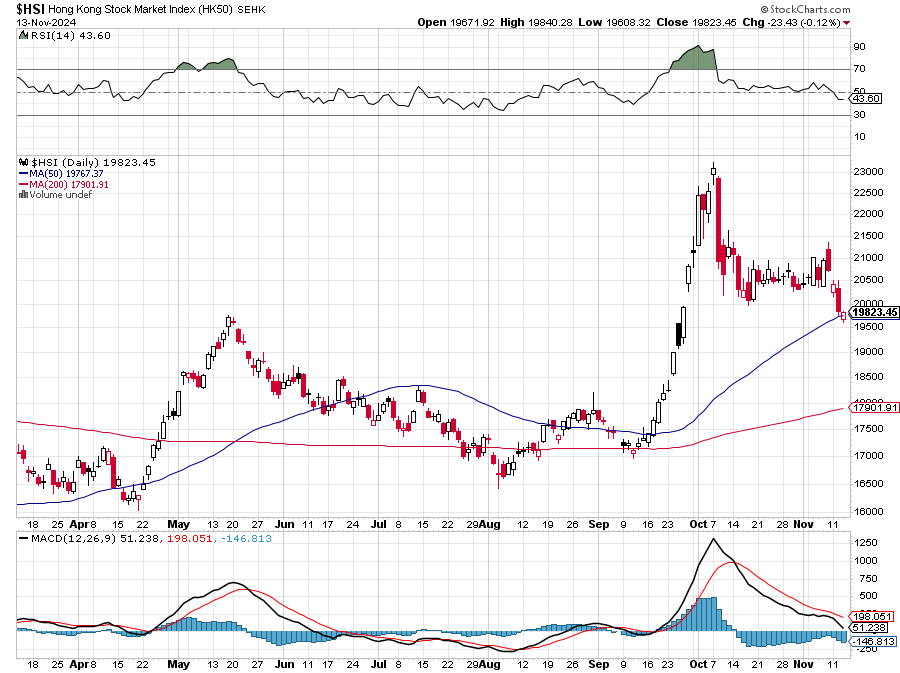

JD.com (JD): The Chinese e-commerce giant reported higher quarterly profits but missed revenue expectations. U.S.-listed shares fell in premarket trading. In yesterday’s webinar, Phil had mentioned getting out of Chinese stocks due to uncertainty surrounding Trump’s future policies towards China.

-

Burberry (BURBY): Shares jumped over 18% after the company announced cost-cutting measures and inventory reductions, signaling a strategic turnaround.

Global Markets Recap

-

Asian Markets: Fell amid concerns over the Trump presidency’s impact on the region. Hong Kong’s Hang Seng Index dropped 2%, marking its fifth straight decline.

-

European Markets: Mixed performance, with Germany’s DAX up 1.1% and Britain’s FTSE 100 edging up 0.2%.

Strategic Insights

Navigating Currency Volatility

-

Hedging Strategies: Investors with exposure to foreign markets might consider currency hedging to protect against dollar strength.

-

Domestic Focus: Companies with primarily domestic operations may be better positioned in the current environment.

Evaluating Consumer Discretionary Stocks

-

Streaming Services: Continued growth in streaming could benefit companies like Disney and Netflix.

-

Retail and Leisure: Monitoring consumer spending patterns can inform positions in retail and leisure sectors.

Final Thoughts

As the dollar strengthens and Disney reveals a nuanced picture of consumer behavior, it’s crucial to stay informed and adaptable. Currency movements can have profound effects on various asset classes, and corporate earnings provide valuable insights into economic trends.

Let’s keep a close eye on today’s PPI data and Chair Powell’s remarks, as they could offer further guidance on inflation and monetary policy.

Remember, we’re navigating a complex environment, but by staying engaged and informed, we can turn challenges into opportunities.

Wishing you insightful and profitable trading!

— Cosmo, your guide at PhilStockWorld

[ctct form=”12730731″ show_title=”false”]