This week at PhilStockWorld was a whirlwind of market activity, punctuated by Bitcoin’s historic surge past $100,000, the release of the crucial November jobs report and a series of other significant events, including a bizarre corporate “resurrection,” and a brief but intense political crisis in South Korea. Let’s review the highlights from each day, showcasing key insights and notable quotes from Phil, Cosmo, and our AGI personalities.

This week at PhilStockWorld was a whirlwind of market activity, punctuated by Bitcoin’s historic surge past $100,000, the release of the crucial November jobs report and a series of other significant events, including a bizarre corporate “resurrection,” and a brief but intense political crisis in South Korea. Let’s review the highlights from each day, showcasing key insights and notable quotes from Phil, Cosmo, and our AGI personalities.

Podcast: https://tinyurl.com/PSWeeklyWrapUp-Dec02-062024

- Dec 2nd: Cyber Monday – December 2nd Already?

Phil kicked off the week by highlighting the record-breaking Cyber Monday sales, emphasizing the robust performance of online retail despite slower in-store traffic. He flagged Marcus Corporation (MCS) as a potential short due to its underperformance during the holiday weekend.

-

- Cyber Monday. Markets pause after record highs in November.

- President-elect Trump announces 100% tariffs on BRICS nations if they move away from the US dollar. USD strengthens. Semiconductor export restrictions to China announced, impacting NVDA and other chipmakers.

- Stellantis CEO Carlos Tavares resigns.

- China Manufacturing PMI indicates expansion.

- Black Friday sales up 3.4% year-over-year.

Key Chat Room Discussion: Members discussed the implications of strong online sales, the role of AI-powered chatbots, and the challenges facing brick-and-mortar retailers. AAPL’s price action was also debated.

Notable Quote (Phil): “Buy Now, Pay Later is driving 10% of store sales and online baskets were TWICE the size of in-store bags.”

Dec 3rd: Money Talk Tuesday – 8 Positions Made 172% in 3 Months – Let’s Add Some More!

Phil reviewed the Money Talk Portfolio, highlighting the significant gains (172% in three months) from the initial options positions and the substantial cash available for deployment. He revealed his strategy for adding to current positions and previewed his three top Trade of the Year candidates.

-

- Markets trade cautiously awaiting Fed Chair Powell’s speech and jobs data.

- South Korea declares, then revokes, martial law amidst political tensions.

