We're looking for our 2025 Trade of the Year.

We're looking for our 2025 Trade of the Year.

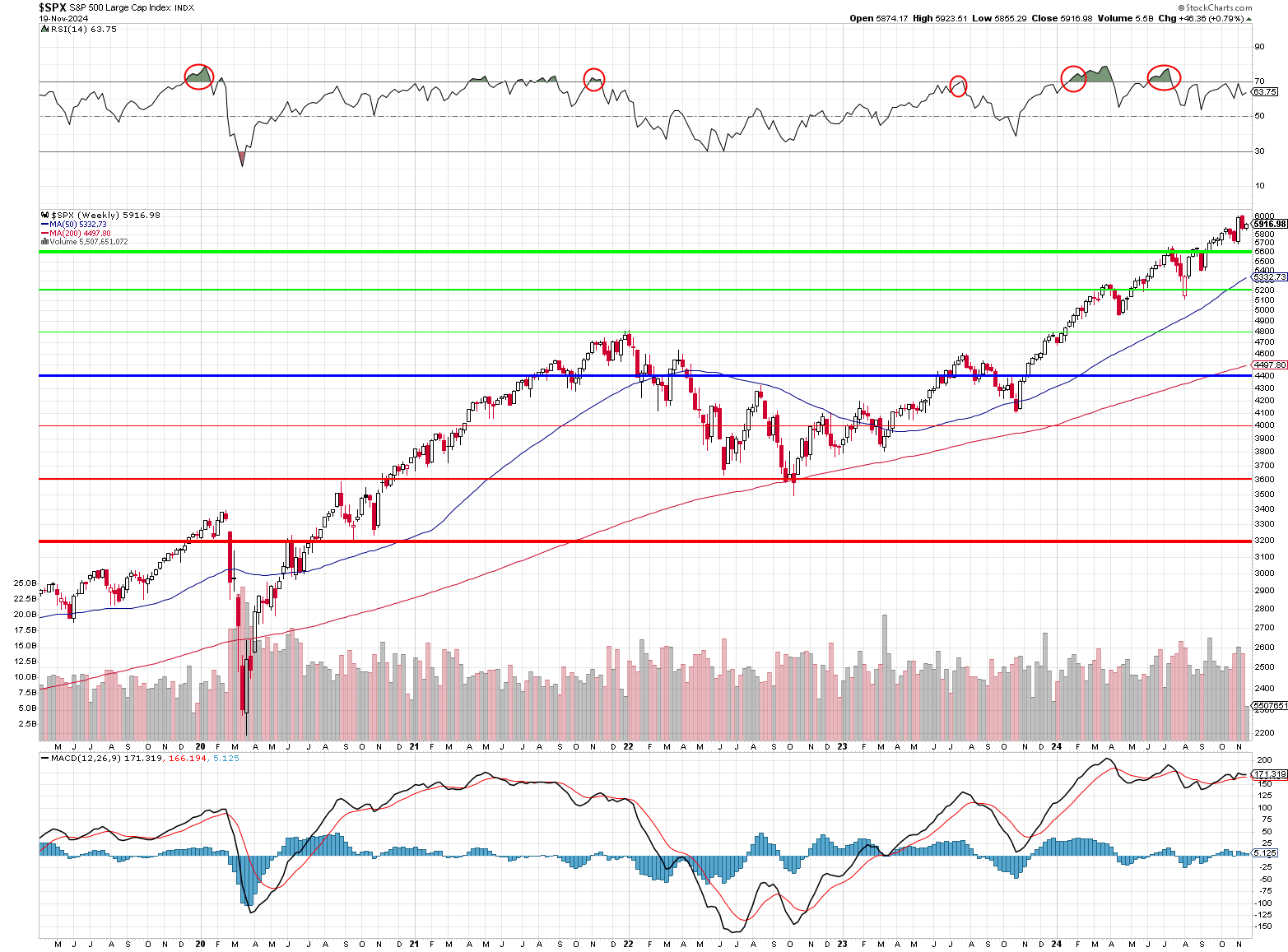

Our last Watch List was published on July 10th, following up on our main list (like this one) from Dec 27th, 2023 and now it's time to take a long hard look at what stocks are still buyable - and it's going to be a short list this year, for sure! The S&P was kissing 4,800 in December and 5,200 in July but now we're at the 6,000 line - up 25% for the year!

Keeping in mind that 8% is a "normal" market year - that's 3 years worth of gains in 11 months and yes, we did do that from 2020 to 2022 but that was 21 months and involved $11Tn in stimulus to get us there and we STILL pulled back from 4,800 to 3,600 (25%) in 2022 and this run hasn't pulled back at all - yet. That makes it a LOT harder to pick winners for the next 12 months.

When we add a stock to one of our Member Portfolios, it generally begins with the sale of a put, to give us an even lower net entry price (see “How to Buy a Stock for a 15-20% Discount“) and then we build a position from that over time (see our Strategy Section). With the entire S&P 500 up 20% since December, bargains are certainly harder to find – but they’re out there…

For our Watch List, we look for Blue-Chip type companies with low debt, low p/e and reasonable anticipated growth. I’m including legacy prices in the descriptions (in the brackets), so we’ll know at what price we began watching – regardless of the date we began.

We're going to start with what worked and what didn't in 2024 and THEN we'll move onto the macro view and THEN we'll move on to the analysis and, HOPEFULLY, we'll be done with this post around Thanksgiving - so expect to come back frequently for updates...