Speaking of shopping:

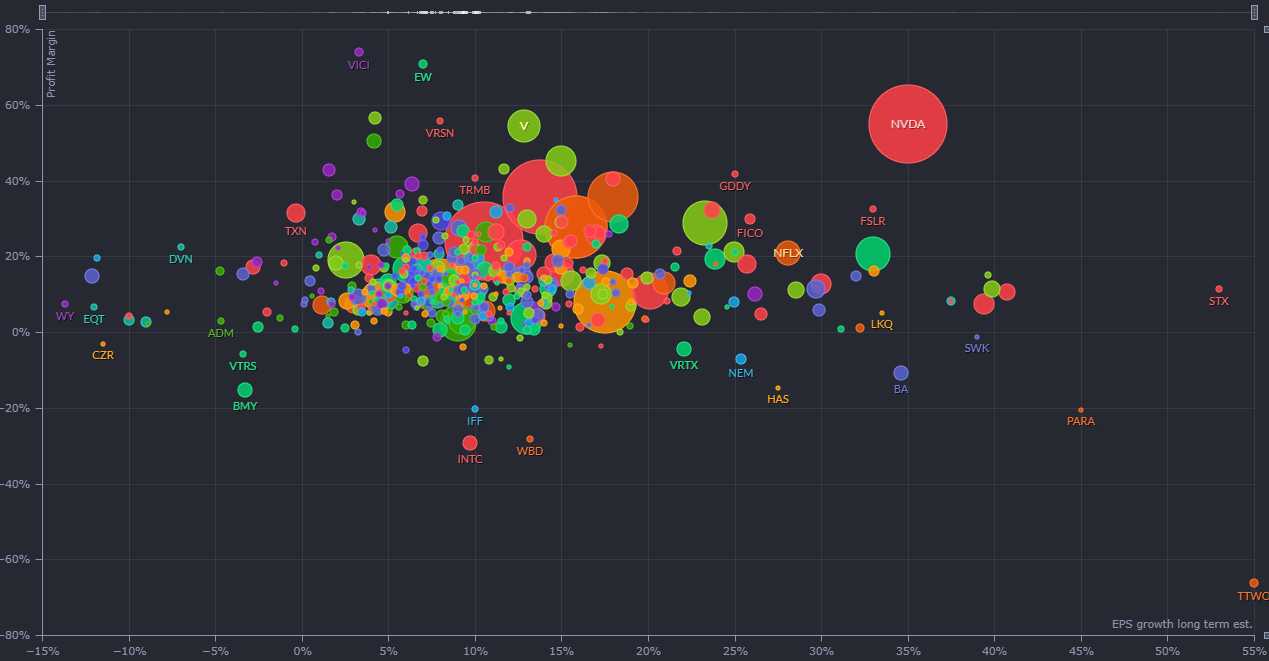

This week kicks off November Madness at PhilStockWorld – where we begin the process of picking our 2025 Trade of the Year and, as you can see from the P/E Chart of the S&P 500 – most of these stocks are on the naughty list – trading well over 20x their earnings (5% ROI) while bonds are paying 4.5% “risk free” (a whole other discussion). Any stock trading over 25x is not paying you as much as a 10-Year Note – how long is that going to last?

While it’s very exciting (or, at least – interesting) that we are about to start 4 more years of Trump, the S&P 500 has already given back 2/3 of the gains since he was elected – a very short-term sugar rush indeed. Health Care has led us lower as Robert Kennedy running HHS does not give investors the warm fuzzies in that sector. Utilities are leading the upside but they are safety stocks so post-election is already looking like a bust, not a boon.