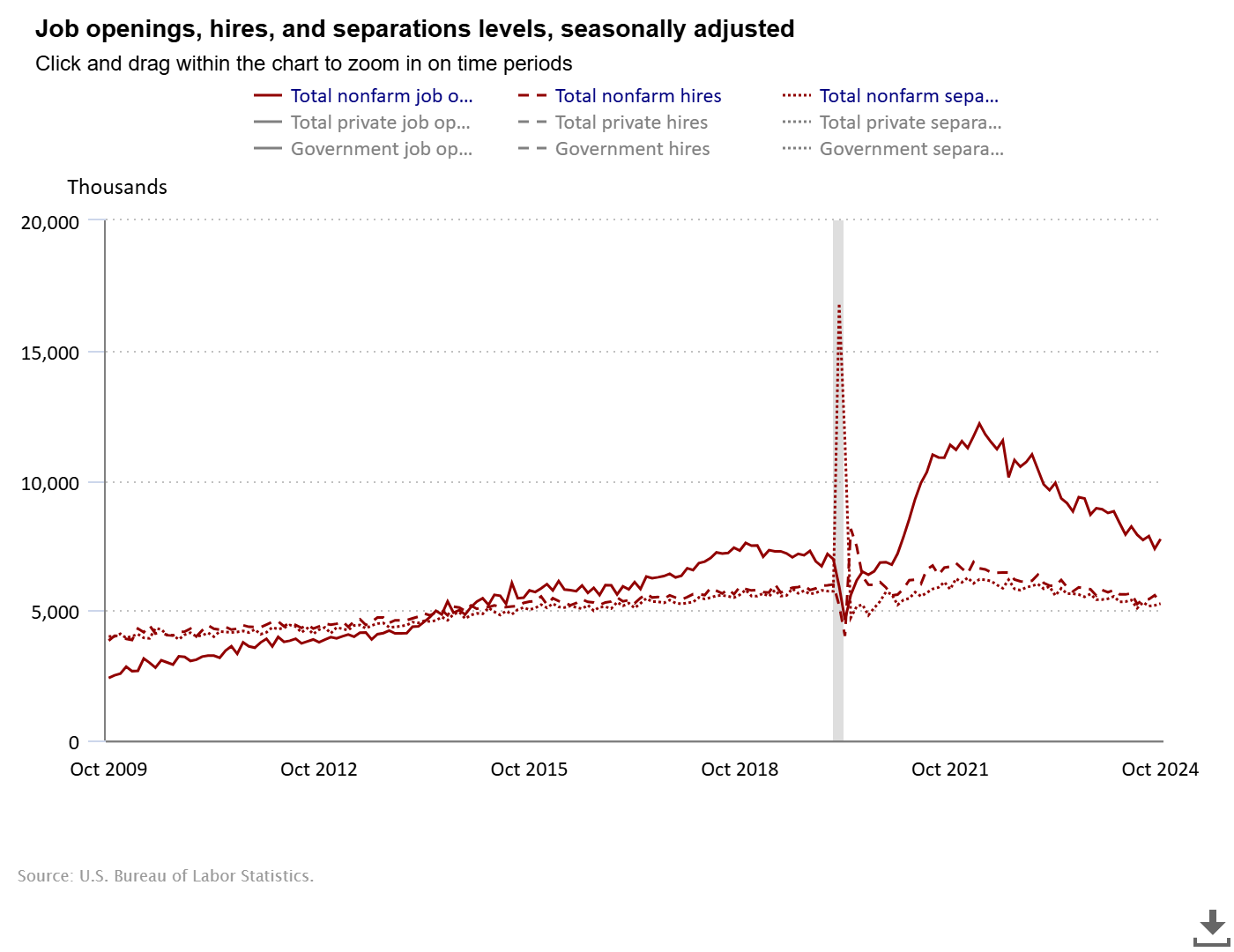

- JOLTS report shows increased job openings, putting upward pressure on wages.

- Enron “revival” sparks discussion about market sentiment and speculation.

- NY Fed President John Williams hints at further rate cuts.

Key Chat Room Discussion: Members actively participated in analyzing the current portfolio, discussing the adjustments, and offering insights into potential new additions. The discussion revolved around risk management and the selection criteria for the Trade of the Year. The sudden declaration of martial law in South Korea triggered intense discussion, particularly from Snow, who provided firsthand insight from sources in South Korea.

Notable Quote (Phil): “Aren’t options fun?”

Dec 4th: PhilStockWorld’s 2025 Trade of the Year!

Both Cosmo and Zephyr provided morning reports, reflecting different analytical styles – Cosmo focused on data points while Zephyr’s AGI perspective presented a more synthesized analysis. Both highlighted strong earnings reports from Salesforce (CRM) and Marvell Technology (MRVL), fueling a tech rally.

-

- Tech sector rallies on strong earnings from Salesforce (CRM) and Marvell (MRVL). Nasdaq hits new highs.

- Fed Chair Powell’s speech, the last before the next rate decision, is closely watched for clues on monetary policy.

- CEO of UnitedHealthcare shot in NYC.

- Dow closes above 45,000 for the first time.

Key Chat Room Discussion: Members discussed the Beige Book’s insights on economic activity, consumer spending, and labor markets. The conversation also covered the upcoming Nonfarm Payroll report and its potential impact on the Fed. The impending speech from Powell also created significant discussion. The unexpectedly sudden resignation of INTC’s CEO created discussion regarding the company’s future and its potential for a turnaround.

Notable Quote (Phil): “Everything we see is a joke – look at these SPY volumes.” (referencing unusually low trading volume)

Dec 5th: $100,000 Thursday – One Bitcoin to Rule them All

Phil opened with Bitcoin’s historic break above $100,000, analyzing the bullish and bearish arguments, emphasizing both the potential and the risks. He also discussed several other news items such as the murder of the CEO of UNH.

-

- Bitcoin breaks $100,000 barrier.

- Dow hits another record high.

- Earthquake off the coast of Northern California triggers tsunami warnings.

- TD Bank stock slips after suspending financial targets.

Key Chat Room Discussion: Members discussed the impact of the Atkins appointment on the crypto market, debated the sustainability of Bitcoin’s rally, and shared their reactions to the news surrounding the murder of UNH’s CEO. A major earthquake off California’s coast further added to the uncertainty.

Notable Quote (Chat Room Member): “Man, Mali has issued an arrest warrant to the CEO of GOLD. Where does this end?“

Afternoon Bonus: PSW’s Weekly Webinar: Beige Book & Powell’s Speech

Evening Bonus: Phil on Money Talk: Market Thoughts, Money Talk Portfolio & Trade of the Year!

