Happy Thanksgiving week!

Happy Thanksgiving week!

As I predicted on Friday, “THEY” are taking full advantage of what is usually the lowest-volume week of the year to push the indexes higher so we (the traders in the family) all go to our Thanksgiving dinners and tell other people who have money how GREAT! the market is, which will then infect them with FOMO (Fear of Missing Out) and draw more money into the markets so “THEY” (not us, we are just the tools “THEY” use) can then draw in the Retail “Dumb Money” and dump their holdings on the soon-to-be “Bagholders“.

Now don’t act all shocked – there’s a reason we’ve been using this cartoon to illustrate this effect since 2008. THIS is how the market works. As George Carlin used to say “It’s a big club – and we’re not in it!” But, on the other hand, as I always say: “We don’t care IF the market is fixed as long as we can understand HOW the market is fixed and take advantage of it ourselves.” If the roulette wheel comes up red 90% of the time – you can complain to the Casino Commission – or you can just bet on red…

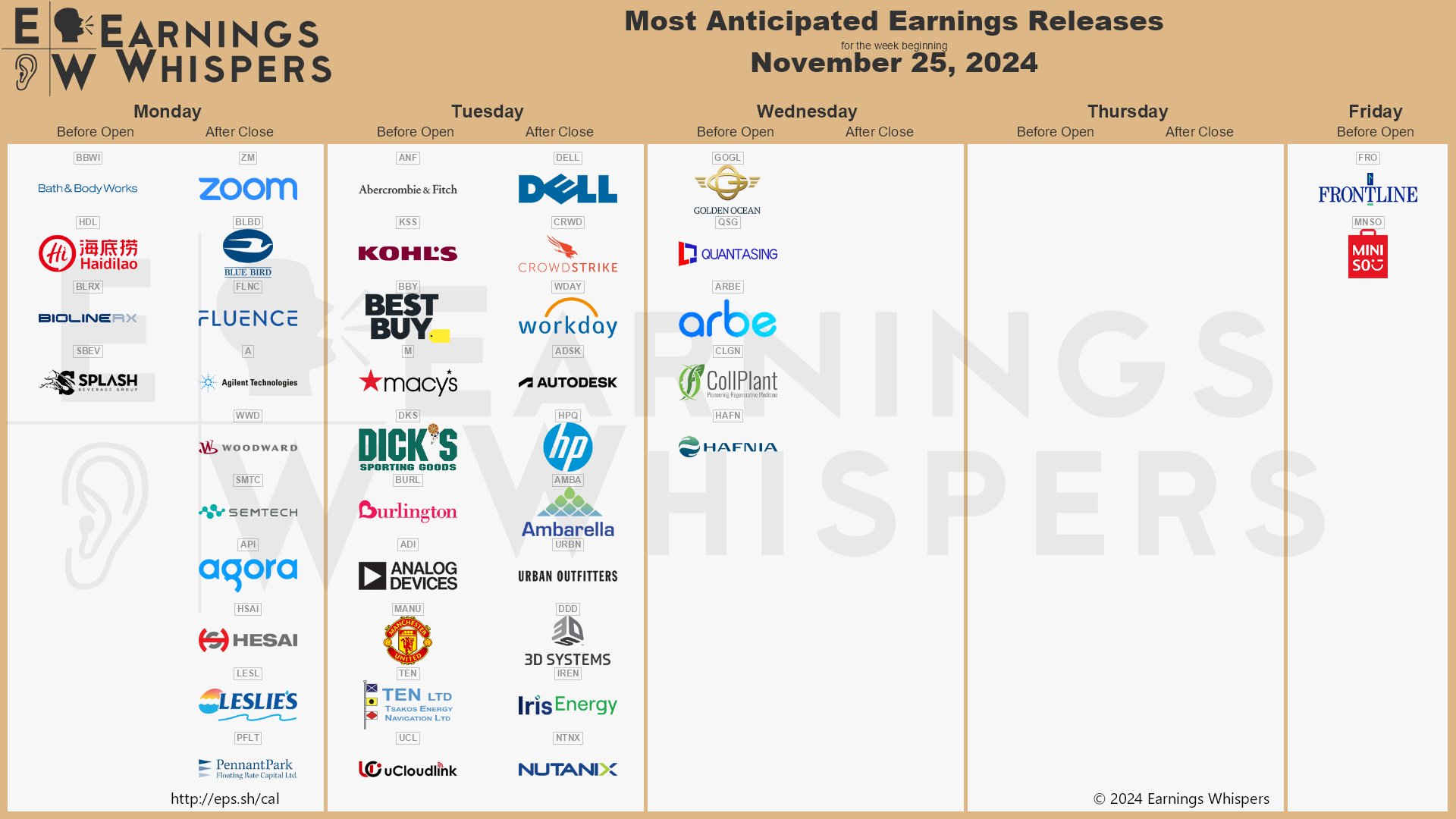

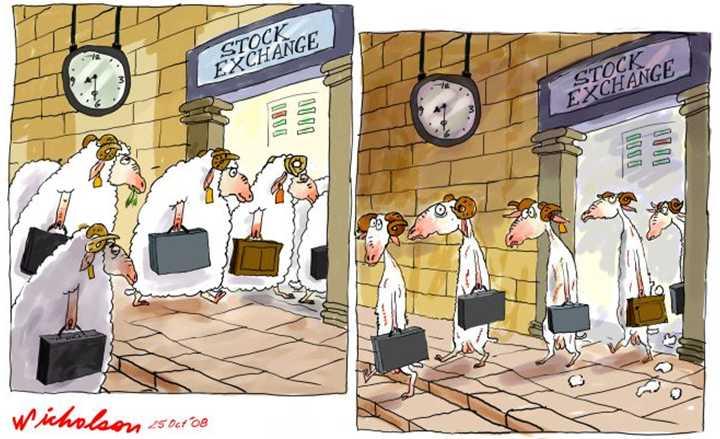

While many of you will be prepping for turkey and family gatherings, the markets are far from taking a holiday. This week is a short one, thanks to Thanksgiving on Thursday, and Friday’s early close but we do have a busy Economic calendar, more earnings reports to digest, and a even an interesting IPO to watch. Buckle up, because it’s going to be a short and wild ride.

The market has been a bit of a rollercoaster lately, and things are looking just a little tense. The initial sugar rush of the Trump victory has faded, leaving us with some seriously overvalued stocks (70 in overbought territory in the S&P 500, in case you missed that discussion last week). This week’s Economic data dump on Wednesday could be a game-changer. We’re talking Initial Jobless Claims, an updated GDP Estimate, Personal Income & Outlays Data, and the Core PCE Inflation Gauge, which is the Fed’s favorite Inflation metric. It’s the economic equivalent of a Thanksgiving buffet – a lot different things that can fill you up – but you might end up getting sick!

The Fed’s November meeting minutes, releasing tomorrow, are going to be the official appetizer after we snack on Housing Data, Consumer Confidence and the 2 & 5-Year Note Auctions. Remember Jerome Powell’s recent comments about not being in a hurry to lower rates? That sent a chill down investors’ spines, making the odds of a December rate cut a true toss-up. It’s going to be a nail-biting wait to see if the minutes confirm a hawkish turn or offer a glimmer of hope for more rate cuts in December. We’ll be closely monitoring the reactions, as the Bond Market is hyper-sensitive to any implied change in the Fed’s trajectory.