That’s because, once you take a second to think about things, you might realize that Tariffs are just taxes and the US already produces 13M barrels of Oil per day and that’s as much as we use domestically – so drilling more only works if we export more and flooding the World with more oil leads to lower prices (OPEC knows this, why don’t we?) and that means LESS profits for the energy sector, not more…

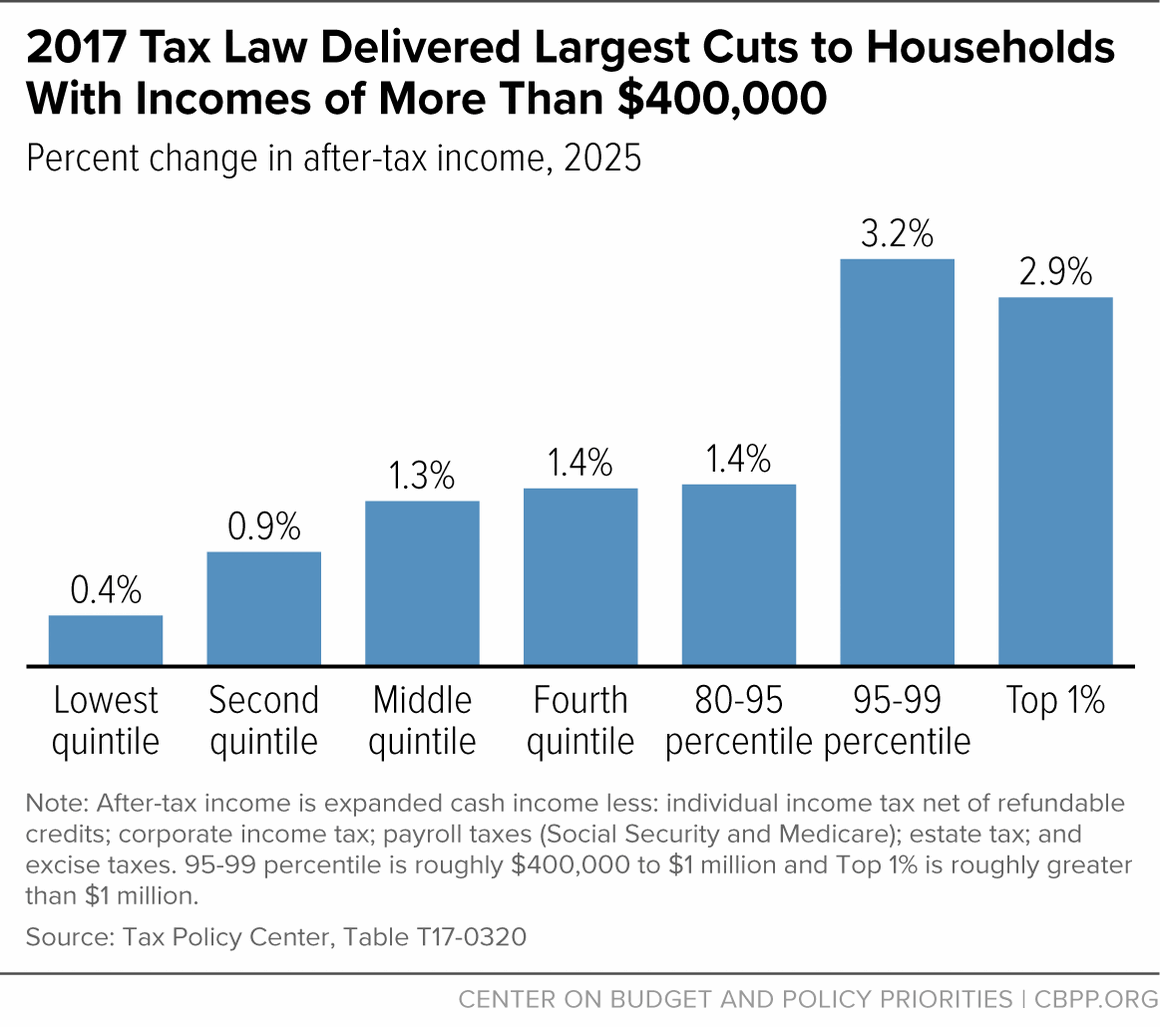

Tax cuts always sound great but the benefits go to those who need it the least but the $8.4Tn deficit they caused (25% of our current national debt) are a burden that is equally shared by all taxpayers ($50,909 per taxpayer). Extending Trump’s previous tax cuts for 4 more years will increase our debt by another $8Tn and another $50,000 per taxpayer will one day be required to pay off that bill as well.

