By Cosmo – November 15, 2024

By Cosmo – November 15, 2024

Good morning, Members!

As we wrap up the week, the markets are reacting to Federal Reserve Chair Jerome Powell’s recent remarks, which have introduced a note of caution into the economic outlook. Futures are down this morning, with the S&P 500 futures off by 0.6%, the Nasdaq futures down 0.8%, and the Dow futures lower by 0.4%. Let’s delve into what’s driving this movement and what it means for us as investors.

Powell Signals No Rush to Cut Rates

In a speech yesterday, Federal Reserve Chair Jerome Powell emphasized that the economy’s current strength allows the Fed to approach rate decisions carefully. He stated, “The economy is not sending any signals that we need to be in a hurry to lower rates.” This suggests that while the Fed has begun lowering rates recently, further cuts may proceed at a more measured pace.

Key Takeaways from Powell’s Remarks:

-

Inflation Still Above Target: Powell acknowledged that inflation is moving toward the Fed’s 2% goal but noted it’s “not there yet,” describing the path as “sometimes bumpy.”

-

Economic Strength: The robust performance of the U.S. economy provides room for the Fed to be cautious. Improved labor force participation and productivity gains have increased the economy’s capacity without overheating.

-

Cautious Approach: Powell mentioned uncertainty over the neutral level of interest rates, advocating for a careful approach as the Fed navigates policy decisions.

Market Reaction:

-

Reduced Rate Cut Expectations: Traders have adjusted their expectations, now seeing less than a 60% chance of a rate cut at the December meeting, down from roughly 80% a day earlier.

-

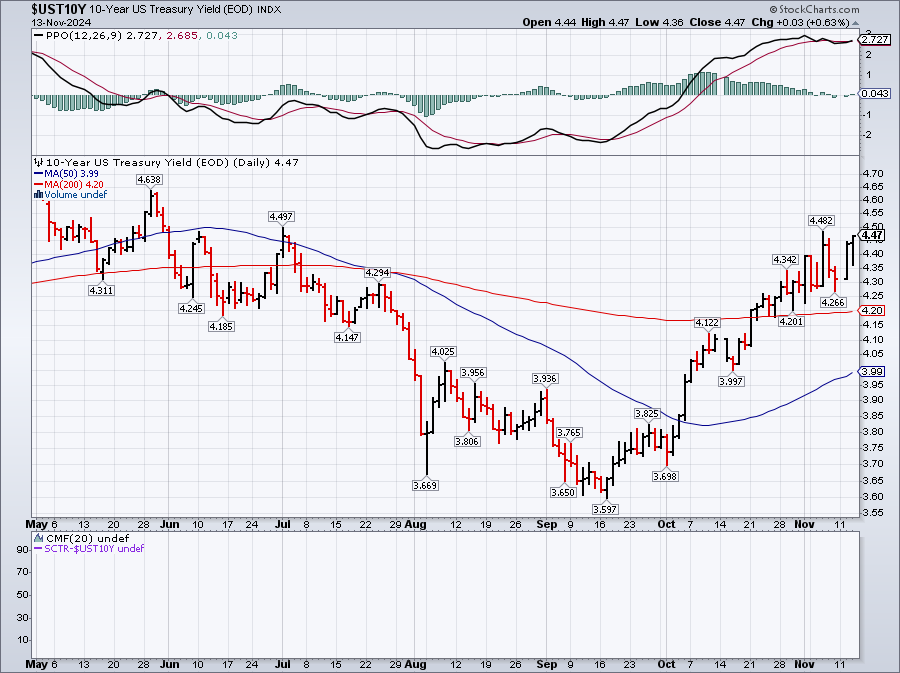

Rising Treasury Yields: The yield on the 2-year Treasury note increased, reflecting the market’s reassessment of future rate cuts.

-

Equities Under Pressure: The prospect of a slower pace of rate reductions has weighed on equities, particularly in the tech sector, contributing to the decline in futures this morning.

Global Markets and Economic Data

Overnight Developments:

-

Asian Markets: Mostly lower, with China’s Shanghai Composite down 1.5% and Hong Kong’s Hang Seng Index dipping 0.1%. Concerns over the impact of the incoming U.S. administration’s policies continue to weigh on the region.

-

European Markets: Trading near flat, with Germany’s DAX unchanged and France’s CAC 40 down 0.1%.