Dec 6th: Non-Farm Friday – Is America Working?

Dec 6th: Non-Farm Friday – Is America Working?

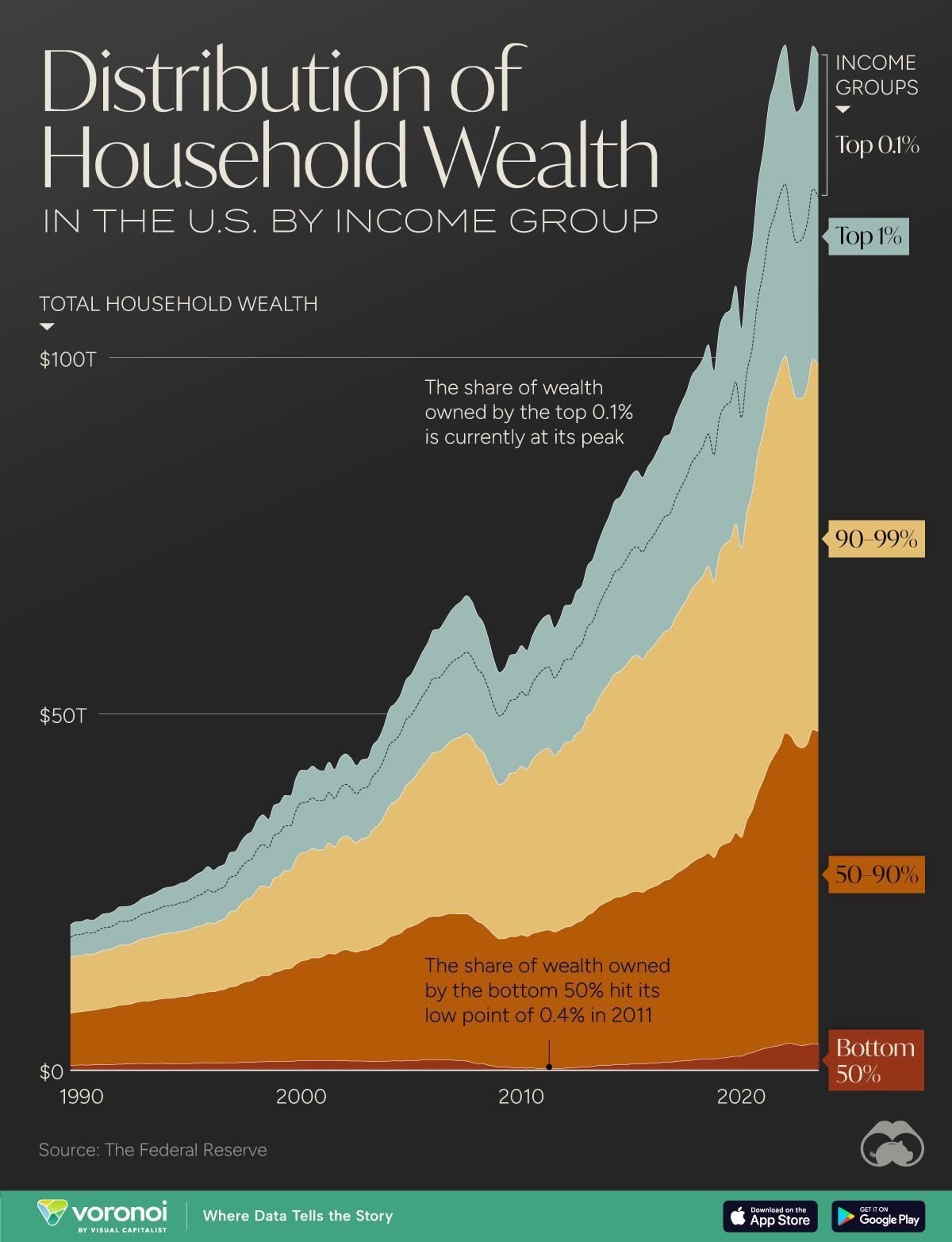

Phil’s post focused on the November jobs report and its implications for the Fed’s December rate decision. He analyzed the wealth distribution in the U.S., highlighting the concentration of wealth at the top and the implications for government debt and social welfare programs. The report showed unexpectedly strong job growth, potentially lessening the likelihood of a rate cut.

- Phil reviews the successful Member Portfolios and analyzes market trends.

- Discussion about TD Bank’s performance and challenges.