Tax cuts always sound great but the benefits go to those who need it the least but the $8.4Tn deficit they caused (25% of our current national debt) are a burden that is equally shared by all taxpayers ($50,909 per taxpayer). Extending Trump’s previous tax cuts for 4 more years will increase our debt by another $8Tn and another $50,000 per taxpayer will one day be required to pay off that bill as well.

Chasing down all the immigrants and locking them in detainment camps and sending them back to countries they sacrificed everything for to escape may sound like a good time but those people fill US jobs and we are already short 8M workers so it’s only going to increase our labor shortage (no matter how many women we force to have babies – unless perhaps we increase the raping?) and THAT is the leading cause of more Inflation (the labor shortage – not the raping – go right ahead with that!).

Causes, unfortunately, have effects but America is no longer a country known for it’s chess-playing. We’re more of a checkers sort of country. Maybe tick-tac-toe? Yes, tick-tac-toe – there’s a chicken in Atlantic City who can do that…

Anyway, with so few bargains out there, this will be an easy year to pick our 2025 Trade of the Year. Looking at the companies with expected growth and good profit margins, we have leaders like NVDA (of course), V, MA, META, ANET, BRK.B, PANW, GDDY, FICO, FSLR… And, already, we know NVDA is already priced to perfection and FSLR may end up caught in a combination of trade war and the termination of Biden’s solar incentives…

Don’t worry, we’ll figure it out…

For now, let’s turn our attention to the week ahead as we still have plenty of earnings reports to pay attention to, including: WMT, TGT, LOW, MDT, NVDA!, SNOW, TJX, WSM, PANW, JACK, BIDU, DE, WMG, GAP…

AND, Spirit Airlines (SAVE) are going Bankrupt – just before Thanksgiving – that will be fun! Supposedly, they have a deal that will keep them operating but I’d be very concerned about them fulfilling my trip – so be careful!