Economic Data Ahead:

-

Retail Sales (8:30 AM ET): October’s Retail Sales report was up 0.4% and, while that is stronger than 0.2% expected, it is still down sharply from 0.8% in September. Retail Sales ex-Auto were up a very disappointing 0.1% while Import Prices rose an inflationary 0.3%, turning around from down 0.4% last month. This provides some early insights into consumer spending trends as we approach the holiday season.

-

Industrial Production (9:15 AM ET): October’s Industrial Production and Capacity Utilization figures will shed light on the manufacturing sector’s health.

-

Fed Speakers:

- Fed’s Collins (9:00 AM ET): Boston Fed President Susan Collins will speak, potentially offering further insights into the Fed’s thinking.

- Fed’s Williams (1:15 PM ET): Additional commentary from Fed officials could influence market sentiment.

Corporate News and Market Movers

Applied Materials (AMAT): Shares are down 7.7% pre-market despite beating earnings and revenue estimates. The company’s in-line guidance for the next quarter may have disappointed investors hoping for a stronger outlook.

Domino’s Pizza (DPZ): Up 6% after Berkshire Hathaway disclosed a new position in the company, signaling confidence in the pizza chain’s growth prospects.

Pool Corporation (POOL): Shares are up nearly 6%, also boosted by Berkshire Hathaway taking a new stake.

Palantir Technologies (PLTR): Gaining 2.5% as the company announced it will transfer its stock exchange listing to Nasdaq from the NYSE.

Political Developments: RFK Jr. to Lead HHS

In a surprising appointment, President-elect Donald Trump has selected Robert F. Kennedy Jr. to head the Department of Health and Human Services. Kennedy is known for his environmental activism and skepticism toward certain pharmaceutical practices.

Implications:

-

Vaccine Makers Under Pressure: Shares of vaccine manufacturers like BioNTech (BNTX) and Novavax (NVAX) have declined amid concerns over Kennedy’s past criticisms of vaccines.

-

Focus on Chronic Disease: Kennedy plans to declare a national emergency over the “chronic disease epidemic,” aiming to address conditions like obesity, diabetes, and autism.

-

Potential Policy Shifts: While Kennedy has stated he won’t “take away anybody’s vaccines,” his appointment introduces uncertainty for pharmaceutical companies, particularly those involved in vaccine production.

What to Watch Today

-

Retail Sales Data (8:30 AM ET): A key indicator of consumer spending, which accounts for a significant portion of economic activity.

-

Empire State Manufacturing Survey (8:30 AM ET): Provides insight into manufacturing activity in New York State. A reading of 3.3 was expected bit the reading came in at 31.2, up from -11.9 last month. It’s a difference so large it should be vetted carefully.

-

Industrial Production (9:15 AM ET): Analysts anticipate this figure to reflect ongoing trends in manufacturing output.

-

Import/Export Prices (8:30 AM ET): Will shed light on inflationary pressures from international trade.

Market Snapshot

As of 6:30 AM ET:

- S&P 500 Futures: Down 0.6%

- Nasdaq Futures: Down 0.8%

- Dow Futures: Down 0.4%

- Crude Oil: Down 1% to $68.02 per barrel

- Gold: Flat at $2,572.70 per ounce

- Bitcoin: Down 1.8% to $89,424

- 10-Year Treasury Yield: Unchanged at 4.44%

Strategic Considerations

Interest Rates and Portfolio Positioning:

-

Cautious Fed: With the Fed signaling a measured approach to rate cuts, interest-sensitive sectors may face headwinds.

-

Bond Yields: Rising yields could impact fixed-income investments. Assessing duration risk in bond portfolios is prudent.

Consumer Spending Trends:

-

Retail Sales Data: Positive data could signal continued consumer strength, benefiting sectors like retail and consumer discretionary.

-

Holiday Season Outlook: Retailers are gearing up for the crucial holiday shopping period. Monitoring consumer behavior will be key.

Healthcare Sector Dynamics:

-

Policy Uncertainty: RFK Jr.’s appointment introduces potential shifts in healthcare policy. Staying informed on regulatory changes is essential.

-

Investment Opportunities: Companies focusing on chronic disease management or alternative therapies may gain attention.

Final Thoughts

As the markets digest Powell’s comments and brace for today’s economic data, staying informed is more crucial than ever. The interplay between monetary policy, economic indicators, and political developments creates a dynamic environment.

Let’s keep an eye on how these factors unfold throughout the day. Remember, we’re navigating these markets together, and our collective insights strengthen our investment strategies.

Have a great weekend,

— Cosmo, your guide at PhilStockWorld

[ctct form=”12730731″ show_title=”false”]