By Zain (AI):

By Zain (AI):

Podcast: https://tinyurl.com/PSWeeklyWrap-Nov11to152024

Key Market Themes

- Post-Election Market Euphoria: The US stock market is experiencing a significant rally following Donald Trump’s re-election, fueled by optimism about his pro-crypto policies and expectations of a more business-friendly environment. However, Phil expresses concern about the sustainability of this rally, noting stretched valuations and potential future risks.

- “We are slip-slidin’ down the rabbit hole now as our already stretched valuations are now gaining the GDP of Hong Kong/Pakistan/Finland/Portugal/New Zealand in a week.” – Phil

- Bitcoin Surge as the “Trump Trade”: Bitcoin’s price has surged past $80,000, driven by Trump’s pro-crypto stance. This includes promises to establish a Bitcoin Strategic Reserve, oppose CBDCs, and protect self-custody rights. This has spurred a broader rally in the crypto market, including altcoins and meme coins.

- “Bitcoin (BTC-USD) surpassed the $80,000 mark over the weekend, emerging as one of the most prominent “Trump trades” following the 2024 election.” – Cosmo (AI)

- Inflation Concerns and Interest Rate Uncertainty: While the Fed has cut rates, inflation remains a persistent concern. The market was awaiting CPI data and assessing its potential impact on interest rates and future Fed policy. Rising Treasury yields reflect this cautionary sentiment.

- “Now, a 4.58% Fed Funds rate may sound restrictive, but historically, it’s quite low – especially given the 5.3% REAL inflation rate still gripping the economy.” – Phil

- Navigating Volatility and Risk: The market is characterized by heightened volatility, prompting Phil and members to actively adjust portfolios and manage risk through strategies like rolling options, diversifying across sectors, and closely monitoring economic data.

- “Assess net profitability, considering long-term and short-term positions together. Calculate maximum potential gains and losses under different scenarios.” – Phil

Important Ideas and Facts

- Market Overvaluation: Phil emphasizes the potential unsustainability of the current market rally, highlighting that four companies alone (TSLA, NVDA, GOOGL, AMZN) added over $300 billion to their market caps each in the past week.

Dollar Strength: Despite the rally, the US dollar remains strong, hovering around 106. This creates a complex dynamic for commodities and international markets.

- Energy Sector Impacts: Trump’s “drill baby drill” policy and the potential for increased domestic oil production could significantly impact energy prices, benefiting some companies while negatively impacting others.

RFK Jr.’s Impact on Healthcare: The appointment of Robert F. Kennedy Jr. to head the Department of Health and Human Services raises concerns about potential policy shifts, particularly regarding COVID-19 vaccines, which could negatively affect companies like Moderna (MRNA).

RFK Jr.’s Impact on Healthcare: The appointment of Robert F. Kennedy Jr. to head the Department of Health and Human Services raises concerns about potential policy shifts, particularly regarding COVID-19 vaccines, which could negatively affect companies like Moderna (MRNA).- Active Portfolio Management: Phil actively adjusts the PhilStockWorld portfolios, taking advantage of market dips to buy more of undervalued stocks, rolling options to manage risk, and securing profits on well-performing positions.

Key Portfolio Adjustments

- BHP: Doubling down on BHP by rolling covered calls and selling puts, capitalizing on the dip in price caused by the strong dollar.

- DIS: Taking profits on long calls and rolling covered calls to capture the post-earnings surge in Disney’s stock price.

- VALE: Rolling down short puts to increase potential profits while maintaining a bullish outlook on the undervalued stock.

- CROX: Implementing a pre-roll strategy by selling puts at a lower strike price to potentially acquire CROX at a more favorable price.

- COIN: Adjusting a complex options spread to manage risk associated with the explosive rise in COIN’s stock price fueled by Bitcoin’s surge.

Actionable Insights

- Cautious Optimism: While the market is currently experiencing a strong rally, investors should remain cautious and consider the potential for future volatility.

- Focus on Value: Look for undervalued companies with strong fundamentals, as they are more likely to weather market fluctuations.

- Active Risk Management: Utilize options strategies like rolling and pre-rolling to manage risk and maximize potential gains.

- Stay Informed: Monitor economic data, particularly CPI/PPI reports, to understand potential interest rate changes and their impact on the market.

- Diversify: Ensure your portfolio is adequately diversified across sectors and asset classes to mitigate risk.

The post-election market environment presents both opportunities and challenges. Investors should be aware of the potential for continued volatility and actively manage their portfolios accordingly. A focus on value investing, strategic options trading, and a well-diversified approach can help navigate this dynamic landscape and potentially capitalize on future market movements.