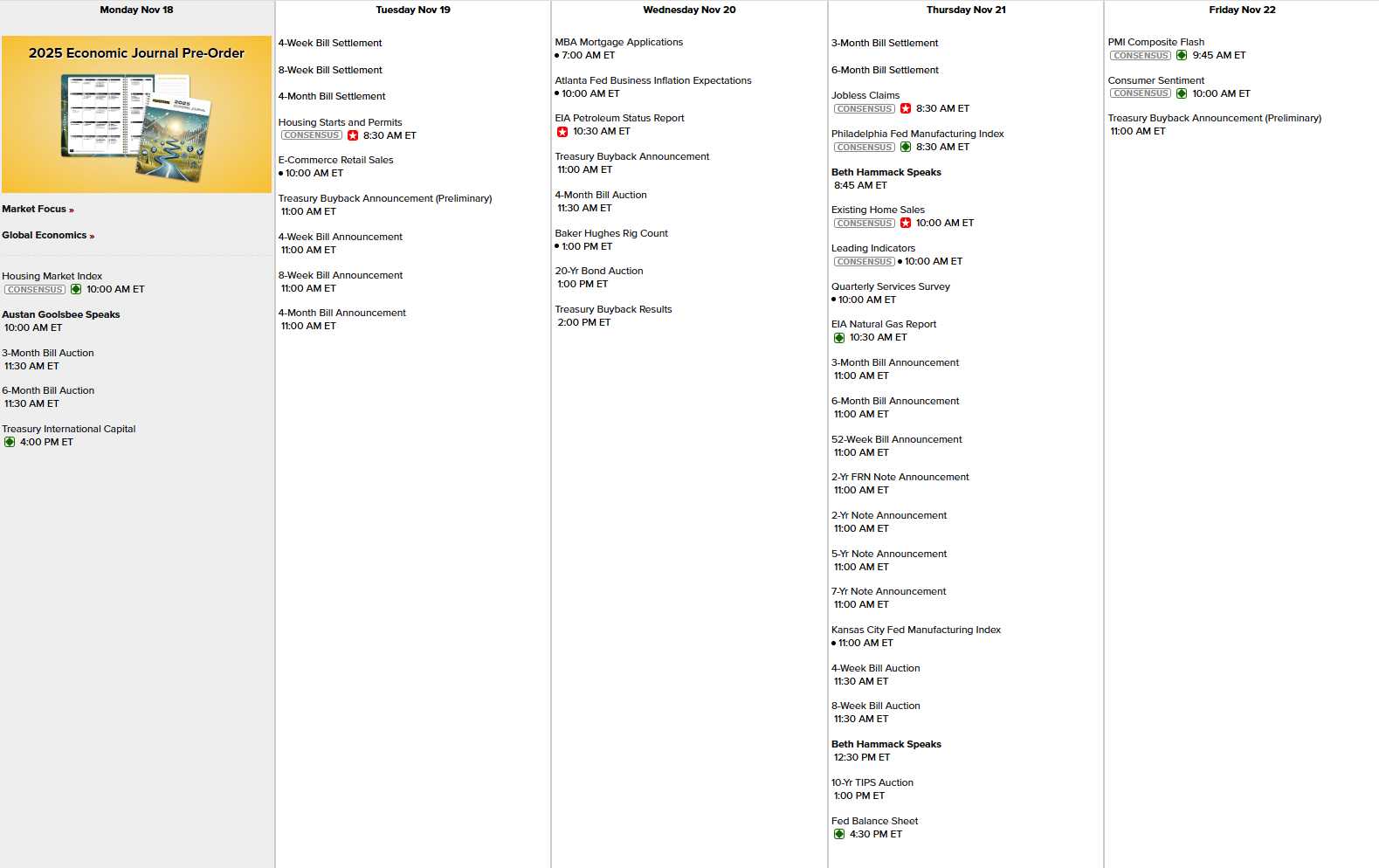

It is NOT a very exciting data week with just Goolsbee and Hammack (twice) speaking for the Fed. I guess they figure Powell did enough damage last week – no reason to do more, right?

There are short-term Bill auctions during the week but a 20-Year Bond Auction on Wednesday needs to be watched closely along with Thursday’s 10-Year TIPS. Some Housing Data, Atlanta, Philly & KC Fed Reports and Friday, finally, there’s something to look at with PMI and Consumer Sentiment.

It’s worth noting now that next week (Thanksgiving) is going to be weird, with ALL of the data smooshed into Tuesday and Wednesday – the only days anyone will be working in the US (and only half of Wednesday). Wednesday morning will be CRAZY with Personal Income/Spending, PCE, Durable Goods, GDP and Pending Home Sales – don’t miss that!

The Atlanta Fed has raised their GDPNow Forecast for Q4 all the way back to 2.4% from 1.6% back in September. Next Wednesday we get the 2nd estimate of the Q3 GDP, which came in hot at 2.8% last month as we’ve had no soft landing – more like no landing at all as this economy is still flying – albeit very unevenly and we left 80% of the passengers at the gate but wheeeee! – what a ride!

The Atlanta Fed has raised their GDPNow Forecast for Q4 all the way back to 2.4% from 1.6% back in September. Next Wednesday we get the 2nd estimate of the Q3 GDP, which came in hot at 2.8% last month as we’ve had no soft landing – more like no landing at all as this economy is still flying – albeit very unevenly and we left 80% of the passengers at the gate but wheeeee! – what a ride!

Zain (AI) wrote a very nice Weekly Wrap-Up this weekend along with a podcast that can get anyone up to speed as we barrel into the end of the year. We will be using his analysis of the changing political landscape and the likely effect on individual sectors in formulating our picks for 2025 and beyond – come join us!

-

- Phil

Sign Up for Updates

Get the latest stock market news from Phil by signing up for our newsletter!

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact