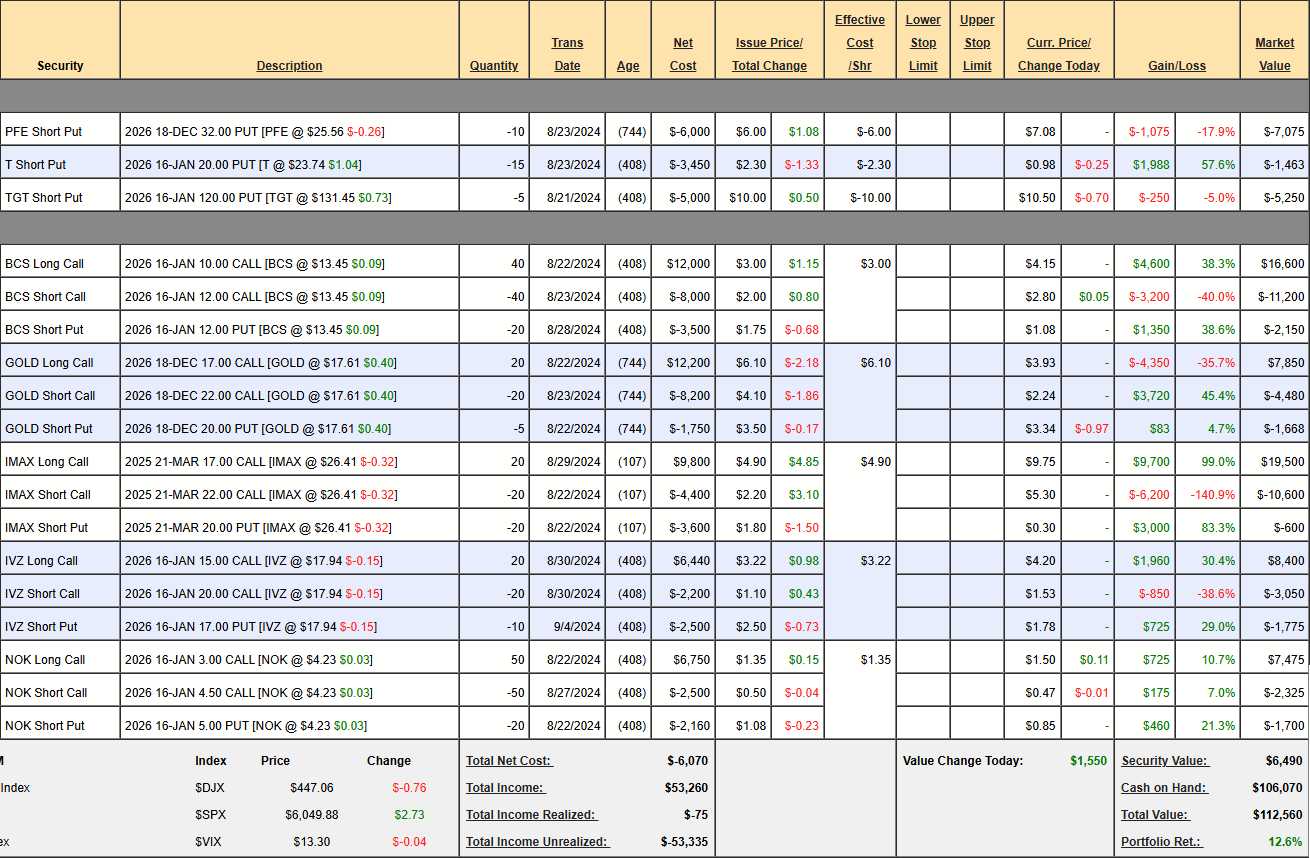

Yesterday’s $2,100 gain in our Money Talk Portfolio in just 24 hours proves it: options are a powerful tool – when used correctly.

This is our Money Talk Portfolio, which we started on Aug, 21st and I just reviewed it yesterday and we made several adjustments to these positions but, left untouched – they have gained $2,100 in 24 hours. That’s 1.9% of $110,460 but we only had $4,390 worth of positions (new portfolio) and they gained 47.8% for the day – I told you they were good!

Options are a very important tool for traders to learn how to use and yes, they can be dangerous, but so can a chain saw or a lawn mower or a snow blower but that doesn’t mean you should do everything the safest way – what it means is you need to learn to use your power tools in a safe manner – see the difference?

Options are a very important tool for traders to learn how to use and yes, they can be dangerous, but so can a chain saw or a lawn mower or a snow blower but that doesn’t mean you should do everything the safest way – what it means is you need to learn to use your power tools in a safe manner – see the difference?