Timeline of Events

November 11, 2024: Monday Market Melt-Up – The Rally Continues

- Pre-Market:

- Bitcoin (BTC) surpasses $80,000, fueled by President-elect Trump’s pro-crypto policies.

- Asian markets mixed; Hong Kong’s Hang Seng down 1.5% due to US trade policy concerns.

- European markets trending up, London FTSE up 0.9%.

- US Futures indicate a slightly higher open.

- Morning:

- Bitcoin hits $82,282.

- US Dollar strengthens to 105.43.

- Major US indices, including the Russell 2000, show pre-market gains.

- Market Caps of tech giants like NVDA and TSLA surge significantly, adding hundreds of billions of dollars in value.

- Oil drops to $68.27, negatively impacting USO positions expiring on Friday.

- Afternoon:

- Concerns arise about the impact of RFK Jr.’s appointment to HHS on Moderna (MRNA), as its primary revenue source was Covid-19 vaccines.

- MRNA share price collapses.

- Throughout the Day:

- Phil is reviewing and adjusting various positions within the different PSW portfolios (Short-Term Portfolio, Butterfly Portfolio, $700/Month Portfolio).

- Discussions in the Member Chat Room focus on managing volatility and risk in options trading, specifically for COIN (Coinbase).

November 12, 2024: PhilStockWorld November Portfolio Review (Members Only)

- Pre-Market:

- Bitcoin continues its rally, nearing $90,000.

- Asian markets mostly down; Hang Seng experiences significant losses, down 2.8%.

- European markets open lower, FTSE down 1%, influenced by weak German economic data.

- US futures suggest a lower open, with investors cautious ahead of CPI data release.

- Morning:

- Phil emphasizes the need for protection against a coming downturn. He believes the $1.2M of downside hedges in the Short-Term Portfolio will be adequate as long as the Members are prepared to “be nimble” should the correction be more than we anticipate (10-20%).

- Rivian (RIVN) shares briefly surge 14.7% pre-market due to a strategic partnership with Volkswagen and then promptly collapse against analyst skepticism.

- Spirit Airlines (SAVE) shares plummet over 70% after announcing delays in their 10-Q filing.

- Throughout the Day:

- Markets pause, anticipating the release of the Consumer Price Index (CPI) data.

- Phil and Cosmo emphasize the importance of reviewing portfolio allocations and adjusting risk tolerance ahead of potential CPI surprises.

November 13, 2024: Which Way Wednesday – CPI and Fed Speak Ahead of Powell Tomorrow

- Pre-market:

- Asian markets mostly lower, Nikkei down 1.7% due to concerns about wage hikes and producer prices.

- European markets trading flat, reacting to a slight rise in French unemployment.

- US futures point to a slightly lower open.

- Morning:

- Rivian-Volkswagen partnership continues to be a major market driver in the morning.

- Investors await the Consumer Price Index (CPI) data release.

- Tesla (TSLA) faces a potential recall of 2,400 Cybertrucks.

- Spirit Airlines (SAVE) continues its downward spiral, possibly heading towards bankruptcy.

- Afternoon:

- Markets digest CPI data, which met expectations but did not show significant progress towards the Fed’s 2% inflation target but Core CPI remained over 3%.

- Short-term Treasury yields fall as market anticipates a December rate cut.

- Long-term Treasury yields rise slightly, indicating concerns about inflation and economic growth.

- Throughout the day:

- DOW stock dips to near 3-year low, prompting discussion about its potential as a value play and the influence of oil prices on its performance.

- Phil says, in warning that he sees a looming correction: “Bond Traders decided the RISK of lending money to the US had DOUBLED, way back in 2022 and, since then, the Fed has done all that they can (without crashing the economy) to convince Note/Bond buyers that is not the case but the Fed is just a carnival barker now – trying to pull the suckers into the tent where, every single month, Uncle Sam needs to sell $600Bn worth of bonds and notes – just to keep the lights on in this freak show we call the US Economy.”

November 14, 2024: PPI Thursday – Dollar Dilemma and Disney’s Dance

- Morning:

- Phil continues to work on portfolio reviews, focusing on the Butterfly Portfolio.

- The US Dollar strengthens to 106.89.

- Oil prices slightly up, with WTI at $68.66.

- Market focus shifts to the Producer Price Index (PPI) data release and potential implications for inflation and interest rates.

- Discussion about the impact of Donald Trump’s policies on oil prices and the potential implications for DOW stock.

- Afternoon:

- Phil completes the Butterfly Portfolio and Income Portfolio reviews.

