3.8%

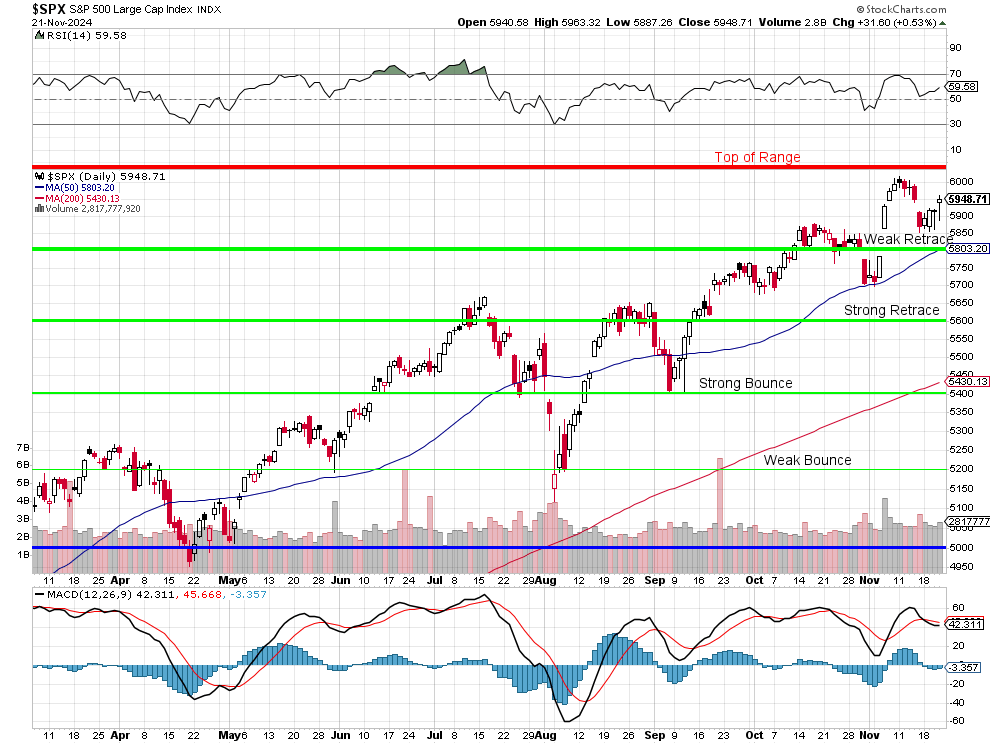

That’s how much the S&P 500 is up since the election (and earnings) so nothing to complain about and the S&P is about 0.5% behind the other indexes and all of them are way behind the Russell 2000, which is up 7.6% since Trump won on November 5th. Overall, the indexes are the same over-bought messes they were BUT, now there is hope – hope of lower taxes, less regulation, etc. with Big Business getting many seats at the table in the Trump 2 Cabinet.

So, we may be on the way to a new range from 6,000 to 7,200 but that requires a full week of closings above 6,000 before we’d even consider it and we’ve already been rejected there on the 11th but next week is a low-volume week and if “THEY” want the Thanksgiving (Thursday) conversations around the US to be about the record-high markets to kick off the next round of FOMO (Fear of Missing Out) – then “THEY” have a very low-volume holiday week ahead to jam things higher.

