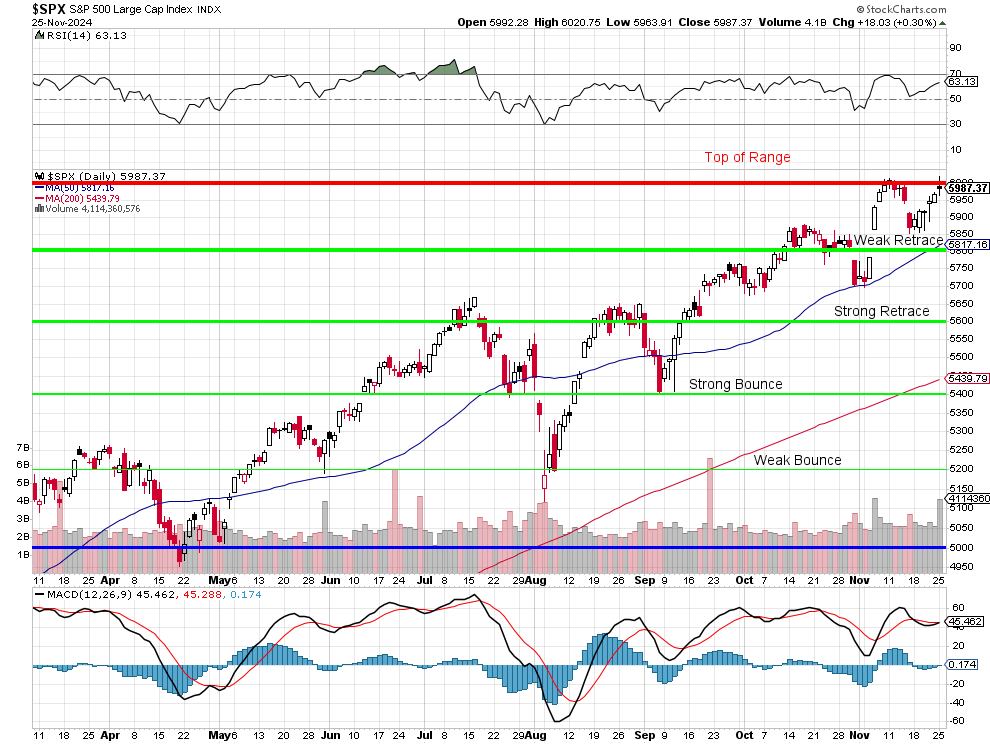

We’re back at 6,000 and we put up positive numbers yesterday, as expected and the 50-day moving average has pushed up over the Weak Retrace line at 5,800 and the 200 dma is over the Strong Bounce line at 5,400 so it does look like we at least have solid support – even if the market does pull back. The RSI isn’t even 70 yet – so there should be room to run.

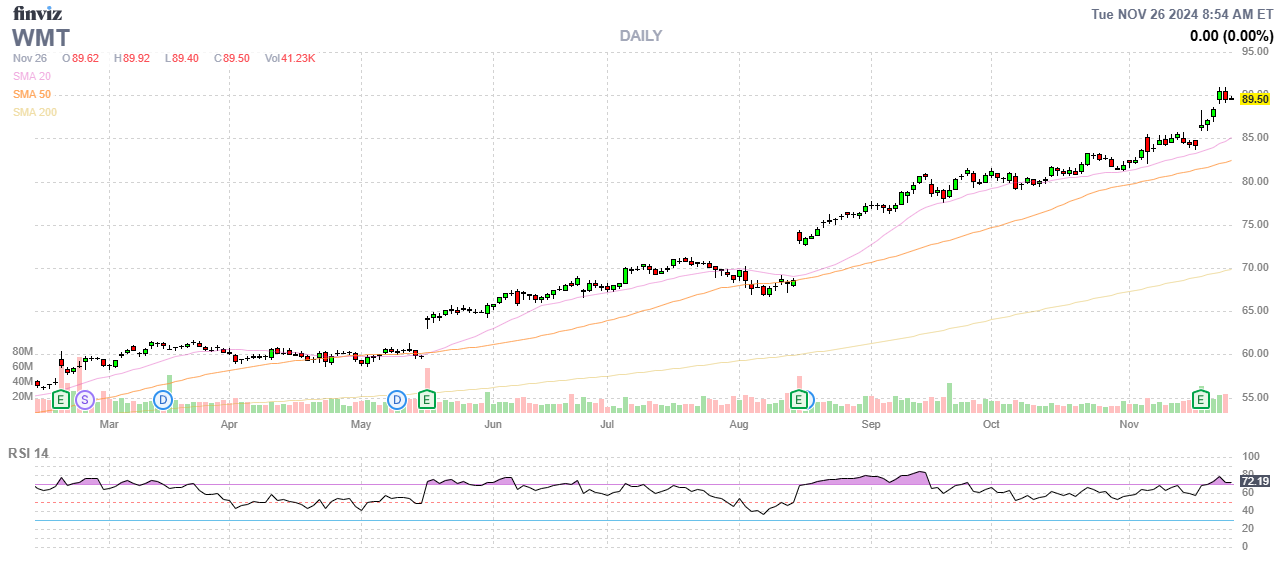

Yesterday, Walmart (WMT) dropped a bombshell with sudden about-face on DEI and the anti-woke ripples are already spreading with aftershocks that will be felt all around Corporate America. Before we discuss, however, let’s define terms:

🚢 DEI stands for Diversity, Equity, and Inclusion. It’s a multifaceted concept encompassing various initiatives and policies aimed at fostering a more representative and equitable environment within organizations and broader society.