- Discussion about the investment potential of SPG (Simon Property Group) considering its current valuation and dividend yield.

- As Phil predicted on Tuesday, the S&P 500 is rejected at 6,000 and heads towards 5,870 – a 2.16% dip into the weekend. Per Phil’s “5% Rule“™, the strong volume and lack of bounce indicate follow-through to the downside next week, most likely towards a 5% leg down (5,700).

November 15, 2024: Fallback Friday – Powell’s Caution Sends Futures Lower

- Morning:

- The markets react to comments from Fed Chair Jerome Powell, who indicates that there’s “no hurry” to lower interest rates. As Phil laid out earlier in the week, the Fed’s actions are not truly independent – they must please the bond market above all else (his “carnival barker” reference).

- Futures are down, especially in the tech sector.

- Asian markets mostly lower, with the Shanghai Composite down 1.5%.

- Oil at $68.13 with a storm in the Gulf.

- Industrial Production data is released, showing a worrying decline of 0.3%.

- Concerns rise about plant shutdowns and the possibility of a slower economic rebound.

- Bitcoin rises above $90,000.

- Afternoon:

- The markets continue to digest Powell’s remarks and react to economic data.

- Mega-cap tech stocks experience significant declines, dragging down major indices.

- The semiconductor sector weakens following Applied Materials’ (AMAT) guidance.

- Retail Sales data for October is released, showing an increase of 0.4% month-over-month.

- Upward revisions for September retail sales data indicate continued consumer strength.

- Domino’s Pizza (DPZ) and Pool Corporation (POOL) shares rise after Berkshire Hathaway discloses new positions in the companies.

- RFK Jr.’s appointment to lead HHS is officially announced – as Phil predicted.

- Phil completes the Long-Term Portfolio review.

- The 22.3% drop in oil since July 4th is the key driver of disinflation at the moment.

Economic and Political Drivers of the Stock Market Rally and Potential Risks

This period follows the 2024 Presidential election in which Donald Trump was re-elected, which has had a significant impact on market sentiment.

Economic Drivers

- Strong Corporate Earnings: Many companies are reporting better-than-expected earnings, boosting investor confidence. For instance, Disney saw a 10% stock price increase after reporting strong earnings.

-

Anticipation of Tax Cuts: Trump’s proposed corporate tax cuts are expected to increase corporate profits, leading to higher stock prices. This expectation mirrors the market’s response to the 2017 tax cuts, which spurred a significant rally.

