HUGE travel weekend.

HUGE travel weekend.

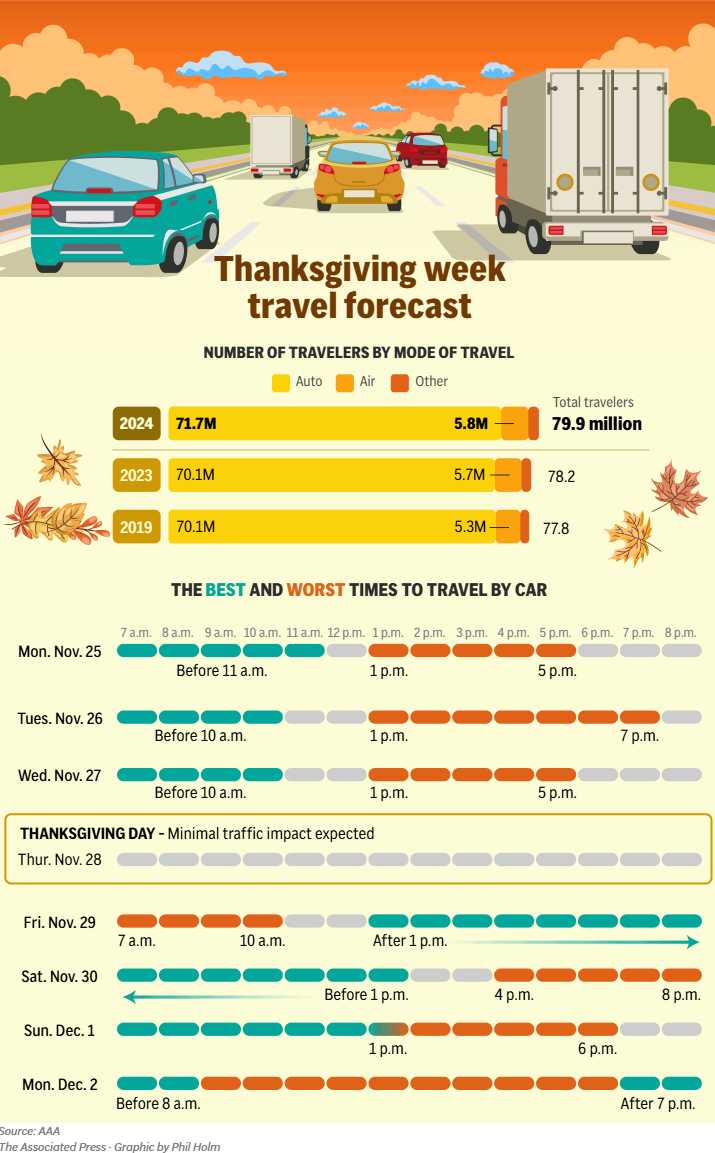

About 1/3 of all Americans will travel more than 50 miles from home and 5.8M of them will be at the airport! That’s up 2% from last year and, thankfully, gas prices are down 5.5% ($3.07) from last year ($3.25). Notice when the traffic is heaviest – people leave Mon, Tues or Weds night – everyone is where they want to be by Thursday and SOME people come back Friday Morning but most hang out until Monday – which is why nothing gets done Thanksgiving week in America.

Of course Friday is Black Friday and Monday is Cyber Monday so the people who do show up for work spend all day using their work computers to shop on-line. Europeans only THINK we take less days off than they do but that’s because when they go to work they actually work while we have lots of not-really-working days in the US. In fact, both Christmas and New Years are going to be not-really-working weeks as they both fall on Wednesday this year – so enjoy!

This does not bode well for Q4 productivity and, due to a trick of the calendar – it might not bode well for Retail Sales because people are spending more money traveling than they are buying stuff AND there are 5 less shopping days between Thanksgiving and Christmas this year – could be very tricky to navigate for the Retail Sector.