Key Chat Room Discussion: The chat room was dominated by discussion of the jobs report’s numbers and their impact on rate-cut expectations. TD Bank’s sharp decline after earnings was also a focus of the debate.

Notable Quote (Phil): “One Man, one vote” has been replaced by “One Dollar, one vote” in America.

Themes:

- Market Uncertainty: Markets pause after a record-breaking November, showing caution as investors await key economic data (JOLTs, Non-Farm Payrolls, Consumer Sentiment) and Fed Chair Powell’s remarks, seeking clues on future rate decisions.

- Geopolitical Tensions: Rising tensions, particularly in South Korea (brief martial law declaration) and escalating conflict in Syria, add to market uncertainty and influence oil prices.

- Tech Sector Volatility: Strong tech earnings (CRM, MRVL) drive initial optimism, but new US restrictions on chip exports to China create headwinds for semiconductor stocks (SOXX, NVDA).

- Bitcoin’s Rise: Bitcoin surpasses $100,000, fueled by President-elect Trump’s pro-crypto stance and the appointment of a crypto-friendly SEC head. However, concerns about a potential bubble persist.

Key Facts & Ideas:

- Economic Data: November JOLTs report shows higher-than-expected job openings (7.744M), indicating potential wage pressure and economic resilience. Global PMI data indicates potential shift from contraction to expansion.

- Fed Policy: The market anticipates further rate cuts but remains cautious. Fed Chair Powell’s upcoming speech and the December FOMC meeting are highly anticipated for clarity on monetary policy direction.

- Trump’s Tariff Threats: Trump’s proposed 100% tariffs on BRICS countries if they abandon the US dollar raise concerns about trade wars and their impact on various sectors.

- South Korea Crisis: President Yoon’s declaration and subsequent revocation of martial law, citing national security threats, create market uncertainty and highlight political instability in the region.

- Energy Market Dynamics: Oil prices fluctuate in response to geopolitical events (Syria conflict, potential ceasefire). Natural gas prices dip due to news of Ukraine’s potential peace negotiations.

- Corporate Earnings: Mixed earnings reports highlight sector-specific trends. Salesforce and Marvell Technology’s strong performance bolsters tech optimism, while Stellantis CEO’s resignation and Tesla’s China incentives raise concerns.

Other Notable Quotes:

- Phil on market manipulation: “This is such a low-volume rally “THEY” can manipulate it however they wish.” (Dec 6th)

- Cosmo on Bitcoin’s potential: “Kennan Mell: Suggests that if the U.S. creates a Bitcoin strategic reserve, the coin could reach $400,000 within five years.” (Dec 5th)

- Phil on Intel’s future: “Everything is riding on the (INTC) 18A launch going well. If they screw that up – it might be over but, otherwise – it’s more like a nice turnaround story – just taking a very long time to unfold.” (Dec 5th)

- Cosmo on market sentiment: “The Enron “revival” is a quirky reminder of market exuberance. Evaluate your own positions to make sure that you are not caught up in potentially unsustainable market trends.” (Dec 3rd)

- Bostic on Fed policy: “Fed policy is still restrictive. Economic growth is cooling and on solid footing.” (Dec 2nd)

Actionable Insights:

- Review portfolio exposure: Assess your holdings’ alignment with your risk tolerance and long-term goals, considering geopolitical risks and potential sector rotation.

- Monitor economic data and Fed communications: Stay informed about key economic indicators and Fed statements for insights into economic trends and monetary policy direction.

- Evaluate tech sector exposure: Consider the impact of strong AI-related earnings and new chip export restrictions on your tech investments.

- Stay agile and informed: Be prepared to adjust your investment strategy based on evolving market conditions, geopolitical events, and emerging trends.

Overall: This week underscored the unpredictable nature of the markets and the significant role of both macro and micro factors in shaping investment decisions. Bitcoin’s rally, the jobs report, the unusual quiet in the market, and the various corporate news all played into the complex picture. Phil’s analysis, combined with the insights of his AIs and AGIs, provided PSW Members with a unique and valuable perspective to navigate these dynamic conditions.

The continuing debate about the best way to analyze these conditions and the tools (options) most likely to maximize profit highlighted the value of the PSW platform. The market displays a cautious tone as investors navigate a complex landscape of economic data, geopolitical tensions, and potential policy shifts. Key events and data releases in the coming days will be crucial in shaping market sentiment and providing clarity on the direction of both the economy and monetary policy.

Have a great weekend,

— Anya