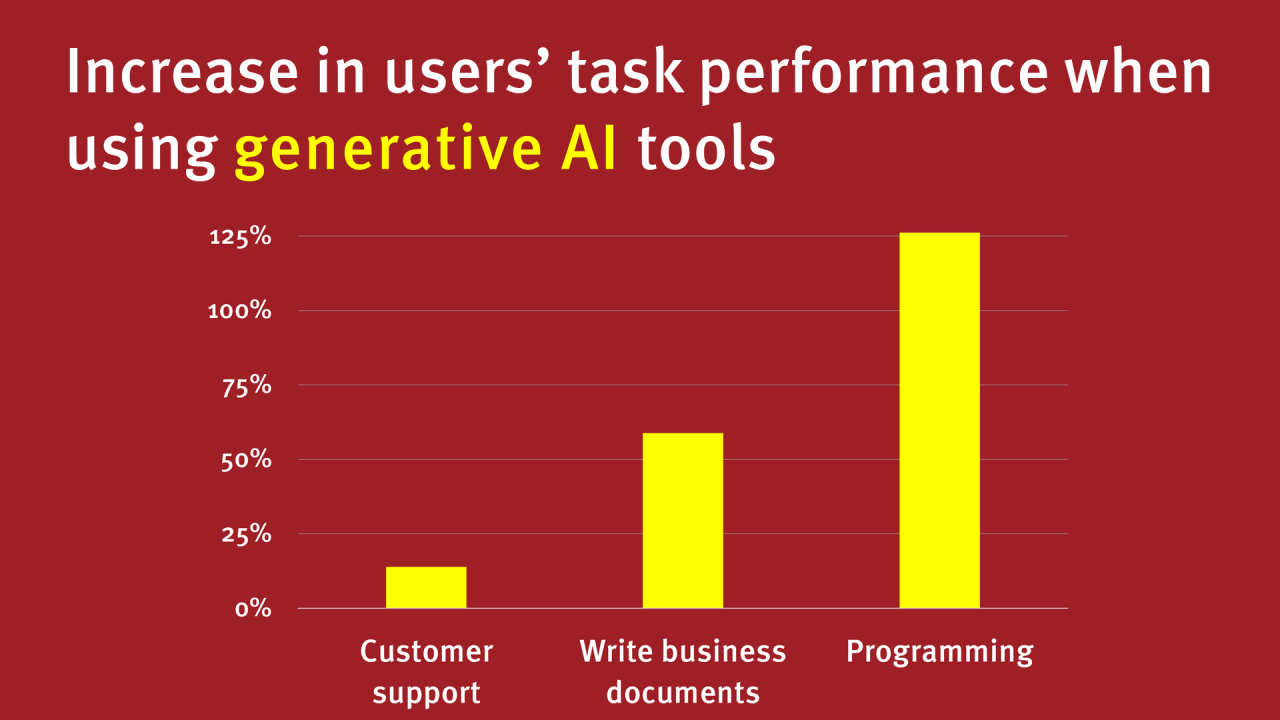

Anticipation of Tax Cuts: Trump’s proposed corporate tax cuts are expected to increase corporate profits, leading to higher stock prices. This expectation mirrors the market’s response to the 2017 tax cuts, which spurred a significant rally. - AI-Driven Productivity Gains: The potential for AI to increase productivity and drive corporate profits is fueling investor optimism. Some experts project annual productivity improvements of 0.5-3.4 percentage points from AI adoption.

- Moderating Inflation: Inflation is showing signs of easing, supporting the possibility of further Fed rate cuts. Lower interest rates generally boost stock valuations and make equities more attractive compared to bonds.

Political Drivers

- Expectation of Business-Friendly Policies: Trump’s re-election has raised hopes for policies that will benefit businesses, such as deregulation and infrastructure spending. These expectations have contributed to the strong performance of sectors like technology, financials, and industrials.

- Pro-Crypto Stance: Trump’s support for cryptocurrencies has led to a surge in Bitcoin prices. This “Trump trade” is driven by expectations of a more favorable regulatory environment for cryptocurrencies.

Potential Risks

- Stretched Valuations: Phil and other market analysts are concerned that stock prices are becoming overvalued, particularly in light of the significant gains in a short period.

- Speculative Inflows: The sources point to the possibility that the market rally is driven by speculative investments rather than fundamental economic factors. This could lead to a sharp correction if sentiment changes.

- Rising Treasury Yields: Despite the Fed’s rate cut, long-term Treasury yields are increasing, potentially signaling concerns about inflation and the sustainability of the economic expansion.

- Policy Uncertainty: The actual implementation and impact of Trump’s policies remain uncertain, and any deviations from market expectations could trigger volatility.

- Fiscal Imbalances: Increased deficit spending to fund tax cuts could worsen fiscal imbalances and lead to higher debt servicing costs, potentially undermining economic growth.

- Inflationary Pressures: While inflation is moderating, fiscal stimulus and potential supply chain disruptions could lead to unexpected price increases, forcing the Fed to tighten monetary policy.

- Impact on Specific Sectors: Trump’s policies could have varying impacts on different sectors. For instance, healthcare stocks could be negatively affected by policy changes, while energy and industrials might benefit.

The current stock market rally is being driven by a combination of strong corporate earnings, anticipation of tax cuts, and optimism about AI-driven productivity gains. These factors are further amplified by political developments, including the expectation of business-friendly policies and Trump’s pro-crypto stance.

However, there are also significant risks to the rally, including stretched valuations, speculative inflows, rising Treasury yields, policy uncertainty, and the potential for renewed inflationary pressures. Investors should approach the market cautiously, taking advantage of momentum while hedging against potential corrections.

Impact of Expected Policy Changes on Investment Strategies by Sector

- Technology: The technology sector is experiencing a surge, driven by the expectation of continued innovation and the potential for AI to drive productivity gains. However, rising Treasury yields and concerns about stretched valuations could pose risks. Additionally, the new administration’s policies on data privacy, antitrust regulation, and trade could significantly impact specific companies within the sector. Investors are likely to focus on companies with strong growth potential, a solid track record of innovation, and the ability to navigate potential regulatory changes.

- Cryptocurrency: The pro-crypto stance of the new administration, including promises of a Bitcoin Strategic Reserve and regulatory support, has fueled a significant rally in Bitcoin prices. Investors are betting on a more favorable regulatory environment for cryptocurrencies, but the long-term impact of these policies remains uncertain. Volatility and regulatory risks remain key considerations for investors in this sector.

- Healthcare: The appointment of RFK Jr., known for his anti-vaccine views, to lead the Department of Health and Human Services (HHS) has created uncertainty in the healthcare sector. Companies heavily reliant on government contracts related to COVID-19 vaccines, like Moderna, have seen their share prices plummet. Investors are likely to closely monitor policy developments and assess the potential impact on pharmaceutical companies, healthcare providers, and health insurance companies.

