Let’s talk trading!

After making 400% in 4 years with our previous Money Talk Portfolio, we started a new one on August 21st and, since we only trade this portfolio live on the show (I’ll be on tomorrow and taping this afternoon), we have to be VERY SELECTIVE in what we pick so these are what we call “Bulletproof Stocks” – positions we either have EXTREME confidence in heading higher or, if not (Pfizer!), then we are THRILLED for the opportunity to buy more – as you will see.

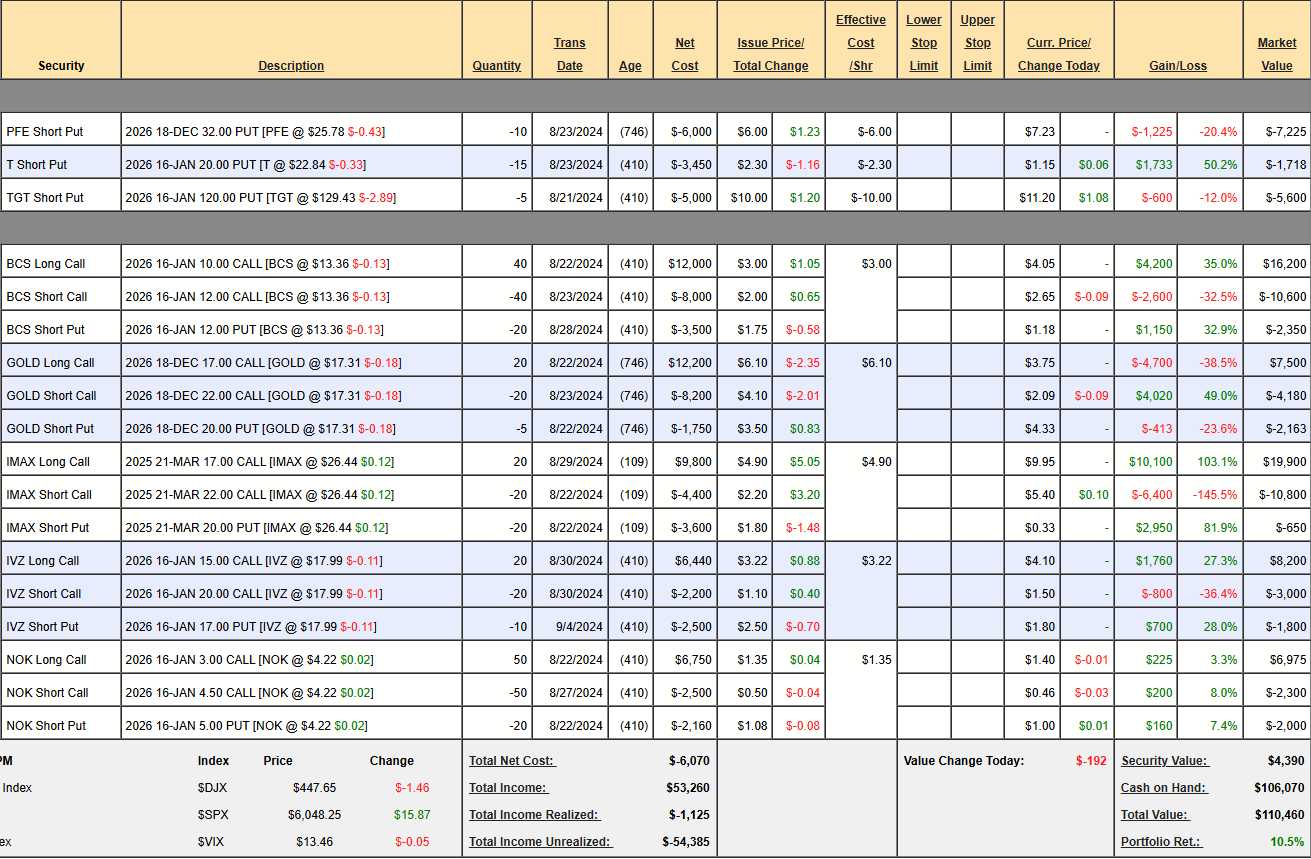

As you can see, the entire portfolio is up $10,460 (10.46%) but that’s because we deployed very little cash in our first quarter. In fact, we spent no cash at all and collected net $6,070 against our 8 positions, using about 25% of our buying power in margin. Now it is an excellent time to do a thorough review of our current positions, which have gained $10,460 (172%) against a $6,070 credit and we can adjust them and discuss which new ones we’re thinking of adding (to be finalized tomorrow).