-

-

-

Diversity: Refers to the presence of a wide range of human qualities and attributes within a group or organization. This includes, but isn’t limited to, race, ethnicity, gender, sexual orientation, socioeconomic status, age, physical abilities, religious beliefs, political beliefs, or other ideologies. The goal is to have a workforce and environment that reflects the diversity of the population it serves.

-

Equity: Goes beyond simply acknowledging differences; it addresses systemic barriers and historical injustices that have created disparities in opportunity. Equity focuses on providing fair access to resources and opportunities, recognizing that some groups may need additional support to achieve equal outcomes. This is often contrasted with equality, which treats everyone the same regardless of their background or circumstances. Equity aims for equitable outcomes.

-

Inclusion: Focuses on creating an environment where everyone feels welcome, respected, valued, supported, and able to fully participate. This involves actively creating a sense of belonging and ensuring that all voices are heard and considered. It means creating an environment free from discrimination and harassment.

-

-

In practice, DEI initiatives can involve a wide range of strategies, including:

-

-

-

Recruitment and hiring practices: Designing processes to attract and hire a diverse workforce.

-

Training and development programs: Educating employees about diversity, equity, and inclusion issues.

-

Mentorship and sponsorship programs: Providing support and guidance to underrepresented employees.

-

Policy changes: Implementing policies to promote fairness and equality.

-

Cultural shifts: Creating an inclusive organizational culture.

-

-

The concept of DEI is often debated and sometimes controversial, with varying interpretations and approaches. However, the fundamental goal remains consistent: to create a more just and equitable world where everyone has the opportunity to thrive.

This brave step is aligning WMT with Trump’s mandate and, as he said in a recent speech:

-

-

Rebuilding our national economy with initiatives aimed at supporting American workers and farmers.

-

Ensuring that our education system instills pride in our history and respect for our traditions.

-

Walmart’s decision to dismantle many of its DEI initiatives is not simply a PR move; it’s a calculated gamble that could reshape the corporate landscape. The company’s actions – ditching the terms “DEI” and “Latinx,” ending racial equity training, and reviewing LGBT+ funding – are sending a powerful signal. While some applaud this as a return to meritocracy and a move towards a more competitive business environment, others will undoubtedly view it as a step backward in social progress (but they will soon be rounded up and deported too).

Regardless of your stance, the impact will be significant. Expect a domino effect. Companies, especially those with similar DEI programs, are likely to face increased pressure from both sides of the political spectrum. Will they follow Walmart’s lead? Will they double down? Or will they simply try to navigate this increasingly turbulent social landscape? Today’s market movements could offer some initial clues.

While the DEI debate rages, another intriguing story is emerging: the surprisingly resurgent strength of the nuclear power sector! A recent SA Sentiment poll highlighted nuclear’s popularity as the most realistic alternative energy source in the US. The sector has seen a surge in Big Tech investment recently, fueled by the growing demand for reliable power in the AI and Data Center boom.

This sector could be a true long-term winner – a potential safe haven in an otherwise uncertain market. Companies like Vistra (VST), GE Vernova (GEV), and Constellation Energy (CEG) all saw enormous gains in 2024 and remain in a strong position.

See how nicely all this ties together?

While the markets are digesting the DEI news and the potential for a nuclear power resurgence, Trump has once again thrown a wrench into the works. His new tariff threats against Mexico, Canada, and China are raising serious concerns and the markets are already reacting. The Mexican Peso and Canadian dollar are both down and China is reacting negatively as well. This “America First” approach, while appealing to some, carries significant global economic risks. Expect heightened volatility, especially in sectors heavily reliant on international trade. Will Bessent really be able to temper Trump’s protectionist instincts?

Best Buy’s (BBY) disappointing earnings report serves as a chilling reminder that the Retail Sector is not immune to the Economic headwinds. The company’s declining sales, rising inventory, and lowered full-year forecast paint a bleak picture for the holiday season. This is not isolated. Target’s (TGT) struggles provide a clear sign that consumers are getting more selective about their spending, prioritizing essentials over discretionary purchases. Walmart’s apparent success sits in stark contrast, suggesting that companies catering to value-conscious shoppers remain best positioned to weather the current economic climate.

Asian markets opened mostly lower, mirroring concerns about Trump’s tariff threats and the ongoing global uncertainty. European markets are also showing weakness at midday, and US futures are suggesting a cautiously optimistic open, but this could be easily reversed by any further news. The 10-Year Treasury Yield is up again and that’s always a sensitive indicator of market sentiment.

Today’s economic calendar includes several Housing Reports (Case-Shiller, FHFA, New Home Sales), Consumer Confidence, the Richmond Fed and, most importantly, the FOMC minutes from the November meeting. These minutes could offer crucial insights into the Fed’s thinking regarding future rate cuts, potentially triggering significant market moves.

[ctct form=”12730731″ show_title=”false”]