Industry forecasts estimate that 183.4M people will shop in U.S. stores and online between Thanksgiving and Cyber Monday, according to the National Retail Federation and consumer research firm Prosper Insights & Analytics. Of that number, 131.7M are expected to shop on Black Friday.

November sales at brick and mortar stores peaked more than 20 years ago. In 2003, for example, e-commerce accounted for just 1.7% of total retail sales in the fourth quarter, according to Commerce Department data. For last year’s holiday season, e-commerce accounted for about 17.1% of all non-adjusted retail sales in the fourth quarter – that’s up from 12.7% seen at the end of 2019.

That’s why this statistic confuses people because you been hearing for 20 years that on-line sales are up 10-20% each year and you would think on-line is now 300% of all sales but it was up 20% of 1.7%, which is 0.34% – so it’s taken ALL THIS TIME to get to just 17.1%. E-commerce has captured all the growth, but Retail is still not dead… yet…

Retailers with discretionary products are relying heavily on promotions to generate demand this year and S&P Global Ratings expects holiday sales growth will slow to about 3% in 2024 from 4.7% last year, remaining below the 10-year average of 5.3%. Retailers that are exposed to discretionary spending are nearly 1.5x as likely to face a downgrade within the next one to two years than retailers whose sales rely on more stable nondiscretionary spending.

![Charlie Brown Thanksgiving [1973] (2) by KahlanAmnelle on DeviantArt](https://images-wixmp-ed30a86b8c4ca887773594c2.wixmp.com/f/40eb3ade-91e8-48e4-9923-dc622562072f/dg4i3bt-d8e693c9-e914-4dbf-9129-931d4700f7e5.png/v1/fill/w_512,h_512/charlie_brown_thanksgiving__1973___2__by_kahlanamnelle_dg4i3bt-fullview.png?token=eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ1cm46YXBwOjdlMGQxODg5ODIyNjQzNzNhNWYwZDQxNWVhMGQyNmUwIiwiaXNzIjoidXJuOmFwcDo3ZTBkMTg4OTgyMjY0MzczYTVmMGQ0MTVlYTBkMjZlMCIsIm9iaiI6W1t7ImhlaWdodCI6Ijw9NTEyIiwicGF0aCI6IlwvZlwvNDBlYjNhZGUtOTFlOC00OGU0LTk5MjMtZGM2MjI1NjIwNzJmXC9kZzRpM2J0LWQ4ZTY5M2M5LWU5MTQtNGRiZi05MTI5LTkzMWQ0NzAwZjdlNS5wbmciLCJ3aWR0aCI6Ijw9NTEyIn1dXSwiYXVkIjpbInVybjpzZXJ2aWNlOmltYWdlLm9wZXJhdGlvbnMiXX0.53Kclxgw_bedMMPzQ9DLj5RU6H6t1ssbvOEr8cudH3Q) The Labor Market shows clear signs of cooling. Real Income Growth has been running behind Real Spending Growth since the middle of last year and the Household Savings Rate is at a two-year low with Delinquency Rates for credit cards and autos are above pre-pandemic levels and still edging higher. As a result, Consumers are likely to maintain tight budgets and seek value in the form of promotions as they enter the holiday season.

The Labor Market shows clear signs of cooling. Real Income Growth has been running behind Real Spending Growth since the middle of last year and the Household Savings Rate is at a two-year low with Delinquency Rates for credit cards and autos are above pre-pandemic levels and still edging higher. As a result, Consumers are likely to maintain tight budgets and seek value in the form of promotions as they enter the holiday season.

As we come to the end of earnings season, most retailers have been expressing caution about the Q4 Holiday Shopping Season but, for the most part, these warnings are falling on deaf ears as the market races on to record highs but it doesn’t matter if Donald Trump doesn’t tax your earnings – if you haven’t got any earnings to tax!

I’m not looking to pre-judge, let’s see how the weekend goes and, most importantly, let’s enjoy this time with our families.

Have a very happy Thanksgiving,

–Phil and the PhilStockWorld family

[ctct form=”12730731″ show_title=”false”]