PFE – Our big loser is not a loser at all as we sold the Dec 2026 $32 puts for $6 so we’ve promised to buy 1,000 shares of PFE at net $26 and PFE is now at $25.78 so the loss is all premium and the one thing we know for an ABSOLUTE FACT in trading is that ALL PREMIUM EXPIRES WORTHLESS. That means, as long as we REALLY want to own PFE at net $26 for the long-term – there’s nothing at all to panic about at $25.78, is there?

Not only that but it must be time for us to buy more, since PFE is now at the bottom of our range. Earnings were fine, so our original premise is intact and the forward p/e is below 10 – what’s not to love? That being the case, let’s add the following legs to this position:

-

- Buy 20 PFE 2027 $20 calls at $7.15 ($14,300)

- Sell 15 PFE 2027 $27 calls at $3.50 ($5,250)

- Sell 7 PFE April $26 calls for $1.70 ($1,190)

- Sell 7 PFE April $27 puts at $2.20 ($1,540)

We’re turning PFE into an income-producer by spending net $6,320 to set up a $14,000 bull call spread but we also already sold the short $32 puts for $6,000 so net net on this spread is $320 with an upside potential of $13,680 (4,275%) if we do make it to $32. At $25.82, of course, the spread is already $11,640 (3,637%) in the money – a good start! Of course we need to clear $32 to fully realize our gains (because of the short puts).

MEANWHILE, we sold $2,730 (853%) using 135 of the 773 we have to sell and we can’t lose on both ends so our plan is to roll the losing leg (hopefully the short calls) and we’ll replace the expired leg and collect more money and so on and so on for the next two years. Aren’t options fun? Hopefully we can add a few thousand more to our overall profits – nothing to sneeze at!

-

- T – Boringly on track with an upside potential of $1,718 if T manages to hold $20 into Jan 2026. See, if you REALLY wouldn’t mind owning T at net $18.75, which is a 19.5% discount to the current price, then this is like free money while you wait for T to go on sale and, if it doesn’t go on sale – you keep the $1,718 as a consolation prize!

TGT – In this case, we’re just happy TGT stabilized but yes, let’s also take advantage here and add a bull call spread:

-

- Buy 10 TGT 2027 $120 calls for $30 ($30,000)

- Sell 10 TGT 2027 $150 calls for $17.50 ($17,500)

That’s net $12,500 less the $5,000 we sold the puts for is net net $7,500 on the $30,000 spread with $22,500 (300%) upside potential.

