I hope everyone had a great Thanksgiving…

“Buy Now Before Tariffs Hit, Retailers Are Telling Shoppers” is the headline of the Wall Street Journal this morning and of course the Corporate Media is trying to push you and your wallet out the door with just 26 shopping days left until Christmas. And, speaking of Christmas – the other leading headline for the WSJ this morning is “The Local Sheriffs Gearing Up to Help Trump Carry Out Mass Deportations“. God bless us, everyone – now get the F out!!!

While we may be feeling all fat an happy in the US (and today is a half day in the markets, which close at 1pm – and no one will be here in the morning anyway), China has been solving their debt crisis by not paying workers – an idea Elon Musk may want to try (Donald Trump has been using that trick for decades already).

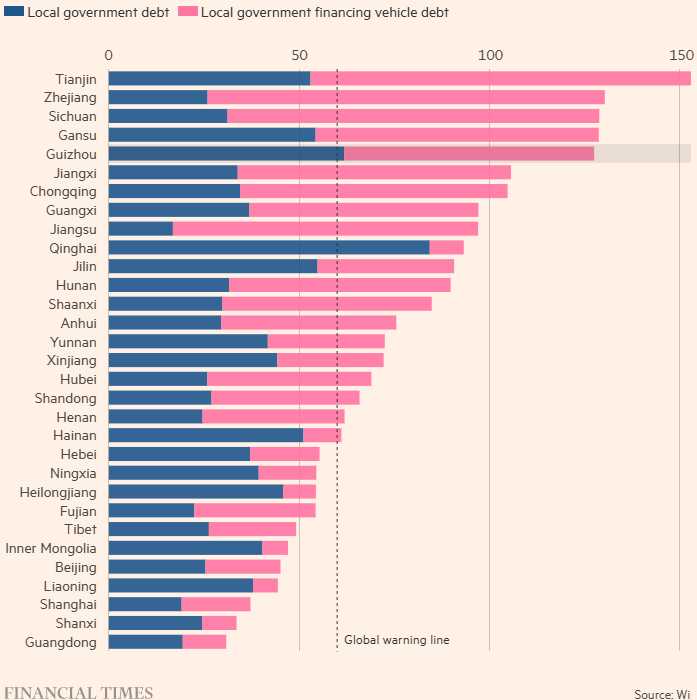

It turns out, Chinese Local Governments, who are ALSO Trillions of Dollars in debt have been cutting back on wages and services and spending, which has a very high potential to throw China’s already stagnant economy straight into a Recession. In what may be as much at $11Tn of Local Government Debt, $800Bn is considered at high risk of default. Monthly debt payments across China’s provinces reached 125% of revenues at some points last year.

It turns out, Chinese Local Governments, who are ALSO Trillions of Dollars in debt have been cutting back on wages and services and spending, which has a very high potential to throw China’s already stagnant economy straight into a Recession. In what may be as much at $11Tn of Local Government Debt, $800Bn is considered at high risk of default. Monthly debt payments across China’s provinces reached 125% of revenues at some points last year.

For years, local governments used complex state-owned funding vehicles that borrowed on their behalf, often to finance projects with little economic benefit. Across China, there are railroads with too few commuters, industrial parks with no tenants and even a ski resort in an area with little snow. Meanwhile, the trillions of Yuan in revenue that local governments collect from selling land has shrunk sharply since the collapse of China’s epic property boom while the Government dumping land on the open market to pay their bills further depresses property prices – putting builders even more underwater.

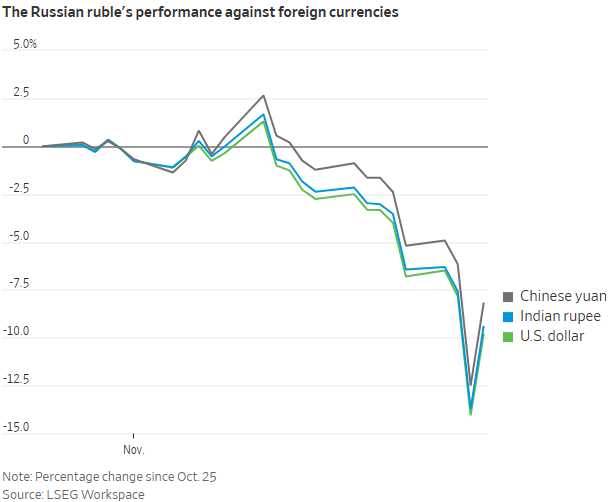

But, you know what? I could do a whole report on how screwed China is but that was just a prelude to discussing how F’d Russia is… The Ruble has fallen by 10% in November – and that’s the bounce off 12.5% causing Vladimir Putin to spend his Thanksgiving reassuring the Nation that “The situation is under control and there are certainly no grounds for panic.” As we all know, when there is no reason to panic – the Government doesn’t need to make announcements, do they?

But, you know what? I could do a whole report on how screwed China is but that was just a prelude to discussing how F’d Russia is… The Ruble has fallen by 10% in November – and that’s the bounce off 12.5% causing Vladimir Putin to spend his Thanksgiving reassuring the Nation that “The situation is under control and there are certainly no grounds for panic.” As we all know, when there is no reason to panic – the Government doesn’t need to make announcements, do they?

The catalyst for the change in economic fortunes was a decision by the Biden administration to ratchet up sanctions on Russia’s Gazprombank, the last major unsanctioned bank that Moscow uses to pay soldiers and process trade transactions, as well as more than 50 other financial institutions. The GOP, of course, says this is just another example of still-President Biden going after Trump’s biggest supporters…

Gazprombank had been carved out of previous rounds of sanctions to allow allies in Europe to pay Russia for critical supplies of energy. It was a vital conduit for inflows of hard currency in exchange for Russia’s exports. That caused the Ruble, which is now essentially an unusable currency, to drop to a 32-month low. Russia’s Central Bank intervened on Wednesday but – as we learned from the BOJ – it’s hard to stop your currency from crashing.

At this point, we have to wonder if Russia can AFFORD to end the war in Ukraine. Was spending is now 30% of Russia’s entire Economy and interest rates are 21% – just one point lower than Greece was at their peak. 600,000 dead (more than that injured) and 1.5M active soldiers (not counting North Koreans now) have drained Russia’s workforce and caused labor shortages to add to Russia’s trouble. Mobile armies consume a lot of fuel, millions of barrels each day and maintaining supply lines is also very expensive.

At this point, we have to wonder if Russia can AFFORD to end the war in Ukraine. Was spending is now 30% of Russia’s entire Economy and interest rates are 21% – just one point lower than Greece was at their peak. 600,000 dead (more than that injured) and 1.5M active soldiers (not counting North Koreans now) have drained Russia’s workforce and caused labor shortages to add to Russia’s trouble. Mobile armies consume a lot of fuel, millions of barrels each day and maintaining supply lines is also very expensive.

US Retailers have been maintaining their supply lines by pulling forward inventory to avoid disruptions but now there’s the danger they may end up eating that inventory as Consumers spend more money on experiences and less money on gifts. While the $100,000+ income groups plan to spend 17% more over the holidays, the great unwashed masses are cutting back. Fortunately, the rich are so much richer than the poor, that The Top 10% make up for the bottom 90% – God bless us, everyone!

We’ll be rounding out our Watch List and zeroing in on our 2025 Trade of the Year this weekend, so stay tuned but today is a half day so nothing much matters until Tuesday.

Have a great weekend,

-

- Phil

[ctct form=”12730731″ show_title=”false”]