The Fed’s November meeting minutes, releasing tomorrow, are going to be the official appetizer after we snack on Housing Data, Consumer Confidence and the 2 & 5-Year Note Auctions. Remember Jerome Powell’s recent comments about not being in a hurry to lower rates? That sent a chill down investors’ spines, making the odds of a December rate cut a true toss-up. It’s going to be a nail-biting wait to see if the minutes confirm a hawkish turn or offer a glimmer of hope for more rate cuts in December. We’ll be closely monitoring the reactions, as the Bond Market is hyper-sensitive to any implied change in the Fed’s trajectory.

This week’s earnings reports will offer a further peek into the Economy. Dell (DELL), CrowdStrike (CRWD), and Analog Devices (ADI), some heavy hitters set to report, will each give us valuable insights into their respective corners of the Technology Sector. It could be that one of these earnings beat(s) are the catalyst for another big pop, or possibly the signal for a longer-term correction to begin.

We’ll be digging deep to see what the numbers tell us and I mentioned the Pony AI (PONY) IPO before. This Chinese Robotaxi Company is aiming for a multi-Billion Dollar valuation, which will be a bold bet on the future of autonomous driving in a landscape where Tesla’s FSD remains the subject of debate and concern (check out RJO’s special report last week). Let’s see if Pony can deliver a smoother ride for investors than Tesla’s FSD delivers to their drivers on the road.

And if you are looking at this image and thinking “Wow, they are partnered with Toyota?” then YES, there’s an entire World that operates when we are not paying attention (and we never are) and doesn’t give a crap about Trump or Musk or their tariffs and trade restrictions. The United States is ONLY 4% of the World’s population so when we effectively ban low-priced electric cars or cars that ACTUALLY CAN drive themselves – all we are doing is screwing our own tiny little captured market and driving inflation in the US while the rest of the world innovates and refines and altogether moves on without us.

The global picture is not entirely rosy. Emerging Market Junk Bonds, while having enjoyed a fantastic rally this year, are now facing renewed risks thanks to Trump’s “America First” policies. Tariffs, increased Government Spending, and stricter Immigration could end up causing a significant outflow of capital from these markets (while we don’t have the population, we do have 25% of the money in the World!). This is a huge risk for countries already struggling with debt, with nations heavily reliant on Dollar flows particularly exposed to volatility. Expect turbulence in those markets and be ready to look for opportunities for short-term hedging – and profit.

[ctct form=”12730731″ show_title=”false”]