-

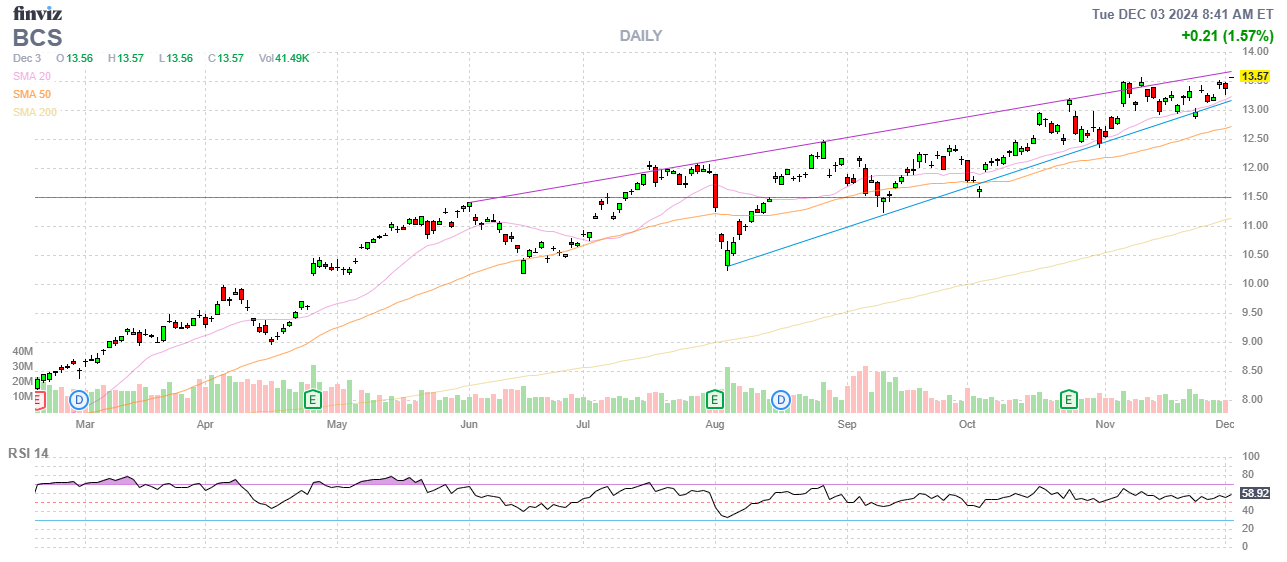

- BCS – Already over our $12 target at net $1,850 on the $8,000 spread so we still have $6,150 (332%) upside potential – even after already making $1,350 (270%) from our original net $500 entry in the first 3 months – that’s just a good start! Aren’t options fun? Still great for a new trade with that potential.

GOLD – This spread is surprisingly lower than where we started at net $2,250 on the $10,000 spread. We’re down net $983 (43.6%) because you live by the leverage and you die by the leverage BUT, since we are THRILLED to get more aggressive on GOLD, we will simply make the following adjustment:

-

- Roll 20 GOLD Dec 2026 $17 calls at $7,450 to 30 GOLD 2027 $15 calls at $4.75 ($14,250)

- Roll 20 GOLD Dec 2026 $22 short calls at $4,210 to 25 short 2027 $20 calls at $2.70 ($6,750)

- Sell 10 short March $18 calls for $1 ($1,000)

- Sell 10 short March $17 puts for $1 ($1,000)

That’s net $2,260 spent on the adjustments and we had the net $2,250 entry so now we’ve spent net net $4,510 to be in a $15,000 spread that’s $6,630 in the money AND producing a potential income of $2,000 (44.3%) using 108 of the 773 days we have to sell. Not including our income stream, the spread has an upside potential of $10,490 (232%) if it can get over $20 in two years.

-

- IMAX – Miles over our target already at net $9,600 on the $10,000 bull call spread so we will cash that out with a $4,200 (77%), 3-month profit (why wait?) and leave the short puts since they still have $1,400 of upside potential.

-

- IVZ – This one is right on track at net $3,025 with $6,975 (230%) left to gain so good for a new trade!

-

- NOK – Getting close to goal but still just net $2,770 on the $7,500 spread so there’s $4,730 (170%) upside potential at $4.50 – good for a new trade!

So, after deploying net $16,800 in cash, we are now in our 8 original positions for $10,810 and we have $67,643 of upside potential and we STILL have $90,000 left to deploy! Aren’t options fun?

That then brings us to what we should add this quarter and, since it’s time to pick our 2025 Trade of the Year – let’s take a look at the finalists. Two weeks ago, we updated our Watch List for 2025 with 84 stocks we’ll be focusing on over the next 12 months. They were selected based primarily on their overall value but also taking into account the anticipated new political environment (lower taxes, fewer regulation, tariffs..) as well as the Global Macros but, to make the Top 10 – they also had to have a near-term catalyst that should propel them over their current trading channel:

-

- CNH ($12.40) – Trading at just 7.94x forward earnings, their agricultural equipment focus aligns well with potential farm subsidies and trade policies. Their precision agriculture technology investments and operational streamlining provide multiple catalysts, while their strong position in U.S. farming communities suggests policy tailwinds. However, while agricultural equipment demand looks strong, Chinese exposure creates too much uncertainty to make the cut for our final 3.

-

- DOW ($44.03) – Currently benefiting from favorable spreads between Brent oil and US natural gas prices, with 75% of production capacity in North America providing significant cost advantages. Their commodity chemical production is well-positioned for profit recovery in 2025, particularly as volume recovery continues. Any “America First” manufacturing policies would directly benefit their domestic production focus. While chemical cycle recovery looks promising, tariffs and trade wars create too much uncertainty for the final 3 – we already have Dow in our portfolios too.