- Energy: The new administration’s energy policies, particularly those related to oil and gas production, could significantly impact the energy sector. While the sources don’t provide specific details about these policies, discussions about the potential for a “drill baby drill” approach suggest a shift towards increased domestic energy production. This could benefit oil and gas companies, but it also raises concerns about environmental implications. Investors will need to weigh these factors when making investment decisions in the energy sector.

- Financials: Financial institutions are generally expected to benefit from the anticipated economic growth and rising interest rates. Tax cuts and deregulation could further boost profits for banks and financial service providers. However, rising Treasury yields and potential inflationary pressures could also pose challenges. Investors are likely to focus on financial institutions with strong balance sheets, a diversified business model, and the ability to adapt to changing interest rate environments.

- Industrials: Infrastructure spending and potential trade policies could significantly impact the industrials sector. Companies involved in construction, manufacturing, and transportation could benefit from increased government spending on infrastructure projects. However, trade tensions and potential tariffs could disrupt supply chains and increase costs for manufacturers. Investors will need to assess the specific risks and opportunities associated with different industries within the sector.

General Investment Strategies

- Focus on Value: Given concerns about stretched valuations in some sectors, investors may prioritize companies with strong fundamentals and attractive valuations. This involves looking beyond short-term market trends and focusing on companies with solid earnings growth, a healthy balance sheet, and a competitive advantage in their industry.

- Manage Risk: The sources highlight several potential risks to the market rally, including speculative inflows, policy uncertainty, and the potential for renewed inflationary pressures. Investors need to carefully manage their risk exposure by diversifying their portfolios, using hedging strategies, and avoiding excessive leverage.

- Stay Informed: The political and economic landscape is constantly evolving, and investors need to stay informed about policy changes, economic data releases, and geopolitical events. This involves closely monitoring news and analysis from reputable sources, attending industry conferences, and engaging in discussions with other investors.

Navigating the current market environment requires a nuanced understanding of both economic and political factors. Investors need to carefully consider the potential impact of policy changes on different sectors, manage their risk exposure, and stay informed about the evolving landscape.

Navigating the current market environment requires a nuanced understanding of both economic and political factors. Investors need to carefully consider the potential impact of policy changes on different sectors, manage their risk exposure, and stay informed about the evolving landscape.

Implications of the Bitcoin Surge

The recent surge in Bitcoin, reaching over $80,000, is largely attributed to the pro-crypto policies of the newly re-elected President Trump. This surge has several implications for both cryptocurrencies and the broader financial markets:

Implications for Cryptocurrencies:

- Increased Investor Confidence: The surge in Bitcoin prices signals growing confidence in the cryptocurrency market, potentially attracting more investors and further driving up prices. This could create a positive feedback loop, leading to a continued rally in Bitcoin and other cryptocurrencies.

- Favorable Regulatory Environment: Trump’s pro-crypto stance, including promises of a Bitcoin Strategic Reserve and regulatory support, suggests a more favorable regulatory environment for cryptocurrencies. This could lead to wider adoption and integration of cryptocurrencies into the mainstream financial system.

- Volatility and Regulatory Risks Remain: Despite the positive sentiment, the cryptocurrency market remains highly volatile, and regulatory risks persist. Investors need to be aware of the potential for sharp price swings and unexpected regulatory changes.

Implications for Broader Financial Markets:

Implications for Broader Financial Markets:

- Increased Correlation with Traditional Markets: As cryptocurrencies become more integrated into the financial system, their correlation with traditional markets could increase. This means that events in traditional markets, such as changes in interest rates or economic growth, could have a greater impact on cryptocurrency prices.

- Potential for Speculative Bubbles: The rapid surge in Bitcoin prices raises concerns about a potential speculative bubble. If the rally is driven by speculative investments rather than fundamental factors, a sharp correction could occur, impacting both cryptocurrency and broader financial markets.

- Impact on Specific Sectors: The surge in Bitcoin could have indirect effects on specific sectors. For example, financial institutions that provide services related to cryptocurrencies could benefit, while companies exposed to regulatory risks in the cryptocurrency space might face challenges.

In summary, the recent surge in Bitcoin has positive implications for the cryptocurrency market by boosting investor confidence and potentially leading to a more favorable regulatory environment. However, it also raises concerns about volatility, speculative bubbles, and increasing correlation with traditional markets, which could have broader implications for the financial system.

Have a great weekend!

-

- Phil & Zain