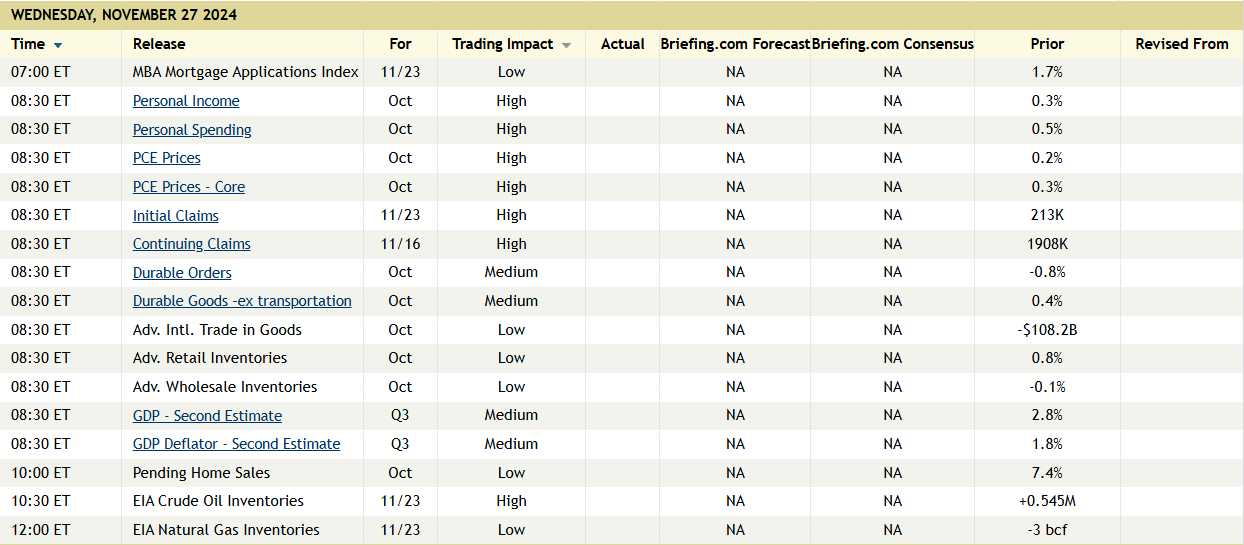

Generally, Wednesday before Thanksgiving people are already getting ready for the holiday or traveling and Friday the market is only open until 1pm so why bother? On the data front next week we have a crazy busy Wednesday that looks like this:

And that comes AFTER Consumer Confidence and Housing Data on Tuesday. Friday is so not a thing in America that the Natural Gas Inventories have been moved UP to Wednesday (usually Thursday) rather than back to Friday because NO ONE takes the Friday after Thanksgiving seriously… Except shoppers!