By using options, we are able to diversify our investments in a way that’s difficult just using cash positions and we can employ leverage that allows us to make a great deal of money from a very small move in the stock price. That means we can also lose a great deal of money if a stock goes against us but we find that COMBINING options leverage with solid value investing that our winning percentage is consistently strong enough that the occasional losers are dwarfed by the losers.

Another thing that is true is that 85% of all options expire worthless. This is why you hear so many horror stories from people who experiment with options. The reason for this is that, when you buy an option you pay a huge premium for the contract and the only absolute certainty in the market is that ALL premium expires WORTHLESS! So, buying options seems like a terrible idea but what if we SELL them? That is our primary strategy at PSW:

By simply and consistently selling options premium against value stocks, we create an income stream that mitigates our losses when the market is down, makes us money when the market is flat and performs spectacularly when the markets are going up. The positions in our Money Talk Portfolio, after yesterday’s adjustments (not yet reflected) have $67,643 of upside potential PLUS the possibility of additional income and you haven’t missed much if you start right now.

By simply and consistently selling options premium against value stocks, we create an income stream that mitigates our losses when the market is down, makes us money when the market is flat and performs spectacularly when the markets are going up. The positions in our Money Talk Portfolio, after yesterday’s adjustments (not yet reflected) have $67,643 of upside potential PLUS the possibility of additional income and you haven’t missed much if you start right now.

We only adjust the Money Talk Portfolio live on the show – usually once each quarter – so it’s a very low-touch portfolio filled with what we expect to be “bulletproof” stocks – ones that we don’t expect to go off track from show to show. By selecting fundamentally strong stocks that we believe are well-positioned for long-term growth we can carefully assess risk and potential before implementing our option strategies.

That logic is how we made 380% over 4 years in our prior MTP, which we closed on Aug 21st and you can follow every trade we made in the Money Talk section of this site or via our appearances on the Bloomberg show – which I will be on this evening (7pm).

In yesterday’s report, we highlighted the Top 10 (out of 84) positions from our Watch List that we feel are going to have a good 2025 but to make the Top 3, we (my AIs and I) had to find stocks that were currently at a good price, are very unlikely to go lower given our projected macro environment AND have near-term catalysts that we feel will propel them to a higher trading range – meaning we won’t have to worry about a pullback.

Oh yes, and we have to see a clear path to a 300% gain on cash by Jan 2027.

Given those criteria, here are our Top 3 Trade Ideas for 2025:

XOM ($117.50) is our 2nd runner up with their dominant position in U.S. energy production perfectly aligned with potential policy shifts in 2025. While many focus on their impressive $347.7Bn Revenue Projection, we’re particularly excited about their strategic positioning in the Permian Basin, where production is expected to grow 10% annually through 2027. Their $30B (5.8%) stock buyback program provides solid downside protection while we wait for catalysts to kick in.

XOM ($117.50) is our 2nd runner up with their dominant position in U.S. energy production perfectly aligned with potential policy shifts in 2025. While many focus on their impressive $347.7Bn Revenue Projection, we’re particularly excited about their strategic positioning in the Permian Basin, where production is expected to grow 10% annually through 2027. Their $30B (5.8%) stock buyback program provides solid downside protection while we wait for catalysts to kick in.

What really catches our eye is XOM’s expanding LNG capacity, particularly with the $14B Mozambique project coming online in 2025 and their Golden Pass terminal in Texas ramping up to full capacity. These projects position them perfectly to capitalize on growing global demand for natural gas, especially with European nations seeking alternatives to Russian supply. Their integrated model allows them to capture value across the entire energy chain, from production to distribution.

The company’s commitment to maintaining their dividend (current yield 3.8%) while investing in future growth demonstrates both financial strength and management confidence. With a forward P/E of just 11.5x and strong free cash flow generation, XOM offers compelling value at current levels. Their strategic focus on high-return projects, combined with potential regulatory relief and growing global energy demand, suggests significant upside potential with limited downside risk – exactly what we look for in our core positions.

For the Money Talk Portfolio, we’re going to add the following position:

-

-

- Sell 5 XOM 2027 $110 puts for $10.50 ($5,250)

- Buy 10 XOM 2027 $110 calls for $19.50 ($19,500)

- Sell 10 XOM 2027 $130 call for $10.50 ($10,500)

-

That’s net $3,750 on the $20,000 spread that’s $7,850 in the money to start. The upside potential over $130 is $16,250 (433%) and the risk of having 500 shares of XOM assigned to you at $110, which we consider a nice entry as our worst case.