-

- GEO ($26.86) – Currently showing strong fundamentals with Q2 revenue up 2.2% year-over-year to $607.2M. Their focus on ICE processing centers and USMS detention centers aligns directly with Trump’s proposed immigration policies. Trading at compelling valuations, GEO’s potential for increased detention utilization and new contracts under a Trump administration provide clear catalysts for 2025. A lot of Trump’s “final solution” is priced in, so not quite enough upside potential to give us confidence for the top 3 and what if Trump’s immigration promises turn out like his “Build a Wall” promises from his last term? Then it’s all just another load of BS.

-

- LMT ($521.06) – Defense stocks historically benefit from Republican administrations, and Trump’s hawkish stance on defense spending, particularly his push for NATO members to increase spending to 3% of GDP, provides clear catalysts. Their F-35 program and global conflicts create strong demand, while their market leadership in aerospace defense suggests significant upside potential. LMT is already our Stock of the Decade (we began playing at $50 and it’s only 2025) but how can we not take advantage of this recent pullback?

-

- MGM ($36.89) – Trading at 13.11x earnings with strong fundamentals and improving margins. Their Las Vegas operations continue to show strength, while their diversification into online gaming provides growth potential. The hospitality sector typically benefits from economic expansion, and their strong brand recognition and market position suggest significant upside potential from current levels. China is a bit too much of a wild card to make them a final 3 pick but if they come back below $30 – I’ll be very excited to add them to our portfolios.

-

- SYF ($67.66) – Our experience with SOFI gives me a lot of faith in this one and SYF got the best overall score with impressive metrics across all categories, particularly in catalysts (9 out of 10). Their consumer credit focus positions them well for continued consumer spending strength, while their technological innovations and expanding financial products provide multiple growth drivers and, though we may disagree on the degree – it is almost entirely certain that Fed Funds Rates WILL go down next year – a HUGE catalyst. All this movement on the chart only gets them to 10x earnings – money is coming in so fast the stock price can barely keep up!

-

- T ($22.70) – We are loaded up with them already and they are up 50% from our entries. Their 5G infrastructure investments align with potential infrastructure spending initiatives, while their strategic focus on network expansion provides clear catalysts. Their domestic focus and essential service nature provide policy and macro protection. Despite some positive catalysts, they’ve already had nice gains and the uncertainty about debt management and competitive pressures makes an 80% confidence threshold difficult to achieve.

-

- VALE ($9.79) – Despite disappointing us in 2024 (it was our Trade of the Year), their position as a major iron ore producer aligns well with potential infrastructure spending and trade policies. Their cost reduction initiatives and high-grade iron ore focus provide clear catalysts, while potential Chinese stimulus measures could drive significant upside in 2025. Despite potential upside to $15.84 by 2025, ongoing legal issues create continued uncertainty that keeps them out of the top 3.

-

- VTRS ($13.06) – Currently trading at just 4.2x forward earnings despite impressive 46% growth from our initial watch price. Their successful debt reduction strategy, having paid down $1.4B year-to-date, shows strong execution. Their expansion into complex generics and biosimilars, combined with strategic partnerships in emerging markets, positions them well for 2025. The potential for domestic pharmaceutical manufacturing incentives provides additional tailwinds. Multiple analyst forecasts, however, suggest significant downside risk, with predictions ranging from $4.88 to $10.77 by end of 2025. The -40.21% average projected decline indicates too much uncertainty.

-

- XOM ($117.93) – Aligns perfectly with Trump’s anti-regulation stance, particularly regarding LNG projects and fracking. Their Appalachian Basin operations in Pennsylvania and West Virginia position them well for policy shifts. Trading at attractive valuations with strong dividend yield, XOM’s strategic positioning and potential regulatory relief provide multiple catalysts for 2025.

So there you have it. Any of our Top 10 are going to be good trades but the Top 3: LMT, SYF and XOM don’t have any glaring negatives to detract from all the positives so all 3 of these are going into the Money Talk Portfolio (and probably others as well) and we’ll figure out which is going to be number one for tomorrow’s show

[ctct form=”12730731″ show_title=”false”]