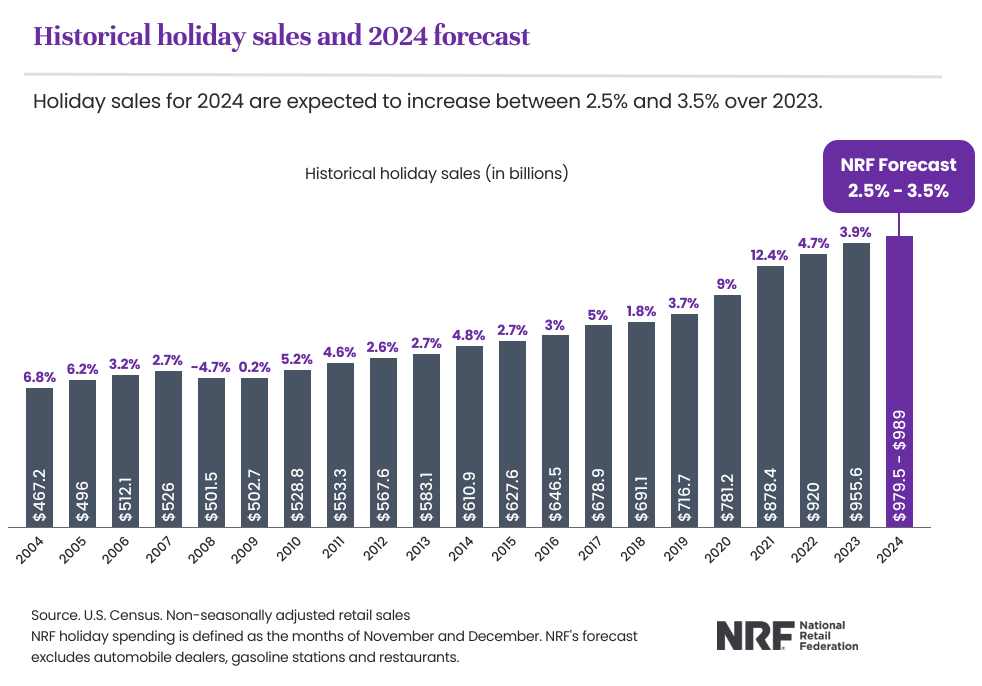

That’s right, the Friday after Thanksgiving is Black Friday and that’s the day that, theoretically, Retailers finally get into the black for the year and then they have one month to make all their money for the year. So yes, we will pay A LOT of attention to Tuesday’s Consumer Confidence report because, if there is anything that is likely to derail Trump’s rally – it’s a failure in the Retail Sector between Black Friday and Cyber Monday.

According to Forrester, Total Holiday Retail Sales will top $1,000,000,000,000 and that’s up 3.7% from 2023 with on-line sales at $250Bn (25%) and that’s up 10.1% from last year (good for Bezos). A recent US Federal Reserve study shows that wealthier households are the primary drivers of US Retail Sales, supported by rising asset prices, particularly in housing and stocks.

For the little people, Consumer Behavior is shifting, with 53.2% of purchases now made on-line but 75% of the shoppers have said they are looking for sales, up from 61% last year and that behavior can impact margins substantially, though the average consumer is planning to spend $1,778 this holiday season and that is up 8% from last year (though there may be sticker shock at the grocery store that impacts what remains for the Retailers).

Also, there are only 26 days between Thanksgiving and Christmas this year and that is 5 (FIVE!) days less than last year so, unless people are REALLY focused on catching up in those 26 days – the Holidays are in danger of being a bust due to the clock running out – and that’s something that will really come down to the wire.

Also, there are only 26 days between Thanksgiving and Christmas this year and that is 5 (FIVE!) days less than last year so, unless people are REALLY focused on catching up in those 26 days – the Holidays are in danger of being a bust due to the clock running out – and that’s something that will really come down to the wire.

Another thing that is happening is 400,000-500,000 seasonal workers are being hired to the Dec 6th jobs report is likely to blow out expectations (which are very low since the November report was just 12,000) but we may not see most of it until January’s report. This all matters a lot as the Fed’s last meeting is Dec 18th and currently the betting is 50/50 on whether we get another cut to end the year.

We may be setting up for disappointment as a 3.7% rise in spending is only keeping up with inflation so people will only be getting the same AMOUNT of things they got last year – just paying more for them. That can lead to disappointing growth for UPS, FDX, etc. though, of course, they are charging more too (smart!). 2.5M more people have jobs than last year – that should help a little but that’s 1.5% of the labor force so it really dilutes the per person spending level overall – tricky.

Year over year, this is not a very pretty change in overall Retail Sales:

And that trend is sort of worrying too. 2021 and 2022 were stimulus checks and revenge spending and, since then, Biden has added 13M jobs back to the economy but Americans have voted to stop that nonsense and go back to the glory days of Donald Trump – the only President to preside over a net loss of jobs since Herbert Hoover.

And that trend is sort of worrying too. 2021 and 2022 were stimulus checks and revenge spending and, since then, Biden has added 13M jobs back to the economy but Americans have voted to stop that nonsense and go back to the glory days of Donald Trump – the only President to preside over a net loss of jobs since Herbert Hoover.

And sure, COVID, right? That’s not likely to happen again unless we do something insane like stop vaccinating people… oops! Well, I’m sure it will be fine because, speaking of Oligarchs, Elon Musk can simple cut the budget for reporting on disease outbreaks and we’ll never even know it’s happening – problem solved!

“Only” 50,000 Americans died of Covid this year – just over 1.2M total since 2020 yet, with 4M people traveling this Holiday Season, essentially NONE of them will wear masks and very few of them have kept up with their vaccines – what could possibly go wrong? Something to talk about as you gather with your loved ones next week… 😉

Have a great weekend,

-

- Phil

[ctct form=”12730731″ show_title=”false”]