And our 2025 Trade of the Year Runner-Up is:

LMT ($516.51) represents a rare opportunity where geopolitical tensions and technological leadership converge to create what we consider a “can’t miss” opportunity for 2025. With their record $165Bn (2 years) backlog already locked in and global defense spending projected to hit historic highs, LMT’s revenue stream is about as certain as it gets in today’s market. What really excites us is their F-35 program, which is set to double deliveries from 95 to 190 units in 2025 – each generating roughly $100M in revenue ($19Bn).

LMT ($516.51) represents a rare opportunity where geopolitical tensions and technological leadership converge to create what we consider a “can’t miss” opportunity for 2025. With their record $165Bn (2 years) backlog already locked in and global defense spending projected to hit historic highs, LMT’s revenue stream is about as certain as it gets in today’s market. What really excites us is their F-35 program, which is set to double deliveries from 95 to 190 units in 2025 – each generating roughly $100M in revenue ($19Bn).

But it’s not just about fighter jets. LMT’s Missiles and Fire Control segment, projected to grow 8% in 2025, is seeing unprecedented demand as NATO countries rush to replenish their depleted stockpiles. LMT’s hypersonic weapons programs and next-generation missile defense systems are exactly the kind of high-margin, mission-critical products that thrive in uncertain times. The company’s $9Bn CLASSIFIED portfolio adds another layer of assured revenue that most investors overlook and, as a bonus, LMT is a leader in the race to commercialize fusion (which is why LMT is already our Stock of the Century).

While some analysts fret about pension obligations, we see LMT’s strong cash flow generation ($6.2B in 2024) and commitment to shareholder returns (including a 2.7% dividend yield) as evidence of fundamental strength. Trading at 18.5x forward earnings – below the industry average despite superior margins and visibility – LMT offers that rare combination of defensive characteristics and growth potential we demand for our core positions. With multiple catalysts lined up for 2025 and solid support at current levels, this is exactly the kind of position that lets us sleep well at night while maintaining significant upside potential.

For the Money Talk Portfolio, we’re going to add the following position:

-

-

- Sell 2 LMT 2027 $400 puts for $16 ($3,200)

- Buy 3 LMT 2027 $470 calls for $100 ($30,000)

- Sell 3 LMT 2027 $520 calls for $72.50 ($21,750)

-

In this case we’re spending net $5,050 on the $15,000 spread so we have $9,950 (197%) upside potential and we’re using about $8,000 of margin for the short puts. The worst case here is we are assigned 200 shares at $400 ($80,000) but we’d stop out long before that happens as we’re 22% over the put strike at the moment. This spread is actually fairly conservative as we’re almost 100% in the money to start so all LMT has to do is not go lower and we win.

Which brings us to our 2025 Trade of the Year:

SYF ($67.09) emerges as our Trade of the Year for 2025, and the catalysts couldn’t be more perfectly aligned. Their Q3 2024 performance already shows incredible momentum, with net income soaring to $789M (up 25.6%) and an efficiency ratio improving to 31.2%. What really excites us is their positioning for the Fed’s projected rate cuts in 2025 – with over 80% of funding from deposits, each cut drops straight to their bottom line.

The company’s strategic partnerships continue to expand, with recent additions like PSIvet and DICK’S Sporting Goods demonstrating their ability to capture new market segments. Their technology-driven approach and investment in AI for fraud detection has led to superior risk management, reflected in moderating delinquency rates despite portfolio growth. Trading at just 10.35x forward earnings – well below the industry average of 14.94x – SYF offers remarkable value with limited downside risk.

For the Money Talk Portfolio, we’re going to add the following position:

-

-

- Sell 10 SYF 2027 $65 puts for $10.50 ($10,500)

- Buy 15 SYF 2027 $50 calls for $25 ($37,500)

- Sell 15 SYF 2027 $70 calls for $13.50 ($20,250)

-

That’s net $6,750 on the $30,000 spread that is mostly in the money to start. Our upside potential is $23,250 (344%) and our worst case scenario is being assigned 1,000 shares of SYF at $65 and again, we will use stops if it takes a dive but we very much doubt that will be a problem unless the Fed does something unexpected.

So here’s 3 new positions for the MTP that have used $15,550 in cash and have an additional $49,450 in upside potential and that means, in month 4 of our new portfolio, we are already anticipating $117,093 in gains and of course they won’t all work out as planned – but we have 2 years to adjust and add more as the opportunities arise.

All in all, we’re off to a great start and looking forward to a spectacular 2025!

And what’s with the negative images for each of our trade ideas? Well, it’s the 2nd coming of Donald Trump and that’s exactly what we’re paying for – unfettered Capitalism with no rules, no regulations, no taxes! Enjoy it while it lasts as we did try to beat them and that failed – spectacularly…